Imposter DollarOUZILLY, France – We’re going back to basics here at the Diary. We’re getting everyone on the same page… learning together… connecting the dots… trying to figure out what is going on. We made a breakthrough when we identified the source of so many of today’s bizarre and grotesque trends. It’s the money – the new post-1971 dollar. This new dollar is green. You can buy things with it. |

The new three dollar bill issued by the Apprehensive States of America. |

| Yes, it has lost more than 80% of its buying power since it was put in place. But still, it’s not so bad. Compared with the Argentine peso (current inflation rate: 47% a year), it is splendidly solid.

But the new dollar is an imposter. The old one was connected to gold at a fixed rate. And gold was anchored in the real economy. The new dollar has no gold backing. Billionaire investor Warren Buffett believes it’s silly to pay someone to take gold out of the ground, and then put it back in the ground and pay someone to guard it for you. But Buffett misses a vital point: Real money is essential to building real wealth. It’s what makes the economy operate smoothly. It helps us all decide when to buy and when to sell, when to invest and when to refrain from investing, and where to apply our scarce time and resources. |

There is actually a half ounce Warren Buffett gold coin. He’s not the guy to ask about gold though. |

Real Money, Real ValueReal money has real value. Gold-backed money increased about as fast as the mining industry could extract gold from the ground – which was about the same rate as the economy was growing. So, when people got more money, they had a claim on more real wealth. But the new money was phony. Governments and banks could add as much of this new money as they wanted. But it did not create or even track real wealth; it just took it away from those who owned it. It was as if Baltimore Orioles owner Peter Angelos tried to increase attendance at Oriole Park by printing extra tickets. Like a counterfeit ticket to a baseball game, the new money didn’t magically add a new seat to the stadium. The Fed made funding readily available to the banks, and the banks lent lustily to their customers. Each new bank loan created money that hadn’t existed before. Out of thin air. No additional wealth attached. Just credits. That’s why some economists call this new system “Creditism.” Because the new money is no longer based on real wealth, but on credit. And the flip side of credit is debt. You can see the problem already. There’s no limit to how much real money you can have. Each additional dollar represents additional wealth. Credit money is different. With credit, you know you can increase your spending dramatically. But you know, too, that there is a limit to how much you can borrow. Eventually, you reach a point where you don’t have the cash flow to service the interest on your debt. Then it’s time to open the book to chapter 7. Or chapter 11. You are insolvent. |

The US dollar’s purchasing power since the establishment of the Federal Reserve, based on official price inflation data. This chart may explain why it is occasionally referred to as the “clownbuck”. Note: the zero line hasn’t been reached yet. There is obviously still more work to do (all indications are that it will be done). |

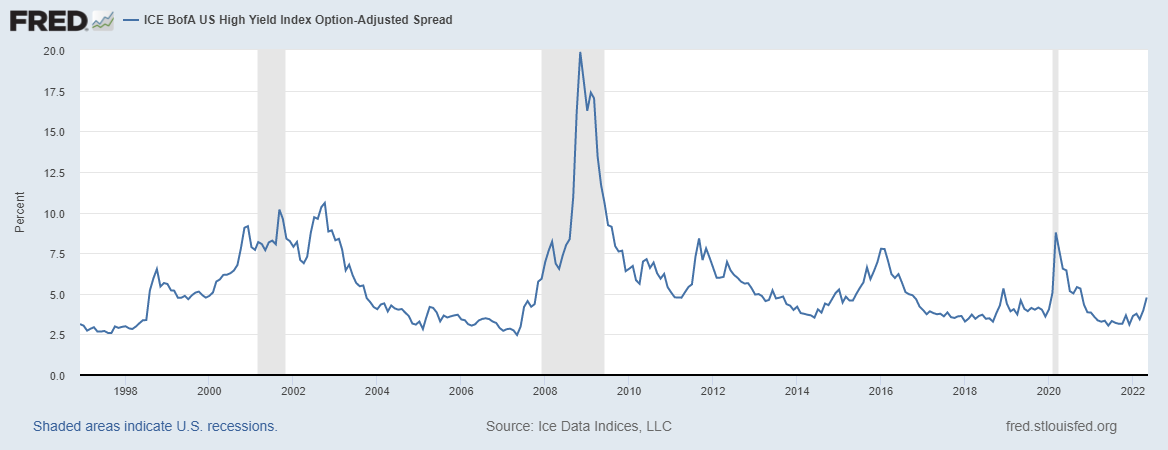

New Credit CrisisWith real money, the more you have, the richer you become. But as the quantity of credit money increases, the economy becomes more and more vulnerable to a turn in the credit cycle. As the quantity of debt increases, the quality decreases. That’s what’s happening with corporate debt now. You’ll recall that, since 2008, corporations have been big borrowers. According to analysts at Goldman Sachs, corporate America has more than doubled its debt since the collapse of Lehman Brothers. And that’s a big problem. Here’s Michael Lewitt, editor of The Credit Strategist newsletter:

Yes, get ready for a new credit crisis – this time centered on corporate debt. “But wait,” you say, “the feds can print money. They can make sure we never again suffer a credit crisis. Right?” Alas, no. They can’t create real money. They can only issue more tickets for seats that don’t exist. That is, they can only make the underlying problem worse, by lending more money to more people who can’t pay it back. The first big crack in the credit money system came in 2008, when a giant fissure broke open between mortgage debt and the homeowners’ ability to pay it. House prices fell. One in 20 houses was in foreclosure by 2010 and the suicide rate had risen 20%. And here’s the big, dirty secret of the system and why the rich love it so much – and why they’re giving millions to Hillary Clinton to keep it going. |

|

First in LineWhen the housing bubble popped, about $800 billion (our estimate) worth of housing went into foreclosure. Houses are real assets. When owners couldn’t pay, the houses went to the banks that had lent the money against them. Sudden wealth disappearance. These banks hadn’t built the houses. They never owned them. They never earned the money that they lent to buy them either. Nor did the money come from savers who had deposited their money in the bank. It was money that no one ever earned. It was a fiction. But this didn’t stop banks using this fake money to capture real wealth – our houses. And this is how the rich – heavily concentrated in the financial sector – get richer, thanks to the new credit money system. It increases the values of their stocks, bonds, and real estate (thanks to low interest rates and Fed buying). It increases corporate profits, too, by lowering financing costs (and incidentally reducing returns to savers) and by boosting credit-fueled retail sales. Most important – the rich are first in line when the counterfeit tickets are distributed. Then you go to the stadium – and you find them sitting in your seats. |

Charts by: St. Louis Federal Reserve Research, Standard & Poor’s

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.

Tags: Bill Clinton,Hillary Clinton,newslettersent,On Economy,Warren Buffett