The SNB increased the equities share from 18% to 20% in Q1/2016. Purchases focused on US equities.

It raised holdings in U.S. Equities 32 percent in the first Q1 2016, from $41.3 billion at the end of last year. The S&P 500 rose 0.8 percent over that period.

This makes obvious that the central bank goes higher risk. The first risk is the risk on equities, the second one is the dollar that is currently quite expensive.

via Bloomberg

Unlike many other major central banks, the SNB invests in equities, with 20 percent of its 576.5 billion-franc ($603 billion) foreign-exchange portfolio held in shares as of the end of March. That’s a 2 percentage point increase from the end of December. Spokesman Walter Meier at the SNB declined to comment on Wednesday’s SEC filing, which is the only detailed disclosure of the central bank’s stock holdings. It showed the institution had stakes in some 2,600 companies listed in the U.S.

SNB officials have said repeatedly that they replicate broad-based indexes to serve the interest of monetary policy rather than to generate a profit. Some companies are excluded on ethical grounds.

“The SNB adopts a passive approach,” SNB Governing Board Member Andrea Maechler said in a speech on March 31. “This means, in particular, that we do not actively engage in equity selection”

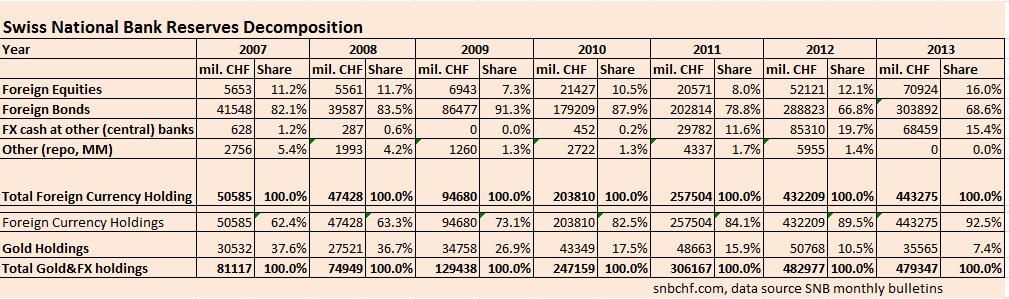

See the recent development of the SNB investment strategy

The risk for the SNB

Earnings at big U.S. companies are on track to tumble 6.4 percent in the first quarter.Analysts think earnings will fall again in the second quarter and then start growing, meaning 2016 might not be a total wash for corporate profits. The American indices and so the SNB’s passive strategy possess oil companies like Exxon and even stocks of the U.S. fracking industry. On the other side, Swiss chemicals or pharmaceuticals profit on low oil prices, this creates financial flows into CHF-denominated stocks.

|

A share of 20% equities is too much for a conservative investor. - She increases the CHF debt with continuing interventions at a pace of 10% per year. - yield on bond investments is less than 1% p.a. and equity markets might not improve a lot any more. - Expensive dollar: she bought U.S. equities when the dollar was relatively expensive. - Click to enlarge |

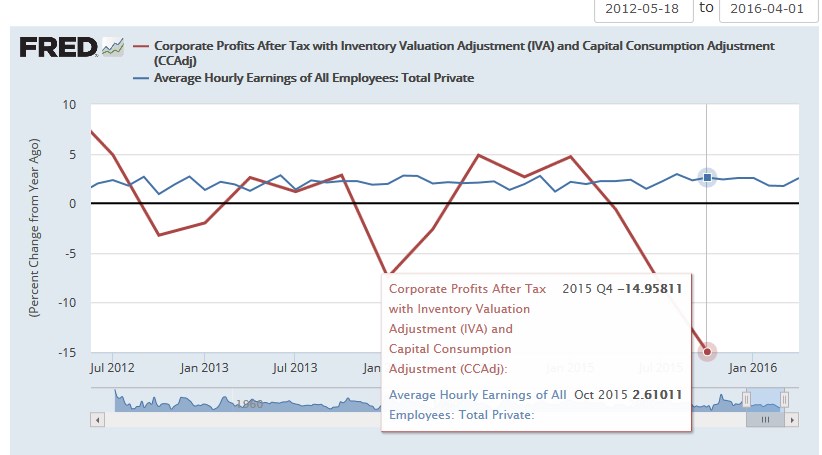

Will wages increase more than company profits?

Corporate profits and wages, YoY2012 – 2016 U.S. wages increase by 2.6% per year, Given the worsened profit situation, there is no guarantee that stock prices continue to rise as they did in the years before. |

The SNB contradicts her mandate as “conservative investor”

- A share of 20% equities is too much for a conservative investor.

- She increases the CHF debt with continuing interventions at a pace of 10% per year (see weekly sight deposits). She buys stocks with borrowed money.

- On the other side, yield on bond investments is less than 1% p.a. and equity markets might not improve a lot any more.

- Expensive dollar: she bought U.S. equities when the dollar was relatively expensive against the Swiss franc: between 0.95 and 1.00 while USD/CHF was at 0.80 in 2011.

Tags: newslettersent