Swiss FrancWe have recognized that euro shorts are getting covered against USD and apparently also against CHF. This explains the rising euro. |

|

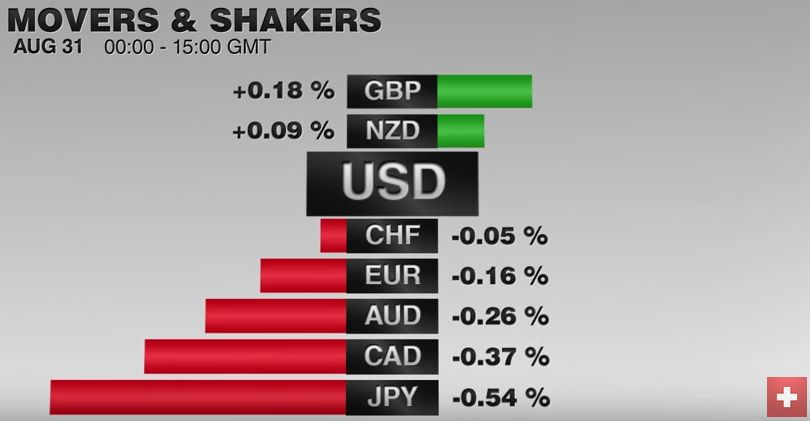

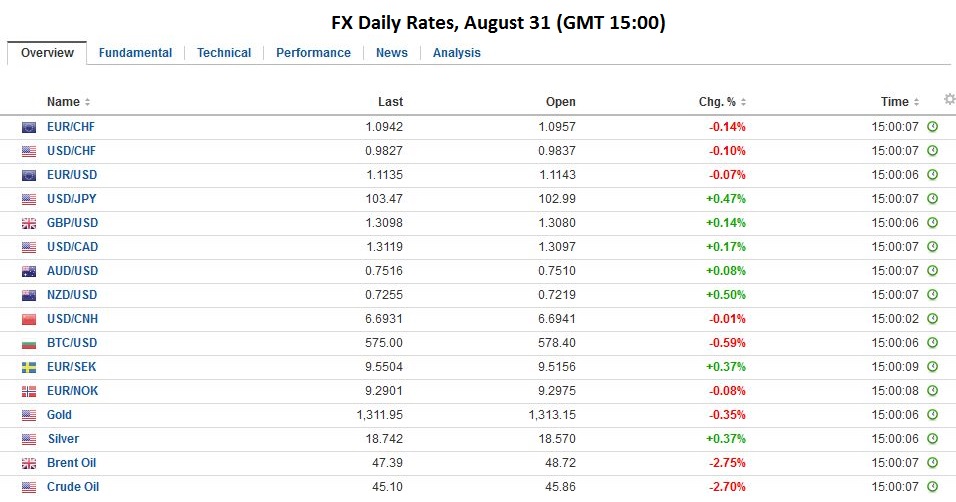

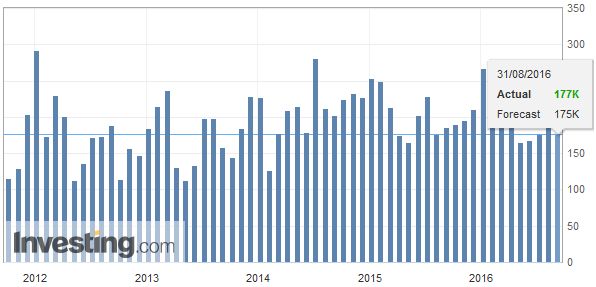

FX RatesThe US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive. That said, before the weekend, the September Fed funds futures implied a 42% chance of a hike, whereas by the close yesterday, the odds had been scaled back to 34%. And still, the dollar remained firm. The ADP employment estimate is kicked off the focus on US jobs. The median forecast from the Bloomberg survey is 175k, essentially unchanged from 179k in July. Our caveat is straight forward. The June and July jobs growth was well above recent and long-term averages. A mean-reversion process warns of the risk of the softer number. Moreover, the recent pattern, that is for the past five years, the actual August report has been below median expectations. |

|

| The euro posted a marginal new low for the move at $1.1130. However, the range is about a third of a cent and appears to be waiting for US leadership. The $1.1110-$1.1120 area is important from a technical perspective. It houses the 200-day moving average and a 61.8% retracement of the euro’s rally since late-July when it last dipped below $1.10. The $1.1170-$1.1180 may cap upticks. | |

| Whereas the news stream has picked up today, month-end considerations may also be operating. The US dollar ticked up against most of the major currencies. nThe exceptions were the Scandi bloc and the New Zealand dollar. On the other hand, the Swiss franc was the weakest, losing around 1.3% and the yen, which is off 1% coming into the last North American session in August. Benchmark 10-year bond yields tended to rise–a dozen basis points in the US and Japan, 2-4 bp in core Europe. Peripheral European bonds and UK Gilts saw around a six bp decline in 10-year yields. Equities were mostly higher, though the US S&P 500 is up a little more than 0.1% on the month coming into today’s session.

