Swiss Franc |

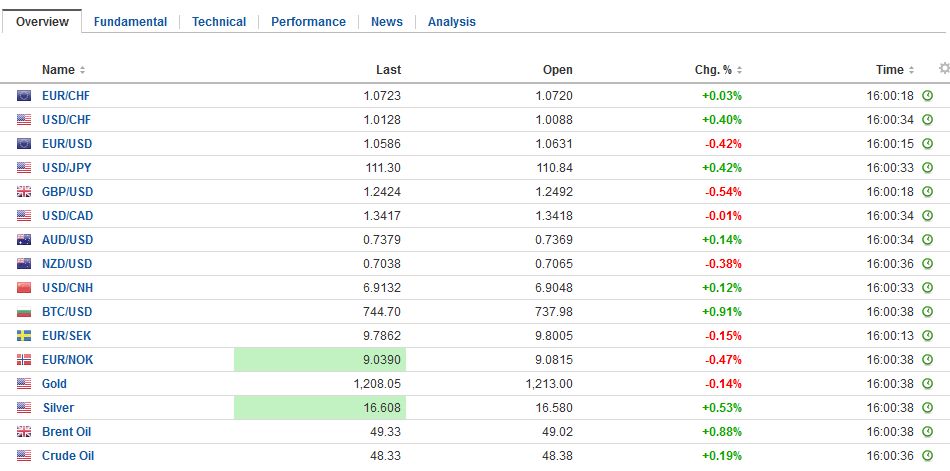

Switzerland Trade Balance, October 2016(see more posts on Switzerland Trade Balance, ) . Source: Investing.com - Click to enlarge |

|

Sterling has seen huge gains vs the Swiss Franc during today’s trading session as Prime Minister Theresa May spoke out in an attempt to reassure the UK economy. It was one of the most positive speeches since her she took her position and she suggested that the UK would be open to a deal which could see the UK take more time to organise a different relationship with the European Union. As yet Theresa May is convinced that Article 50 will be triggered by March 2017 and with the Supreme Court due to meet in early December we are sill in a very uncertain period politically. |

GBP/CHF - British Pound Swiss Franc(see more posts on GBP/CHF, ) |

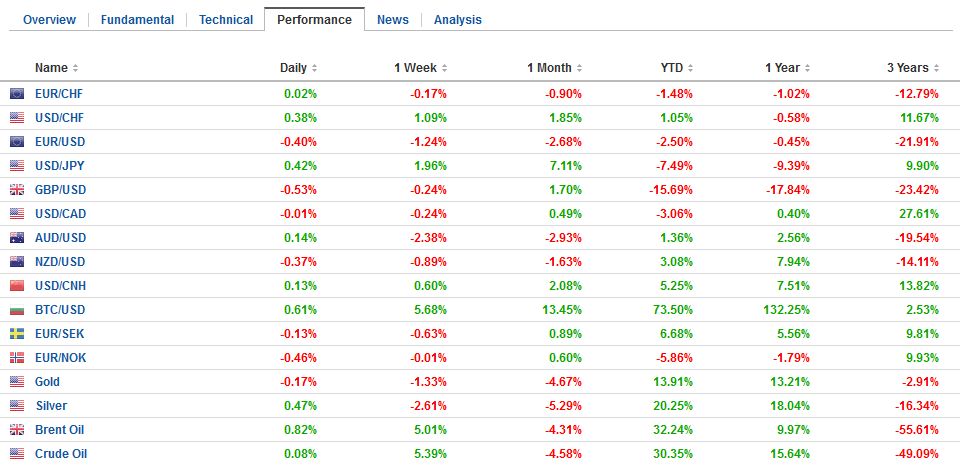

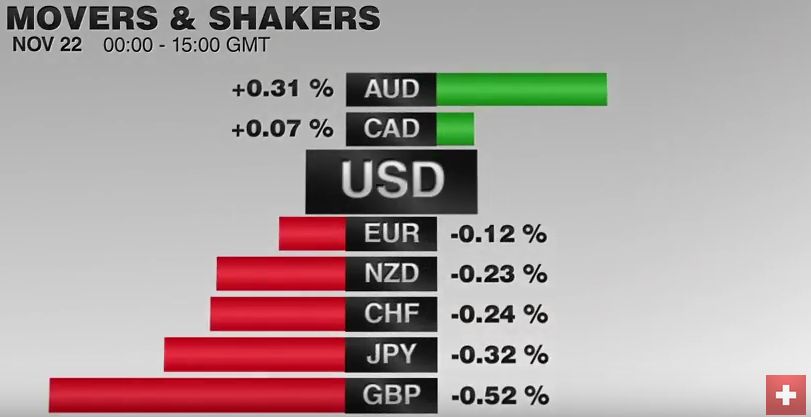

FX RatesThe US dollar entered a consolidative phase yesterday, and this carried into today’s activity.While the foreign exchange market is sidelined as the two-week trend slows, the stocks and bonds are posting strong gains today. Equities are being led by energy and materials, as oil and industrial metals continue to advance. Bond are recovering from their recent slide. Yesterday was the first session since the US election that the euro rose above the previous day’s highs. It is doing so again today, but the new highs are fought hard. Initial resistance is seen in the $1.0660 area and then $1.0720. The euro’s downtrend does not appear over. One of the key drivers pushing the euro lower is the widening interest rate differentials in the dollar’s favor. The premium the US charges is still rising. Today it stands at a new high of 180 bp. It is up seven basis points on the week, though the euro is up a little more than half a cent. The premium widened by 22 bp last week and nine the week prior. The 10-year premium is hovering around 3.0%. Through various business cycles, the US premium rarely been greater going back to the last 1990s. |

FX Performance, November 22 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The dollar has pulled back against the yen after approaching JPY111.40. It is finding support in the JPY110.30-JPY110.50 band. The US two-year premium is at new highs today near 125 bp. It is up a couple of basis points this week after rising eight basis points last week and 11 the week before. The 10-year premium rose to 230 bp last week, its highest in five years and is consolidating a little below there now.

