- In our view, the ECB measures of June 2014 want to increase German lending, spending, salaries and inflation. Finally they target a reduction of German competitiveness.

- The ECB wanted to talk down the euro but will not succeed.

- We explain why the measure are bullish for the euro. We expect EUR/USD of 1.40 in the coming months, once traders forget Draghi’s euro down-talk.

- With EUR/USD 1.40 German competitiveness is reduced via the currency, unfortunately only at the global scale.

The Limits of ECB’s Euro Downtalk Measures

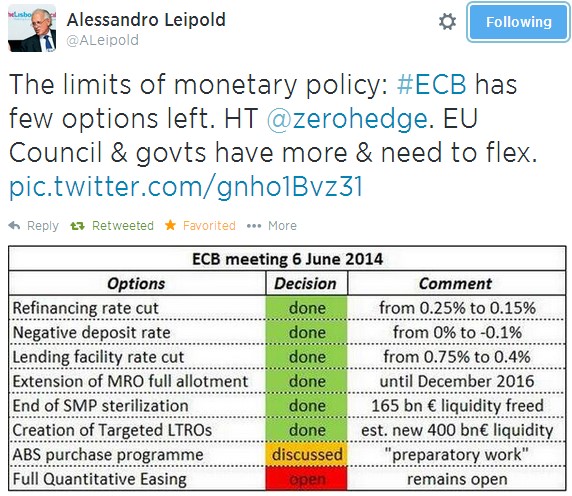

How all these new ECB measures are exactly called and what they do, is economically not very important; the more complicated words the ECB employs the more traders are impressed. Given that some peripheral yields are nearly as low as US Treasury yields, we do not think that these measures targeted the weak member states.

How all these new ECB measures are exactly called and what they do, is economically not very important; the more complicated words the ECB employs the more traders are impressed. Given that some peripheral yields are nearly as low as US Treasury yields, we do not think that these measures targeted the weak member states.

Yes, there was another (T)LTRO for the few banks that have not yet absorbed enough liquidity yet.

We reckon that banks simply do not lend because the potential borrowers are not creditworthy compared to the potential return of their projects. Or the opposite: peripheral companies do not invest because new projects will not give enough profit or because they have too much debt.

The ECB has employed its very last Euro down-talk measures, many more are not left.

The main take-away, however, is that there will be slightly negative rates on Target2 and the few sight deposits at the ECB. Enforcing negative rates might facilitate that German banks start more lending. As opposed to the period until 2008 possibly not to the periphery, but to the German private sector.

Since this targets rather creditworthy borrowers, it may really increase broad money supply (M1-M3). Therefore we think that this time the ECB aims to increase German wages and inflation; what could finally reduce German competitiveness.

