Summary:

Global bonds and global stocks ended last week on a weak note and this will likely carry into this week’s activity.

The Bank of England meets, but the data may be more important.

Oil and commodity prices more generally look vulnerable, and this coupled with higher yields sapped the Australian ad Canadian dollar in the second half of last week.

The week ahead will likely be shaped by a combination of what happened last week and what will happen the week after next. The end of last week saw a sell-off in equities and bonds and a recovery in the US dollar. The week after next the FOMC and BOJ meet in apparently live meetings, meaning that policies may be adjusted.

The S&P 500 suffered its biggest decline in two months, falling 2.5% ahead of the weekend. It gapped lower and sold-off sharply and closed on its lows. It is a particularly poor sign. Our initial expectation is that this is not a normal gap that is quickly closed. On Saturday (September 10) the Taiwan equity market sold off 1.2%, its biggest decline in two months as well. This may be a hint of what is going to happen when Asian equity markets on September 12.

The MSCI Asia-Pacific Index fell last Thursday and Friday, the first two-day loss in a month. Friday’s 1.2% decline was the largest since early August. This much-watched index enjoyed a 15% rally since the end of June, and at the very least, a technical correction of this advance is likely unfolding. The first target is the late-August low near 137.20, which is about 2.3% below last week’s close, but the 38.2% retracement objective is found at 135.35. That suggests scope for a 3.6% decline. Ahead of the quarter-end asset managers may be tempted to protect profits.

The MSCI Emerging Market equity index snapped a five-day advance before the weekend. The nearly 2% drop gave back nearly half of that five-day rally. It was the biggest decline since the UK referendum. This benchmark rallied more than 17.5% since the UK referendum. The prospect is for a decline on the magnitude as we have noted for the Asian-Pacific Index (2.3%-3.6%). Here too weakness of US shares, the backing up of US interest rates, and the prospects that the Fed hikes rates, may encourage position adjusting ahead of the end of the quarter.

The Dow Jones Stoxx 600 rallied a little less than 14.5% since the UK referendum. It finished last week on a soft note, dropping 1.1% ahead of the weekend, its largest loss since August 2. The index appear to have stalled in the same area that stopped rallies in April and May (~351). A minimal technical correction gives scope for 2%-3% near-term declines.

Before the weekend there was also a sharp increase in benchmark bond yields. It is likely overdetermined, meaning that there are many causes. There had been a significant rise in long-term Japanese yields amid speculation that the BOJ may adjust its asset purchases to facilitate a steepening of the yield curve. For example, the 40-year JGB yield has risen more than 50 bp since the end of June. The 10-year bond yield bottomed in late-July nearminus30 bp. It has flirted with zero in recent sessions.

Many investors were disappointed that the ECB did not announce an extension of its asset purchases last week. Ahead of the weekend, the EMU core bond yields rose around seven bp, and peripheral bond yields rose nine bp. The generic 10-year German bund yield rose from minus 12.5 bp before the ECB meeting and finished the week at positive one basis point, the highest yield in nearly two months.

United KingdomAfter an initial hit to sentiment, the UK referendum does not appear triggered an economic contraction. Economic data are generally coming in better than expected. The Bank of England acted preemptively, providing low rate loans to banks, cutting interest rates and re-launching an asset purchase plan than includes corporate bonds. Critics of Bank of England Governor Carney argue he was too partisan before the referendum and led a panicked response afterward. Some of the criticism is unfair. We do want policymakers to act to minimize the biggest regret. The biggest regret would have been if officials did nothing and the economy took a hit. Part of the reason the economy did not take a harder hit was that sterling and interest rates fell sharply, and this was facilitated by the signal and real response by the BOE. Nor can medium and long-term investors forget that despite all the talk, Brexit has not yet taken place. Business decisions on location and hiring take some time to formulate and implement. The full impact of the referendum is still to come. The week ahead will provide more fodder. Ironically, the BOE meeting may not be the highlight for investors. In the past, when the BOE would not do anything, they did not say anything. Times are different now. The minutes, for example, are released simultaneously, with the decision. The market is interested in how the Monetary Policy Committee understands the context of its decision, and, in particular, the prospects for a further cut in interest rates, which seemed to have been previously implied. Three UK economic reports that will be the focus for investors: Inflation, employment, and retail sales. The structure of the UK economy means that the decline in sterling will boost consumer prices, which had already begun recovering from the deflation scare. UK consumer prices were flat in 2015 (December CPI was zero year-over-year). It stood at 0.5% in June and rose to 0.6% in July. It is expected to rise to 0.7% in August. The core rate is essentially flat. It was 1.4% at the end of last year, and in August, it is expected to have edged to it from 1.3% in July. Separately, the drop in sterling will also lift producer prices. This may also spur some businesses to lift selling prices or face margin compression. It may take some time for sterling’s impact to work its way through. Although it appears to be consolidating its decline in the $1.30-$1.35 range, the duration of some business contracts argues in favor of a prolonged process. Consumer prices are rising while wage growth is slowing. The August jobs report is unlikely to show a major change in conditions. However, average weekly earnings are expected to be up 2.1% in the three-month period through July from a year ago. This is down from 2.4% in June, after having peaked last August at 3.2%. Real wage growth will slow and this may impact consumption. Retail sales leaped 1.4% in July, defying conventional wisdom. This pace cannot be sustained. The median forecast is for a 0.4% decline in August (0.7% excluding petrol). The risk may be on the upside as anecdotal reports suggest elevated tourism, drawn, yes, to the weak pound. Tourists from EMU and Japan have not seen sterling this soft for three or four years. Chinese shoppers see the most favorable exchange rate in around a quarter of a century. Americans see the lowest exchange rate for sterling in more than 30 years. |

