Tag Archive: Bundesbank

No Relief for the Euro or Sterling

Overview: The euro traded below parity for the second time this year and sterling extended last week’s 2.5% slide. While the dollar is higher against nearly all the emerging market currencies, it is more mixed against the majors.

Read More »

Read More »

New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.”

Read More »

Read More »

To The Asian ‘Dollar’, And Then What?

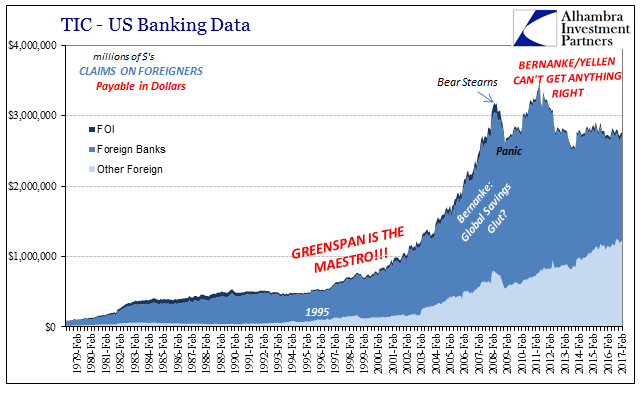

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property).

Read More »

Read More »

L’Allemagne est le patron-sponsor de l’Eurosystem.

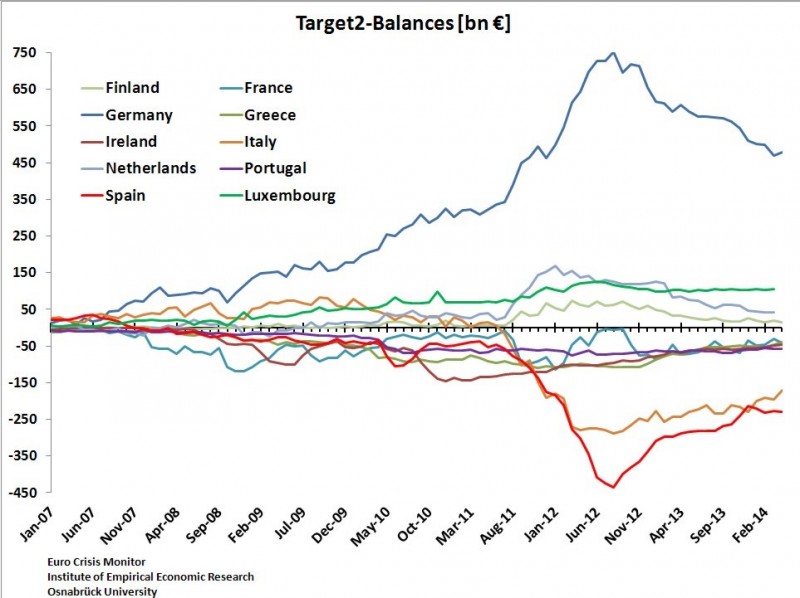

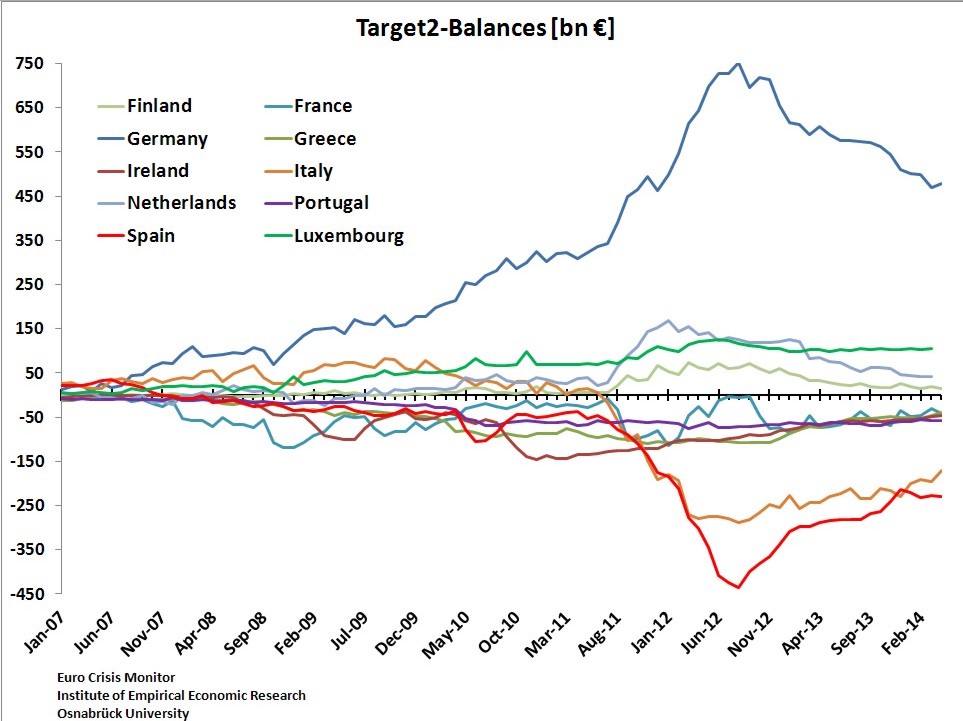

Lors des échanges commerciaux et interbancaires, il y a des banques émettrices de monnaie et vis-à-vis une banque réceptrice. Normalement, à la fin de la journée, tout cela devrait être ramené à l’équilibre. Ceci n’est plus le cas depuis la crise américaine de 2007 (subprimes) comme nous le voyons sur le graphique ci-dessous de quelques pays de la zone euro.

