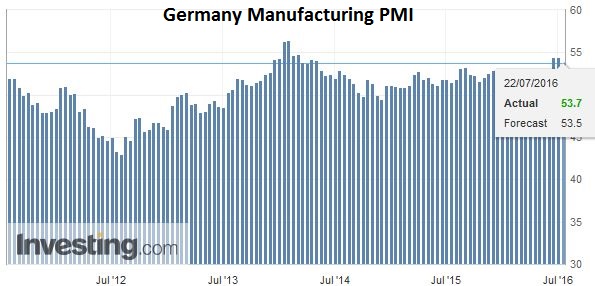

Swiss FrancThe EUR/CHF ended lower today. Today’s data showed that Germany has stronger growth than the rest of the Eurozone. Given the strong Swiss trade ties with Germany, the Swiss franc appreciated. See more in Correlation between CHF and the German Economy |

|

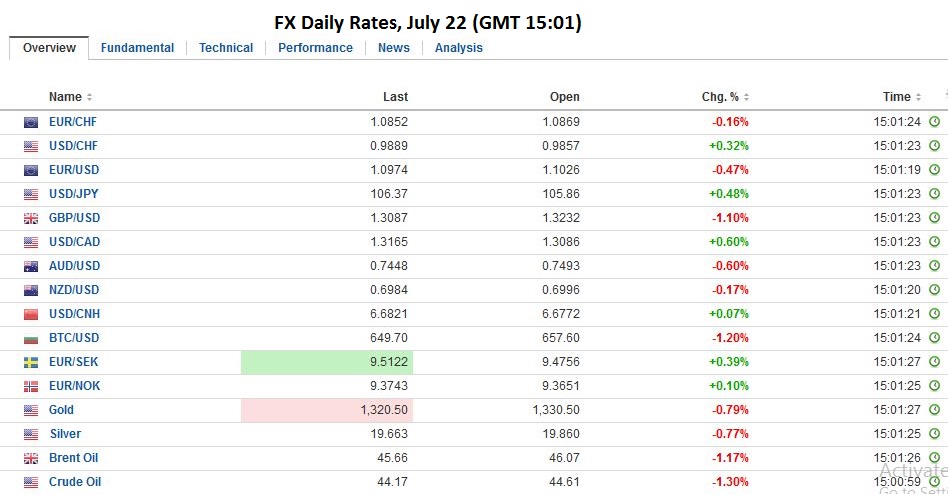

FX RatesAs the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US equities yesterday has continued in Asia and Europe today. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 in Europe are both off around 0.5%. The second development is continued heaviness of the dollar-bloc currencies. They have underperformed this week. Expectations that both New Zealand and Australia may cut interest rates next month weighed on their respective currencies. The Kiwi is the weakest of the majors over the last five sessions, falling 1.7%. The Aussie is off 1.3%. It is holding a little above a two-month trendline, found near $0.7450. |

Click to enlarge. Source Dukascopy |

| The Canadian dollar has been dragged down in sympathy, as no Bank of Canada rate cut is anticipated. However, weaker commodity prices, including oil at two-month lows, have not done the Loonie any favors. It is the weakest of the dollar-bloc today, off about 0.3% to take its losses for the week to about 1.2%, matching the yen’s weakness.Sterling was trading a little above yesterday’s high and just below $1.33 when the news hit. Sterling was sold off and briefly and shallowly traded below $1.3150. It has traded on both sides of yesterday’s range. A close below yesterday’s low (~$1.3156 according to Bloomberg) would be a bearish technical development. That said, good buying interest was detected earlier this week as the $1.30 level was approached.

The euro is little changed today. It is holding above $1.10, but has been capped near $1.1040. Yesterday’s initial attempt to buy the fact after selling the rumor stalled at $1.1060. Continued narrow range trading is likely to prevail ahead of the weekend. Recall that the euro hit $1.09 when the results of the UK referendum back clear and the following session, it held $1.0970. |