Economic Events: United Kingdom |

Unites StatesThe US will also report August retail sales. The headline will be kept in check by autos and gasoline. The median forecast is of a 0.1% decline. However, the underlying news should be better than the headline. Excluding autos, gasoline, and building materials, the component used for GDP calculations is expected to rise 0.4%. Policymakers may be encouraged by such a report. Over the past 12-months, the average monthly increase as been 0.3%. Despite the disappointing PMI, the US economy is likely to post its strongest growth since Q2 2015 (NY Fed GDP tracker) or mid-2014 (Atlanta Fed GDP tracker). Ahead of the blackout period around the FOMC meeting, three Fed officials will speak on Monday. Atlanta and Minneapolis Fed presidents will be overshadowed by Governor Brainard. Brainard has been consistently a voice of caution, and has tended to emphasize the international context in which the Federal Reserve operates. Her speech, in Chicago, on the outlook for the economy, will be closely followed. No change in her stance or tone, could encourage softer yields, a softer dollar and lend support to equities. On the other hand, any hint that the Fed has been sufficiently cautious, and recognition that the Fed’s objective are near would likely see a more dramatic reaction the other way. Some observers argue that the Fed has become so politicized that it will not hike rates before the election. This is not a strong argument on a number of counts. First, the US Senate has left the Board of Governors understaffed. It has refused to confirm Obama nominee to fill two vacant seats. Second, the structure of the Federal Reserve included staggered terms, which the chair not concurring with the President’s allows for a great degree of independence, especially after the 1951 agreement with the US Treasury. Third, and most importantly, a rate hike in the current context is a vote of confidence in the US economy. It is not clear what monetary policy the Obama Administration or Clinton (or Trump for that matter) desire. Increasing the Fed’s target range for Fed funds from 25-50 bp to 50-75 bp will likely have little impact on most Americans. Last December’s rate hike, similarly had little perceptible impact. It did not stop mortgage rates from easing. It did not lead to higher unemployment. It did not sap consumption. |

Economic Events: United States |

Lastly, we note that the backing up in interest rates and market-based measures of inflation expectations were in part driven by the rally in oil prices. A two-week drop was ended by two considerations. First, there is some defensive positioning taking place amid a steady, although not contradictory, news stream playing up the possibility of an agreement to limit future oil output.

Some saw the reports that OPEC output may have slipped in August as some kind of sign that an agreement is looming. We see it differently. The minor 45k barrel decline in Saudi output is noise. It may be a result of less production for domestic demand. Saudi Arabia is one of the few countries that burn oil for electricity, and demand for cooling often sees this kind of seasonal pattern.

Moreover, insight from game theory, assuming rational actors, output is not cut ahead of an anticipated freeze. It is boost instead to lock in a superior position for the freeze and possible future agreements for a cut in output. In addition, we had previously anticipated that the Iranian output would be back at pre-embargo levels by the end of this year, creating the conditions for a future agreement. However, the latest indications suggest its output may have stalled recently.

In any event, the second boost to oil prices came from large drop in US oil and gas inventories.The market overreacted. The dramatic fall stemmed from weather conditions (hurricane) rather than a sudden restoration of equilibrium. After the large run-up, oil prices fell ahead of the weekend. Brent managed to finish the week 2.5% higher at $48 (front-month November futures contract) after dropping 4% at the end of last week. WTI fell 3.7% on Friday, leaving it up 3.2% on the week, a little below $46 (front-month October futures contract).

We are skeptical of the merits of either of the two considerations that lifted oil prices. However, the real takeaway is the that the price of oil has largely been in a $40-$50 range for six months (with Brent a little higher). From neither a fundamental nor technical point of view does a breakout appear to be at hand.

More broadly, commodity prices are trading heavily. Even though the CRB Index closed higher (1.4%), it lost its momentum ahead of the weekend and fell 1.7%. It held below its 100-day moving average and is 7% below its May highs. The combination of falling oil and commodity prices, coupled with rising core yields, saw the Australian and Canadian dollar sell-off in the last three sessions. Technically, they look vulnerable as well.

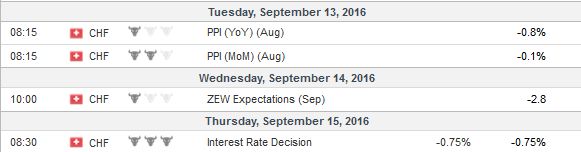

SwitzerlandThis week, Swiss Statistics publishes the PPI. Furthermore, the Swiss ZEW index is published. The SNB holds its quarterly meeting on Thursday. |

Economic Events: Switzerland |

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$AUD,$CAD,Bonds,newslettersent,OIL,stocks