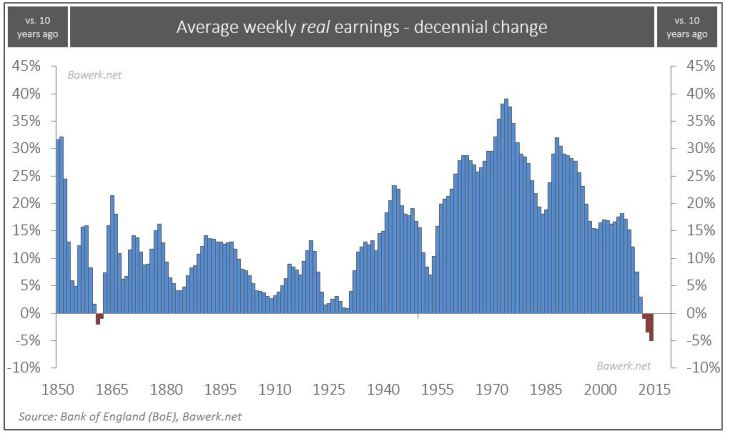

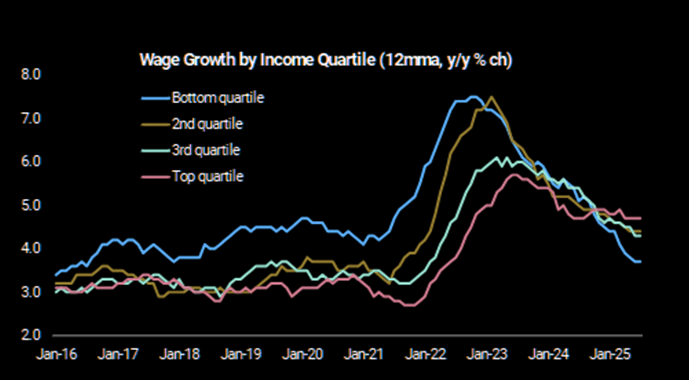

U.K. Average Weekly Real Earnings

Consider the following chart that depicts decennial change in average real earnings for the UK worker. It shows an unprecedented development. Not since the 1860s have the UK worker experienced falling real earnings over a ten-year period. Such dramatic change obviously does something to the so-called social contract people have been tricked into. People no longer believe in a brighter future and there is nothing more detrimental to a human being than that. No longer vested in the status quo, people opt for radical change, hence; Brexit, Trump, Le Pen, Lega Nord, 5MS. Old rules does not apply anymore.

Over the next couple of years, we will experience a torrent of sea change, a lot of it unpleasant, but it will come nonetheless. In the social contract, immigration is OK when jobs are plentiful and people’s houses are worth more every year. Not so much when they are unemployed and without a house or even prospects of ever owning one. Corruption in the higher echelons of society is grudgingly accepted when the elite allegedly runs a system where incomes and productivity constantly moves upwards, but will not be tolerated as blue collar jobs are moved offshore. |

