Summary:

Fitch cut Italy’s rating outlook to negative from stable, while DBRS left Portugal’s rating and outlook unchanged.

Europe and Canada’s free trade negotiations broke down, but many seem to be making exaggerating the significance of the drama.

Japan and Australia report inflation figures, and both are exceptions to the generalization that price pressures are rising in (most) high income countries.

Switzerland: UBS will publish the consumption indicator and the KOF the economic barometer.

There were two developments before the weekend that will likely spur a response in the week ahead.

EurozoneFirst, while most were looking out for DBRS credit review of Portugal, Fitch surprised by cutting Italy’s credit outlook to negative from stable. At the heart of the decision was concern about the repeated delays and back loading of fiscal consolidation. The disappointing growth, the non-performing loan burden, and the political climate pose downside risks. Italian bonds which had been under performing Spain bonds had begun holding their own. Last week, the benchmark 10-year bond yield fell 2.5% in Italy but rose slightly in Spain. The divergence was sufficient to change the month-over-month back into Italy’s favor (+18.5 bp vs. Spain’s +19.7 bp). Fitch noted that even if Renzi does not resign if the referendum fails, the government may be weaker, and parliamentary elections are scheduled for May 2018, and Euro-skeptic political forces are on the rise (5-Star Movement won Rome and Turin in elections earlier this year). The surprise action by Fitch, coupled with EU demands that Renzi alters the draft budget may weigh on Italian bonds. Italian bank shares rallied for three consecutive weeks, including a sharp 7.3% advance last week. They may also be vulnerable if yields continue to rise. Recall that DBRS put Italy on credit review with negative implications in August. DBRS is the only one of the top four rating agencies that put Italy in the “A” band. A cut would increase the haircut the ECB imposes on Italian bonds used as collateral for loans. The under performance of Italian bonds relative to Spanish bond may resume if Spain is able to avoid a new election before the end of the year. Separately, we note that the average of the last 10 referendum polls in Italy with 1000 or more people surveyed was 35.3% supporting the change of the Senate and 41.5% opposed. Most recently, former (unelected) Prime Minister Monti came out last week siding with the No’s, as has a wing of Renzi’s own party and the leaders of all the opposition parties. DBRS did not downgrade Portugal’s rating or cut the stable outlook. We had thought that at most, the only major rating agency to recognize Portugal as an investment grade credit could have changed the outlook to negative from stable. Investors had been anticipating that the DBRS would do little, if anything in recent weeks, and were encouraged by comments from the Finance Minister. The 10-year yield had fallen from 3.6% on October 7 to 3.14% last week. Below last week’s lows, and the yield can move back to 3.00%, where it had seemed to find an equilibrium in August and early-September. |

