Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga.

It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5 tonnes of gold by air freight to Switzerland (via Paris), and fascinatingly in this instance, the exact details of the transfer are already available, including the cargo manifest, courtesy of Venezuelan newspaper El Cooperante which broke the news on 11 March.

As per the January gold exports to Switzerland, which most likely were part of a gold swap to generate much-needed financing for the crisis-ridden Venezuelan economy, this latest shipment appears likewise.

Air France flight AF 385 and Brinks Switzerland

The BCV’s 12.5 tonne gold shipment was flown out of Caracas International Airport (Maiquetia Simon Bolivar) on Air France flight AF 385 to Paris, leaving at 5:49pm local time on Tuesday 8 March, and arriving into Paris Charles de Gaulle Airport at 7:54am on Wednesday 9 March.

FlightAware screenshot of Air France flight 385 on 8 March 2016 – Source: El Cooperante

The sender of the shipment was Banco Central de Venezuela, and the consignee (initial receiver) was Brinks Switzerland. Given that Brinks Switzerland was listed as the consignee for a flight arriving into Paris Charles de Gaulle at 8am, then there would have been a second flight from Paris to presumably Zurich in Switzerland which is the main destination airport for gold arriving into Switzerland. As giant Swiss refiner Valcambi says under Transportation Services, it provides “Import services and transportation from Zürich airport to Valcambi“.

The 3 immediate direct flights from Paris Charles de Gaulle to Zurich after 8:00am are Swiss Air flight LX 655 at 09:55, Air France flight AF 1614 at 12:55, and Swiss Air flight LX 639 at 15:05. Brinks has its operations centre headquarters in Zurich at Zurich Airport (and also a Geneva office at Geneva Airport).

The Cargo Manifest

The Cargo Manifest from Maiquetia Airport (Caracas International Airport) shows that the BCV’s gold shipment was described as ‘GOLDS BARS’, with tracking number 057-91145645, and comprised 12,561 kilos, packed in 318 packets, which are listed somewhat surprisingly as being ‘caja de carton’ (which translates as cardboard box). Super-strong cardboard presumably.

Cargo Manifest for 12.5 tonnes of gold on Air France flight 285 from Caracas to Paris – Source: El Cooperante

If each bar weighed approximately 400 ozs, there would have been about 1,009 or 1,010 bars in the shipment. With 318 packets, and with 12,561 kgs = 403,845.53 troy ounces = 12.56 tonnes, then on average there were 39.5 kgs per packet (12561 / 318 = 39.5), which is a little but more than 3 bars per packet. But since gold bars can’t obviously be divided, then these gold bars may have been slightly larger US Assay Office bars weighing more than 400 ozs. Remember that the London Bullion Market Association (LBMA) Good Delivery specification for gold bars ranges from 350 oz up to 430 oz. Alternatively, most of the packets could have contained 3 bars each and the remaining packets 4 bars each.

Air France has a web-based cargo tracking number website but unfortunately, it does not return any information on tracking number 057-91145645. See screenshot:

However, the Air France website doesn’t return any data on other known gold shipments of Venezuelan gold, for example Air France tracking number 057-53208470 from late 2011, which was actually displayed on Venezuelan TV (see below bar code). Therefore, tracking information on gold shipments may not be publicly available for security reasons.

Some of the repatriated gold (inbound to Venezuela) was flown in on Air France in late 2011, tracking number 057-53208470

Swiss Refineries

It’s important to consider the extent to which this latest BCV gold shipment may be scraping the barrel in terms of the BCV’s remaining unencumbered gold reserves. My theory at this stage is that the gold bars being sent to Switzerland are being sent to Swiss refineries to be refined into modern Good Delivery bars, and not to be refined into 1 kilo gold bars for the Asian market. This would be the case if all of the 160 tonnes of gold (in modern good delivery form) that had been repatriated during late 2011 / early 2012, was already in play (i.e. encumbered, under lien or claim or pledge).

This is assuming that the gold in transit are the gold legs of USD – gold swaps, whereby the gold is then held (and used) by a commercial bank counterpart or via some gold swap arrangement between the BCV and a commercial bank facilitated by the Bank for Settlements (BIS) in Basel. Furthermore, the legal wording of gold swaps would normally stipulate that gold held as part of a gold swap would need to be deposited into the gold vault of an institution such as the Bank of England, FRBNY, or the BIS’ storage facility at the Swiss National Bank etc.

Consider some facts about the BCV’s gold reserves and the gold swap activity and rumoured gold swap activity by the BCV in the recent past, using a reverse timeline:

- The BCV exported 12.56 tonnes of gold to Switzerland on 8 March 2016

- Venezuela (assumed to be the BCV) exported 35.8 tonnes (specifically 35.835 tonnes) of gold to Switzerland in January 2016 (from Swiss Customs Data)

- The BCV agreed a gold swap with Deutsche Bank in late 2015 (Reuters February 2016)