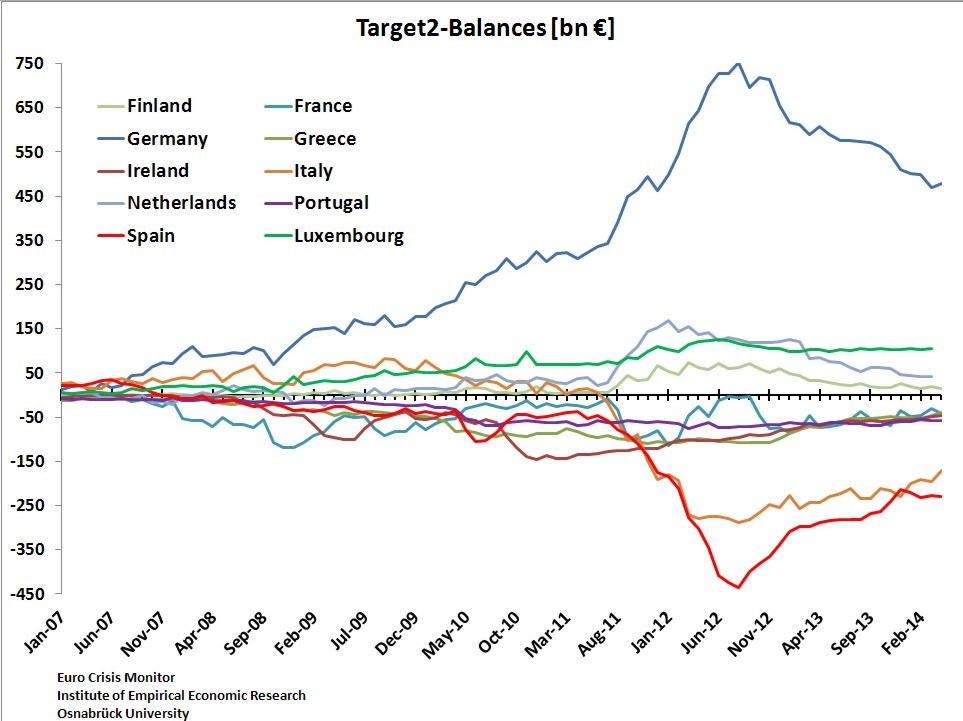

Target2 and the Divergence of Labor Costs in the Euro Zone

In our page “The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained“, we compare the risks of the SNB, the Fed, the ECB and the Bundesbank. We stated that older ECB measures aimed to lower bond yields of the weak member states via explicit and implicit (like unjustified low yields) transfers from the North. They were no “money printing” like the Fed or the SNB do, namely increasing narrow money (M0) with a certain, albeit limited effect on broad money supply (M1-M3). The Fed has only an inflation risk that could cost 200 billion US$, 1.2% of US GDP. The ECB and Bundesbank have the risk that the euro zone splits up.

In case of a split, the Bundesbank could sit on 700 billion € of devalued peripheral assets.A 30% currency devaluation for these assets, they might go for losses of 5% German GDP.

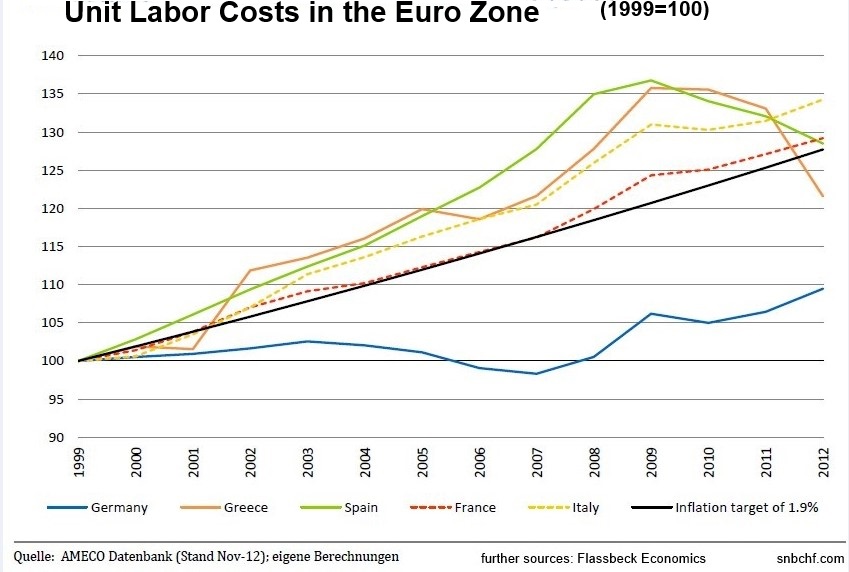

To avoid the bankruptcy of the Bundesbank, Merkel wanted to introduce a “Euro aka Gold Standard“: a euro that is dominated by German stability and competitiveness. A standard that, similarly as the gold standard, forces weak countries into relative salary reductions and deflation. This idea could reverse the 30% “excess rise” of unit labor costs in the periphery between 1998 and 2008 in comparison to Germany.

Given the massive Chinese development that intensified after 1998, only Germans kept their labor competitive. Some reasons were additional labor supply from former communist Eastern Germany and the avoidance of the debt and wage bubble thanks to the fact that Germans were used to low mortgage rates and a strong jurisdictional basis for renting flats instead buying.

After the (temporarily?) successful implementation of this “Euro aka Gold Standard”, the periphery – in particular Greece, Ireland, Portugal and Spain – have effectively reduced wages. As a consequence wage and inflation expectations and peripheral bond yields have strongly fallen. Thanks to Draghi’s “whatever it takes” and the commitment to low inflation and low wage increases contained in “conditionality“, investors finally realized that euro zone government bonds are not exposed to currency or inflation risk; a fact that let Italian and Spanish yields fall to US Treasury levels. We think that if the required longer-term weak wage growth phase is really entered and the “Euro aka Gold Standard” target is maintained (over the next 20-30 years) then Italy or Spain have the potential to achieve yields close to Japanese JGBs.

