UPDATE March 25

The final compromise: via Reuters

TOP NEWSDetail of EU/IMF bailout agreement with CyprusSun, Mar 24 22:19 PM EDTBRUSSELS (Reuters) – Cyprus clinched a last-ditch deal with international lenders on Monday for a 10 billion euro ($13 billion) bailout that will shut down its second largest bank and inflict heavy losses on uninsured depositors.

Following is the detail of the deal in a statement from euro zone finance ministers.

1. Laiki will be resolved immediately – with full contribution of equity shareholders, bond holders and uninsured depositors – based on a decision by the Central Bank of Cyprus, using the newly adopted Bank Resolution Framework.

2. Laiki will be split into a good bank and a bad bank. The bad bank will be run down over time.

3. The good bank will be folded into Bank of Cyprus (BoC), using the Bank Resolution Framework, after having heard the Boards of Directors of BoC and Laiki. It will take 9 billion Euros of ELA with it. Only uninsured deposits in BoC will remain frozen until recapitalization has been effected, and may subsequently be subject to appropriate conditions.

4. The Governing Council of the ECB will provide liquidity to the BoC in line with applicable rules.

5. BoC will be recapitalized through a deposit/equity conversion of uninsured deposits with full contribution of equity shareholders and bond holders.

6. The conversion will be such that a capital ratio of 9 % is secured by the end of the program.

7. All insured depositors in all banks will be fully protected in accordance with the relevant EU legislation.

8. The program money (up to 10 billion Euros) will not be used to recapitalize Laiki and Bank of Cyprus.

With this deal there are many winners and only some big losers.

Winners are:

- The average Cypriots that do not lose their savings.

- European ministers that were able to maintain the 100,000 € deposit insurance in every state of the euro zone. At the same time they avoided any speculation about bank runs in other countries in the European periphery.

- German finance minister Schäuble that was able to avoid moral hazard for the first time, while in 2012 risk aversion allowed hedge funds to profit on the Greek PSI. This ensures a Merkel victory in the upcoming German elections, because the socialist opposition wanted exactly that. In any case the socialization of losses policy that the EU pushed from 2008 ended with Cyprus.

- The Russian ministry of finance. There wasn’t definitely any reason for Russia to bail out Cyprus, even if the Russian prime minister had to utter his opposition against the losses of rich Russians. On the contrary, they urged Russians to repatriate foreign assets.

A Cyprus site said the Kremlin feared grow that both the European Union and United States were preparing for the largest theft of private wealth in modern history. According to this “urgent bulletin,” this warning is being made at the behest of Prime Minister Medvedev who earlier today warned against the Western banking systems actions against EU Member Cyprus. “All possible mistakes that could be made have been made by them, the measure that was proposed is of a confiscation nature, and unprecedented in its character. I can’t compare it with anything but … decisions made by Soviet authorities … when they didn’t think much about the savings of their population. But we are living in the 21st century, under market economic conditions. Everybody has been insisting that ownership rights should be respected.,” he said on Thursday. source

Losers of the deal are:

- The Cypriot government got completely wrong with the assessment of the Russian leaders. The government might soon resign.

