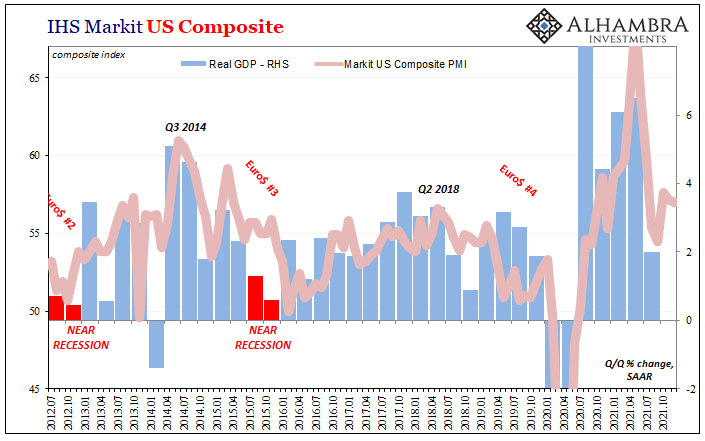

In our series about emerging markets, we name some that are overheating and could face increases of government bond yields due to higher inflation and weaker current accounts.

At the same time, banks are aggressively selling emerging market bonds as possibility to achieve high yields.

Tristan Hanson, head of asset allocation at Ashburton Asset Management in South Africa: “(Yield) spreads on (dollar-denominated emerging market) bonds are now approaching the pre-(financial crisis) lows achieved during the mid-2000s credit bubble… Low rates make EM bonds a riskier proposition going forward… Global bond investors may need to tread carefully over the next year or two.”

JP Morgan: “(Emerging market) corporates had a landmark year in 2012, with total return of 13.7%, which is one of the highest among the various asset classes including equities. In addition, new issuance exceeded US$300 billion while the (total amount of bonds in the market) crossed US$1 trillion mark. Given the strong return and substantial growth in the asset class during 2012, it is perhaps not surprising to expect that it will be difficult to beat such a performance in the coming year. Nevertheless, we still think (emerging market) corporates will have a decent year in 2013, with total returns at a respectable 7.5-8.5%.” (source)

State Street’s Fred Goodwin, who calls emerging-market bonds “the most Unsafe Haven,” notes that currency volatility is heading higher in developed markets–and that it’s only a matter of time before it shows up in emerging-market FX as well. (source)

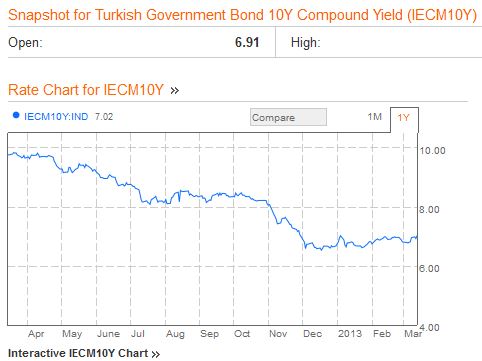

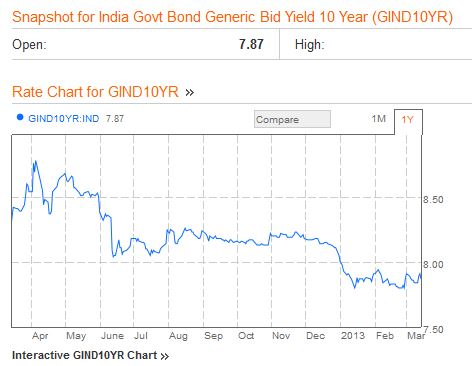

The most prominent emerging markets securities, that retail investors should not touch, are Brazilian, Turkish and Indian bonds:

source Bloomberg

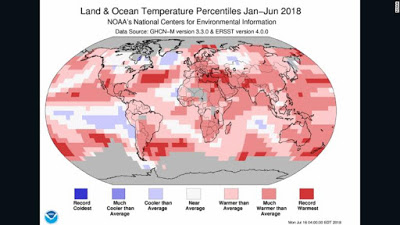

The wholesale price index for India is rising again:

The official Wholesale Price Index for All Commodities (Base: 2004-05 = 100) for the month February, 2013 rose by 0.6 percent to 170.2 (Provisional) from 169.2 (Provisional) for the previous month. (Source)

More details from our partner site:

Submitted by Marc Chandler, Global Head of Currency Strategy, Brown Brothers HarrimanThis overview was written by my colleague Ilan Solot. It provides a thumbnail sketch of the key developments in seven emerging markets. I found it helpful and hope you do too.1) China is rebalancing its policy framework towards a (slightly) greater focus on inflation

