UPDATE May 08:

The extremely positive US unemployment data have put gold and the Swissie in danger again. This was followed by the RBA rate cut on Monday.

UPDATE May 03:

The bet contained two big “ifs”

If this tendency continues, in particular, if Brent oil remains under 100$ and US housing and risk appetite continues to improve,

However the DAX has recovered from 7500, gold and Brent have moved upwards. In particular US Q1 GDP data shows that US consumers spent and imported their way to recovery. Germans and Chinese might strike back this summer.

PMI data shows that US cannot live inside their own bubble like in 2000.

From September on, however EUR/CHF might improve with seasonal effects,

Sight deposits at the SNB are slightly up by 500 million francs since the end of March.

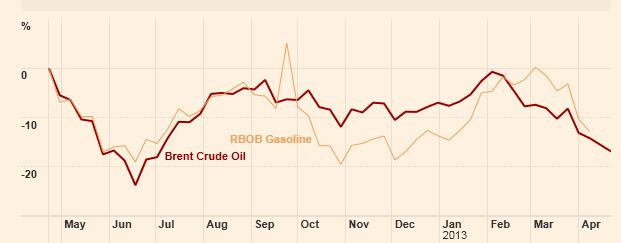

This looks as if long-time investors look for Swiss safety. Many assets that are positively correlated with the Swiss franc, however, are under attack. The Chinese economy is weaker, the Brent oil price under 100$ , the German DAX broke down to 7500, the USD/JPY hovers near 100, the Australian dollar is weaker and last but not least the gold price has broken down.

As SNB research confirms, USD, GBP and JPY are better safe havens than CHF, especially for the case of a weakening of the global economy.

On the other side, Spanish and Italian banks are recently recovering thanks to current account surpluses and weaker inflation. US housing is improving thanks to investment flows to the US and cheaper gas prices. With the cheaper Brent and gas prices, the Sell in May effect will not come, the SNB will have a quiet time.

If this tendency continues, in particular, if Brent oil remains under 100$ and US housing and risk appetite continues to improve, we see the EUR/CHF rise to 1.25 till the end of the year. Due to high German wage increases and German inflation, we do not see a ECB rate hike coming, the euro will not collapse again. See more on correlations of CHF.

If EUR/CHF moves up to 1.25, then Swiss inflation – the European HICP benchmark is at 0.1% – might rise close to the currently falling French inflation rates – currently at 1.2%.

Higher inflation, however, will mean that the SNB needs to exit the floor and it removes the 1.20 lower limit from here in 1 or 2 years. If at that moment China and other emerging markets recover, then EUR/CHF will fall to 1.10.

Tags: Australian Dollar,Eurozone Consumer Price Index,France Consumer Price Index (harmonized),Gold,SNB sight deposits