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience. - Click to enlarge |

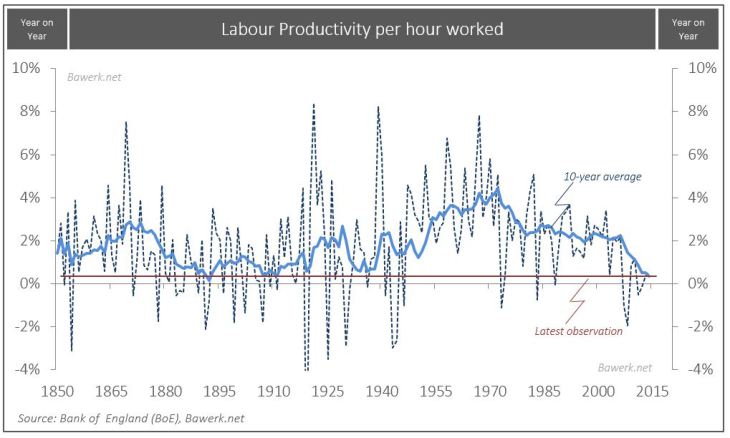

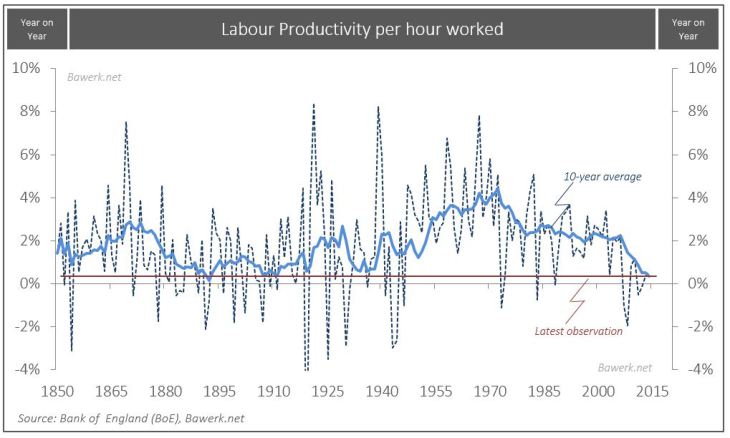

U.K. Labor Productivity per hour worked

Productively invested capital and high savings are the indispensable ingredients in rising labour productivity. Consume your seed corn and productivity growth falls or even turns negative. Falling earnings on a level unmatched through history goes hand in hand with the weakest productivity growth in 100 years. Bottom line, the west is in a structural downturn, caused by decades of economic mismanagement and there is nothing our money masters can do to rectify it; they will only make the problem worse by postponing the inevitable. |

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience. - Click to enlarge |

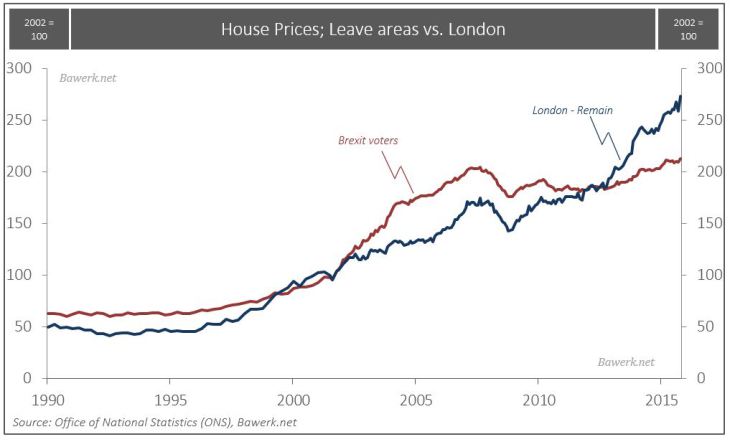

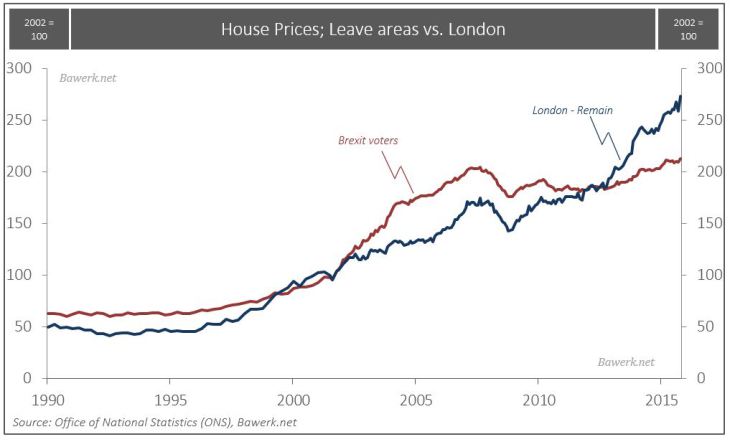

U.K. House Prices: Leave areas vs. London

It is also interesting to note that the Brexiters do not even get to enjoy rising house prices anymore. Those are reserved for the highly paid remainers in the capital where the peak debt cycle has not yet struck.

