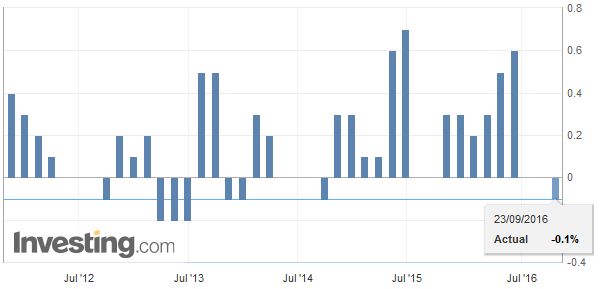

Swiss Franc |

EUR/CHF, September 23, 2016 |

FX RatesAs Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged. Today has the making of the sixth consecutive Friday that the dollar gains against the euro and yen. The Australian dollar has fallen six of the past seven Friday’s and is down today. We note that this pattern has held in weeks that the dollar rose and in weeks, like this one, which the dollar has fallen. If there is a narrative that makes sense of this pattern, it may simply be an effort to reduce short dollar positions ahead of weekends. |

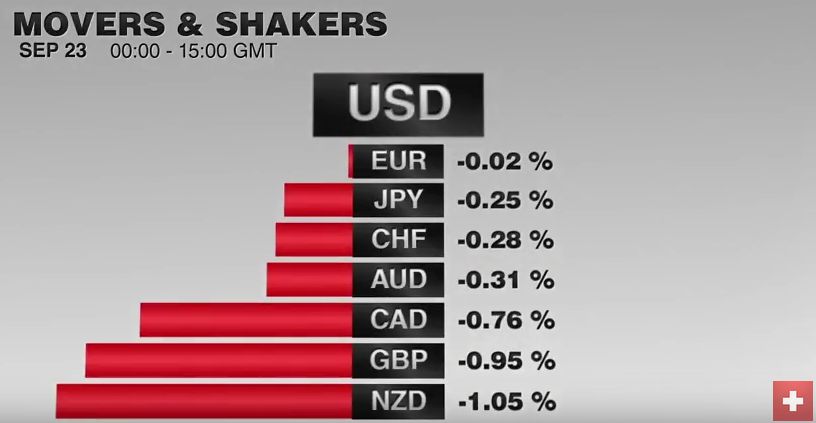

FX Performance September 23 |

| Today’s firmer dollar was partly signaled by the loss of its downside momentum with 12 hours or so of the FOMC decision, which was hardly surprising, even if disappointing. The Fed has painted itself into a corner. Although Yellen conditioned a hike on continued improvement in the labor market and no new global risks, the market remains unconvinced. The chances that the Fed funds target is 50-75 bp at the end of the year is less than 50%.

After bouncing off JPY100 yesterday, the dollar reached almost JPY101.25 in Asia but met sellers that have pushed it back to JPY100.80. Additional intraday support is seen near JPY100.50. Japanese markets were closed yesterday, but it appears that institutions were eager to lock in the dramatic backing up of long-term yields that were triggered by BOJ action. |

|

| The euro has been confined to less than a 25 tick range around yesterday’s North American close. Intraday technicals warn of scope for a mild push higher into the $1.1225 area, before coming back off into the weekend.

Sterling and the New Zealand dollar are competing for the weakest of the majors today. Kiwi has dropped 1.25 cents since the RBNZ indicated it continued to anticipate further monetary easing. The loss does little more unwind the previous three days of gains. Yesterday was the first day in five that sterling did not trade below $1.30. It dipped back below there today. |

|

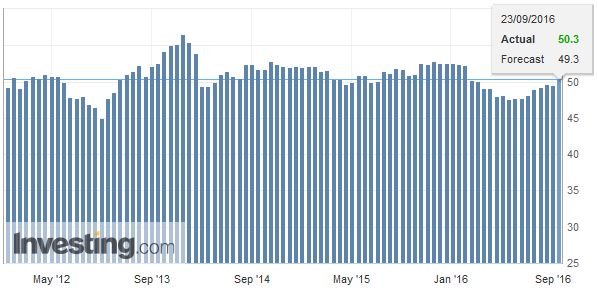

JapanJapan’s Finance Minister was quoted saying that deflation is the biggest problem for the Japanese economy. This seems to wrong diagnosis of the problem. The problem is growth potential. The BOJ estimates that potential growth is only 0.2%. The challenge is not that Japan is expanding below its potential. Its potential is too low. Today’s data confirms the economy is expecting. The preliminary manufacturing PMI rose to 50.3. It is back in expansion mode (above 50) for the first time since February. The All-Industries Activity Index, a proxy for GDP rose 0.3%, a little more than expected. |

