To some reader question, we would like to deliver the whole background, starting with the question why Swiss inflation has been so low in the past and why CHF always appreciated.

1) Why is Swiss inflation so low, when will this change?

2) Do you see EUR/CHF appreciate?

I’m a regular follower of your blog and I find your thoughts and research interesting and insightful.

3) I would like to learn more on your thoughts on CHF interest rates,

4) especially short term money market rates which are negative.

5) How long do you believe the negative rate pressures will continue?

6) Additionally, does the SNB’s sight deposit facility allow banks to hold unlimited about of excess reserves or are they limited by a cap?All thoughts will be greatly welcome. Many thanks Sunny,

Question 1) Why is Swiss inflation so low, will this change?

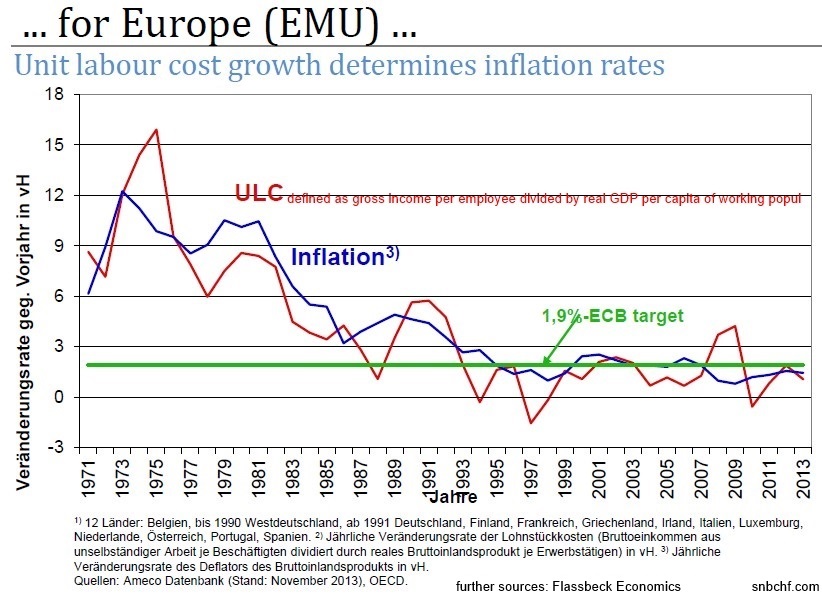

Wages and inflation are very closely related (see graph).

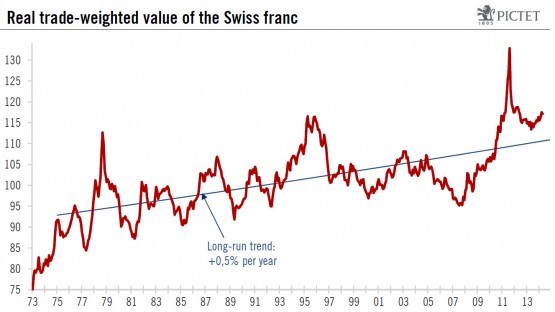

Swiss wages historically increased less than the ones in Europe or the U.S. This is the main reason why CHF had the tendency to appreciate. Lower wage increases means higher profits for companies and investors buy CHF-denominated stocks.

Currently Swiss wages increase by 0.7% per year. Swiss inflation is at 0.2%. A big part of the “real wage difference” can be explained by cheaper imports that still reflect the CHF appreciation phase. The rest is structural.

Historical reasons for the lower Swiss inflation

- Lower inflation and smaller wage growth imply smaller cost increases for Swiss companies. This is reflected in low interest and borrowing rates and in the interest rate parity.

- Small borrowing rates lower the cost of capital for Swiss firms.

- Immigration of (for Swiss levels) cheap personnel keep inflation low.

- Thanks to attractively low personal tax rates, Swiss multi-nationals like chemicals, pharmaceuticals or banks are often able to pick the best qualified people world-wide. In the last 15 years many Germans and Americans took over high positions in Swiss companies.

- Switzerland has still relatively high prices compared to other countries, while German ch

Higher savings imply a stronger currency and lower inflation

- Huge current account surpluses that are often not fully exported via the capital account. It is sufficient to buy stocks of Swiss multi-nationals to profit on global growth. Those invest globally imposing a sort of “Swiss/German governance” of companies and supply chains.

- Higher Swiss savings rates: Like anywhere, most savings are done in the local currency; a savings overhang implies a current account surplus and over the long-ter

-

Swiss wealth has spread far beyond the top 1%, but rather 20% of the Swiss are really wealthy. Swiss diversify their wealth in different types of assets. Due to low interest rates and for tax reasons, mortgages are often not paid back quickly – “the bank still owns the house.” The well-diversified assets have a far higher value than this housing debt.

- As opposed to other countries, Swiss wealth improved not only via the artificial accounting entry called “home price” that is inflated everywhere by central banks, but by the far more tangible value “Net International Investment Position“.

