With many equity markets having fallen 20% from their peaks, meeting a common definition of a bear market, investors, analysts, and journalists understandably seek a narrative that gives it meaning. At the very start of the year, the culprit singled out was drop in Chinese shares and the yuan. However, the yuan has stabilized as the PBOC drew down another $100 bln of reserves in January to help ease the pressure what appears to at least in part be a speculative attack by hedge funds (who conclude the yuan is overvalued).

Some narratives attributed the market turmoil to the drop in oil prices. From the end of 2015 through January 20, the price of black gold fell by nearly 30%. Here too the explanation was not very convincing, and despite the recovery in oil prices over the past two weeks, investors are still anxious. We note, for example, that the German Dax finished last week at its lowest level since late 2014.

A third narrative has been constructed: the US is recession-bound or worse. The Senior Investment Commentator at the Financial Times wrote that the tightening of lending conditions reported by the Federal Reserve's Survey of Senior Loan Officers is a "reliable harbinger of depression in the past." We have argued that there is no agreed upon definition of recession or depression. We have suggested that the word recession was ideological construct to distinguish the end of a business cycle with the experience in the late-1920s through much of the 1930s. The use of the word depression here is reflective of the extreme swing in market psychology. And it is over done.

The US economy is not contracting though the fallout from the energy sector on the dollar-value of industrial output, new orders, capex and the like is palpable. Not only is the US economy not contracting, but it is accelerating here in Q1. Specifically, the initial estimate of Q4 15 GDP was a lowly 0.7% annualized. Subsequent data suggests scope for a modest upward revision. More important, Q1 15 growth tracking 2.1%, according the Atlanta Fed GDPNow.

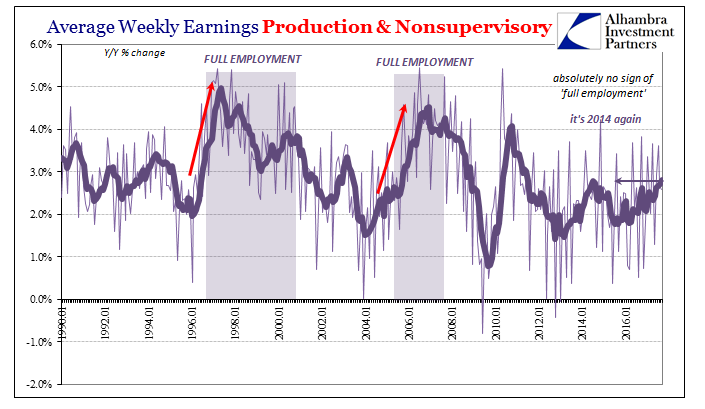

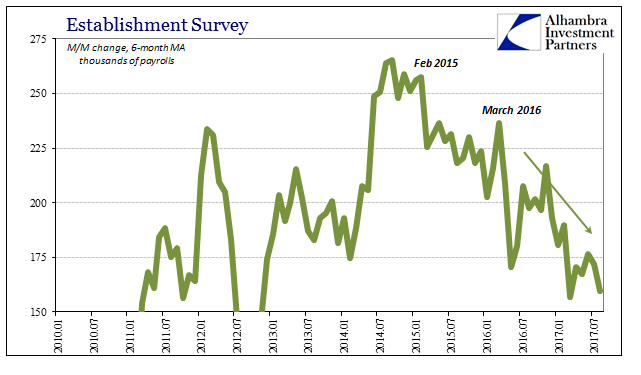

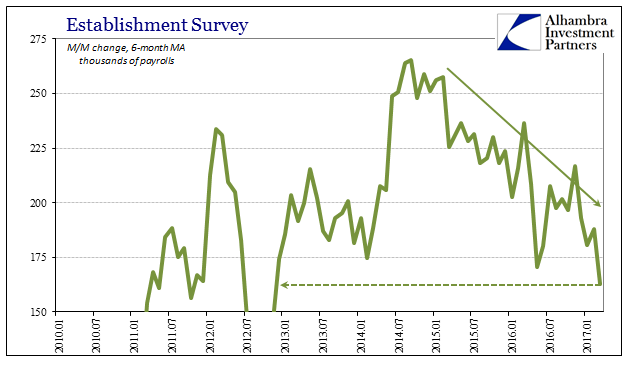

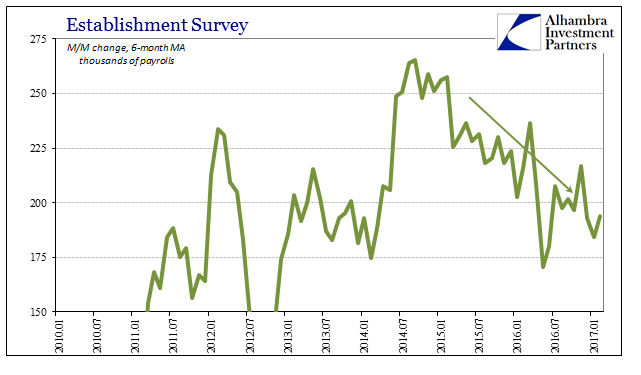

The January employment data showed more Americans are working, for somewhat higher pay and the workweek increased. Although the overall job creation was a bit less than the consensus expected, as the economy reaches full employment job growth is going to slow. However, job growth remained sufficient to absorb more slack in the labor market. The unemployment rate ticked down to 4.9%. This is not associated with the end of a business cycle.