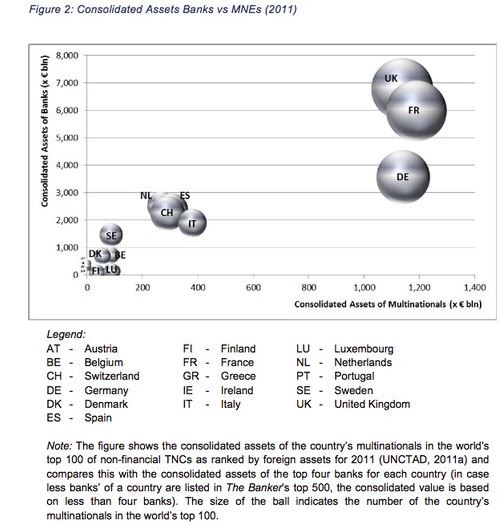

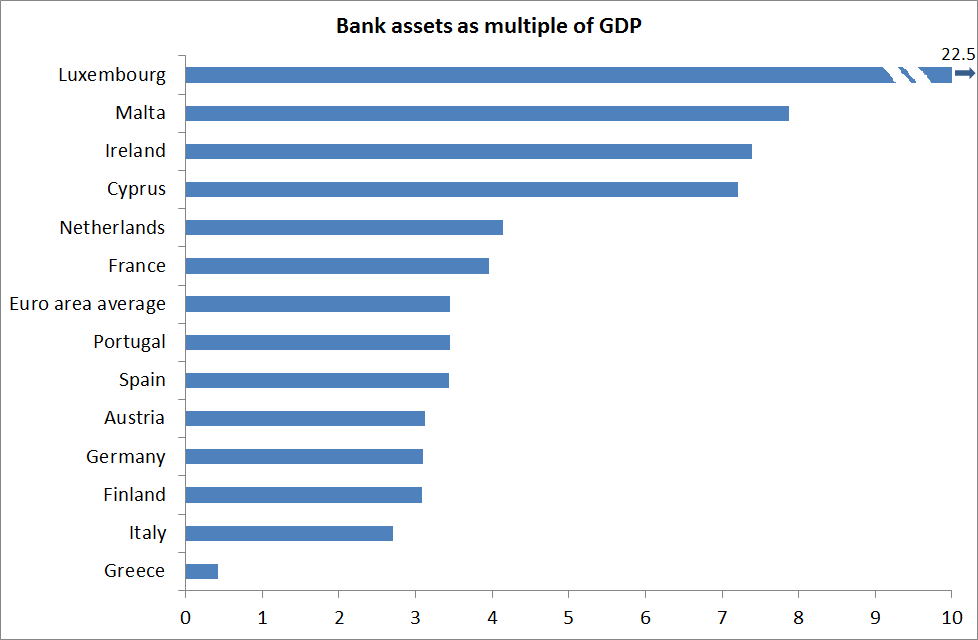

- The Cypriot economy lost a main pillar of growth: The financial sector. Other financial centers like Switzerland, Sweden or the tax havens in the U.S (e.g. Delaware or Miami) and in the UK-backed Channel Islands take profit on it, because they are secured by a stable and balanced economy with strong multi-nationals or exporters that possess foreign assets.

source FT

- Malta, Luxembourg, Bahamas, Bermudas, the Cayman Island and other independent states with offshore centers might face similar issues, because their economies mostly concentrate on banking, just like Cyprus. However they were not engaged that much in Greek bonds, but in the global search of yield possibly too much in emerging markets.

- Banks in similar situations like Laiki. Bankia, the Spanish pendant of Laiki, is currently losing 52% of its stock price.

- Rich Russians, Ukrainians and Brits that lost big parts of their Cypriot funds in Laiki and BoC.

The spirit of the decision on guaranteeing deposits, no matter the amount, taken in the aftermath of the Lehman Brothers collapse has clearly been broken.

COMMENT Friday, March 22

The Cypriot president is ultimately responsible for his actions. There was an alternative: tax the depositor above 100000 € s at 15.5 percent and leave the smaller ones untouched. Anastasiades didn’t want to do this as it would have angered Russia and undermined Cyprus as an offshore financial center. But both of these have happened anyway.

When Anastasiades found he couldn’t sell the deposit grab to his people, he backtracked. There was jubilation in the streets. How quickly the mood has changed now that queues have started forming outside cash machines.

The Cypriot government then asked Russia for help. But again Nicosia overestimated its negotiating position. Moscow wasn’t interested in buying a bankrupt bank or lending more money. Michael Sarris, Cyprus’ finance minister, was sent home empty handed.

In the meantime, the ECB has threatened to pull the plug on insolvent Cypriot banks unless there is a deal with the euro zone by Monday night.

The Governing Council of the European Central Bank decided to maintain the current level of Emergency Liquidity Assistance (ELA) until Monday, 25 March 2013

Thereafter, Emergency Liquidity Assistance (ELA) could only be considered if an EU/IMF programme is in place that would ensure the solvency of the concerned banks.

The government has therefore scrabbled together a “plan” with three elements: “resolving” Cyprus Popular Bank, the country’s second-largest and most troubled lender; imposing capital controls; and creating a national “solidarity fund”, built with money of the Church of Cyprus, the central bank’s gold reserves and the state pension fund.

The best of these ideas, apparently originally proposed by the IMF, is to resolve CPB. It would be divided into a good bank and a bad one. The insured depositors would go with the good assets; the uninsured with the rotten ones.

Last week, Cyprus had a chance of salvaging most of its financial center. Now that will be largely destroyed. Last week it was staring at a middling recession. Now, with confidence crushed, its economy faces a slump.

Why did Cyprus not go for real haircut?

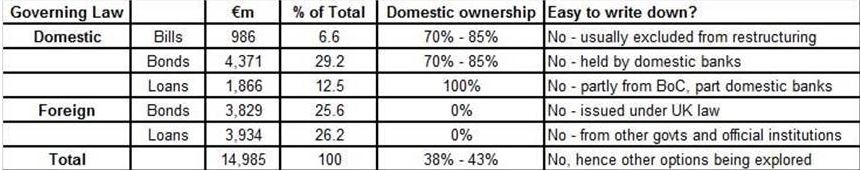

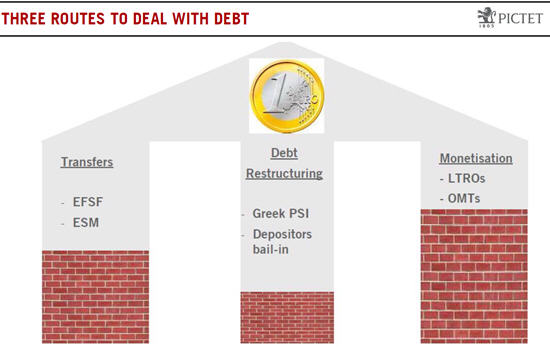

Why no “haircut” on sovereign debt (a la Greek PSI [“private sector involvement”)?

- High domestic ownership (“shooting in one’s foot”),

- official loans (from Russia, IMF, EU etc) or

- bonds issued under UK law (messy from a legal standpoint)

source Pictet

It becomes clear in which world we are living now: the hunt on the rich investors via higher taxes, PSI and depositor bail-in:

The reduction of public debt financed by the rich.

Tags: bank run,Bank-Recapitalization,Bonds,Capital Controls,Cyprus