A Witless Tool of the Deep State?

Finance or politics? We don’t know which is jollier. The Republican presidential primary and Fed monetary policies seem to compete for headlines. Which can be most absurd? Which can be most outrageous? Which can get more page views?

Politics, led by Donald J. Trump, was clearly in the lead… until Wednesday. Then, the money world, with Janet L. Yellen wearing the yellow jersey, spurted ahead in the Hilarity Run.

A coo-coo for the stock market…

A coo-coo for the stock market…

“Cautious Yellen drives global stocks near 2016 peak,” reported a Reuters headline. The story itself was a remarkable tribute to the whole jackass money system.

At first glance, “cautious Yellen” would seem incongruous with stocks rising to “near 2016 peak.” Caution normally means playing it cool, not encouraging speculation.

But it wasn’t so much what Ms. Yellen said that sent stocks racing ahead. It was what she hasn’t done. And she hasn’t done exactly what we thought she wouldn’t do. That is, so far this year, she has not taken a single step in the direction of a “normal” monetary policy; our guess is that she never will.

Why not? Is it because she is a witless tool of Deep State cronies? Is it because her economic theory is silly, superficial, and simpleminded? Or is it because she and her predecessor, Ben Bernanke, have done so much damage to the normal world that there is nothing to go back to?

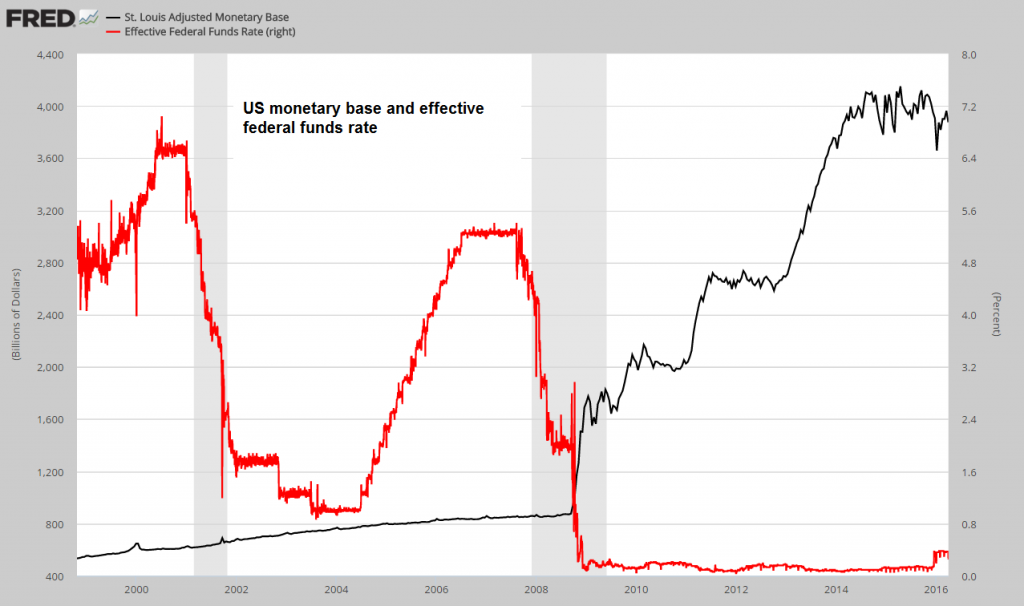

US monetary base and the effective federal funds rate – the “new normal”. It’s the new normal, because any serious change toward a normal state of affairs as it used to be understood will implode the credit and asset bubble – click to enlarge.

US monetary base and the effective federal funds rate – the “new normal”. It’s the new normal, because any serious change toward a normal state of affairs as it used to be understood will implode the credit and asset bubble – click to enlarge.

They have burned our bridges… our factories… our savings… and everything else behind them. Now, it is better just to pack up, move out… and keep on going. That is more or less what Charlie Munger sees coming.

Prepare for the Worst

Asked whether the Fed would reduce its balance sheet to pre-Great Recession levels (by selling back to the private sector the $4 trillion worth of bonds it bought over the last eight years), Warren Buffett’s long-time business partner had this to say:

I remember coffee for 5 cents and brand new automobiles for $600. The value of money will continue to go down. Over the past 50 years, we lived through the best time of human history. It is likely to get worse. I recommend you prepare for worse because pleasant surprises are easy to handle.

The “normal” financial world is no longer habitable. Ms. Yellen went on to say that these soupçons of recklessness – her hints about not returning to normal – provided an “automatic stabilizer,” to the global financial system. That’s right (and here is where we begin to laugh uncontrollably).

Not only does outrageously easy credit help “stabilize” the system, so does the anticipation of more of it! Maybe giving out the news that she will NOT even try to get back to normal helps to settle investors’ nerves. Maybe normal wasn’t all that great anyway.

Either way, speculators can continue whatever perverted hustles they have going… free from the fear that “normal” will walk around the corner and catch them in the act.

But what’s this? A complicating factor, the “outlook for inflation,” is “uncertain,” says Ms. Yellen. The Financial Times clarifies: “[I]nflation could take longer to return to the Fed’s 2% target.”