- The ever appreciating currency is a “self fulfilling prophecy”: the Swiss tend to invest in local currency or to hedge foreign currency exposure (an example for a recently offered fund hedged against CHF appreciation). Americans, however, often buy foreign stocks without hedging the currency risk against USD.

Structural arguments for a strong Swiss franc

- Low Swiss taxes, efficient administration, low debt.

- Small Swiss distances and low spending on energy compared to the U.S.: Until the 1960s and in the 1980s oil was cheap and the United States could expand well. In the future, the U.S. may always have high (oil) trade deficits and therefore higher inflation.

- This results in positive Swiss real wage growth. In America you see the different movement: in particular due to rising prices of (imported) oil, real wage growth in the U.S. has been negative.

- Even more, Arabs or Russians that profit on rising oil prices often bring their wealth to Switzerland to safeguard it from their governments. This boosts the Swiss banking business and the whole economy.

Question 2) Do you see EUR/CHF appreciate?

When you trade currencies, you should always know that you trade (relative) inflation and (relative) interest rates. Thanks to cheaper imports after years of currency appreciation, the Swiss CPI has not yet reached the yearly wage growth rate of 0.7%, but will approach it sooner or later. In 2011/2012 European leaders introduced austerity and supply-side reforms. Together with high unemployment, this exercises pressure on wage growth in Europe as a whole. Inflation came down, the Spanish or Italian producer price index fell from over 3% YoY in mid 2012 into negative territory in 2013/2014. Thanks to this disinflation the EUR/CHF floor was not in danger any more. In 2013, currencies with higher inflation and wage growth like the US dollar, the Norwegian Krone or the Australian dollar fell in value against the euro.

Hence I’m of the opinion that Draghi’s “whatever it takes” was nearly irrelevant, but “conditionality” was the key for the European success story until 2013.

American and German wages are currently rising by around 2% per year. This is the CPI number those two countries might adopt over the longer term. Due to the American oil dependency mentioned above, German inflation should be a bit lower, the U.S. CPI a bit higher than 2%. Swiss wages should continue to rise by 1%: this rate might accelerate in some years.

I strongly doubt that peripheral and French wages will match the 2% German salary increases in the future. Their unit labor costs had risen by around 25% compared to Germany between the year 1999 and 2008.

European spending and inflation will remain subdued. The ECB will not hike rates for years, maybe for a decade. Therefore a EUR carry trade against CHF is impossible – but the opposite, a CHF carry trade against EUR could happen in some years.

Question 3) I would like to learn more on your thoughts on CHF interest rates?

Short-term rates are determined by wage growth and inflation. Due to the nearly booming Swiss economy and the recent Swiss referendum that limits immigration, I reckon that future Swiss wage increases will be higher than the ones in France or Southern Europe. Certainly Swiss inflation is limited by the structural arguments mentioned above, but this is not enough. On the other side, German and Northern and Eastern European wages will rise more than Swiss wages. Therefore the Swiss YoY CPI should be more or less identical to the euro zone CPI from 2015 or 2016 on.

Once global inflation accelerates, I see Swiss home prices increasing more strongly again. Swiss homes act as an inflation hedge not only for the Swiss but for safety-seeking wealthy investors worldwide.

At that moment, the SNB might be forced to hike rates well before the ECB.

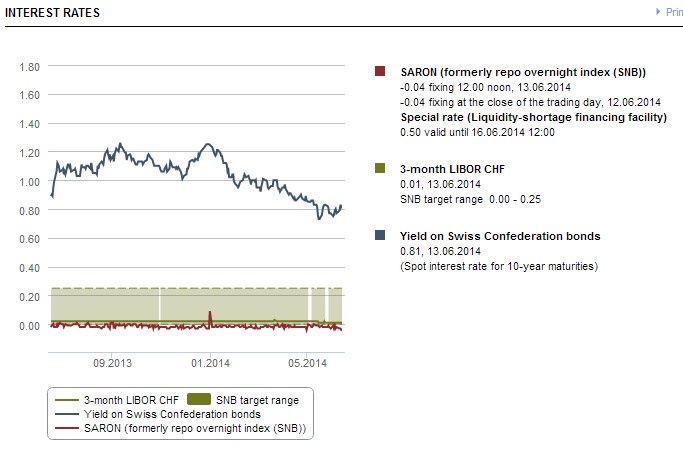

Question 4) Especially short term money market rates which are negative.

Currently only the SARON, the Swiss money market rate for overnight deposits is negative. It stands at -0.04% as opposed to +0.043% for the EONIA, the one for the euro zone. Swiss banks are ready to pay negative rates, because they have abundant liquidity. They do not offer EUR lending despite interest rate differentials. This has four main reasons: 1. The currency risk: namely that CHF appreciates more than the 0.08% during the lending period. See the arguments above. 2. They would lose risk-weighted assets (RWA) when they lend against less safe commercial banks instead against a central bank – the SNB. If they do so they have issues in fulfilling the leverage ratios given by the Swiss regulators. 3. There is no demand of EUR liquidity, because banks’ liquidity is already abundant in the euro zone. The problem is that there are not enough private-sector borrowers. Due to low growth expectations demand for credit has fallen, but supply is already enough. (See Buba’s Weidmann who says the same.) 4. Transaction costs may be close to 0.08% per year.

