This in turn will lead to more Brexit-type events, resulting in even more forcible reactions by central banks, even more multiple expansion, even higher stock prices, even lower bond yields, even more scramble for yield and risk, and even more inequality, and so on until something snaps.

The details:

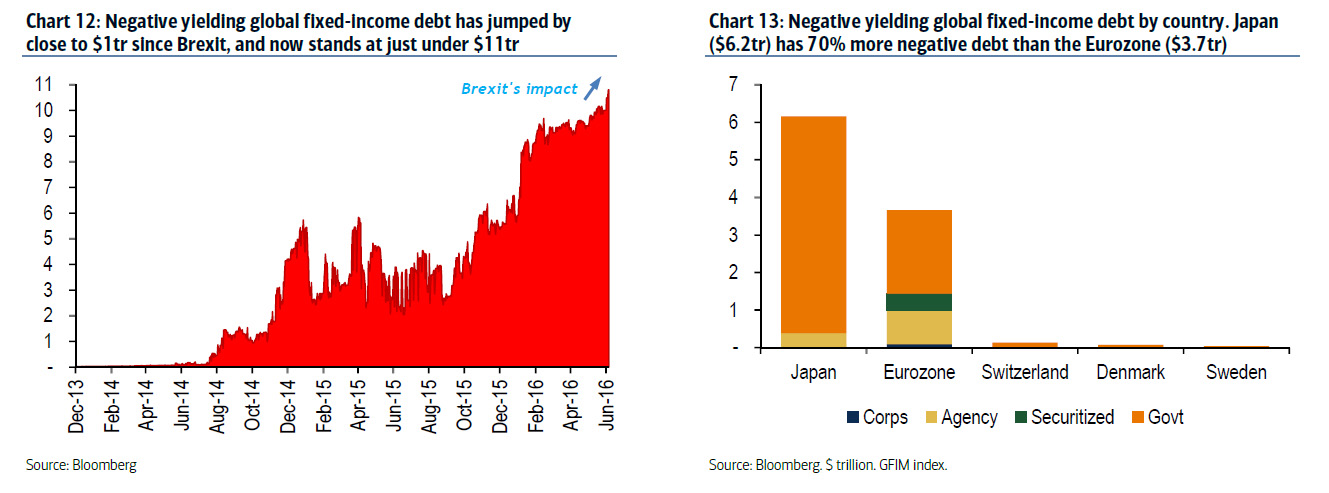

Negative yielding global fixed-income debt has jumped by close to $1tr since Brexit, and now stands at just under $11trSince last Thursday’s Brexit, the stock of global negative yielding fixed-income debt has jumped by almost $1tr, and now stands just shy of $11 trillion (chart 12). Note that Japan is a big driver of this, as market doubts over Abenomics grow. Japan’s negative debt now stands at $6.2tr, almost 70% more than the amount of Eurozone negative debt ($3.7tr), despite the latter having a large amount of negative yielding corporate, agency and securitized bonds. No wonder then that more institutions are becoming vocal in their criticism of central bank largesse. Note the BIS over the weekend, in their latest annual report, arguing that easy central bank policies may well be a contributing factor to the rise of boom and bust economic cycles. |

|

And some thoughts from BofA on the biggest Catch 22: Monetary policy and populism