Japan Manufacturing PMI(see more posts on Japan Manufacturing PMI, ) Click to enlarge. Source Investing.com |

Eurozone

|

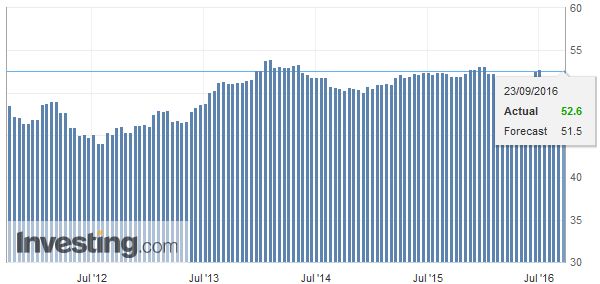

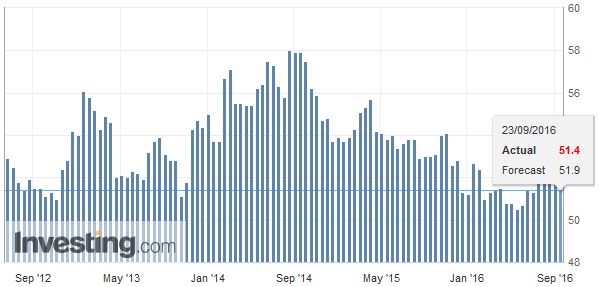

Eurozone Manufacturing PMI(see more posts on Eurozone Manufacturing PMI, ) Click to enlarge. Source Investing.com |

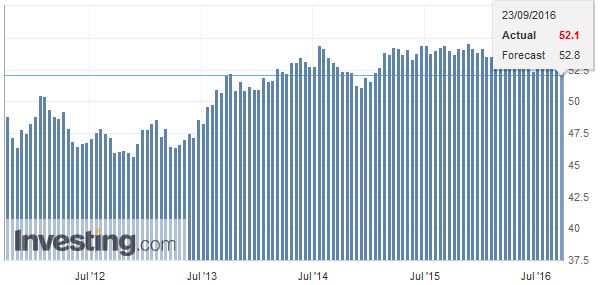

| The aggregate service reading fell to 52.1 from 52.8. The composite fell to a 20-month low of 52.6. The year’s average until now was 53.1. |

Flash Eurozone Services PMI(see more posts on Eurozone Services PMI, ) Click to enlarge. Source Investing.com |

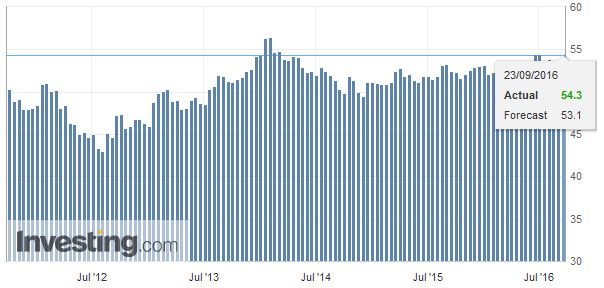

| The German service sector was at 54.4 as recently as July. It fell in August and fell further in September. It stands at 50.6. Manufacturing edged higher to 54.3 from 53.6. The composite eased to 52.7 from 53.6. It is the lowest since May. If there is a silver lining in the disappointing German data, it is economic weakness may, over time, prompt more stimulus policies. |

Germany Manufacturing PMI(see more posts on Germany Manufacturing PMI, ) Click to enlarge. Source Investing.com |