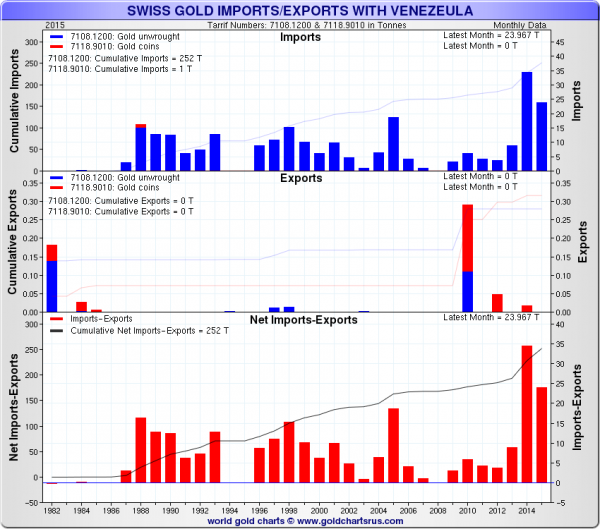

- Venezuela exported 24 tonnes of gold to Switzerland in 2015, nearly 35 tonnes in 2014, and approximately 8 tonnes in 2013, after exporting far smaller amounts in any of the 7 prior years (about 0-4 tonnes per annum over 2006 -2012). See chart from Nick Laird’s www.sharelynx.com below.

- The BCV had carried out gold swaps with the Bank for International Settlements ‘in recent years’, with up to 7 swap transactions (Reuters February 2016). These swaps would have to have used gold held outside of Venezuela, i.e. either at the Bank of England or using gold that was exported from Venezuela to Switzerland in 2013-2015

- The BCV shipped an unspecified quantity of gold out of Caracas airport to an international destination on 2nd, 3rd and 7th July 2015 (re-exported for pledging)

- BCV’s gold reserves fell by 60 tonnes over the period March – April 2015

(For the above 2 points see “Venezuela says Adiós to her gold reserves“)

- The BCV entered into a 4 year gold swap with Citibank (announced in April 2015). This Citibank swap most likely used the 50 tonnes of Venezuelan gold that had been left at the Bank of England in 2011.

- Venezuelan opposition leader, Maria Corina Machado, had information in March 2015 that suggested the BCV was engaging in an even larger gold swap that the Citi bank swap: “¿Es cierto que estarían negociando una segunda operacion de empeño similar a la anterior por un monto aun mayor?“

(For the above points, see “Venezuela’s Gold Reserves – Part 2: From Repatriation to Reactivation“)

- 12,819 good delivery bars (160 tonnes) were repatriated to Venezuela in late 2011 / early 2012

- About 4,089 bars (about 51 tonnes) of Venezuela’s gold was left in London after the 2011/ 2012 repatriation

- There were 12,357 bars (about 154.5 tonnes of gold) held in the BCV vaults in Caracas before the gold repatriation started in late 2011. These bars that were originally in Caracas are mainly if not exclusively US Assay office bars since they were repatriated from the FRB in New York in the late 1980s

- There were 25,176 bars (about 315 tonnes) in the BCV vaults when the repatriation to Caracas completed (in early 2012)

(For the above bar number quotes, see “Venezuela’s Gold Reserves – Part 1: El Oro, El BCV, y Los Bancos de Lingotes“).

Conclusion

Approximately 50 tonnes of BCV gold has been exported from Venezuela to Switzerland within the first 10 weeks of 2016. How much longer can this outflow continue? This gold is being exported by the BCV in order to participate in swaps (or maybe even outright sales) in order to provide external financing to the Venezuelan Government. The fact that the gold is being picked up by Brinks Switzerland suggests it is being brought to a Swiss gold refinery. The main reason gold is sent to Switzerland is so that it can be refined or recast.

At least 3 entities have been associated with this external financing so far, namely Citibank, Deutsche Bank and the Bank for International Settlements. Bullion banks and the BIS hold gold in long-term holdings in the form of Good Delivery Bars, and enter into gold transactions using Good Delivery bars, not kilobars. With 50 tonnes of Venezuela’s gold left behind at the Bank of England in 2011, there were only another 160 tonnes of gold bars at the BCV vaults that were not old US Assay Office bars. The gold now going from the BCV to Switzerland is, in my view, old US Assay Office bars. This would suggest that more than 200 tonnes of Venezuela’s gold is already in play, as well as the 50 tonnes from Q1 2016.

With the BCV being totally opaque about the real state of its gold holdings, and with the IMF / World Gold Council still reporting the fantasy that the BCV / Venezuela holds 361 tonnes of gold in its official reserves, some speculation is in my view acceptable, and the above information should go someway towards illuminating a truer state of Venezuela’s gold holdings, but what that true state of play is, only the BCV, Venezuelan Government and associated insider bullion banks and central banks know.

Note, that it’s also possible that Venezuela exported gold to Switzerland (or elsewhere) in February 2016. Swiss customs data, which shows (non-monetary) gold imports and exports, including de-monetised gold, is available each month but with a lag of 3 weeks. Therefore the February 2016 data is available on Tuesday 22 March, on the Swiss Customs website.

Full story here Are you the author? Previous post See more for Next postTags: Bank of England,Bank of international Settlements,Central Bank Gold Holdings,central-banks,Citibank,Deutsche Bank,ETC,France,Reuters,Swiss gold,Swiss National Bank,Switzerland,World Gold Council,Zurich