Moreover, Italy has achieved current account surpluses, Spain, Greece and Portugal have significantly reduced their deficits and could obtain surpluses during this summer tourist season. The introduction of this harsh austerity had also its costs: the euro zone unemployment rate has risen from 10.1% in 2011 to 11.8% recently, while the labor participation rate – in particular among women – is strangely rising (source WSJ).

As a by-product of money inflows from outside the euro zone into the periphery and increasing current account surpluses, the euro had appreciated from 1.20 in July 2012 to nearly 1.40 some weeks ago.

But the ECB has not achieved yet a significant rise of German salaries, inflation and the urgently needed reduction of German competitiveness.

In 2013, German wages were up 2.2%, while the weak member states saw a nominal rise of around 1%. In comparison to the remaining 25% excess peripheral wage increase, we will need another 20 years in order to bridge the competitiveness gap and must keep Southern Europe in a Japanese-style adjustment. With the Keynesian “cash for clunker” in autumn and a salary hike (+3.7% YoY) in anticipation of a longer-lasting renouncement to higher wages, Spain was one country that tried to exit the adjustment again. During the press conference, the ECB was not happy with the status of the reforms, that the German trade surplus against the rest of the eurozone rose again in Q1 might be a reason.

The ECB Target Is a Reduction of the German Competitiveness

Buying asset-backed securities from the euro zone, including Germany,could produce a wealth effect, increase German spending and salaries.

It is clear that this could strengthen the nearly booming German economy further. Given that the euro zone already has a strong current account surplus, a German boom would also move the financial account upwards. One should remember that the 0.1% interest rate differentials between US and Euro zone do play only a role for FX speculators but not for real investors. Those look far more on competitiveness, company margins and on real interest rates.

German companies often do not hedge their U.S. profits, aka German current account surpluses. A part of these dollars is then changed in euro and invested in Germany – or in China or Eastern Europe via the global German supply chain. Building a position against persistent current account surpluses needs heavy speculation on Fed rate hikes, not just an end of tapering. Moreover, this speculative position must increase each day German companies achieve new profits. We admit that between 2005 and 2007 such a huge speculative position was built up against JPY and CHF and the massive trade surpluses of Japanese, German and Swiss companies. This so-called “carry trade” was accompanied by heavy U.S. household debt and spending, a real estate bubble and Fed rate hikes while Japanese, Germans and Swiss were fine without these spending orgies. And like all carry trades, it finally collapsed.

And most importantly, the ECB buys European assets and – unlike central banks of emerging markets – it does not buy U.S. Treasuries; there is no central bank recycling of current account surpluses and capital account inflows.

Forexlive’s Adam Button even said “The big story is in Europe where [investors] are buying any asset that isn’t nailed down.”

Temporary Euro Talk-Down?

As said above, the ECB measures are just a temporary down-talk of the euro. FX speculators quickly change their mind, as seen in the rapid change of CFTC speculative positions. Traders are now short the euro and they will be during the time they remember Draghi’s words, some weeks or maybe two months.

On the other side, the Fed might not hike rates for years, but U.S. wages and inflation are rising. Hence the U.S. is losing competitiveness, real U.S. interest rates will fall again. Germany (the same as Switzerland), however, will see cheap labor immigration from Southern Europe. This immigration should help to limit German wage increases and keep the big German low-cost sector competitive (similarly as Switzerland often absorbs the highly-qualified).

We doubt that Germans really want to increase borrowing and build a similar housing bubble like the U.S. and Southern Europe or the U.K. today again. And if German companies borrow, then it will be more useful investments, those that improve competitiveness. The only consequence is therefore:

Still the reader should look at the final reaction to the ECB press conference: All inflation hedgers like gold, CHF and the yen appreciated against EUR and USD. If inflation really rises not only in the U.S. but also in Germany and the whole euro zone, then CHF and gold will appreciate further; wealthy Germans will buy gold and invest in their most-loved inflation hedge country, in Switzerland.

Background:

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

German Economists and Merkel, the Implicit Followers of the Gold Standard

Are you the author? Previous post See more for Next post

Tags: Bundesbank,competitiveness,ECB,gold standard,U.S. Treasuries