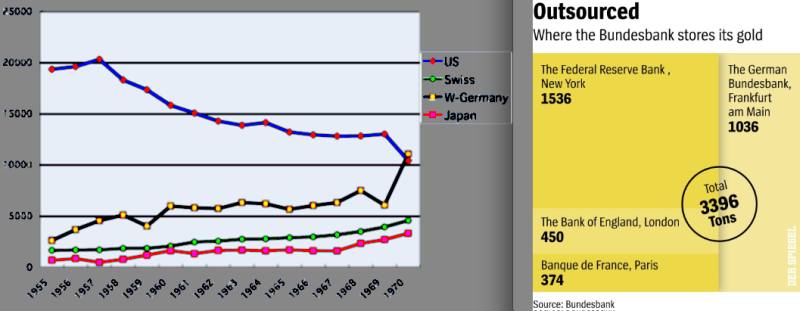

During the Bretton Woods system, Germany managed to obtain current account surpluses. They converted these surpluses into gold. At the time they bought it at 35$ per ounce at a relatively cheap price – at the end of the 1960s the price was augmented to 42$.

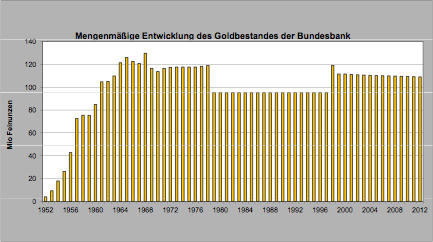

At the end of the 1960 and with the collapse of Bretton Woods, gold became very expensive and the Bundesbank switched to buying U.S. treasury bonds. First to take profit via higher treasury yields due to the rising inflation and later to control a bit the fluctuating exchange rates. When gold was at its highs at the end of the 1970s, the Germans sold some gold and bought it again when the price was at the lows in the year 1999 (see below).

Gold and FX Reserves

Gold and FX Reserves US, Germany, Switzerland, UK, Japan 1950-1970 vs. German Gold - Click to enlarge

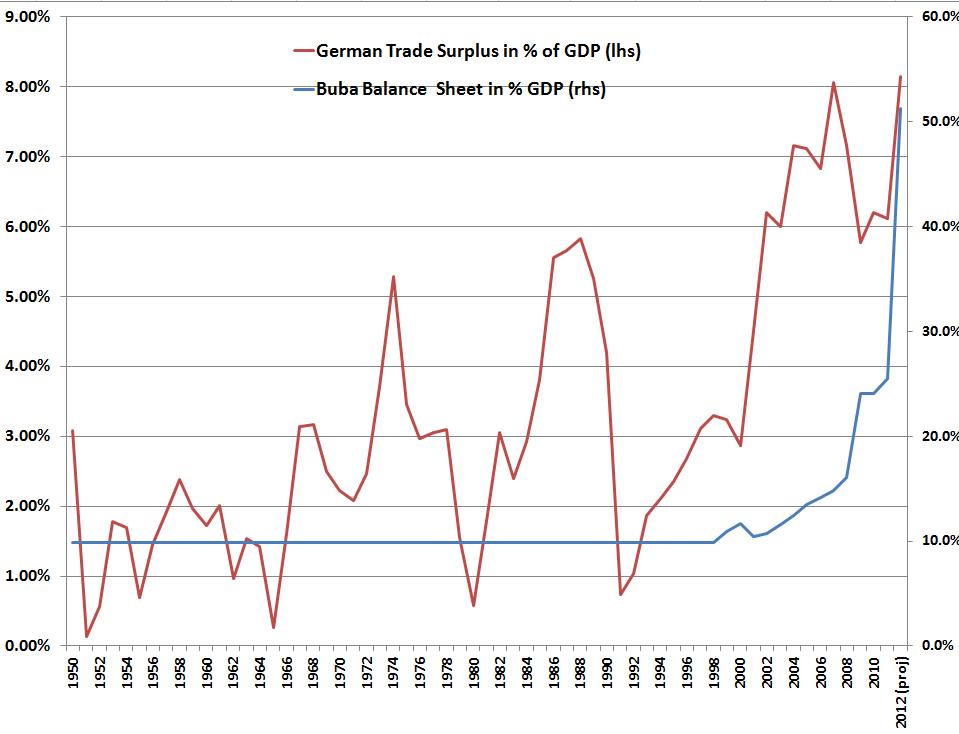

From the introduction of the EMU in the 1990s and even more from the euro introduction in 1999 this changed again: The Bundesbank bought assets from the European periphery and France instead, in the last ten years via the Target2 balances.

While the trade surplus amounts to 8% of GDP, the surpluses are not exported via the capital account, but the current account surplus remains on the Bundesbank balance sheet. In 2012 the BuBa possessed assets for around 50% of German GDP. On the contrary, a capital flight further blew up the Bundesbank balance sheet. Since October 2012, however, the capital flight is reduced, the target2 balance has decreased and the Bundesbank balance sheet has become a bit shorter again.

German Trade Surplus vs. Bundesbank Balance 1950-2012 (till 1994 only rough estimate of Buba balance) , click to expand Sources 1. destatis, 2. crp-intotec, 3. Arbeitsagentur, 4. Querschuesse.de, 5.Deutsche Bundesbank

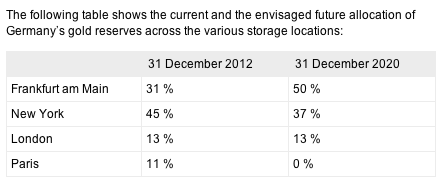

In the future foreign German gold reserves will partially come back to Germany.

Source Bundesbank

Are you the author? Previous post See more for Next post

Tags: Bundesbank,capital account,current account,Gold,SNB balance sheet,Target2,trade surplus