Keith Weiner's weekly look on Gold. Gold and silver prices, Gold-Silver Price Ratio, Gold basis and co-basis and the dollar price, Silver basis and co-basis and the dollar price. - Click to enlarge

Precious Metals Surge

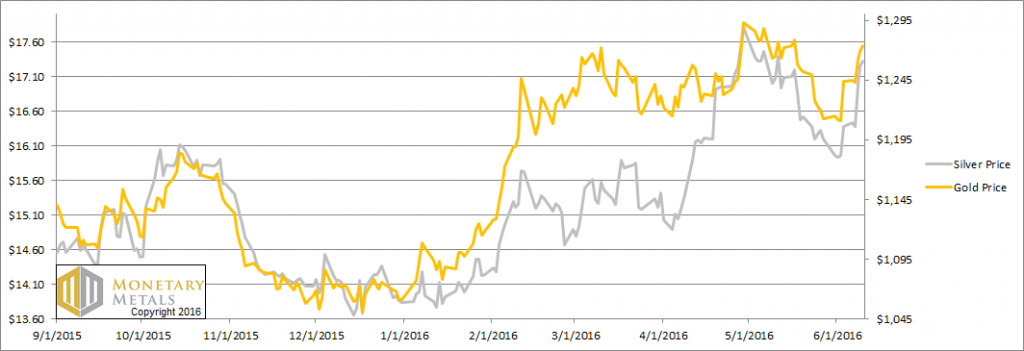

The price of gold bumped up thirty bucks, and that of silver about one buck. Is this liftoff — when the dollar falls sharply, and the price of each metal in dollar terms skyrockets?

Is this the denoument when the gold bug does not get rich, because although his net worth measured in dollar is massively up, the dollar is down in equal measure?

It’s complicated.

But we doubt it. Perhaps a labor report will come out, or news of a government doing something even more insane than irredeemable paper currency (such as giving the power to outright print currency to the legislature) will cause a rush to gold hoarding.

Fundamental DevelopmentsIn the meantime, read on for the only true picture of the supply and demand fundamentals. Prices of gold and silverBut first, here’s the graph of the metals’ prices. | |

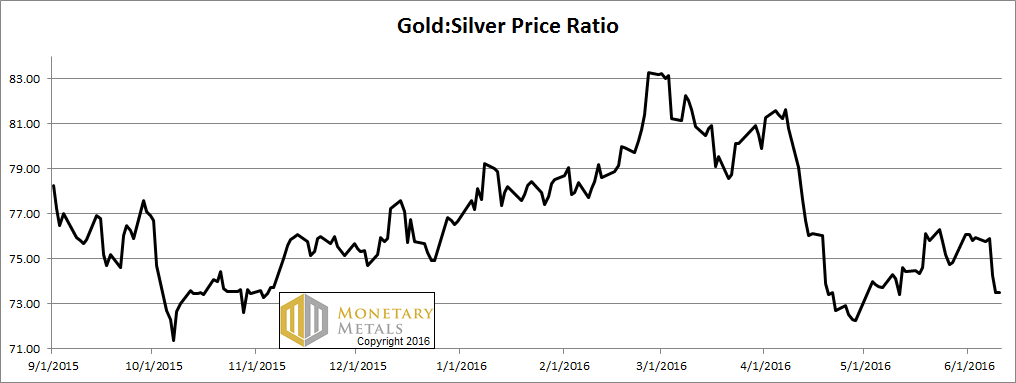

Gold-silver ratioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio was down about two and a half points. | |

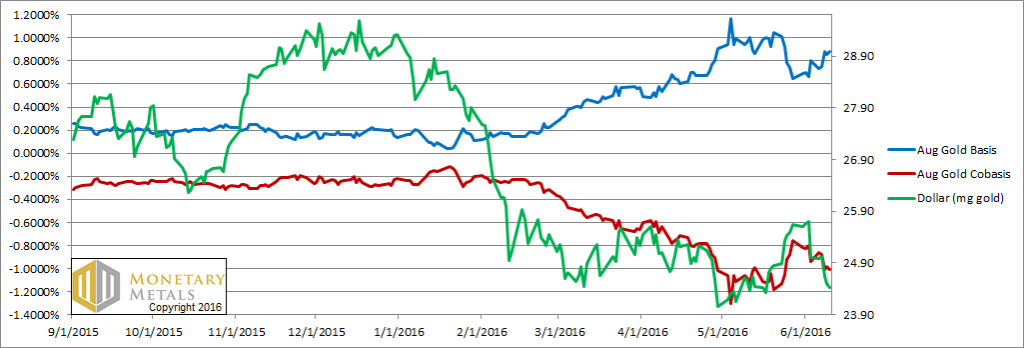

Gold basis and co-basis and the dollar priceHere is the gold graph. The price of the dollar is down (i.e. the price of gold is up). Along with it, the abundance of gold (blue line) is up. More gold is available at the higher price. But not quite proportionally. Our calculated fundamental price is up $11. It’s now about ninety bucks below the market. We would never recommend to anyone to naked short a monetary metal (see the above for the kind of insanity that could cause a big spike in the price). However, we would not be buyers when gold is selling at such a premium. At least not for a trade — for those who don’t have any, we would always recommend getting some regardless of price. Note that little changed from last week. The price blipped up, but it was primarily speculators buying. | |

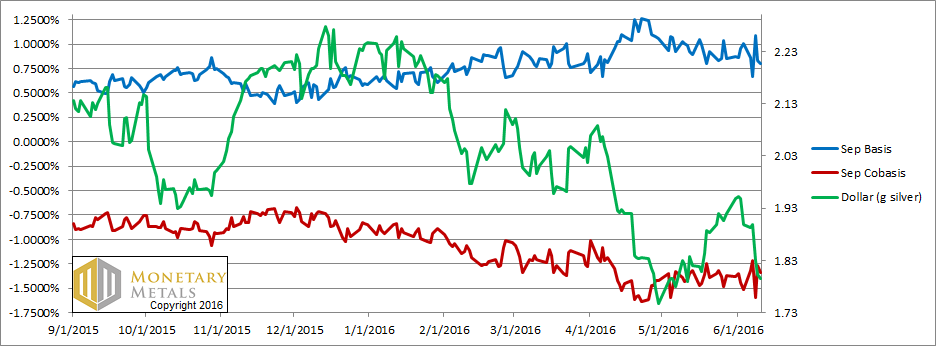

Silver basis and co-basis and the dollar priceNow let’s turn to silver. In silver, the price of the dollar is down sharply and silver became slightly more scarce. Note that we have switched from following the July to following the September contract, as July has become too volatile. We regard the co-basis to be bouncing along at the bottom. Yes, it is higher than it was last week, and yes the price of silver is up sharply, and yes the fundamental price is up from last week. It is still about two bucks below the market. Two bucks is a premium of almost 11.5% to its fundamental price. For now, it seems trading momentum favors silver. “And if that fails, where then will you go, silver?” (paraphrasing Saruman addressing Gandalf in Lord of the Rings). Charts by: Monetary Metals |

Tags: dollar price,gold basis,Gold co-basis,gold price,gold ratio,gold silver ratio,Precious Metals,silver basis,Silver co-basis,silver price,silver ratio