|

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience. - Click to enlarge |

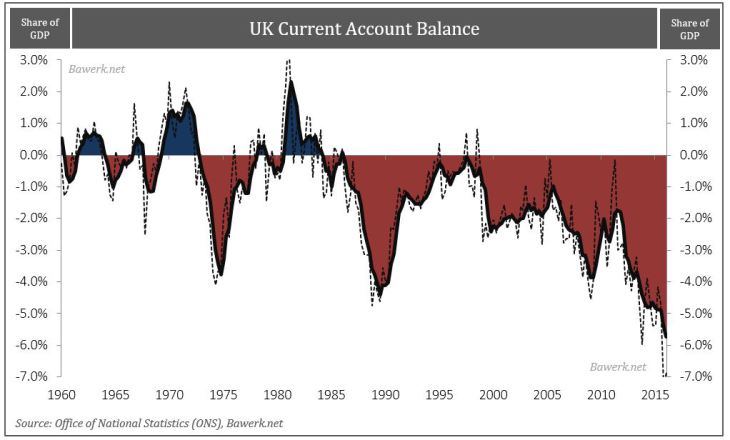

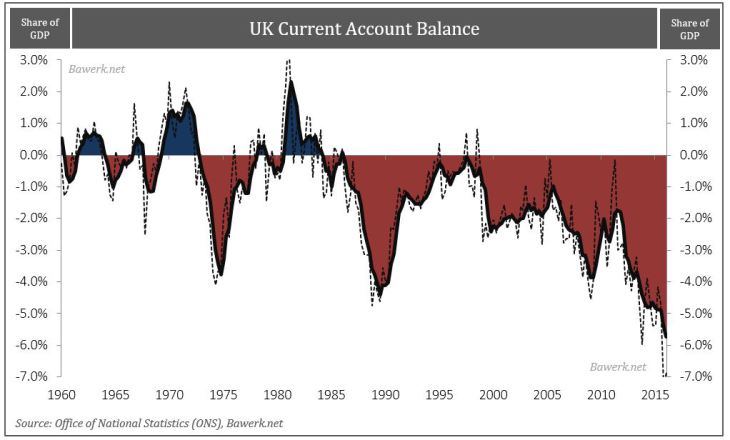

U.K. Current Account Balance

So what does this mean for the UK specifically? Few have lived as high on the hog as the brits have. Their current account deficit at 6 per cent of GDP is reminiscent of countries heading into depressions. In the mid-1970s, the IMF had to bail them out and in the early 1990s, the infamous ERM regime collapsed as Soros made his billion. The pound got a pounding on the Brexit vote, but it was destined to fall anyways. The adjustment needed to correct this imbalance is not over and we should all expect a far weaker pound in the months and years ahead. Brexit only triggered what was already baked into the cake in the first place. |

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience. - Click to enlarge |

U.K. Balance of Payments

It is no secret that short-term portfolio investments fund a large part of Brits excesses. These are mere claims on UK future production or assets. The immediate withdrawal form UK real estate funds, which has since been gated, is the dying canary signalling what will come; the current account deficit will no longer be funded by complacent foreigners. The pound will collapse thus forcing the long overdue correction the UK economy desperately need for long-term sustainable prosperity. |