Economic Events: Eurozone, Week October 24 |

United StatesThe second development was Canada walked out on the free-trade talks with the EU when a small part of Belgium succeeded in throwing a wrench into the works at the last minute. The agreement required the unanimous consent of all EU countries. Belgium could not commit without all five sub-federal governments and Wallonia objected. Its ultimate objection was over the establishment of new courts to resolve disputes. This is a controversial measure that is in the TPP and TTIP. While Wallonia’s objection is understandably frustrating for Canada, but the walking out by the Canadian delegation, led by Trade Minister Freeland was melodramatic. She is inexperienced in an inexperienced government. The drama does not end the prospects for the deal and leaders are scrambling for a workaround. Too much is being made of it. Even the optimists pointed to a 12 bln euro (~$13 bln) boost to the EU GDP and about CAD12 bln (~$9 bln) to the Canadian economy. It was all about symbols. For the Trudeau government, is would have been a tangible success. For the EU, a successful trade agreement would be the first with a G7 country, and show that despite its demise having been foretold, it was still forward and outward looking. Many observers are viewing the breakdown in talk through the prism of Brexit. They blame the EU and think the failure bodes ill for its future and negotiations with the UK. This seems too seems exaggerated. First, if the deal can be successfully concluded, does it say anything about the difficulty of Brexit negotiations, whenever they begin? The failure of trade negotiations (remember Multilateral Agreement on Investment or the Free Trade Agreement for the Americas) are not the end of the world nor a telling sign of protectionism or incompetence. The weight on the Canadian dollar, which was the weakest of the major currencies last week, falling nearly 1.5% to its lowest level since March, was largely homegrown. After upgrading the risk assessment to balanced, Bank of Canada Governor admitted that there was a discussion about easing policy. This surprised the market, and it was followed up with an unexpected contraction in August retail sales and a slightly softer CPI report. The euro is also trading at seven-month lows. Our understanding emphasizes the role of the expected trajectory of monetary policy. Even though ECB President Draghi claimed that neither extending nor taper of the asset purchase program was discussed at the last two monthly meetings, there is a high expectation that the purchases are extended for another six months. We wonder too if sterling’s weakness has helped boost the euro on a trade-weighted basis, which is important for policymakers, needs to be neutralized by a weaker euro against the dollar. At the same time, the pendulum of market expectations has swung toward expecting a December rate hike. There is some variance of estimates due to assumptions, but the Fed funds futures imply a roughly 2/3 chance. Ironically, but importantly, the expectations have increased at the same time that Q3 GDP estimates have been cut. The first estimate will be reported on October 28. The median Bloomberg estimate is 2.5%. The risk is on the downside. The Atlanta Fed’s GDPTracker puts it at 2.0%, and the NY Fed’s tracker says 2.2%. The relevant comparison context here is not the average pace of growth in previous periods, but for the conduct of monetary. For the conduct of monetary policy, current growth and trajectory need to be assessed relative to trend growth. The Federal Reserve has been gradually cutting its estimate of trend growth. It now stands at 1.8%. Raising potential growth is not one of the masters that monetary policy can serve. |

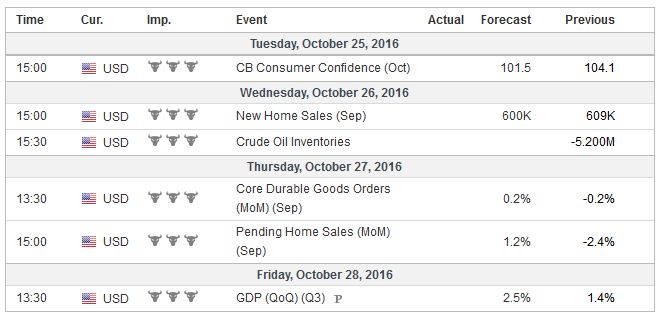

Economic Events: United States, Week October 24 |

United KingdomThe UK reports its first estimate of the day before the US. A marked slowing of the UK economy is believed to have taken place in the three months after the referendum. Most of the weakness seemed to be concentrated in July. The British economy is expected to have expanded by 0.3% in Q3 after 0.7% growth in Q2. The year-over-year pace will stay deceivingly stable at 2.1%. A substantial decline will likely be experienced this quarter as Q4 15’s 0.7% expansion drops out of the measure. Expectations for a follow-up rate cut at the early-November MPC meeting have eased, but it has not done much for sterling. For the better part of two weeks, since the flash crash, sterling has been largely confined to a $1.21-$1.23 trading range. While the shift in Fed expectation may not have been particularly helpful for sterling, the prospect of a hard Brexit is the more potent force. European officials, including Tusk, the President of the European Council, have made two things clear. There are no negotiations until the UK has standing, which means until Article 50 is invoked. Any Brexit will be a hard Brexit to the extent that it means that will not have unfettered access to the single market if it insists on limiting what Europeans call free movement, which is an exaggeration, especially for non-Schengen members. It is fine and good that Prime Minister May can say Brexit means Brexit, but by allowing the inertia of the victorious Leave camp to dominate the negotiations, she must accept their narrative. The victory was by the slimmest of margins for such a momentous decision. She could have prioritized the preserving the UK standard of living and way of life. The UK is still a member of the WTO, which keeps it integrated into the system of free-trade, But even with manufactured goods, for which the WTO is strongest, the UK is vulnerable. Japanese and German auto manufacturers are threatening to leave the UK. The UK will ultimately be poorer, and investors have already written down the value of all UK assets by 20% in dollar terms and more than 15% in yuan terms. |

