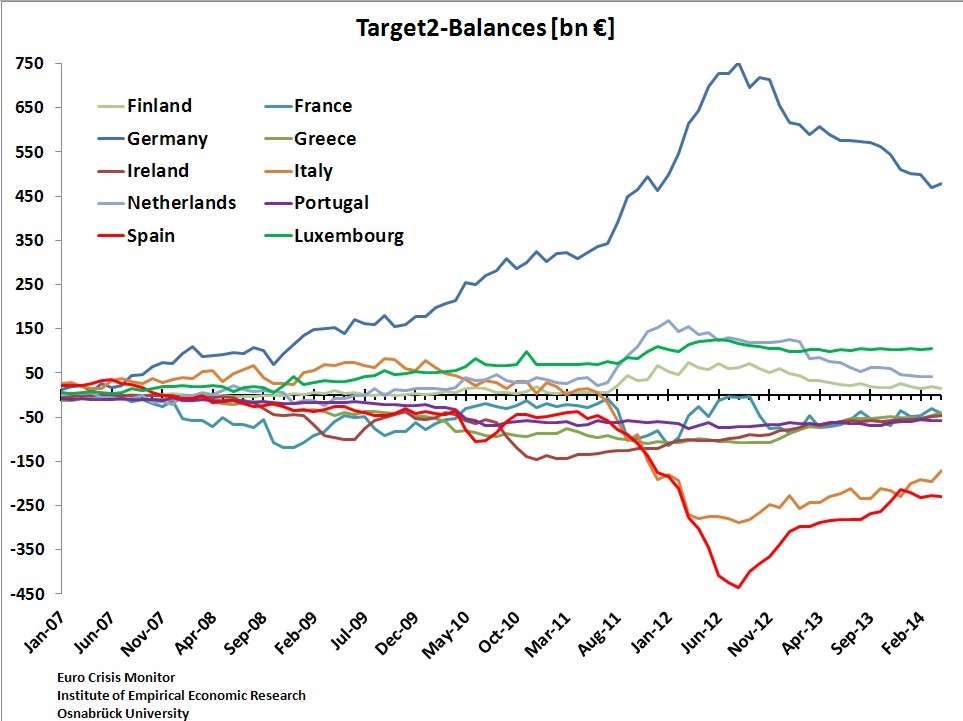

The ECB surprised with negative rates on excess reserves, on the deposit facility and even on TARGET2. We clarify whether the Bundesbank, as a member of the euro system, must pay negative interest rates on its huge TARGET2 surplus.

It has been a quite discussed item in the blogosphere:

Is the Bundesbank obliged to pay negative rates on its Target2 surplus?

5 June 2014 – ECB introduces a negative deposit facility interest rate

- Deposit facility interest rate cut effective as of 11 June 2014

- Negative rate to apply also to average reserve holdings in excess of the minimum reserve requirements and other deposits held with the Eurosystem

When deciding to lower the key ECB interest rates at its meeting today, the Governing Council of the ECB took the decision to cut the interest rate on the deposit facility to -0.10%. This change will come into effect on 11 June 2014, together with the changes to the interest rates on the main refinancing operations and on the marginal lending facility. The negative deposit facility interest rate will also apply to:

(i) banks’ average reserve holdings in excess of the minimum reserve requirements;

(ii) government deposits held with the Eurosystem that exceed certain thresholds that will be set in the relevant Guideline to be published by 7 June;

(iii) Eurosystem reserve management services accounts if not currently remunerated;

(iv) participants’ account balances in TARGET2;

(v) non-Eurosystem NCB balances (overnight deposits) held in TARGET2; and

(vi) other accounts held by third parties with Eurosystem central banks when stipulated that they are not currently remunerated or are remunerated at the deposit facility rate.For media queries, please call William Lelieveldt on +49 69 1344 7316. (Source ECB)

Given that the Bundesbank is a participant in Target2, this would cost the Germans 500 million € a year.

William Lelieveldt was kind enough to answer:

Dear Mr Dorgan,

Here’s the answer from our experts: Eurosystem NCB TARGET2 balances, including that of Bundesbank, are not remunerated at the deposit facility rate (and thus not subject to the negative deposit rate), whereas non-Eurosystem NCB balances are.

Kind regards,

William Lelieveldt

Principal Press Officer

Directorate General Communications & Language Services

EUROPEAN CENTRAL BANK

Tel: +49 69 1344 7316

Mobile: +49 170 2279090

http://www.ecb.europa.eu

Hence the Bundesbank would not pay for its TARGET2 surplus. Soon the Swiss SIC system will be linked to to the euro system. Then the Swiss National Bank (SNB) will also participate as National Central Bank (NCB). Swiss companies will be able to settle their transactions with European counter-parties via this combined SIC/Euro system. The SNB might build up a TARGET2 surplus similarly as the Bundesbank. However, as Non-Euro-NCB, the SNB must pay the negative interest because it automatically is remunerated at the deposit facility.

Are you the author? Previous post See more for Next postTags: Bundesbank,interest,negative rates,Swiss National Bank,Target2