Similarly, the US two-year premium over the UK is at 93 bp. It has not been larger since at least 1992 when the Bloomberg data starts. The premium has risen seven basis points so far this week and 19 the week before. The prior week the premium rose five basis points. Sterling could not maintain yesterday’s upside momentum that faltered just above $1.25 in Asia. Resistance was pegged near $1.2530. Support is seen ahead of $1.24 as the focus shifts to Hammond’s Autumn Statement that is expected to feature some new infrastructure spending. Many investors anticipate a deal among oil producers and have rallied oil prices to three-week highs.Our concern is that the most vocal comments suggesting a deal is likely are coming from OPEC countries like Iran and Iraq that seek an exemption from cuts or freezes. Similarly, Russia has expanded its output to post-Soviet Union highs, seemingly anticipating the possibility of a freeze. Moreover, the change ushered in by the US election could, through deregulation and a stronger driver to make the US even less dependent on foreign energy, could see America’s output increase more than previously projected. The January light sweet oil contract appears to have traced out a bottoming pattern that projects another run toward $54, which has stemmed rallies twice earlier this year. |

FX Daily Rates, November 22 (GMT 16:00) |

| Base metal prices are also higher. Copper is at its highest level in over a year. Zinc and lead are also benefiting from the anticipation of stronger growth and infrastructure spending. More broadly, we note that the CRB Index gapped higher yesterday (and gap take on added significance as it appears on the weekly bar charts as well). This follows a gap higher opening last Tuesday, 15 November. The bullish price action suggests scope for a couple more percentage points of gains near-term.

The MSCI-Asia Pacific Index rose 0.9% in its second days of gains. Led by telecom, energy, and materials, Japan’s Topix rose 0.3% to extend its winning streak into the ninth consecutive session. The Dow Jones Stoxx 600 is up 0.5%, with the common theme being energy and materials. The reprieve from the bond market sell-off has seen utilities recover. |

FX Performance, November 22 |

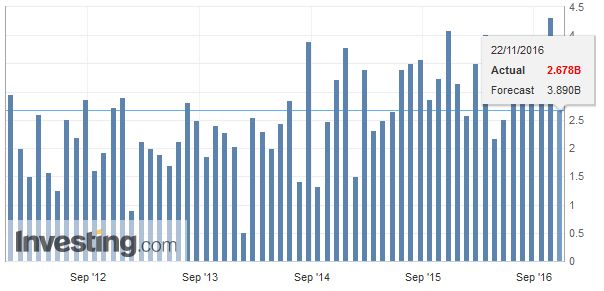

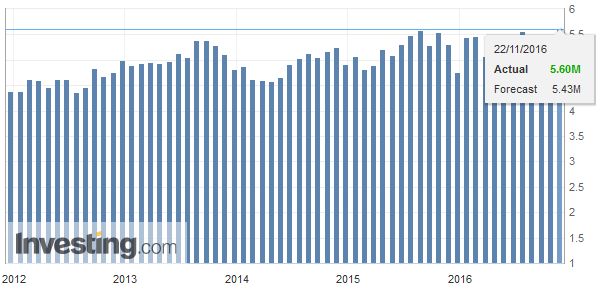

United StatesThe US reports existing home sales and the Richmond Fed manufacturing survey. Neither are typically market movers. Strong housing starts reported last week do not necessarily translate into existing home sales. They are expected to be little changed, but slightly softer, near the best levels since the crisis. The US auctions $28 bln of five-year notes today. Given that policy expectations are in flux, today’s auction may not go much better than yesterday’s that saw primary dealers stuck with over 50%. Tomorrow the FOMC minutes from the meeting earlier this month will be released. Regardless of the election outcome, the minutes will likely reveal that the Fed was poised to hike rates, with “most participants” seeing a move shortly. Canada reports October retail sales. If there is a risk, it may lay on the upside of the median 0.6% forecast after a stronger than expected US report. The Canadian dollar is up about 0.8% this week as are the other dollar-bloc currencies (and Swedish krona and sterling). The oil story appears to be trumping the rate differential story for the Canadian dollar. The US two-year premium over Canada is widening a couple more basis points today to 42, which is the most since January. However, the CAD1.3380 offers support for the US dollar. Resistance is seen near CAD1.3450. |

U.S. Existing Home Sales, October 2016(see more posts on U.S. Existing Home Sales, ) . Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CAD,$EUR,$JPY,EUR/GBP,FX Daily,gbp-chf,newslettersent,Switzerland Trade Balance,U.S. Existing Home Sales