In our first part on Japans currency debasement, we look on three aspects, government bond yields, current account balances and potential hyper-inflation which causes yields to rise strongly.

Once again an analyst is calling for the a currency and debt crisis in Japan, similarly things uttered Kyle Bass. We would like to add two starting points, Japanese Government Bonds and the current account.

Japanese Government Bonds and capital account of the balance of payments

We all know that over 90% of government bonds (JGBs) are in Japanese hands. It is proven that Japanese are very risk-averse as compared to Americans or even Europeans. The ones who invested in foreign currency, burned their fingers in the financial crisis when the yen strong rose.

Do you really think that some hedge funds or other JGB bears are able to influence such a big market over a longer term? Do you really think that Japanese firms and private investors will invest their huge savings in foreign currency and move out of the yen and JGBs, given the news that arrived from the U.S. these years and recently from Europe?

No, Japanese will remain invested in JGBs and Japanese assets. Apart from paying a higher price at the pump, Japanese private investors have not lost anything with the weaker yen.

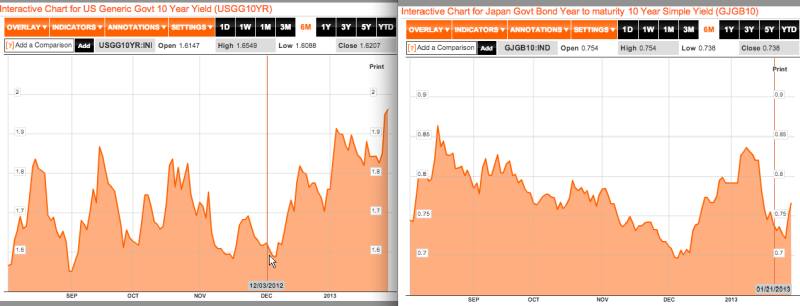

Ten years U.S. bond yields have risen far more strongly than Japanese ones since December, there is no sign that Japanese or other investors lose confidence in the Japanese state, clearly visible in the recent yield development. U.S. treasuries 10 year yields have risen from 1.6% to nearly 2%, while Japanese JGBs have just adjusted from 0.7% to 0.75%.

Hence, the costs of Abe’s operation seems to be limited and for the meantime Kyle Bass seems to be wrong.

Trade Balance and Current Account

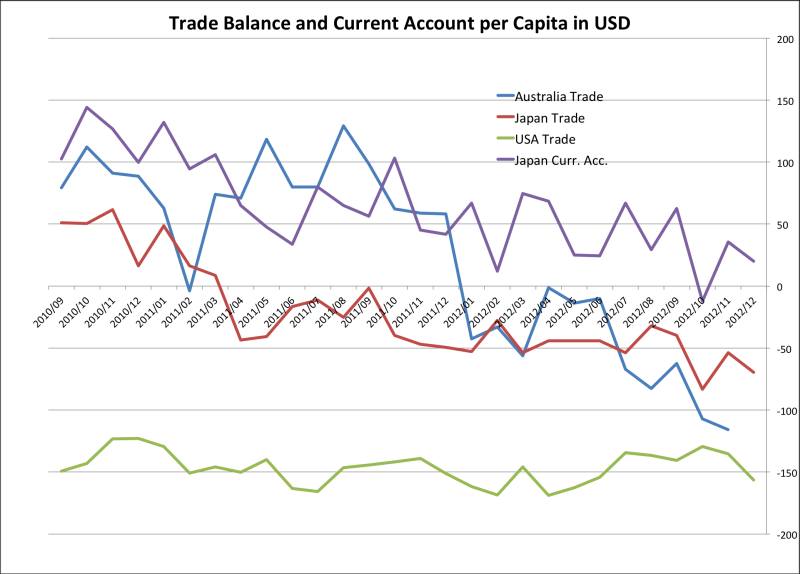

For Kyle Bass the quickly falling current account and trade surplus or even deficits are the trigger why Japan should go bust after so many years of accumulation of public debt. The following graph shows that not only Japan has suffered from recent slowing in China after the weaker demand from Europe, from the PBoC tightening and the end of the Chinese real estate boom.

