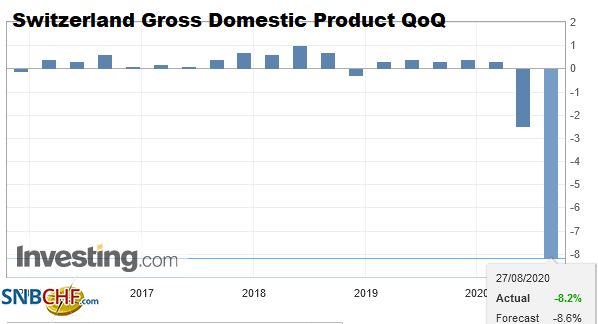

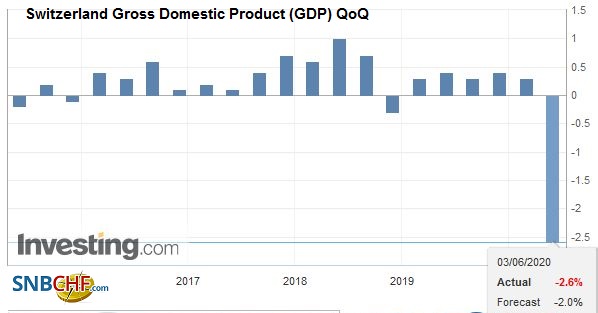

As usual, the Swiss economy seems to be better than economists thought. After 1.40 still in December, the UBS consumption indicator has risen to 1.81, a value higher than the ones in 2012, when private consumption increased by 2.4%. Similarly as last year, the latest reading contradicts UBS’s own growth forecasts, albeit this year a bit less accentuated. The headline is “UBS consumption indicator sent soaring by strong year-end in automobile trade and retail sector.”

The latest UBS growth forecast for the Swiss economy is the following:

Source UBS

While UBS predicts that exports will increase more than imports, we are not of the same opinion. We judge that in 2014, the Swiss current account surplus will shrink a bit because other countries like Italy, France, Spain or China will improve their trade, but the Swiss will continue spending. Swiss exports to Emerging Markets, e.g. China or Russia risk to weaken.

Still it is amazing how the Swiss economy weathered the strong franc between 2009 and 2013. In particular, Swiss banks and in the previously weak machinery sector implemented process improvements and cost reductions.

Investors start piling in Swiss francs again, for both risk-off and risk-on reasons. For risk-off reasons due to the crisis in Emerging Markets and for risk-on motives because strong Swiss GDP growth with low inflation is for investors most attractive.

The logical consequence is that FX Reserves and sight deposits at the SNB are rising again. The cap on CHF will be certainly removed once the increasing Swiss consumption will trigger inflation.

Are you the author? Previous post See more for Next postTags: Consumption indicator,Swiss economy,Switzerland Gross Domestic Product,Switzerland UBS Consumption Indicator,U.S. Consumer Spending,UBS

2 comments

Joseph

2014-02-02 at 14:49 (UTC 2) Link to this comment

Growth brings inflation… and it is becoming more probable that Switzerland will have larger inflation than euro zone. This means that CHF is even more overvalued. 85% of CHF is currently owned by foreign speculators. When they start to sell CHF will fall dramaticly and inflation will demolish Switzerland economy. There are dark clouds at the horizon for Switzerland. You cannot just print money like this…

DorganG

2014-02-02 at 17:03 (UTC 2) Link to this comment

Just some wrong assumptions:

1) CHF is not strongly overvalued. https://snbchf.com/chf/purchasing-power-parity-chf-overvalued/

2) CHF is not owned by foreign speculators, but the CHF increase has been caused by continuing current account surpluses, some repatriation of foreign Swiss holdings and higher foreign purchases of Swiss stocks than the opposite https://snbchf.com/chf/history-swiss-balance-of-payment/