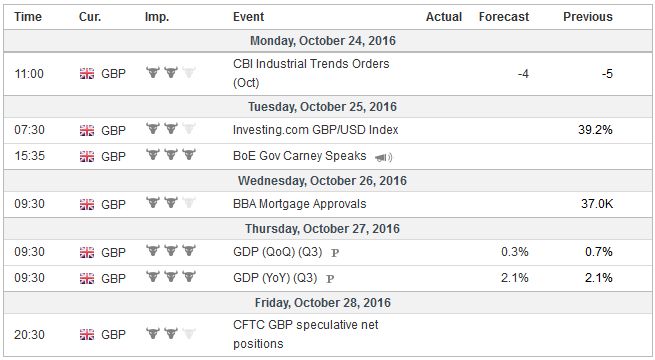

Economic Events: United Kingdom, Week October 24 |

JapanJapan start the week with the September trade balance and finishes the week with CPI. The September trade balance always improves over August. There is one exception since 1992 (2014), but the seasonal pattern should not obscure the fact that Japan’s trade position is improving, even though imports and exports continue to contract on a year-over-year basis. Japan’s surplus has averaged JPY169.6 bln for the past 12-months. In 2015, Japan reported an average monthly shortfall of JPY232.6 bln. Or consider that the monthly average through August is a JPY287.6 bln surplus compared with an average deficit of JPY315.8 bln in the first eight months of last year. While price pressures appear to have bottomed in most high income countries, Japan is a notable exception. Headline and core inflation (excludes fresh food) may have remained stuck at minus 0.5% in September. Using a similar US definition of core, which excludes food and energy, Japan’s inflation likely slipped to 0.1%, down from 0.2% in August. It has been trending lower all year since reaching 0.9% last December. Australia also is continuing to wrestle with low inflation. Headline CPI has been trending lower and at 1.0% in Q2 was the lowest level since the late-1990s. It is expected have stabilized at 1.1% in Q3. The central bank puts more emphasis on the trimmed mean and weighted median measures. The trimmed mean is expected to remain at the record low matched in H1 of 1.7%. The weighted median may tick up to 1.4% from 1.3% in H1, which is also a record low. The subdued price pressures keep many expecting another rate cut next year. For the fourth month, the Australian dollar has been largely confined to a $0.7450-$0.7750 trading range. The poor employment report reinforced the upper end, while a subdued inflation report could see it head toward the lower end of the range. |

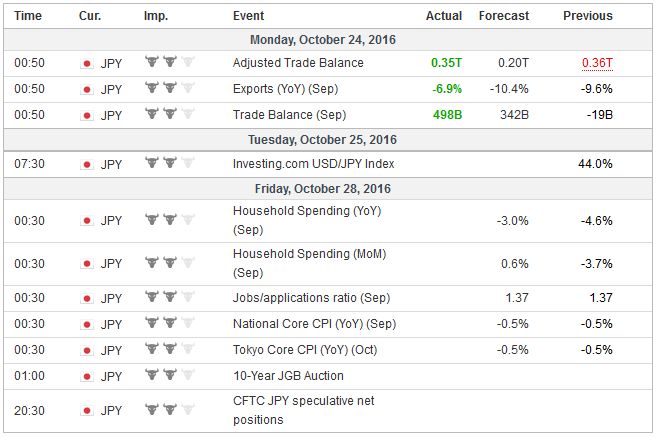

Economic Events: Japan, Week October 24 |

SwitzerlandUBS will publish the consumption indicator and the KOF the economic barometer, the leading indicator for the Swiss economy. |

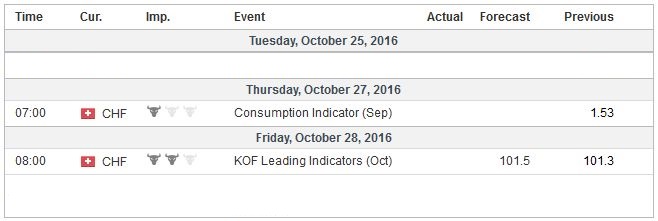

Economic Events: Switzerland, Week October 24 |

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$CAD,$EUR,$JPY,ECB,newslettersent