Moreover, average hourly earnings rose 0.5% for a 2.5% year-over-year pace. This was more than economists expected and remains above headline and core inflation measures. This bodes well for the nearly two-thirds of the economy that is driven by the consumer. In fact, this will likely be reflected in the January retail sales report on February 12. We already know that auto sales increased sequentially in January. Retail sales, excluding autos, gasoline, and building materials, which is used for GDP calculations, is expected to have risen 0.3% in January, despite the equity market turmoil. We suspect there is upside risks to the consensus forecast.

The 0.1% increase in the work week is also important. On one hand, it is the equivalent in output of around 400,000 full-time equivalents. On the other hand, it is often seen as a precursor to stronger hiring. In addition, the 29k increase in manufacturing (consensus was for -2k) matches the largest rise since November 2014, which itself was the highest since August 2013. Initially, manufacturing jobs rose by 8k in December. That was revised to 13k.

This lends credence to our view that manufacturing sector is set to recover. Although the ISM is still below the 50 boom/bust, we noted that forward-looking new orders rose, and the balance between new orders and inventories was consistent with increased output.

What about those credit conditions? It it were a soccer match, the Senior Loan Officer Survey is a yellow card, not a red one. Why? Actual lending remains robust. Commercial and industry loans over the past few months remains near the cyclical high. Investment-grade corporate bond issuance remains strong. The merger and acquisition wave is fueling high yield issuance.

Also, before the weekend, the US reported that consumer credit rose $21.3 bln in December. The consensus expected a $14 bln increase. The 7.7% annualized rate is the most since September. The acceleration from November was not a result of American use of credit cards. In fact, revolving credit slowed to $5.8 bln from $6.4 bln. The increase in consumer credit was a function of auto and student loans.

Fed Chair Yellen delivers semi-annual testimony to Congress starting in the middle of the week. We expect her to be cautious given recent market developments, but generally endorse our interpretation of the labor market and overall economy. She will not pre-commit to the March FOMC meeting. The January FOMC statement is fresh and relevant.

We suspect the statement and the thrust NY Fed President Dudley's recent comments offer a reasonable preview of Yellen's testimony. Dudley suggested a cautious stance as officials continue to decipher the impact of tumult in the markets (which contributed to the tightening of financial condition measures) on the economy and assessment of risks. Yellen's economic analysis is highly influenced by her research into the labor markets. The latest readings may bolster her confidence in defending the Federal Reserve's decision and strategy.

The March Fed funds futures contract implies an average effective yield of 38.5 bp. Over the last couple of weeks, barring the last day of January, Fed funds have actually averaged 38 bp. We do not think the Fed will likely raise rates in March, but we attribute higher odds than the market is pricing. However, the real mispricing in our opinion is with the market not fully discounting a single hike this year.

Sweden's Riksbank meets on February 11. The extreme of its tiered deposit rate regime stands at minus 1.1%. The market's focus is on the minus 35 bp repo rate. The central bank is also engaged in bond purchases. Most recently, the central bank has threatened intervention. Its biggest concern has been deflationary forces.

However, real sector data reported last week was worrisome. Industrial output in December fell 2.9%. The consensus was for a 0.5% decline. Forward-looking orders fell 9.0%. While this is a volatile release, it is the second month in Q4 that saw an outsized drop (18.8% decline in October).

The krona has eased by about 3.7% against the euro and a little more against the Norwegian krone. There does not appear to be a compelling case to intervene now. The consensus expects no change in the Riksbank's monetary settings. However, recognizing the lag effects of monetary policy, we think there is a greater risk than is discounted that the Riksbank's takes preemptive measure ahead of anticipated action by the ECB next month.

The stream of high frequency economic data does not appear to be driving the capital markets recently. The main reports in the week ahead are unlikely to be exceptional. Still, it is worth noting that the eurozone economy likely expanded 0.3%-0.4% in Q4 15, which is faster than the US.

Japan starts the week with the December current account. Although it typically is smaller than in November, don't lose sight of the bigger picture. Over the last 12-months, the current account surplus average JPY1.3 trillion. The 24-month average is JPY740 bln. Also, although Japan is expected to have run a trade surplus (on balance-of-payments basis) in December, the driver of the current account surplus is from investment income earned abroad. The gains in the yen would be a headwind.

The risk of Brexit and global market conditions may be more important for sterling than the December trade and industrial output figures. That said the data is unlikely to do sterling any favors. The UK's merchandise trade deficit did not improve last year. The J-curve effect from sterling's slide this year warns that it may worsen before improving. Industrial output is expected to a fallen for a second month. This would mean that industrial output posted on a single month of gains in H2 2015 (there were two flat months).

While the latest YouGov poll found a majority in UK favor leaving the EU, the event-markets are suggesting a different outcome. PredictIt, for example, shows a nearly 70% chance of the UK staying in the EU. Nevertheless, for many investors, this risk is too high because the impact could be so significant. This suggests that sterling is likely to underperform in the run-up to the referendum.

We see the US dollar's recent weakness as a function of two "transitory" developments. First, the dollar had run-up since mid-October. Technically, that advance is being corrected, which is to say there a profit-taking phase. Second, and what may have helped fuel the technical correction, is the pendulum of market sentiment has swung hard against a Fed hike, and this has sapped some of the dollar's strength as the interest rate differential leg buckled. However, we suspect that the pendulum has swung as far, or nearly as far is it can, without a further deterioration of the economy. And we think the economy is picking up here in Q1 16 from a disappointing Q4 15.

Tags: U.S. Average Earnings