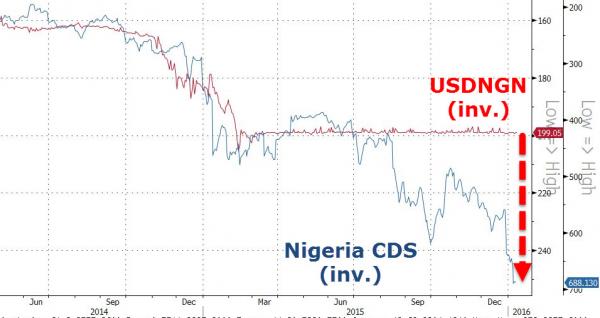

Having told banks and investors "don't panic" in September, amid spiking interbank lending rates and surging default/devaluation risks, it appears the massive shortage of dollars that we warned about in December has washed tsunami-like ashore in oil-producing Nigeria. Following the Central bank's decision this week to halt dollar sales to non-bank FX market operators, black market exchange rates spiked to 282/USD (vs 199 official) and CDS spiked to record highs implying drastic devaluations loom.

As Reuters reports, Nigeria's central bank is halting dollar sales to non-bank foreign exchange operators and letting commercial banks accept dollar deposits with immediate effect, its governor said on Monday, in an effort to shore up dwindling foreign reserves.

Africa's biggest economy, an OPEC member state that depends on oil sales for about 95 percent of its foreign reserves, has been hammered by a collapse in global oil prices, which has triggered a slide in its naira currency.

Godwin Emefiele said the sale of foreign exchange to bureaux de change would be discontinued because they were using up the country's foreign reserves for illegal transactions and selling the dollar at 250 naira compared to the official central bank rate of 197 naira.

The currency hit a record low of 282 per dollar on the unofficial market on Monday after the central bank's announcement.

Emefiele said foreign reserves stood at around $28 billion compared with $37 billion in June 2014, and that the bureaux were depleting them at a rate of $28.4 million per week.

"This is a huge haemorrhage on our scarce foreign exchange reserves, and cannot continue," Emefiele told a news conference in the capital Abuja.

To avoid devaluing the currency, a stance so far supported by President Muhammadu Buhari, the central bank adopted increasingly stringent foreign exchange rules last year and effectively banned dollar access for the purchase of 41 items, which has also been criticised at the World Trade Organisation by the United States and the European Union.

The CDS market gives the clearest picture of what traded levels for the Naira may be like...

Implying at least a 20-25% devaluation of the Naira is already priced in to capital markets and any efforts to stall the outflows will inevitably leak (just as they do in China).

As we concluded previously, of course, defending one's currency is a losing game as not only Argentina most recently, but the Swiss National Bank most infamously, will admit.

"As African central banks place restrictions on access to their dollars, while burning through these reserves to support their currencies, they are also storing up longer-term troubles.

“Few investors will want to put money into a country at an official exchange rate that is not set by the market and which is not seen as sustainable in the long run,“ said Charles Robertson, global chief economist at investment bank Renaissance Capital."

For now Africa has avoided the "hyperinflation monster", the result of an all too predictable scarcity of dollars, however the countdown is on and with every passing day that oil prices do not rebound, the inevitability of a full-on continental currency collapse, with hyperinflation and social unrest to follow, becomes increasingly more likely.

Worse, Africa is just the start: while the manifestations will differ, the mechanics of the dollar shortage, which we recently quantified in the trillions of dollars, are universal, and should the Fed's rate divergence path with the rest of the world continue pushing the USD ever higher, soon this USD-shortage will escape the confines of the world's poorest continent and make landfall somewhere where it will be far more difficult to ignore the adverse consequences of the global commodity collapse and the Fed's monetary policy.

* * *

Finally, Nigeria has resorted to desperation, apparently lying about upcomgh emergency OPEC meetings (the same M.O. Venezuela used multiple times last year)...

OPEC will soon make efforts to convene before the next scheduled meeting in June as the slump in oil prices is hurting producers, including the world’s biggest exporter, Saudi Arabia, said Emmanuel Kachikwu, Nigeria’s minister of state for petroleum resources.

Even so, there’s been no formal request for an OPEC meeting, according to three delegates who asked not to be identified. And the U.A.E.’s energy minister said OPEC can’t change its policy because of low prices.

“I certainly hope that it doesn’t go below $30 for the sake and survival of everybody” Kachikwu said. “My perception is that we will see it get worse before it gets better.” Oil is seen ending the year at $40 to $50 a barrel, he said.

And then there is this...

- *NIGERIA'S STATE OIL CO. PLANS FIRST IPO IN 2 YEARS: MINISTER

Well if Aramco can do it!!??

Full story here Are you the author? Previous post See more for Next postTags: Capital Markets,CDS,central banks,China,default,European Union,hyperinflation,Monetary Policy,OPEC,Reuters,Saudi-Arabia,Swiss National Bank,World Trade