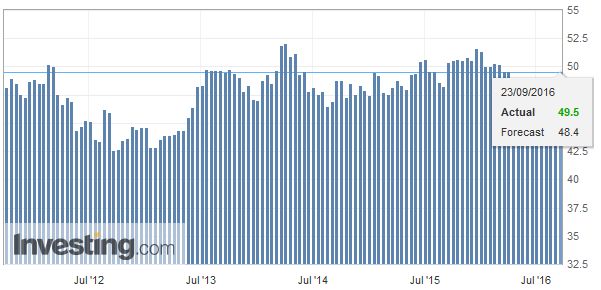

| France showed improvement in manufacturing, services and its composite. Although comparisons between countries is difficult with this time series, it is interesting to note that the French composite of 53.3 (from 51.9) is above the German composite (52.7). It is the best composite reading in France since last October. However, the manufacturing PMI remained below 50 (49.5) where it has been since February. The services reading rose to 54.1 from 52.3. |

France Manufacturing PMI(see more posts on France Manufacturing PMI, ) Click to enlarge. Source Investing.com |

United StatesThe North American session features four Fed speakers, all regional presidents: Harker, Mester, Kaplan, and Lockhart. Insight after the controversial FOMC meeting (three dissents and three seemingly opposed to a rate hike this year via the dot plots) will be helpful, but it may not come today. Next week 12 of the 17 Fed officials will speak, including Yellen and Fischer, but also Governor Tarullo and Chicago President Evans who were likely among the officials who do not think a hike this year is warranted. Markit’s preliminary assessment of the US manufacturing PMI will be reported, but in terms of economic data, the focus will be on Canada.

|

U.S. Manufacturing PMI(see more posts on U.S. Markit Manufacturing PMI, ) Click to enlarge. Source Investing.com |

Crude OilThe Canadian dollar is little changed ahead of the start of the North American session. It is holding on to 1.3% gain this week on the back of a weaker US dollar and higher oil prices. The US dollar bounced off of CAD1.30 yesterday and neared CAD1.3100 in Europe, but is coming off again, and looks poised to retest yesterday’s lows. Oil is pulling back after firming to two-week highs yesterday. Much focus is on next week’s meeting in Algiers. Meetings between Saudi and Iranian officials spurred speculation of an agreement, but reports suggest an deal remains elusive. Given the high level of output, and the coming online of the Kazakstan field, a freeze in production may not be sufficient to sustain the recovery in oil prices. |

Crude Oil(see more posts on Crude Oil, ) |

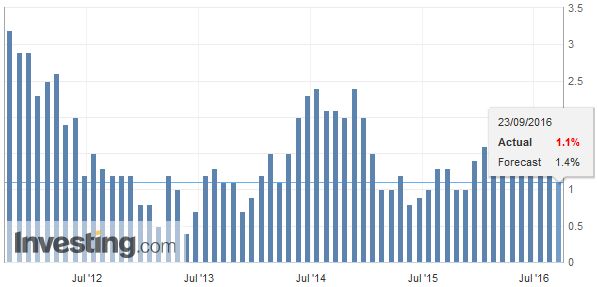

Canada Consumer Price IndexCanada releases its July retail sales and August CPI. The median forecast is for a 0.1% increase in headline retail sales and a 0.5% increase excluding autos. Headline CPI may tick up to 1.4% from 1.3%, while the core rate may slip to 2.0% from 2.1%. |

Canada Consumer Price Index (CPI) YoY(see more posts on Canada Consumer Price Index, ) Click to enlarge. Source Investing.com |

France |

France Gross Domestic Product (GDP) QoQ(see more posts on France Gross Domestic Product, ) Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$CAD,$EUR,Bank of Japan,Canada Consumer Price Index,Crude Oil,Eurozone Manufacturing PMI,Eurozone Services PMI,Federal Reserve,France Gross Domestic Product,France Manufacturing PMI,FX Daily,Germany Manufacturing PMI,Japan Manufacturing PMI,Japanese yen,newslettersent,NZD,U.S. Markit Manufacturing PMI