The US dollar is firm against the Canadian dollar after a three-day rally. That advance has brought it above the downtrend line from the late-July highs. Oil prices also remain soft and do the Loonie few favors. Comments from Saudi and Iranian officials make it harder to be optimistic about next month’s meeting. A foothold above CAD1.31 could see a quick push toward CAD1.32. |

|

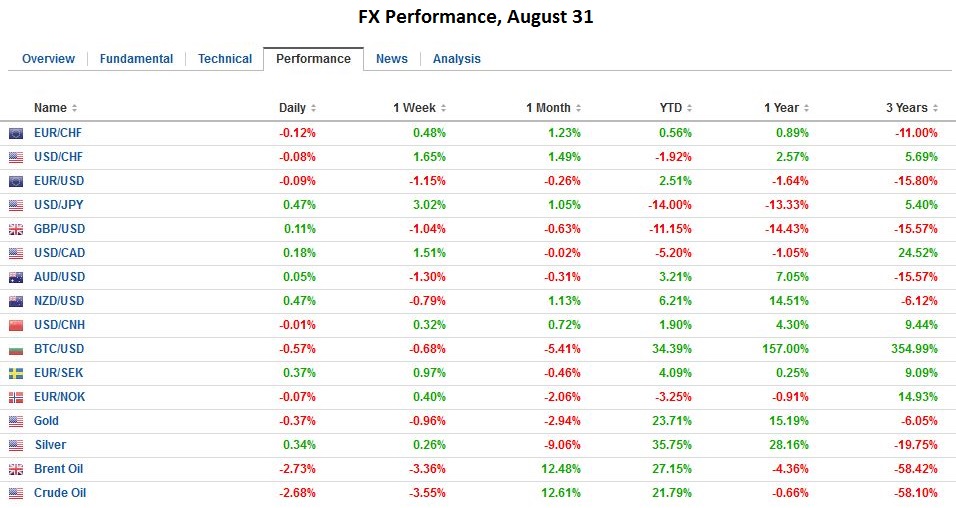

JapanJapan disappointed with a flat July industrial production report. The market had looked for around a 0.8% gain. Industrial output is down 3.8% year-over-year. The problem is the domestic demand has been soft as have exports. Many see such soft data as putting more pressure on the BOJ to ease monetary policy further when it meets later this month. The Nikkei gapped higher today. It finished a little below 16900. The 17000 capped it July and August. While the technicals look constructive, the key may be the yen. The JPY103.50 area is the next immediate target. It is a 50% retracement of the dollar’s losses since the July high. Above there the JPY104.00 area beckons. |

Japan Industrial Production MoM(see more posts on Japan Industrial Production, ) Click to enlarge. Source Investing.com |

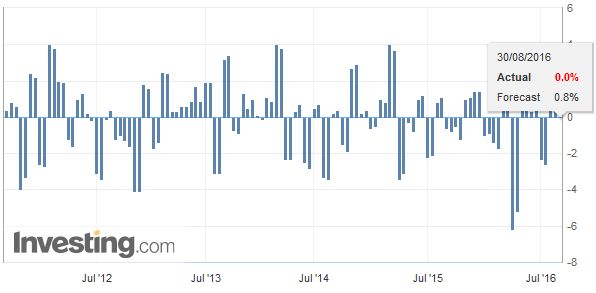

EurozoneEurozone data also disappointed. The July unemployment rate did not improve. It remains at 10.1% for the fourth consecutive month. It finished last year at 10.5%. . |

Eurozone Unemployment Rate(see more posts on Eurozone Unemployment Rate, ) Click to enlarge. Source Investing.com |

Eurozone CPIThe August CPI was also unchanged at 0.2%. The market had expected a little improvement, but yesterday’s softer German numbers make today’s report somewhat less surprising |

Eurozone Consumer Price Index (CPI) YoY(see more posts on Eurozone Consumer Price Index, ) Click to enlarge. Source Investing.com |

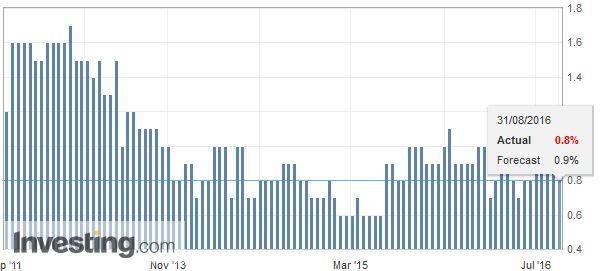

Eurozone Core CPIThe core rate was also softer at 0.8%, slipping from 0.9%. |

Eurozone Core Consumer Price Index (CPI) YoY(see more posts on Eurozone Core Consumer Price Index, ) Click to enlarge. Source Investing.com |

