Monthly Archive: March 2013

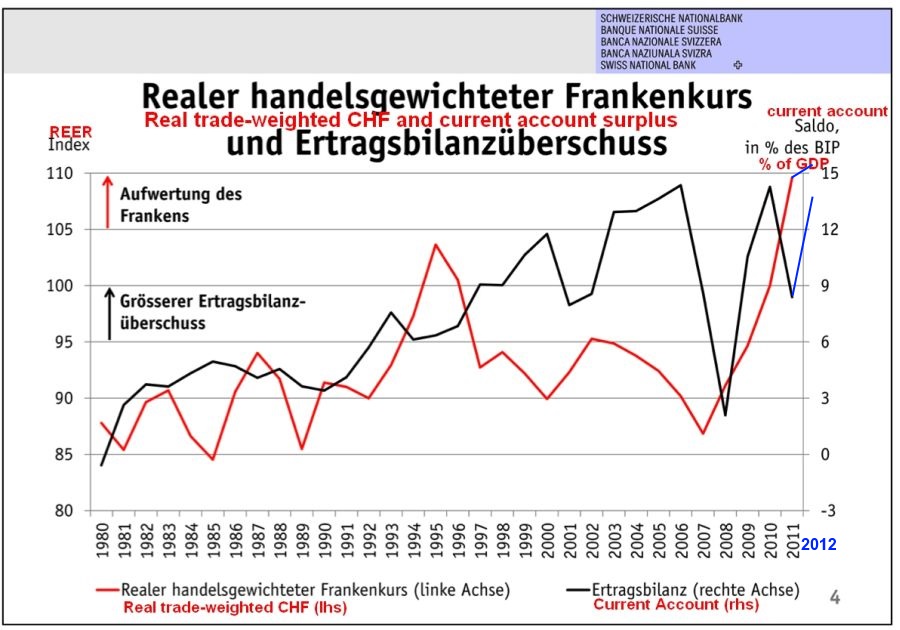

Swiss Current Account Surplus Rises from 8.5 percent to 13.5 percent of GDP

According to latest IMF data the Swiss current account surplus rose from 49 billion CHF in 2011 to 80 billion in 2012, this is from 8.5% of GDP to 13.5%. Details

Read More »

Read More »

Dijsselbloem: The End of the Bankers’ and Bond Holders’ Moral Hazard

We have insisted in several posts that the northern euro zone is very reluctant to continuously bail out the periphery and in particular its banks. The euro group chief Dijsselbloem has confirmed this now.

Read More »

Read More »

Currency Positioning and Technical Outlook: Dollar Correction at Hand?

Submitted by Marc Chandler, Global Head of Currency Strategy, Brown Brothers Harriman The US dollar rose against all the major currencies in the past week. It seems clear that the greenback’s gains were not a reflection of domestic developments, though it is true that US data stands in stark contrast with nearly every other major country. …

Read More »

Read More »

SNB Sight Deposits: Only Slight Increase of 370 Million Francs despite Cyprus

The SNB published the weekly monetary data for the week of the "Cyprus crisis": SNB sight deposits are slightly up 400 million francs, mostly due to local banks. Details

Read More »

Read More »

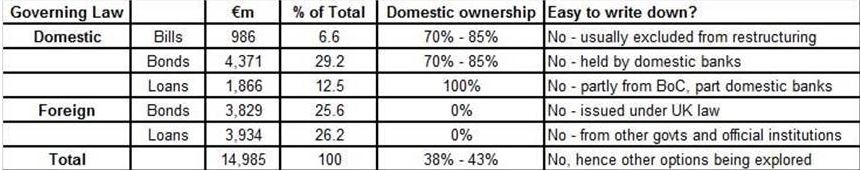

Cyprus, the Final Compromise: The Winners and the Losers

UPDATE March 25 The final compromise: via Reuters TOP NEWS Detail of EU/IMF bailout agreement with Cyprus Sun, Mar 24 22:19 PM EDT BRUSSELS (Reuters) – Cyprus clinched a last-ditch deal with international lenders on Monday for a 10 billion euro ($13 billion) bailout that will shut down its second largest bank and inflict heavy …

Read More »

Read More »

Cyprus: The initial compromise and reactions

The initial compromise The Cyprus compromise combines a 10 billion € bailout with European, basically German tax-payers money, that also obliges rich account owners (9.9% levy) – rich Russians and Brits – and poorer account owners (6.75% levy) – Cypriot tax-payers money – to take part in the deal. Initial reactions from Zerohedge over Keynesian mainstream …

Read More »

Read More »

In Week Before Cyprus SNB Sight Deposits Rise Slightly by 250 Million Francs

The SNB published the weekly monetary data for the week before the Cyprus event: SNB sight deposits are slightly up 250 million francs, mostly due to other sight deposits (companies, the Swiss confederation, foreign banks) while local banks reduced their deposits slightly. Details

Read More »

Read More »

Cyprus Levy on Deposits: New Escalation or Final Stage of Euro Crisis?

