Swiss FrancOnce again the EUR/CHF was weaker. This is an expected behaviour, given that the EUR/USD has fallen to 1.10. Usually CHF goes with the EUR/USD movement, just to a lower extend. |

EUR/CHF Overview, October 12 2016(see more posts on EUR/CHF, ) |

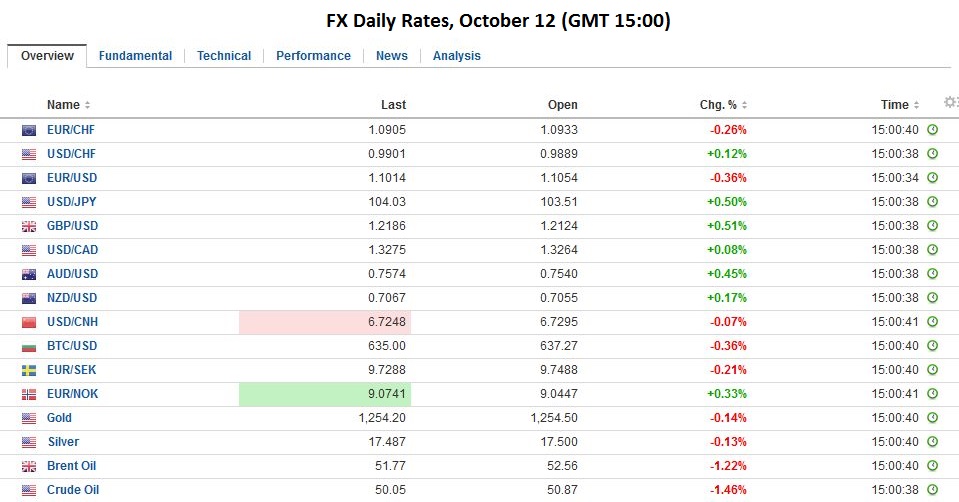

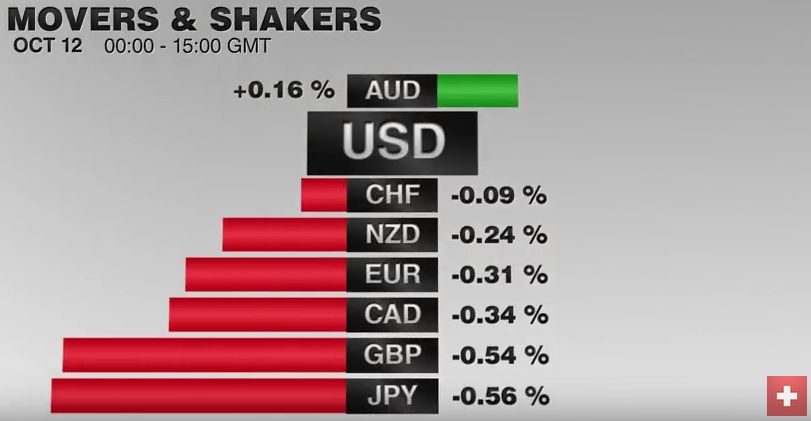

FX RatesNews that UK Prime Minister May has accepted that Parliament should vote on her plan for exiting the EU stopped sterling’s headlong slide. Sterling had been pounded for roughly 8.5 cents since the start of the month including the last four sessions. The idea that parliament, where the Conservatives enjoy a slim majority, is less enthusiastic about Brexit may mean a less acrimonious divorce. Sterling advanced sharply, like the flash crash at the end of last week, took place in thin pre-Tokyo turnover. It recovered from low below $1.21 in the North American session to reach a high just shy of the high set in the European morning yesterday near $1.2330. Sterling’s rise failed to entice more short-covering, and instead, it was sold back toward $1.2220 in late-Asian trade. It choppily traded between $1.2230 and $1.2320 in the London morning. |

. Source: Dukascopy - Click to enlarge |

| May asked that Parliament not try to block Brexit or undermine her negotiations with the EU. May had faced the possibility of a UK High Court ruling that would give Parliament greater say than May had intended. In addition, a Labour motion, which may have garner backbench Tory support. It called for a “full and transparent debate on the government’s plan for leaving that EU” and Parliament scrutiny of the government’s plan before the start of formal talks.

