Cheaper energy prices and long-lasting contracts help against inflation.

Swiss inflation increased by 0.1% against April. According to Swiss Statistics, on a year basis, the CPI fell by 0.5%. Major reasons for lower figures were the 6.3% YoY decrease in energy prices, 4.5% YoY lower clothes and footwear price and technological improvements in communication that caused a YoY decrease. Moreover, e.g. in the area of household appliances, long-lasting contracts slowly adopt the new FX rate.

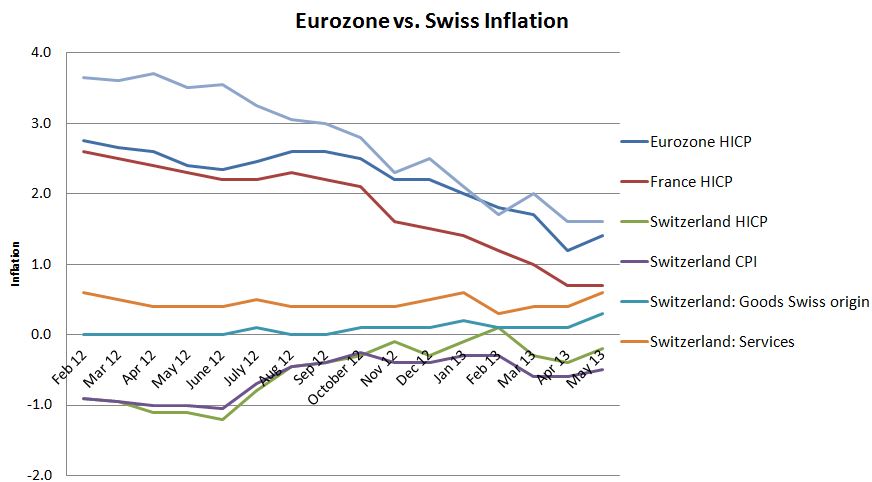

With the new contract periods starting in April, rents are up 0.3% against last year or 0.6% against December. Services are up 0.6% and goods of Swiss origin by 0.3% on the year. The inflation difference between the Euro area and Switzerland in the terms of the European inflation measure HICP, is still at 1.6%.

Due to the sharply appreciating franc the difference was near 4% in early 2012. The gap has shrunk to 1.6% now and is back at levels of autumn 2010 when the EUR/CHF was trading around 1.32.

Given that in April/May 2012 oil prices were high and fell until July 2012, the effect of lower energy prices should wash out in the yearly figures from now on. This means that Swiss inflation could go up from -0.5% to 0% until July.

Will the Swiss franc become a risk-on currency?

While ECB presidents Draghi talks about negative rates, the Swiss have a problem with their real estate boom. For us reason enough to believe that the SNB could hike rates earlier than the ECB if a current risk-on environment starts.

Still, the rate hike depends on a recovery of the global economy and may take 3 to 5 years. Thanks to the high immigration into Switzerland, profits of Swiss multinationals in emerging markets and an SNB interest hike, the Swiss franc could become a risk-on currency that shows similar movements to the Swedish and Norwegian Krones. Even at that moment the Swiss will show many safe-haven characteristics, like a high savings rate, a high trade surplus and huge wealth. Already now the franc is not a pure risk-off currency (read more).

Therefore the most probable scenario is that the EUR/CHF will fall to 1.10 or even lower, when global growth becomes stronger again. In phases of low global growth and high risk appetite that includes a carry trade possibility between EUR and CHF, the FX rate may rise to 1.25 or more.

But the interest rate differential will follow the falling inflation rate differential sooner or later.

Read more on the drivers of Swiss inflation.

Are you the author? Previous post See more for Next postTags: Eurozone Consumer Price Index,inflation,Swiss economy,Switzerland,Switzerland Consumer Price Index,Switzerland inflation