2) Brazil is gearing up to tighten very soon

3) Mexico has cut rates, but MXN is on fire

4) Hungary is going heterodox, faster

5) Turkey is looking less favourable from a fundamental and policy perspective

6) Korean assets, and especially KRW, are facing renewed headwinds

7) India failed to deliver1) China rebalancing its policy framework towards a (slightly) greater focus on inflationWe expect this shift towards greater concern about inflation to be subtle – probably more subtle than most observers expect. Policymakers will focus on slowing targeted sectors such as housing and parts of the (shadow) banking system, relying largely on macro-prudential measures instead of blunt instruments such as interest rates. If anything, an increase in deposit rates would seem the more logical course of action. If they are going to try to deflate the housing market, it would seem reasonable to offer an alternative form of savings given the negative real interest rates prevailing now. We see spot CNY trading largely sideways for the time being, but risks are tilted to the weak side. Officials have expressed a desire to keep China’s REER broadly stable this year and have stepped up their rhetoric about “currency wars.” In any case, the Japanese yen is setting the tone in Asia, so that’s what we should keep an eye on.2) Brazil is gearing up to tighten very soonThe statement to the much awaited March COPOM meetings was more conditional than many had expected, but it still left the door wide open to an interest rate hike. At this point, a hike in mid April is looking ever more likely, probably starting with 50bp. Recent data has come in on the strong side and the government is clearly becoming more alarmed by rising inflation. As such, we think the most logical strategy would be to frontload hikes and try to hike the least possible. Our FX view remains the same: we think that USD/BRL will be largely stable through this period and trade within a range of 1.95-2.00. Moves below or above should be seen as reversal opportunities. The idea here is that authorities will play with only one tool at a time.

3) Mexico has cut rates, but MXN is on fireBanxico hiked earlier than we had expected, but the logic seems to be the same. We think that a stronger peso was a factor in their decision to cut, but that was not the main factor. In any case, the rally in peso after the decision left many scratching their heads. We don’t have a clear answer either, but we would suggest a few factors: (1) the statement could have been firmer than some expected by closing the door for more easing – Banxico didn’t even retain the optionality, making it impossible to even price the risk of another cut; (2) Strong US data; (3) lack of other good options for long EM FX trades. We still think the only factor that could hold back the peso from further gains is positioning, and we caution investors on the risk of sharp short covering spikes.4) Hungary is going heterodox, fasterFinally the political risks we have feared are materializing into action and price action. PM Orban is back to openly antagonise foreign banks, leading some to speculate about nationalization. Matolcsy was confirmed as Hungary’s new central bank president. The appointment was expected, though there were some earlier rumours of a more market palatable appointment. Matolcsy immediately demoted two MPC members, effectively buried the central bank’s independence once and for all. This week, the parliament passed amendments to curb the powers of the Constitutional Court, further infringing on the country’s institutions. Expect more noise from European Commission and the IMF on these matters, possibly via enforcement of the excessive deficit procedures. In any case, the news stream is negative, and will remain so. EUR/HUF made a clean move above the 305 level and we see little that could change negative sentiment in the horizon.

5) Turkey’s is looking less favourable from a fundamental and policy perspectiveThe current account is widening sharply again, undoing much of the gains over the last year. This means that the central bank will remain on its current dual track of keeping the lira from appreciating too much and at the same time containing credit growth to stem imports. It is unclear whether data will warrant further easing in the borrowing rate, but further hikes in reserve requirements seem likely. In addition, there has not been any improvement in the quality of the deficit. FDI remains weak, leaving much of the deficit to be financed by short-term inflows. In short, we are finding it more difficult to be optimistic about the lira under these circumstances and don’t see a clear catalyst to drive the currency stronger, aside from broad risk appetite. Still, we think the lira will remain broadly stable, hence a good option for more medium term carry trades.

6) Korean assets, and especially KRW, are facing renewed headwindsTensions have been rising in the Korean Peninsula after the UN Security Council approved tougher sanctions against North Korea. Perhaps the most important change here was that China was on board with the sanctions. The U.S. and South Korea are conducting military exercises as North Korea threatens to scrap the 1953 armistice and to cut off a Red Cross hotline with South Korea. We are concerned, as always, but we also recognize that past flare up in tensions have proven to be great buying opportunities for Korea assets in the past. At this point, we are still cautiously treating the current escalation in the same way. Still, KRW will remain under pressure given the combination of geopolitical tensions and JPY weakness.7) India failed to deliverWe were underwhelmed and disappointed by the Indian budget. Many observers (including us) were hoping for a positive surprise as the government tries to avert downgrades. But that’s not what we got. In fact, some of the measures seemed on the populist side, raising the risk that the government will succumb to pre-electoral pressure from Sonia Ghandi. What does this mean for the RBI? It’s unclear just yet. Our expectations for further cuts were, in part, premised on a better budget. The bank is likely to ease further, though the timing is more uncertain. So at this stage, we prefer to move into neutral gear on INR, from being positive prior to the budget.

Tags: South Africa