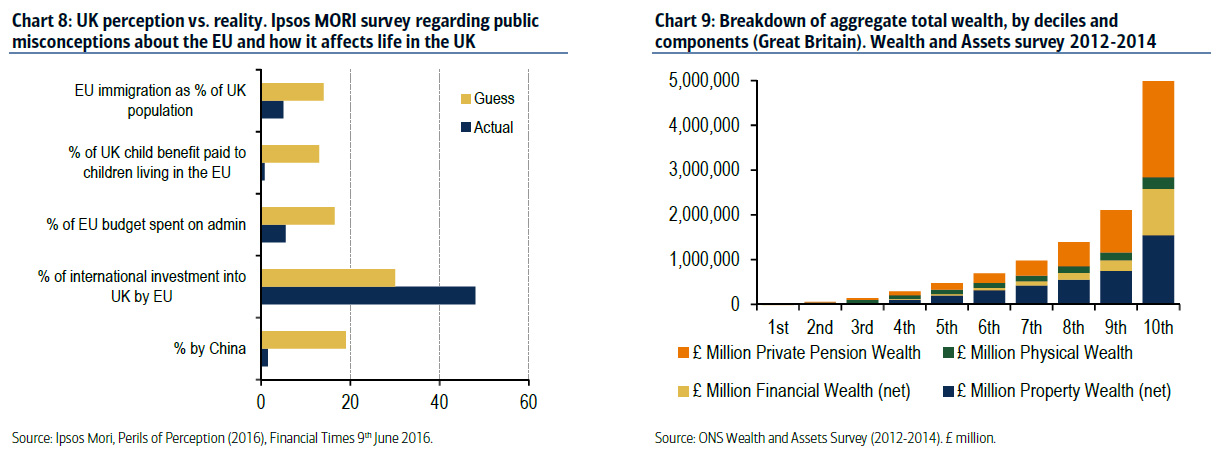

UK perception vs. reality. Ipsos MORI survey regarding public misconceptions about the EU and how it affects life in the UKThe post-mortems of how Brexit came to be are still being written. While the economic and social issues at stake were profound and polarizing, many struggled to truly grasp their scope. Understandably, a perception versus reality gap was clear (chart 8). Breakdown of aggregate total wealth, by deciles and components (Great Britain). Wealth and Assets survey 2012 – 2014.In the end, populism – and a vote away from the status quo – was a likely Brexit driver. Voter anger over themes such as income inequality played its part (see Michael Hartnett’s Wall St. vs. Main St. phenomenon here). As Chart 9 shows, the wealthiest 10% of households in the UK own 45% of aggregate total wealth. And the wealthiest 10% of UK households are over 5x wealthier than the bottom 50% of households…

|

|

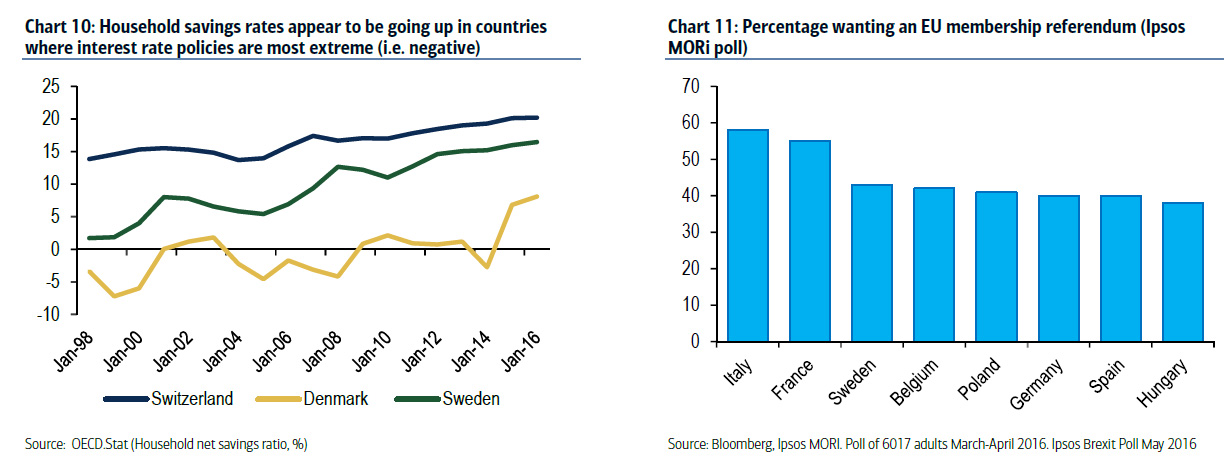

Household savings rates appear to be going up in countries where interest rate policies are most extremeBut, paradoxically, today’s extraordinary monetary policy backdrop is likely adding to voter angst and exacerbating the theme of rising wealth inequality, rather than reducing it. As we highlighted last October, consumer savings rates have gone up in countries where central banks are being the most aggressive with their interest rate policies. Chart 10 shows that household savings rates have gone up in Denmark, Switzerland and Sweden recently. In the case of Denmark, the rise was notable in 2015 and coincided with the Danish Central Bank moving rates into very negative territory (CD rates were quickly cut to -75bp in early 2015). Percentage wanting an Eu membership referendum“Animal spirits” on the consumer side have not as yet flourished. Low yields are likely driving concerns over future income generation (i.e. retirement), and thus contributing to higher consumer savings rates…and paradoxically the feeling of higher wealth inequality. And so as chart 11 shows, policy uncertainty – and populism – is becoming a much broader affair. |

But for now the very catalyst – i.e., monetary policy – that led to Brexit and caused the latest and most vocal yet response by central banks, is ignored because as Germany’s finance minister said it best:

- SCHAEUBLE: EU MINISTERS, G-7 AGREED TO AVOID MARKET CHAOS

Because that’s all that really matters.

Full story here Are you the author? Previous post See more for Next postTags: Abenomics,Animal Spirits,Bank of international Settlements,Bond yield,central banks,Eurozone,Income inequality,Janet Yellen,Japan,Monetary Policy,newslettersent,Reality,Switzerland