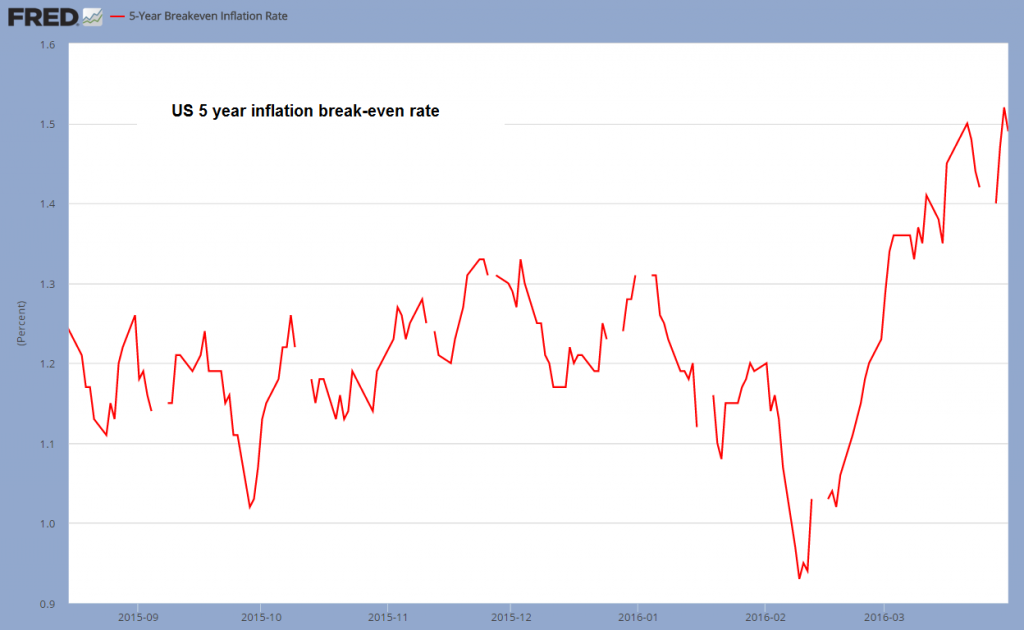

5 year inflation breakeven rate – Ms. Yellen sees one thing, but the market apparently sees something different… – click to enlarge.

5 year inflation breakeven rate – Ms. Yellen sees one thing, but the market apparently sees something different… – click to enlarge.

Ms. Yellen is worried about a lack of inflation in much the same way primitive farmers worried about a lack of rain. Her response is to do more of the ritual dances… and say more of the magic incantations… that have so far only produced more drought conditions.

A Quarter Century of Voodoo

In Japan, they’ve been doing this voodoo for 26 years. We’ve had our eye on Japan since the mid-‘80s, when everyone was sure that Japan Inc. was the hottest thing in the econosphere.

The miracle economy blew up in 1989, and liquidity disappeared. Since then, Japan Inc. has been the Sahara of the developed world. QE, ZIRP, NIRP, monumental deficits, Abe’s Arrows… nothing worked to make it rain.

Data from the island of the parched: the Nikkei remains nearly 60% below its highs of 26 years ago. Meanwhile, the BoJ’s balance sheet has gone into orbit, in the latest ploy that’s not working – click to enlarge.

Data from the island of the parched: the Nikkei remains nearly 60% below its highs of 26 years ago. Meanwhile, the BoJ’s balance sheet has gone into orbit, in the latest ploy that’s not working – click to enlarge.

Negative interest rates, announced late last year, were supposed do the job. Savers were supposed to throw up their hands, open up their wallets… and spend, spend, spend to avoid paying the tax on saving.

Instead, savers saved more. What else could they do? With negative rates they needed more savings to get the same financial bang per buck. Result: In January, Japan’s retail sales fell 2.3% over the previous month.

But the Japanese feds aren’t giving up. And now they turn to two of the world’s most celebrated witchdoctors – Paul Krugman and Joseph Stiglitz – for advice on what to do next.

Krugstitz – the closest equivalent the modern world has to witchdoctors and voodoo practitioners. You might call them quacks to the powerful. Nothing of what these geniuses have prescribed over the years has worked, so obviously the Japanese asked them for more advice, which predictably turned out to be “do more of what hasn’t worked”. As snake oil selling goes, these guys are brilliant.

Krugstitz – the closest equivalent the modern world has to witchdoctors and voodoo practitioners. You might call them quacks to the powerful. Nothing of what these geniuses have prescribed over the years has worked, so obviously the Japanese asked them for more advice, which predictably turned out to be “do more of what hasn’t worked”. As snake oil selling goes, these guys are brilliant.

Photo credit: GDA / AP Images

Japan has famously run huge fiscal deficits in an effort to get the economy moving. Thanks to a quarter century of these loose budgets, the island now has gross government debt equal to 240% of GDP and nearly nine times tax revenues.

Most of the spending is used to fund programs for old people – health care and pensions – making it hard to cut back. Japan’s government finances are nothing more than a huge, compulsory, unfunded, old-age benefit program… one that is sure to go broke.

But don’t worry, Japan. According to the Financial Times, the two Nobel Laureates went to Tokyo and argued – if you can believe it – that Japan needs more liquidity, that is, “a looser fiscal policy.”

Yes, like New Orleans needed a shower after Hurricane Katrina.

Charts by: St. Louis Federal Reserve Research

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Full story here Are you the author? Previous post See more for Next post

Tags: central-banks,Deep State,On Economy,On Politics,Warren Buffet