Nicosia will impose a 9.9 percent one-off levy on deposits above 100,000 euros in Cypriot banks. This constitutes maybe the final stage of the euro crisis, with the very last country to be rescued. Or will it be a new escalation and may be the most dangerous one, a bank-run? How many Cyprus clients managed …

Read More »

Read More »

Why the Yen Is Now Fairly Valued, USD back as Preferred Funding Currency

Producer prices and “real mean reversion” for currencies show that the yen is currently fairly valued. Many momentum factors could, however, speak for some further weakening, while seasonality favours an appreciation. For us, the US dollar is back as the preferred funding currency. The real mean reversion for currencies Some economists, like Goldman’s O’Neill, in the case …

Read More »

Read More »

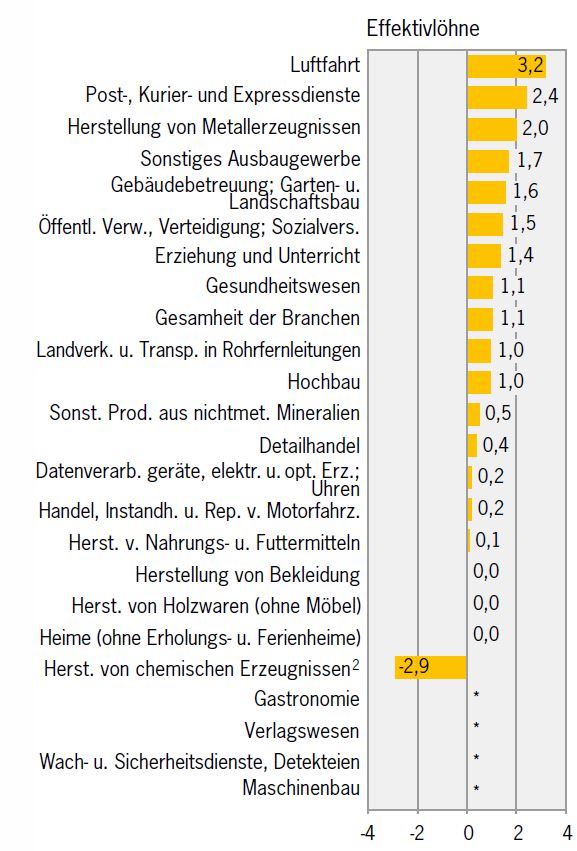

Swiss Wages Keep on Rising: No Signs of Deflationary Pressures

No signs of the so often mentioned "deflationary pressures" by the SNB. According to Swiss statistics hourly wages rose by 1.1% in the year 2012, while they went up by 1.0% in 2011. More details

Read More »

Read More »