|

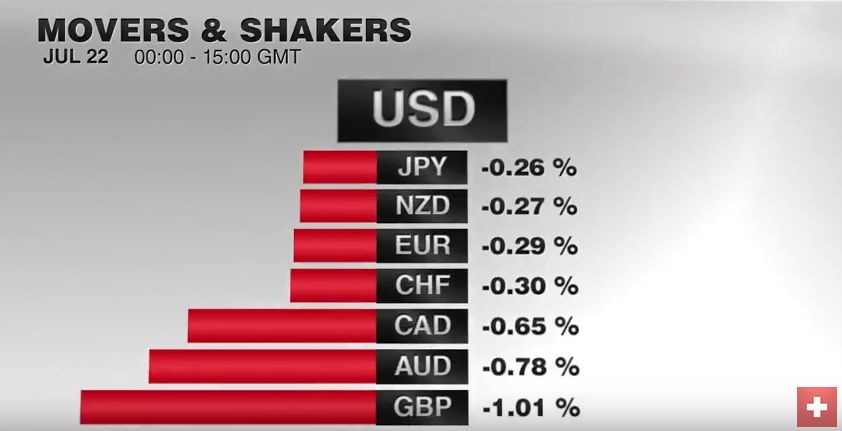

JapanThe third development has been the flash PMIs. Japan was first. Its flash July manufacturing PMI firmed to 49.0 from 48.1. The improvement leaves it below the 50 boom/bust level for the fifth month. The yen is trading within yesterday’s ranges. The dollar did not recovery from the drop spurred by the month-old interview with the BOJ’s Kuroda in which he rejected the kind of helicopter money that has been bandied about. As we have noted, the BOJ, like other major central banks, is barred from buying securities directly from the government. Although there is some suspicion that the law will be changed, there does not seem to be any movement in that direction, and surely not before next week’s BOJ meeting. Many investors do not have much confidence in next week’s outlook or in how the market will respond. Meanwhile the focus is on fiscal efforts, and reports of the size of the package have increased to JPY30 trillion (~$280 bln). We caution that much of these elevated figures are not what Japanese economists would call fresh water, but rather recycled funds and loans. |

Click to enlarge. Source Investing.com |

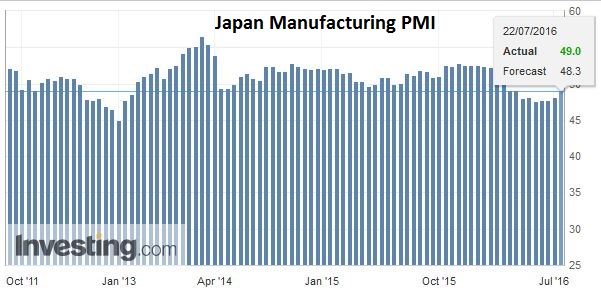

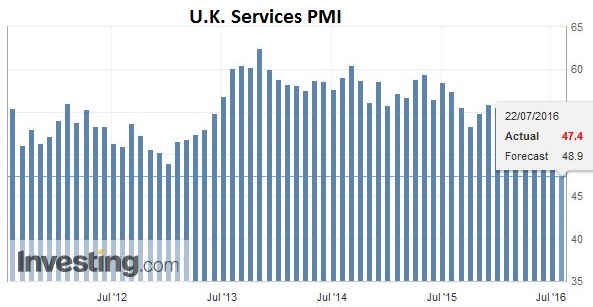

United KingdomIn what Markit said would be a one-off, a flash PMI reading for the UK was made available, which includes about 70% of the responses. The news was not pleasant. The results were below the pessimistic market expectations. Although two MPC members (Weale and Forbes) wanted to see more real sector data before agreeing to ease policy, while the PMI is survey data, the magnitude of the decline may underpin expectations of BOE action in a couple of weeks. The implied yield of the September short-sterling future has fallen three basis points today, which is sufficient to negate the week’s increase. Specifically, the UK flash manufacturing reading fell to 49.1 from 52.1. The Bloomberg median guesstimate was 48.7. |

Click to enlarge. Source Investing.com |

| The flash service PMI fell to 47.4 from 52.3. The Bloomberg median forecast was 48.8. These results led to the composite falling to 47.7 from 52.4. |

Click to enlarge. Source Investing.com |

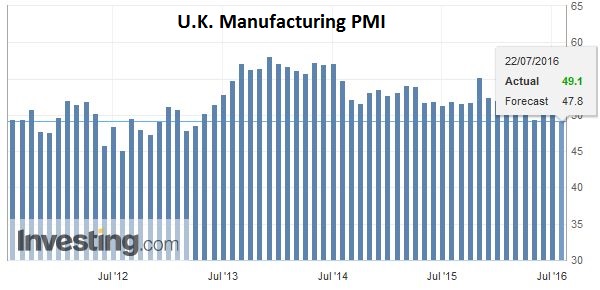

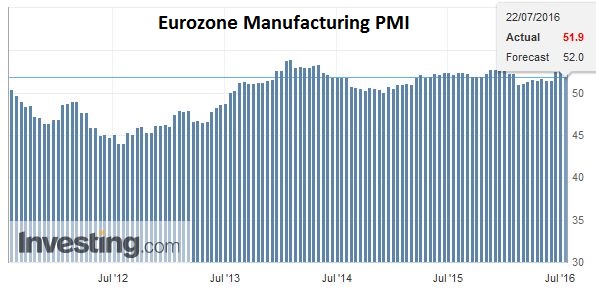

EurozoneThe small declines posted in by the eurozone aggregate readings pale in comparison with the UK. The eurozone flash manufacturing fell to 51.9 from 52.8. This is just below the median expectation. The flash services PMI slipped to 52.7 from 52.8. The median forecast was for 52.3. These results generated a composite of 52.9 compared with 53.1 in June and an expectation for a decline to 52.5. |