Sterling bears may not be persuaded. May is still insisting that limiting immigration is more important than access to the single market. May also appears to see a post-Brexit UK in which financial services are somewhat less important for the economy, while other strategic industries flourish. Global investors seem less convinced. The UK out of the EU may be worth 80% of less than what it was when it is part of the EU. Sterling had appeared to be a one-way bet. No one seemed to want to buy sterling. Talk of parity with the dollar and/or euro had emerged. By nearly any technical measure, sterling was stretched. Momentum was carrying the day, and the inability of sterling to recover from its flash crash, unlike most of victims of flash crashes only fueled the bearish sentiment. |

|

| The issue for many now is at what level the bears re-load. Two levels may be key. Yesterday’s high was seen near $1.2375. Rising above the previous day’s high would be a constructive sign. Note that sterling has failed to close above its five-day moving average since September 28. It is found near $1.2350 today. The other level investors should keep in mind is about a cent higher (~$1.2475), which is the post-flash crash high.The dollar-bloc currencies are firmer, with the Australian dollar’s 0.5% advance leading the pack. The Aussie has been confined to yesterday’s range, where the selling pressure had brought it near $0.7535, its lowest level since September 21. A move above yesterday’s high near $0.7615 could signal a new assault on the $.7700 nemesis. | |

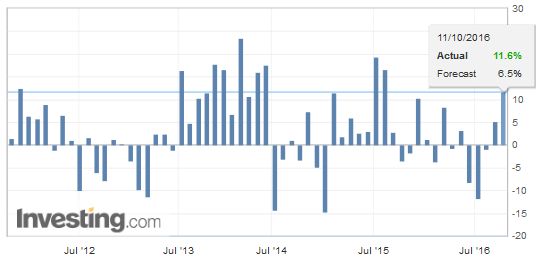

JapanJapan reported August machine orders fell 2.2% or half of what the median forecast. The year-over-year pace jumped to 11.6% from 5.2% in July. This is the strongest pace in more than a year. This follows news early this week indicating that Japan’s external account (balance of payments) continues to improve. Unlike yesterday, the dollar has shied away from the JPY104.00 level and is consolidating in subdued activity around JPY103.60. The market does not appear done probing the dollar’s upside against the yen. The ceiling that needs to be overcome is marked by last week’s high (~JPY104.15) and the September high (~JPY104.35). |

Japan Core Machinery Orders, September 2016(see more posts on Japan Core Machinery Orders, ) Source: Investing.com - Click to enlarge |

United StatesThe main driver is seems is the widening interest rate differentials between the US and Germany. The two-year differential is near 154 bp today, the highest level in a decade. The US 10-year premium is also widening and near 242 bp, it is back to levels not seen since March. Many investors are warming to the idea that the Fed will hike rates in December. Today’s FOMC minutes will be looked at for fresh insight. The fact of the matter is there were three dissent to the FOMC statement in favor of an immediate hike, and subsequent comments suggest others were sympathetic. Both Yellen and Fischer have acknowledged it was a close call. Bloomberg calculates that the pricing of the Fed funds futures strip implies a 57.1% chance that Fed funds target will be 50-75 bp by the end of December. The CME’s estimate is 64%. Our calculation puts us closer to the CME. For its part, the Canadian dollar appears torn between firm oil prices and rising US rate differential. Our work suggests rate considerations are the more important presently than energy prices. At the end of last week, the US dollar briefly traded above CAD1.33. It looks as if the market wants another try. |

Euro Currencies Rate |

Eurozone

Meanwhile, the euro is grinding lower. It has dropped two cents this week to record a low below $1.1020 in the European morning. This means that it has taken out the trendline drawn off the January, June and July lows. It intersected today around $1.1035. A break of $1.10 brings those June and July lows into view (~$1.0915 and $1.0950 respectively).

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$AUD,$CAD,$EUR,EUR/CHF,Japan Core Machinery Orders,newslettersent