The deterioration of the Australian trade balance looks far worse. The Japanese adjusted current account is still in surplus; thanks to a big Japanese services surplus, the gap between the current account (purple line) and the goods (trade balance, red line) is becoming bigger.

data from investing.com

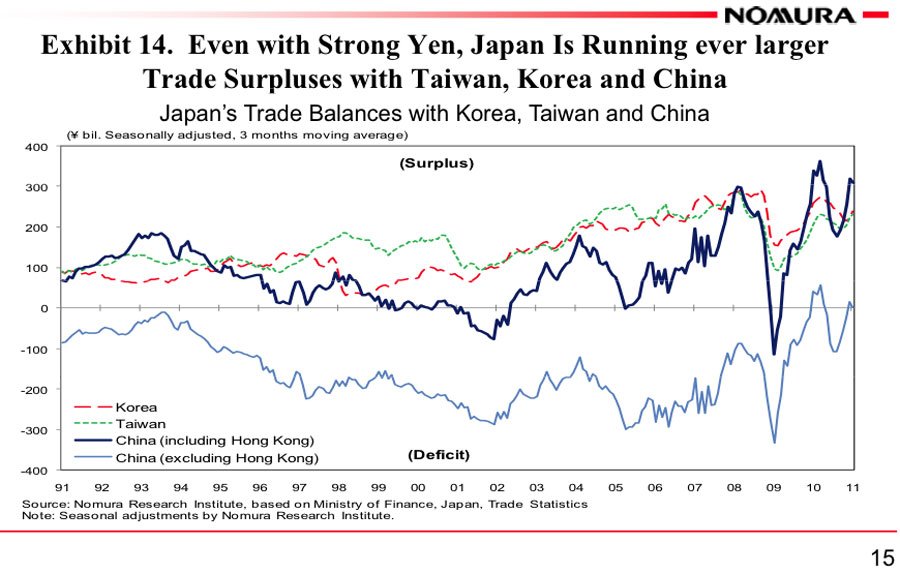

On the contrary, the 20% rise in the EUR/JPY rate, from levels around 100 to 120 and more, makes it possible that the Japanese sell their cars 20% cheaper than the German ones – at least when all pieces are produced in Japan. This will strongly improve the export side. Thanks to Abe’s target to use more nuclear energy again, oil prices will not weigh that much on the import side.

During the Chinese boom until 2011, the Japanese current account continued to improve despite the strong yen. This was stopped with higher import costs; oil replaced big parts of nuclear energy.

Hyper-inflation in Japan?

Kyle Bass’ understanding, however, is that public JGB holdings, so-called “monetization of debt”, will quickly lead to hyper-inflation. Even if we share Austrian and free-market opinions with Bass, we think that he oversimplifies because a sudden increases of government bond yields mostly happen in cases with:

- a high percentage of foreign bond holders (currently JGBs have only 8% foreign holders),

- a weak international investment position (but the Japanese position is positive with +51%),

- high inflation (which can be excluded thanks to Japanese demographic factors and immigration policy and good productivity)

- and a tradition of high wage increases to counter inflation and a history of defaults or high yields (e.g. Argentina and Venezuela).

In summary, at least for the points cited here, the Japanese currency debasement seems to be only positive for Japan: costs in terms of yields remain the same or rise only slightly, but advantages in higher export competitiveness are strong.

Are you the author? Previous post See more for Next postTags: Australia,balance of payments,Bonds,capital account,current account,hyperinflation,Japan,Japan Government Bonds (JGB),JGB,Kyle Bass,monetization of debt,Trade Balance,U.S. Treasuries

2 comments

Domenico Laruccia

2013-03-16 at 19:08 (UTC 2) Link to this comment

why are you so convinced that european will start consuming back? I live in Italy, and I travel Spain, the situation is worst everyday and reasons are not solved. How can they start consuming if EUR will not be depreciated through BCE’s currency deprectiation or through a German/Finland euro exit ? how can they start consuming with a economy eclipsed by a EUR over-evaluated by 40 to 50% of what their domestic currency will be, killing their business and industries and deleveraging not acting as required due to BCE interventions ?? bad reasons sourcing the problems are still there and even geting bigger day by day

DorganG

2013-03-17 at 14:02 (UTC 2) Link to this comment

Domenico, you got the wrong post to write this. I am absolutely convinced about the upcoming Italian and Spanish lost decade. I will write Sunday afternoon about this. It has to do with 3% higher salaries and higher spending in Germany. Definitely no higher spending in Italy.