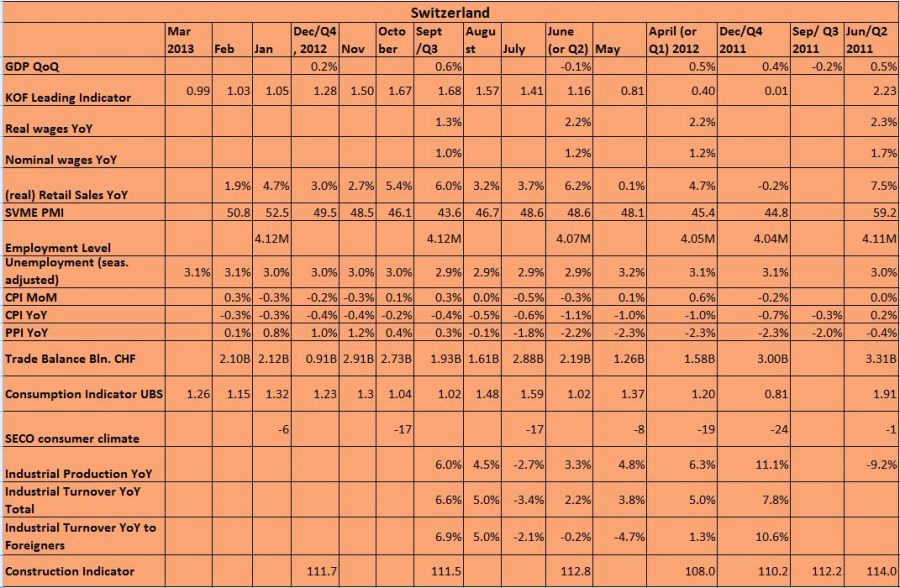

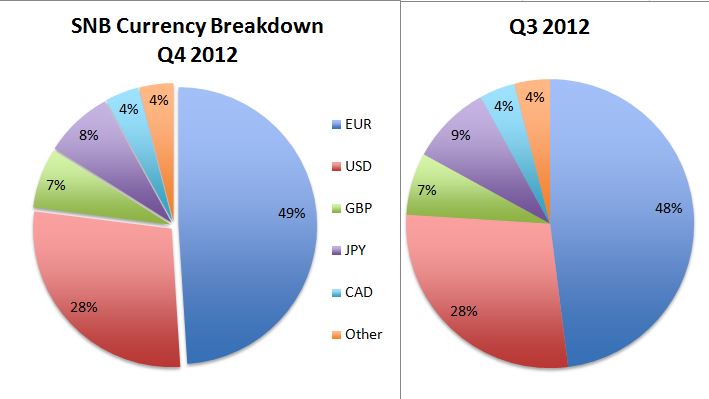

SNB Monetary Assessment March 2013

In its monetary assessment the SNB maintains the EUR/CHF floor and warned against further risks in the euro zone. The SNB has downgraded the inflation path to -0.2% (previously-0.1%) in 2013 and +0.2% (+0.4%) in 2014.We do not completely agree.

Read More »

Read More »

More About Overheating Emerging Markets: Retail Investors Should not Touch these Bonds

In our series about emerging markets, we name some that are overheating and could face increases of government bond yields due to higher inflation and weaker current accounts. At the same time, banks are aggressively selling emerging market bonds as possibility to achieve high yields. Tristan Hanson, head of asset allocation at Ashburton Asset …

Read More »

Read More »

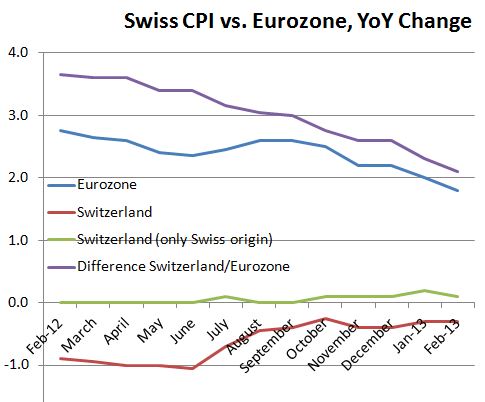

Difference between Eurozone and Swiss Inflation Rates Continues to Shrink

The gap has fallen from 3.7% in February 2012 to 2.1%. Swiss CPI is rising on monthly basis, but still negative with 0.3% YoY.

Read More »

Read More »

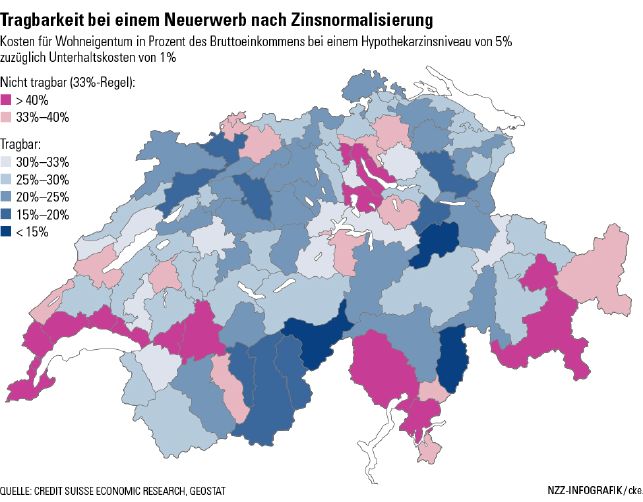

Credit Suisse Study: Swiss Real Estate Market Needs Higher Rates

A new study by Credit Suisse claims that the SNB needs to hike interest rates in order to avoid excessive risk taking in real estate markets; in particular around the centers of Geneva and Zurich, but also in the Southern Swiss cantons with lower income, but high real estate prices.

Read More »

Read More »

When Will Hedge Funds and FX Traders Close their Short Yen Positions?

Hedge Funds have lost their power. This year has shown that their only remaining possibility to gain easy money is a concerted action with some of their friends manipulating currency markets, calling it “currency wars” and creating an unholy alliance with the dovish prime minister Abe. Some of the biggest U.S. hedge-fund investors have made …

Read More »

Read More »

Net Speculative Positions, Technical Forecast, Week March 04: King Dollar Returns?

Submitted by Marc Chandler, Global Head of Currency Strategy, Brown Brothers Harriman The US dollar rose against all the major currencies in the past week. It seems clear that the greenback’s gains were not a reflection of domestic developments, though it is true that US data stands in stark contrast with nearly every other major country. …

Read More »

Read More »