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience. - Click to enlarge |

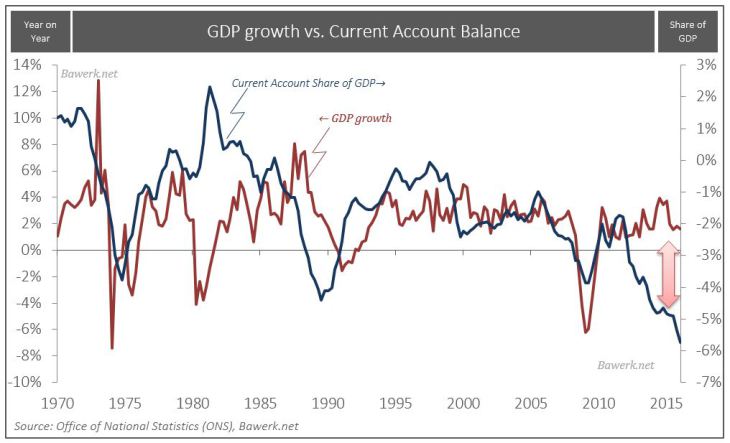

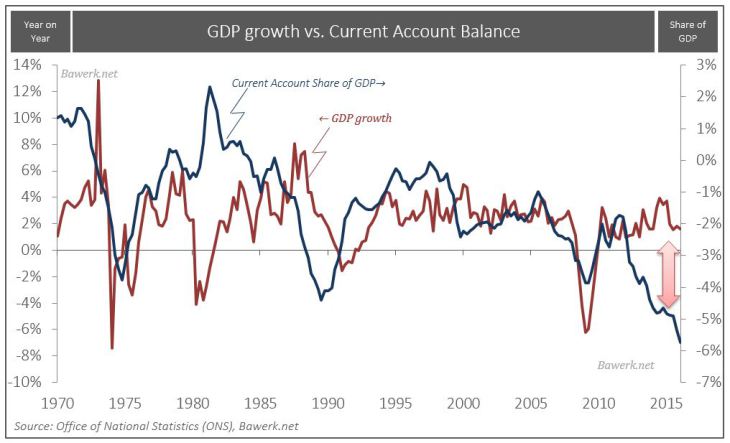

GDP Growth vs. Current Account Balance

When it does GDP follows suit as it have one ever since the UK became a fully financialized economy. From the 1990s whenever the current account deficit went through three per cent of GDP, growth collapsed shortly after as the economy went through necessary adjustments. Today’s gap is at record level and it is thus logical that the coming adjustment will be even more gut wrenching that it has ever been. |