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

Negative Rates for Bundesbank TARGET2 Surplus?

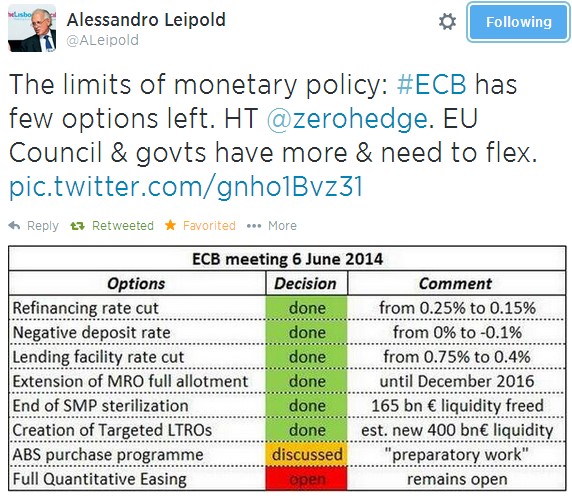

The ECB surprised with negative rates on excess reserves, on the deposit facility and even on TARGET2. We clarify whether the Bundesbank, as a member of the euro system, must pay negative interest rates on its huge TARGET2 surplus.

Read More »

Read More »

Germany: Last European Country with Lots of Cash Under Matresses

In June 2014, the ECB decided to introduce negative rates on the excess reserves of banks. We explain that German banks had already removed most excess liquidity before the ECB meeting of June 2014, and they will continue to do so. Hence hardly any German bank will pay negative rates after the recent ECB decisions at that meeting.

Read More »

Read More »

ECB Measures Background: How to Reduce German Competitiveness and Talk down the Euro

In our view, the ECB measures of June 2014 want to increase German lending, spending, salaries and inflation. Finally they target a reduction of German competitiveness. The ECB wanted to talk down the euro but will not succeed. We explain why the measure are bullish for the euro. We expect EUR/USD of 1.40 in the … Continue...

Read More »

Read More »

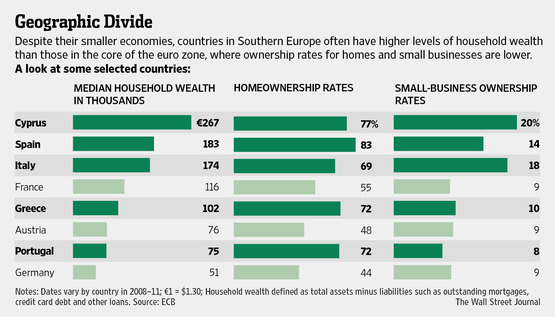

The European Transfer Union From North To South and from Poor to Rich between 1999 and 2007

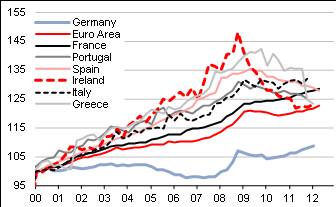

Cheap ECB rates and rising home prices helped to enrich Southern Europeans between 1999 and 2007. Germany's middle-class and poor, most of them not owning a home, were the ones that financed it.

Read More »

Read More »

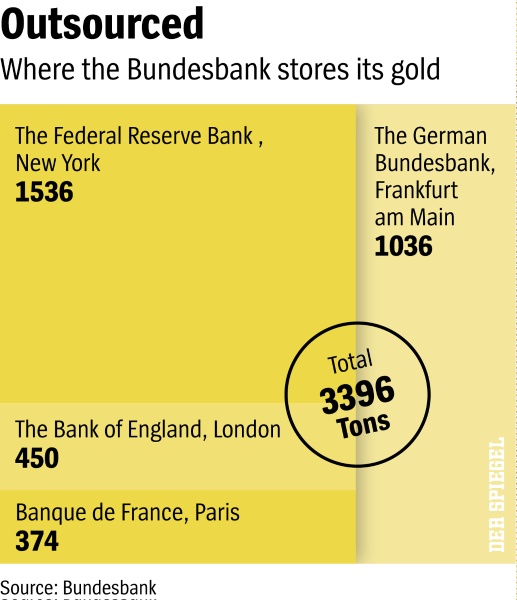

German Currency and Gold Reserves and the German Trade Surplus

During the Bretton Woods system, Germany managed to obtain current account surpluses. They converted these surpluses into gold. At the time they bought it at 35$ per ounce at a relatively cheap price – at the end of the 1960s the price was augmented to 42$. At the end of the 1960 and with …

Read More »

Read More »

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

Potential losses due to money printing are for the Fed: 1.2% of GDP, Bundesbank: 5% of GDP, SNB: 12% of GDP.

Read More »

Read More »

German Economists and Merkel, the Implicit Followers of the Gold Standard

With ECB's OMT & "conditionality", that requires austerity and implicitly reduction of salaries in European periphery, Merkel & German economists have created consequences similar to a gold-standard.

Read More »

Read More »