We believe in the Chinese economy, but it has just gone into a cyclical and a exchange-rate induced slowing.

Any Cassandra views like recently by Charles Dumas, chief strategist of Lombard Research, but also some of Richard Koo’s earlier views, that there will be a burst of the Chinese housing bubble, are exaggerated.

Markets Insight: Weaker yen could burst China’s asset bubbles

China’s extravagant post-crisis recovery splurge, with capital spending raised to 48 per cent of GDP, much of it debt-financed, has left it with high prices for real estate and industrial commodities. These assets with low-to-negative yield are also the most sensitive to interest and exchange rate changes. Whether or not Chinese real estate is in a bubble, high nominal and real interest rates make these asset prices vulnerable. source FTTotal lending from banks et al in China was 198 percent of GDP in 2012 versus 125 percent 4 years earlier, and there is just no way to grow out of a debt problem when credit is already twice as large as GDP and growing nearly twice as fast. Fitch said the ratio of credit to GDP in China has increased 73 percent in 4 years – a 45 percent jump in the ratio from 1985 to 1990 preceded a banking crisis in Japan, and a jump of 47 percent from 1994 to 1998 preceded a banking crisis in South Korea.

Liao Qiang at S&P said China is in a better position to tackle non-performing loans since in the past decade, China’s economy has quadrupled, the number of urban residents surpassed those on farms and policy makers allowed freer flows of its currency in and out of the country. Foreign-exchange reserves surged fivefold from 2004 to year-end 2012. Liao said China’s credit is mostly funded by its internally generated deposits, so a real financial crisis, normally manifested in a liquidity shortage, will not happen anytime soon.

Xu Gao at Everbright Securities sees no basis for concluding that China’s debt is unsustainable as a public debt level of 50 percent of GDP leaves room for the government to borrow more. (via Investa Asset Management)

Cyclical effects: The PBoC and the Chinese government helped to accentuate cyclical effects after the strong growth until 2011: High interest rates and the restriction on the acquisition of a second home. But it managed to tame the real estate boom.

The FX effect: The Chinese have recently lost a lot of their competitiveness against Japan, caused by the 40% yuan appreciation against the yen. These kinds of exchange rate shocks may take some time until investments and technology can replace the lost competitiveness in salaries.

What Dumas ignores, is the absolute desire of a still far poorer Chinese worker to become richer, while we in the West got lazy. Then we got the high growth potential, making the rural population more productive. Sure, Chinese have poor corporate governance, totalitarian structures, but Japan, Taiwan or South Korea had the same issue during their expansion. We live in our Western system that is dominated by taxes and excessive state expenditures. The ratio between government spending and GDP is still far lower in Asia.

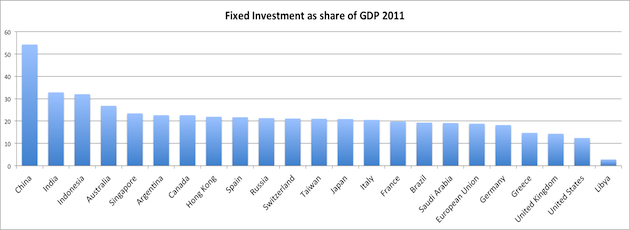

Part of the Chinese success model is that the Chinese simply replace rising labor costs with investment/capital, while in the US investments as part of GDP have risen since 2011 but they are still relatively low.

Chinese investments in fixed assets or real estate are well alimented by continuing current account surpluses. Logically, profits of many companies – possibly not the ones at the Shanghai stock exchange – are still high enough. Chinese investments are then often assigned to German or Swiss engineering firms and enforce their success.

Could the Fed taper MBS or Treasuries purchases?

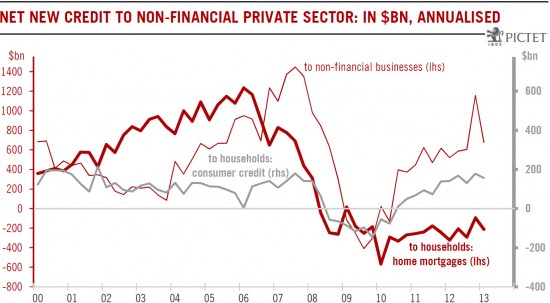

The debt reduction phase, the yin phase for the US has taken six years since 2007, but this is not enough. The recent improvements in the housing market look very artificial because ordinary people do not buy houses but investors and the Fed itself via MBSes. All economic confidence comes from artificial increases in house prices. Tapering purchases at a higher scale, could crash the economy.

Time to be long the Aussie dollar: Bank of Japan and ECB say yes

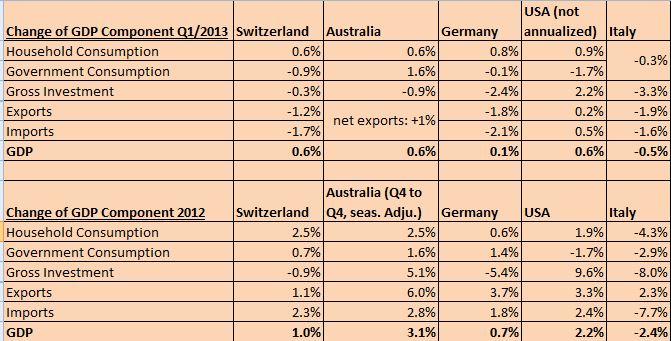

Long-term Investors should profit on the current cheap valuations of gold, silver, Brent oil, of the Aussie dollar or the New Zealand dollar. Australia and New Zealand will continue the phase of very low unemployment. Their interest rates will remain high and could even rise when China recovers. Since December 2007, these two countries have increased employment by 8.1%, while the US lost 2% despite a rising population. Australia and New Zealand have slightly negative current accounts, but far less than in the period of low commodity prices, e.g. 1998/1999. This is nothing one should really worry about, especially given that public debt levels are very low.

At the end, commodity prices have not declined a lot, copper is 10% off its 2012 prices, Chinese demand is still stable enough.

The Bank of Japan have declared that they are quite optimistic for growth. 20% of Australian exports go to Japan, 40% to China. Associating Australia with China is completely exaggerated, even if Australian businesses reduced investments due to the slowing of the main customer China.On the other side the trade balance continues to improve. Both New Zealand and Australia profit on better terms of trade, thanks to a weaker currency and lower Brent oil prices.

But at the latest monetary assessment meeting, the RBA stopped speaking of weaker China. It seems that governor Steven is now happy with the FX rate and fears inflation.

After Draghi’s hint that European growth will rebound in 2014, this is the second hint that not only the U.S. will recover but also the rest of the world. And this time, the RBA will not say no.

The Aussie remains very cheap at 0.94 levels. Time to be long the AUD ?

Are you the author? Previous post See more for Next post

Tags: Australian Dollar,Gold,New Zealand,RBA,silver