Germany Retail SalesWhile many observers do not expect the ECB to ease policy next week, it cannot be happy with today’s report. It can only reinforce the concern expressed by the ECB over the lack of progress. It is difficult to see how it does not extend its asset-buying program. This, in turn, raises questions about the scarcity of some issues. While Germany is the focus, it is not the only country where supply may become a more pressing issue. There were also a few national reports from Europe that are worth noting. First, while German retail sales (July) were well above expectations, France disappointed. German retail sales jumped 1.7%, more than threefold more than expected and the highest since June 2014. French consumer spending fell 0.2% in July. It is the fourth consecutive decline. |

Germany Retail Sales YoY(see more posts on Germany Retail Sales, ) Click to enlarge. Source Investing.com |

France CPIOn the other hand, French harmonized CPI rose 0.4% in August, which is also the increase over the past year. Italian inflation was a bit better than expected at flat. The year-over-year pace moved to zero from -0.2%. It is the first non-negative reading since January. |

France Harmonised Index of Consumer Prices (HICP) YoY(see more posts on France Consumer Price Index (harmonized), ) Click to enlarge. Source Investing.com |

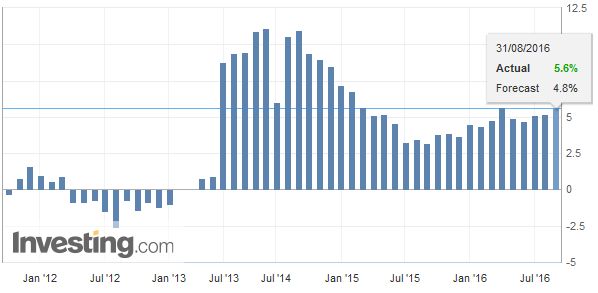

United KingdomNationwide reported UK house price index rose 0.6% in August, defying expectations for a decline. The year-over-year pace of 5.6% is the highest since March. Sterling itself is firm, but is range-bound. It has formed a shelf this week near $1.3060. The top of the range is a little more than a cent higher. Prime Minister May is meeting with her cabinet today, in part to prepare to be peppered at the G20 meeting about Brexit intentions and what “Brexit means Brexit” really means. |

U.K. Nationwide HPI YoY(see more posts on U.K. House Price Index, ) Click to enlarge. Source Investing.com |

United StatesIn addition to the US ADP (and Chicago PMI), Canada’s GDP will draw attention. |

U.S. ADP Nonfarm Employment Change(see more posts on U.S. ADP Employment Change, ) Click to enlarge. Source Investing.com |

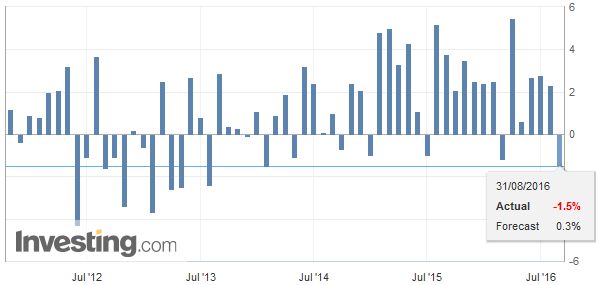

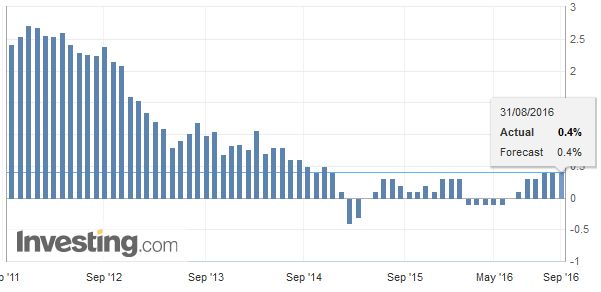

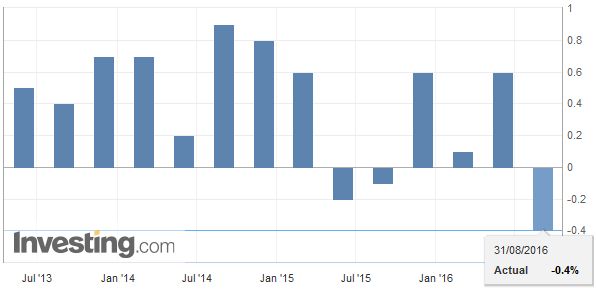

Canada Gross Domestic ProductCanada is one of the few that report monthly GDP. The economy likely snapped back from the 0.6% contraction in May. A 0.4% gain is expected. However, the quarterly GDP may attract more attention, though it is mostly old news. The economy may have contracted by 1.5%. Moreover, we learned yesterday that the Q2 current account deficit swelled by near 20% (to near a record at C$19.9 bln). |

Canada Gross Domestic Product (GDP) QoQ(see more posts on Canada Gross Domestic Product, ) Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$CAD,$EUR,Bank of Japan,Canada Gross Domestic Product,ECB,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Eurozone Unemployment Rate,France Consumer Price Index (harmonized),FX Daily,Germany Retail Sales,Italy,Italy Consumer Price Index,Japan Construction Orders,Japan Industrial Production,Japanese yen,newslettersent,U.K. House Price Index,U.S. ADP Employment Change