Monthly Archive: April 2016

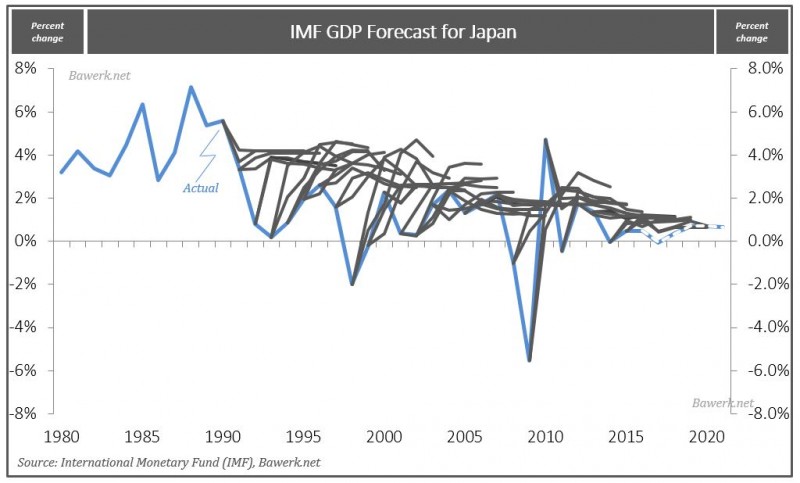

Why All Central Planning Is Doomed to Fail

We’re still thinking about how so many smart people came to believe things that aren’t true. Krugman, Stiglitz, Friedman, Summers, Bernanke, Yellen – all seem to have a simpleton’s view of how the world works.

Read More »

Read More »

Circulus in probando

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because ...

Read More »

Read More »

FX Daily, 04/15: Better Chinese Data Fails to Deter Pre-Weekend Profit-Taking

China’s slew of economic data lends credence to ideas that the world’s second-largest economy may be stabilizing. However, the data failed to have a wider impact on the global capital markets, including supporting Chinese equities. In fact, the seven-day advance in the MSCI Asia-Pacific Index was snapped with a fractional loss today. European shares are …

Read More »

Read More »

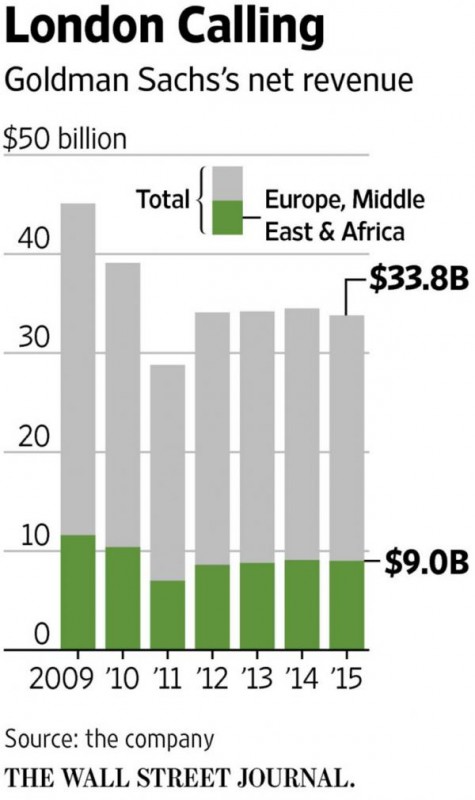

Guess Which Major Bank Loses The Most From Brexit?

Banks have been lobbying intensively against Brexit. Among those leading the charge is Goldman Sachs. For three years, the bank’s executives have publicly warned about the downsides of leaving the EU... and now we know why (hint - it's not concern fo...

Read More »

Read More »

BOE and Brexit

No one can feign surprise that the Bank of England kept policy steady. Nor was the 9-0 vote truly surprising, though there had been some speculation of a couple of dovish dissents. Nevertheless, there are two important takeaways for investors. First, the BOE recognized what many in the market have already accepted; namely that the … Continue...

Read More »

Read More »

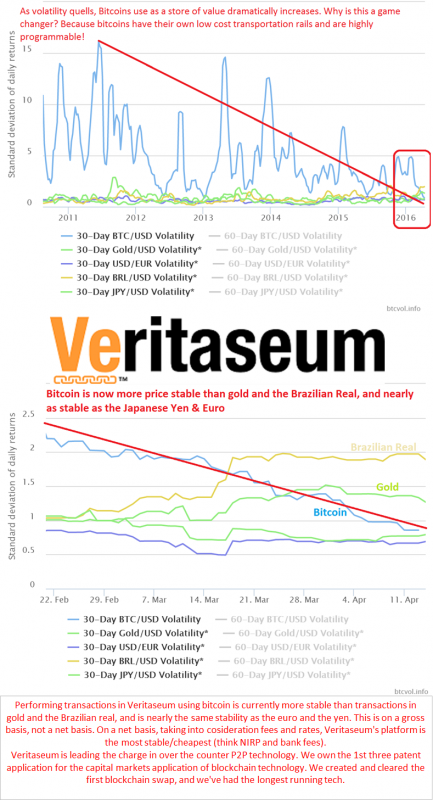

A Take On How Negative Interest Rates Hurt Banks That You Will Not See Anywhere Else

The Bank of Japan and the ECB are assisting me in teaching the world's savers, banking clients and corporations about the benefits of blockchain-based finance for the masses. How? Today, the Wall Street Journal published "Negative Rates: How One Swis...