Click to enlarge. Source Investing.com |

GermanyGermany saw a smaller than expected fall in manufacturing (53.7 vs 54.5 in June and 53.4 median forecast). The service sector improved to 54.6 from 53.2. The median expectation was for 53.7. The German composite rose to 55.3 from 53.6. This is the strongest composite reading since 2011. It points to a good start to Q3 after a softer Q2. |

Click to enlarge. Source Investing.com |

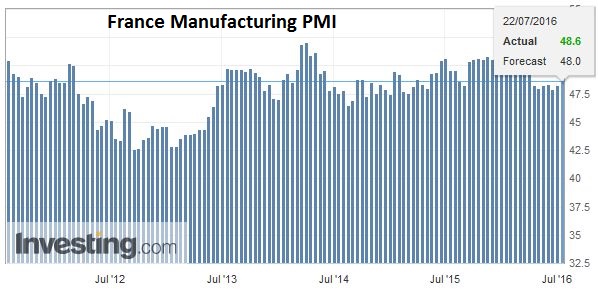

FranceFrance also saw improvement. The manufacturing PMI rose to 48.6 from 48.3. It has not been above 50 since February. The service PMI bounced back to 50.3 from 49.9. These developments were sufficient to lift the composite to 50.0 from 49.6. |

Click to enlarge. Source Investing.com |

ECB meeting

The flash eurozone report follows yesterday’s ECB meeting, in which no new ground was broken. Draghi indicated the ECB will review its monetary policy setting in September by which time there will be new economic data and the staff forecasts will be updated. Despite the urgency in some quarters, Draghi clearly indicated that there were no discussions about a pending shortage of assets or a move away from the capital key criteria. This too looks like something that will be taken up after the summer. Draghi emphasized the ECB’s flexibility.

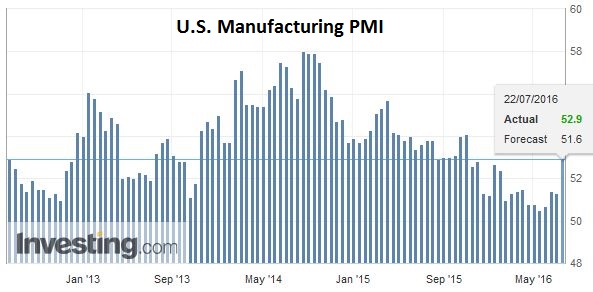

United StatesAs has been the case this week, the US economic calendar is light to close the week with only the Markit preliminary manufacturing PMI on tap. It is expected to firm a little from the 51.3 June reading. |

Click to enlarge. Source Investing.com |

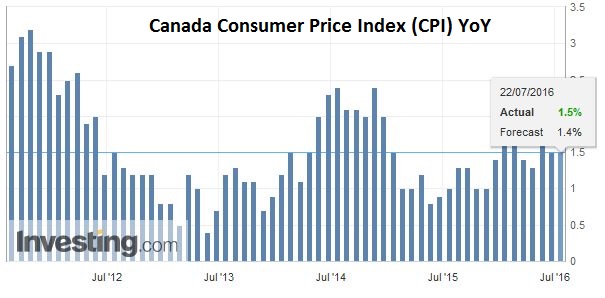

CanadaOn the other hand, Canada reports June CPI and retail sales. Canada’s headline retail sales are expected to have stagnated due to soft auto sales. Without auto, retail sales are expected to have risen by 0.3%. May retail sales rose 0.9% on the headline and 1.3% excluding autos. Consumer prices are expected to have eased to a 1.4% headline pace (from 1.5%) while the core rate may have slowed to 2.0% from 2.1%. |

Click to enlarge. Source Investing.com |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Australian Dollar,Bank of Canada,British Pound,Canada Consumer Price Index,Canadian Dollar,EUR/USD,FX Daily,Helicopter Money,Japan Manufacturing PMI,Japanese yen,newslettersent,U.K. Manufacturing PMI,U.K. Services PMI,U.S. Markit Manufacturing PMI