Asia extended the US dollar's post-Fed gains while Europe has seemed content to consolidate the move, perhaps waiting for US leadership.

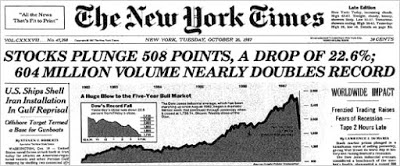

Much of the commentary about the Fed's action have noted that the FOMC statement used the word "gradual" not once but twice evidence of its dovishness. The Fed's dot plots continued to signal that the majority of officials see a 1.375% Fed funds rate at the end of 2016 as appropriate. The Fed may call this gradual, but the December 2016 Fed funds futures contract implies that the Fed funds will average 84.5 bp at the end of next year. The Fed's gradualism is more aggressive than the market.

A key unknown is where the Fed funds market will settle relative to the range. We suspect it will average below the middle of the range. This will maximize the Fed control, with interest on excess reserves, set at the upper end of the 25-50 bp range.

Although it is not final, the US Congress is set to approve large spending and revenue bills that do two big things. First it extends numerous tax cuts that were set to expire. This means that the headwind from fiscal policy will likely be reduced though it is difficult to see it as truly stimulative, as it extends the status quo. Second, and what has captured the imagination of the market is the lift of the ban on US oil exports. This coupled with new Iranian supply expected to hit the market shortly has weighed on crude prices (and sparked a narrowing of the WTI/Brent spread).

It is the drop in oil prices more than the Fed hike that seems to have spurred a significant global bond market rally today. European bond yields are off 5-8 bp, with the core down more than the periphery. US 10-year yield is off six bp to 2.24%. Although short-end yields are also lower, the premium the US pays over Germany on two-year money is widening for the fourth session.

At 134 bp, it is up 12 bp this week. It is within three bp of the multi-year high set just prior to the ECB meeting earlier this month. The euro low near $1.0830 was seen in Asia and recovered to almost $1.0880 in early Europe. We continue to see the euro largely confined to a $1.08-$1.10 trading range. A break of $1.0780 would be noteworthy. On the upside, we think $1.0920 may be important.

November UK retail sales rose more than three times what the Bloomberg consensus expected, and still sterling has struggled in the face of the greenback. UK retail sales, excluding gasoline, rose 1.7%. The consensus was for a 0.5% increase. The October swoon was revised to -0.8% from -0.9%. Discounts related to "Black Friday" helped pump up sales. The market did not see the report as bringing forward a BOE rate hike. The June 2016 short-sterling futures contract was a bit firmer, implying a slightly lower yield.

Sterling's session low was recorded in Europe near $1.4920. It initially responded well to the headline news but ran into sellers as it poked through $1.50. This area is likely to cap upticks. The month's low a little below $1.49 beckons. The year's low set was recorded in April (~$1.4565).

Japan's November trade balance slipped back into a deficit. Although that was not surprising how it got it was. Exports fell twice the pace the market expected. They fell 3.3% year-over-year. This is the second consecutive month of year-over-year declines and December, and January reports are also likely to be challenging due to base effects. This is the weakest report since the end of 2012.

Imports also fell more than expected, but less than in October. Imports in November fell 10.2% year-over-year. The consensus was for a 7.3% decline after the 13.4% fall in October. Given the past decline of the yen (more a 2014 story than 2015), the export performance has surprised many observers. The dollar's gains were extended to almost JPY122.65 in Asia and drifted lower in Europe. Lower US Treasury yields, which would act as a drag, have been neutralized by the rally in stocks. The JPY122.40 area corresponds with a 61.8% retracement of the post-ECB drop. A break now of JPY122.00 would suggest a new consolidative phase.

Perhaps the biggest surprise of the day has Norges Bank’s decision not to cut interest rates. The krone rallied nearly 1.5% against the euro in response. The deposit rate has sat at 75 bp since September. It finished 2014 at 1.25%. Governor Olsen sounded cautious, but the door to rates cuts next year remains wide open. The central bank sees the deposit rate as low as 39 bp in Q4 16. Olsen signaled a rate cut in March was “probable.”

Following the ECB meeting, the euro rallied from NOK9.09 to NOK9.60. It has been capped there. Today it was sold to almost NOK9.41, which corresponds to a retracement objective. A break would signal a further correction toward NOK9.35.

Tags: U.K. Retail Sales