Read More »

Read More »

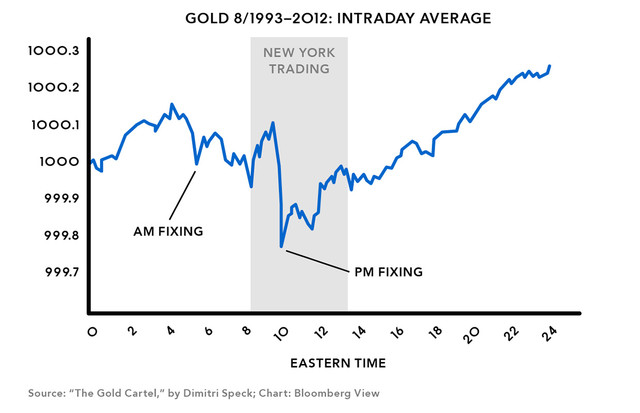

Great Graphic:Is that a Head and Shoulders Top in Gold?

This Great Graphic, created on Bloomberg shows the price of gold over the last six months. The price peaked a month ago near $1285. It seems a distribution top is being formed.

Specifically, it looks like a potential head and shoulders to...

Read More »

Read More »

FX Daily, 04/14: Greenback Steadies Against Majors, but Firmer vs EM After MAS Surprise

After initially extending its recent recovery gains against the major currencies, the US dollar began consolidating in the European morning. An unexpected shift by the Monetary Authority of Singapore, replacing a modest and gradual currency appr...

Read More »

Read More »

Swiss Producer and Import Price Index in March 2016: The Producer and Import Price Index remains stable overall

The Producer and Import Price Index remained unchanged in March 2016 compared with the previous month at 99.0 points (base December 2015 = 100). Whereas the Producer Price Index increased by 0.1%, the Import Price Index remained unchanged on average. Compared with March 2015, the price level of the whole range of domestic and imported products fell by 4.7%. These are the findings of the Federal Statistical Office (FSO).

Read More »

Read More »

Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into...

Read More »

Read More »

Expectation for Doha may be Inflated

The weekend meeting between many OPEC and non-OPEC producers has helped spur the recent gains in the price of oil. We are concerned that market may be getting ahead of itself. First, the freeze in output that had previously been agreed by Russia, Saudi Arabia, and a few other countries was conditional on participation by … Continue reading...

Read More »

Read More »

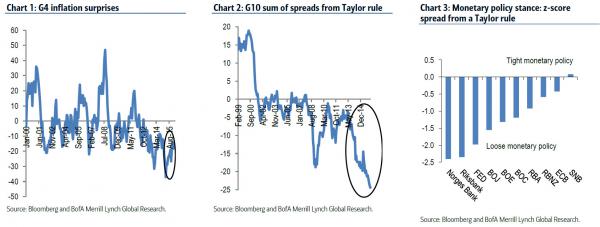

Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as th...

Read More »

Read More »

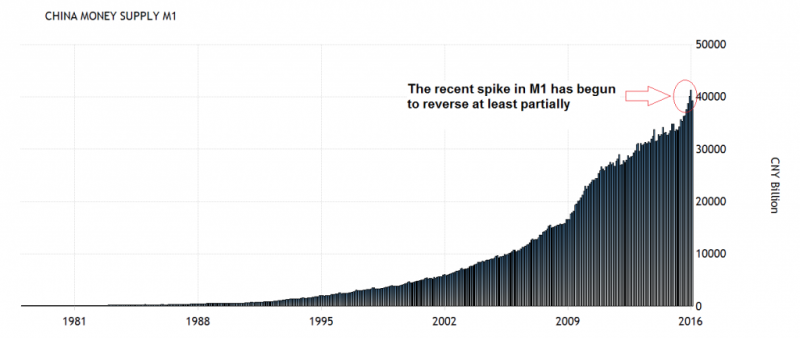

China – A Reversal of Urbanization?

Economic and Demographic Changes We have discussed China’s debt and malinvestment problems in these pages extensively in the past (most recently we have looked at various efforts to keep the yuan propped up). In a way, China is like the proverbial ...

Read More »

Read More »

Argentina – The Times, They Are A-Changing

Our Argentine “Ranch Rebellion” Is Over… for Now… BUENOS AIRES, Argentina – Not much action on Wall Street yesterday. The Dow sold off slightly. Gold and oil were up a bit. How about here in Argentina? “Everything has changed. Everything.” Mauric...

Read More »

Read More »

Dueling Fed GDP Trackers

The decentralized nature of the Federal Reserve lends itself to both a division of labor and competitive analysis. Some Federal Reserve branches have alternative inflation measures and trade-weighted indices of the dollar. On the whole, this seems beneficial for investors and policymakers. One tool developed by the Atlanta Fed has been widely embraced. It is …

Read More »

Read More »

FX Daily, April 13: US Dollar Comes Back Bid

The US dollar is well bid in the Europe and is poised to start the North American session with the wind to its back. Despite firmer equity and industrial metal prices, most emerging market currencies are also succumbing to the rebounding greenback. The euro has yet to convincingly breakout of the range that has confined … Continue reading »

Read More »

Read More »

State of Fear – Corruption in High Places

Mr. X and his Mysterious Benefactors As the Australian Broadcasting Corporation (ABC) reports, a money-laundering alarm was triggered at AmBank in Malaysia, a bank part-owned by one of Australia’s “big four” banks, ANZ. What had triggered the alarm...

Read More »

Read More »

Yes, the Dollar Should Be Backed by Gold…

A Return to Gold BUENOS AIRES, Argentina – “What if you were appointed to head the Fed? In your first week on the job, what would you do?” The question was not exactly serious. Neither was the answer. “We’d call in sick.” Sorry boys and girls, y...

Read More »

Read More »