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience. - Click to enlarge |

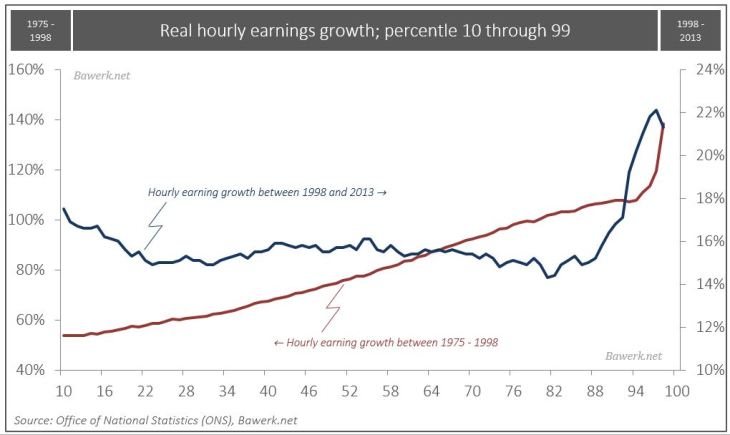

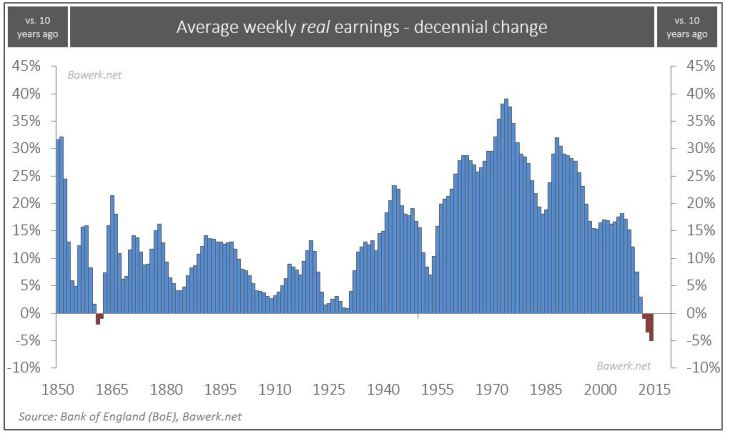

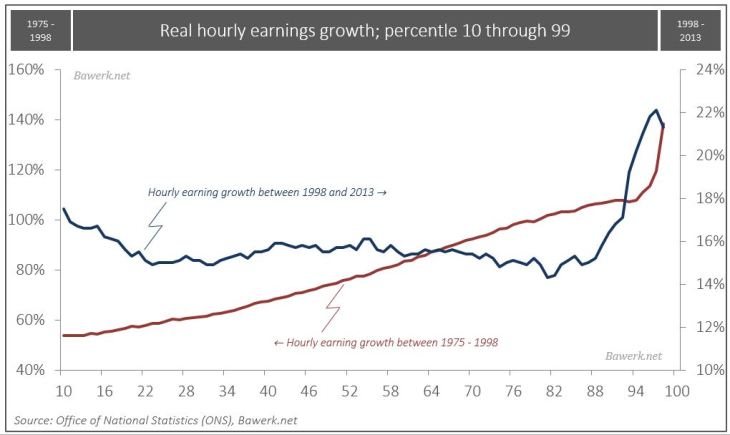

Real hourly earnings growth, percentile 10 to 99

The British middle class are fed-up with the status quo and they no longer feel vested in its future. They are willing to opt for change no matter what the elite tell them, and change they will get. As the pound crashes, current account deficits are balanced and asset prices adjust accordingly the UK economy is up for a rough ride.

- While income stagnated for the middle class, the top earners managed to boost their earnings fuelling resentment

|

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience. - Click to enlarge |

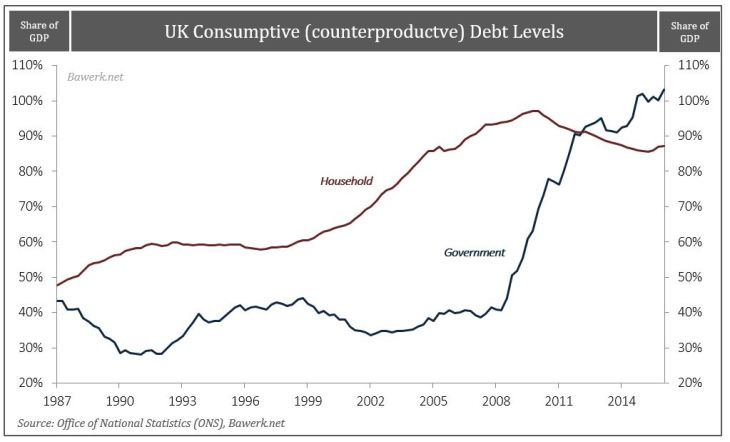

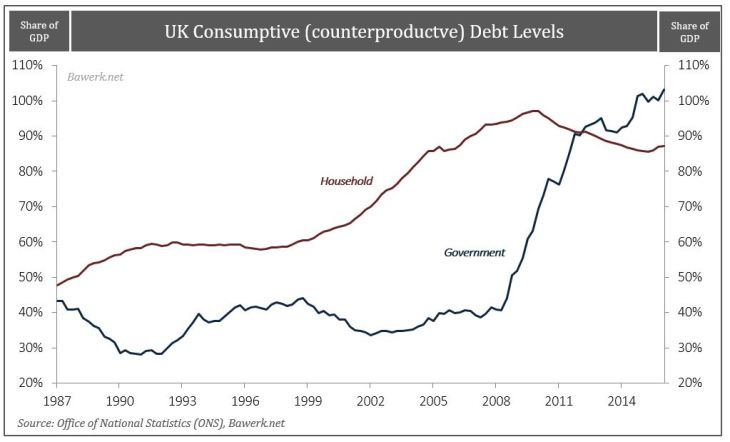

U.K. Household and Government Debt

As peak debt struck the public tried to leverage the collective balance sheet with dire consequences for the longer term |

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience. - Click to enlarge |