Question 5) How long do you believe the negative rate pressures will continue?

As long as global inflation does not take off, negative rate pressure will continue. Still the Swiss CPI should move more and more toward the 0.7% wage growth rate. Both wages and inflation could stabilize between 1% and 1.5% thereafter, provided that the global economy recovers.

Moreover, Swiss banks are lending quite strongly, M3 is increasing by 7.7% per year. This money inflation must end up in price inflation one day, even if weak money and price growth in Europe is able to dampen Swiss price inflation.

While a higher CPI should raise the money market rate a bit, higher lending should reduce excess liquidity. M0 as an indicator of excess liquidity has fallen in recent months, while M1 as an indicator of the use of liquidity has risen. Yes, the money multiplier is rising again in Switzerland, while it is still falling in the eurozone.

Question 6) Negative rates and banks excess reserves: Does the SNB’s sight deposit facility allow banks to hold unlimited about of excess reserves or are they limited by a cap?

As for any other central bank, there is no limit for excess reserves. Introducing a cap on excess reserves or negative rates is counter-productive for the SNB for the following reasons:

- These excess reserves are the means of financing the SNB currency reserves. If banks remove the excess reserves (debt on the SNB balance sheet) then the SNB has to cut the branch it is sitting on. It must sell its euros and dollars (assets on the balance sheet). At least over the longer term, this will be a null-sum-game for the CHF exchange rate.

- The combination of a weaker CHF, rising wages and less labor supply due to the referendum may result into a wage-price spiral. Such a spiral could wreck the Swiss housing market like it did in the 1990s. Already Q1 GDP grew mostly thanks to real estate investments, a potential wrong allocation due to excessive low interest rates.

- We have seen that 90% of German TARGET2 surplus have ended up in cash under German mattresses or in vaults. Keeping Swiss francs in cash is a lot easier. The highest denomination is 1’000 francs, the risk of keeping cash at home is lower and more common, even compared to Germany. Swiss banks and special companies provide easy-to-use cash storages. Moreover, more cash favors money laundering, something what Swiss regulators are combating.

Question 7) Do you think that the SNB minimum euro exchange rate policy was successful?

In September 2011, the EUR/CHF floor was born based on the wrong assumption that Switzerland could go for longer lasting deflation and the global economy into a recession. The SNB continued to sustain and to incite bank research that published two misleading ideas:

1) “The Swiss franc is overvalued at real effective exchange rate REER values of 110%.” We argue that the REER is misleading, in particular because of rising current account surpluses and strong immigration of highly qualified people in the last 15 years.

2) “The Swiss franc is a safe-haven. Once the crisis is finished, it will devalue.” SNB’s own research has proven that this is wrong, too. As opposed to “real safe havens” like USD and JPY – CHF is rather a “safe proxy for global growth.”

source SNB

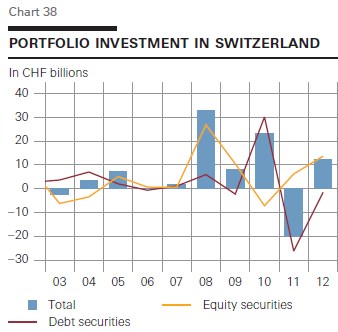

In May 2012 Swiss Q1 GDP was released and, thanks to US, Chinese and global growth, Swiss GDP clearly outpaced expectations. At that moment the two wrong assumptions above turned into a blunt lie. The SNB bluff was quickly called by former UBS chairman Oswald Gruebel. Investors piled massively into the Swiss franc. Balance of Payments data published by the SNB itself showed that a big part of foreign inflows were risk-on investments (see graph). In 2011 and 2012, foreigners sold Swiss bonds.

Equity investors are very sensitive to exchange rates that make stocks of overvalued currencies relatively expensive and they sell them.

Hence, If the minimum rate had been defined at (for CHF) overvalued levels of 1.10, then the SNB balance sheet would be 30-50% smaller. If the EUR/CHF floor had been established at parity, then the SNB would have sold off nearly all reserves and the EUR/CHF might be back at 1.05 or 1.10. The choice of 1.20 as the floor was wrong. Together with excessively cheap money, this will turn into a boom with wrong investments.

Question 8) Do you think that the SNB will be as successful in the future as in the past?

The fight against markets was easy until now. The only task was to print enough money to maintain EUR/CHF around 1.20. Thanks to European disinflation, this phase has taken longer than expected and might go for another two or three years.

Somewhere in the future, the SNB will have another enemy, and this one is the most dangerous one. This enemy is called the “Swiss National Bank,” a central bank with the most hawkish monetary mandate, namely inflation under 2% and not like the ECB or Fed close to 2%.

See more for