Summary

Italian banks have done worse that European banks.

Italian banks outperformed Germany banks from end of H1 12 through H1 15.

US banks and financials more broadly have outperformed Europe.

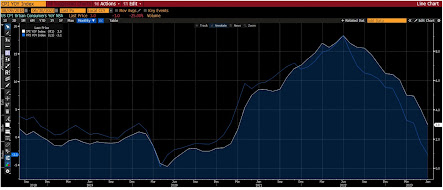

Italian BanksThis first chart show the FTSE Italian bank index (white line) and the MSCI European bank index (yellow line). We indexed both time series to 100 as of 1 July 2009. The Italian bank index has lost two-third of its value over this period. It had staged a recovery from July 2012 through the July 2015. It since sold off, and the index has returned to within striking distance of that 2012 low. The three-year improvement in equity, which partly reflect new capital raising efforts, has been nearly completely reversed.

The MSCI European bank index has fallen nearly half of the decline seen by Italian banks. The index is off 30% since early July 2009. This is the divergence. Looking at only the performance over the past 12 months, we note that the European bank index is nearly 50% lower, while the Italian bank index is 65% lower. The divergence is less over the most recent period, and that is important.

|

|

Italian Bank shares outperformed German ones since 2012The second chart illustrates why. It shows two time series. Italy’s bank index is in yellow, and the German bank index is white. As we have already noted, Italy’s bank index has lost roughly 2/3 of its early July 2009 value. The German bank index has fallen 52%. However, looking at the whole post-Great Financial Crisis period does not do justice to what happened. Consider that from then end of H1 12 through H1 15, Italian banks actually handily outperformed German banks. The Italian bank index had more than doubled (250%), while the German bank index had increased by a little more than 20%. |

|

Dow Jones Financial Sector vs. MSCI European Bank Index and S&P Bank Select Industry IndexThe third chart here looks at the relative performance of three ETFs. The white line is the iShares ETF (IYF) that tracks the Dow Jones financial sector. Over the past five years, it has risen 54%. The yellow line is ETF that tracks the MSCI European Bank Index (EUFN). It has fallen by nearly 30% over the past five years. The green line is the ETF that tracks the S&P Bank Select Industry Index (KBE). It has risen by as much as the EUFN has fallen. |

Tags: Article 50,Italy,newslettersent