Monthly Archive: December 2012

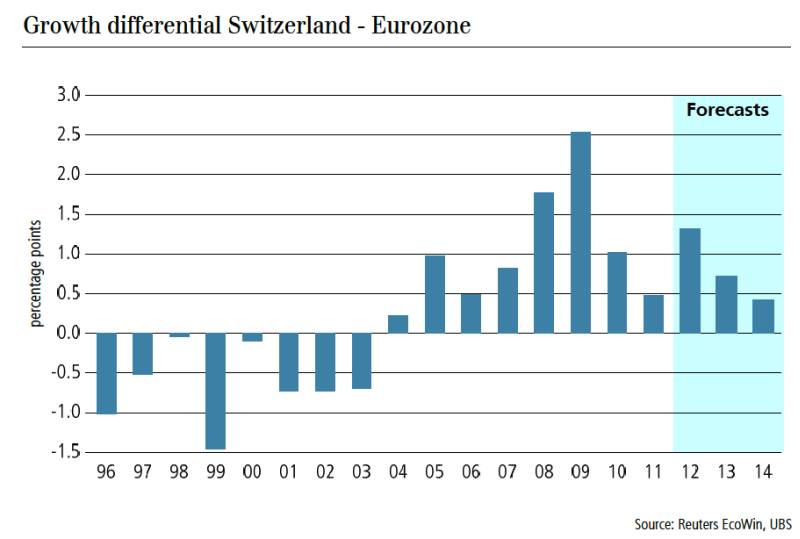

SNB Monetary Policy Assessment Outlook

On Thursday, December 13th, 2012, at 09.30 CET, the Swiss National Bank (SNB) holds its quarterly monetary policy assessment meeting. As we explained in the “drivers of Swiss inflation” post, inflation pressures will remain subdued for the next 2-3 years, because the effects of the quick rise of the franc and weakening global growth need to …

Read More »

Read More »

Warum die SNB nicht Hongkong, sondern Singapur imitieren wird

Im Gegensatz zu Hongkong mit dem USD/HKD-Peg kann die Schweiz ein Currency Board, einen fixen Kurs zum Euro nicht für Jahre durchhalten. Die Gründe auf snbchf.com

Read More »

Read More »

‘Negative’ has such unfairly negative connotations

Dear people, ATTENTION: HEAD OF FINANCIAL INSTITUTIONS/NETWORKMANAGEMENT/TREASURY AND/OR CASH MANAGEMENT FURTHER TO OUR SWIFT DATED 26 08 2011 PLEASE BE INFORMED THAT DUE TO THE CONTINUED PREVAILING MARKET SITUATION AFFECTING THE SWISS FRANC, WE HAVE...

Read More »

Read More »

Robert Mundell: Why Libertarians Must Love the Euro

The idea that the euro has "failed" is dangerously naive. The euro is doing exactly what its progenitor planned for it to do. According to Robert Mundell, the creator of the Optimum Currency Zone concept, the euro would really do its work when crises hit. Removing Keynesian monetary and fiscal juice to pull a nation out of recession. More about this evil genius on

Read More »

Read More »

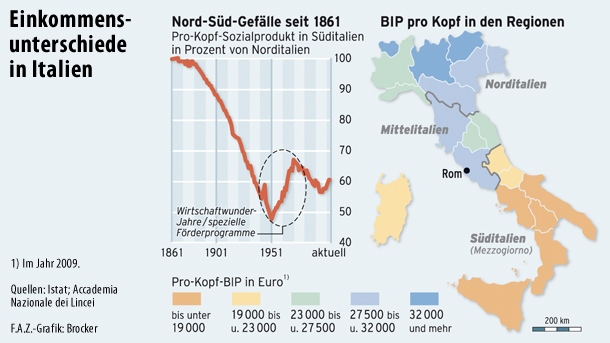

Wie eine Währungsunion Italiens Süden verarmen ließ

Wie eine Währungsunion Italiens Süden verarmen ließ

Vor 150 Jahren wurde in ganz Italien die Lira eingeführt. Der reiche Norden blieb reich. Der Süden stürzte ab.

mehr in der FAZ

Read More »

Read More »

Switzerland, the Paradise of Insider Trading and Intransparency

Switzerland is well known as the country, where even central bankers were allowed to do insider trading. Instead the whistle blowers get problems with the courts. Some new cases of insider trading include UBS, General Electric and Valiant, see the article on

Read More »

Read More »

May Japan face a weak yen and high bond yields?

Like often in global economic downturns, the demand for Japanese cars and electronics has fallen in Q3, especially due to European purchasers. Additionally fueled by a row with China, the current account has become negative. Is Japan doomed because the yen will fall and bond yields will rise?

Read More »

Read More »

Poll: Austrian politicians miss economic skills or are simply liars

For the Austrian public, the Greek crisis shows that 21% of politicians and so-called experts do not have the required economic skills, 60% say that these elites were simply lying

Details on ORF. Latest

Read More »

Read More »

SNB Losses in October and November: 8.4 Billion Francs, 1.5% of GDP

According to the SNB balance sheet and the SNB data delivery to the IMF, the central bank lost 8.4 billion francs of equity in the months of October and November, the equivalent of 1.5% of Swiss GDP. Details SNBCHF.COM

Read More »

Read More »

How Currency Speculators Help the SNB to Fight against Ordinary Investors

A discussion in the investor forum made clear how currency speculators currently help the SNB to maintain the floor against normal investors. A situation that was different in August/September 2011, when the SNB had to fight against these speculators. A discussion in the investor forum Seeking Alpha: part one Based on our analysis of …

Read More »

Read More »

Unicredit: Both Italy and Britain Should Play in the Southern Euro League, Germany in the Northern

The must read "Italy is a better bond bet than Britain" on the Financial Times. Unicredit CEO Nielsen implicitly confirms our latest post on global and European imbalances that can be solved only with a Northern...

Read More »

Read More »

Credit Suisse and UBS Will Charge Negative Interests Above a Threshold

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such was worth 150 bps, this year on 28 bps. See the official news at FT Alphaville

Read More »

Read More »

Jim Rogers, 2012: When Will the Peg Fall? Will Switzerland Become Bulgaria?

Given that most farmers are rather old, he says that the world should be very grateful to speculators that bet on food prices, this helps to obtain the required younger farmers. Jim Rogers has exchanged all his euros into francs, he thinks that the EUR/CHF peg will fall soon. Tagesanzeiger (

Read More »

Read More »

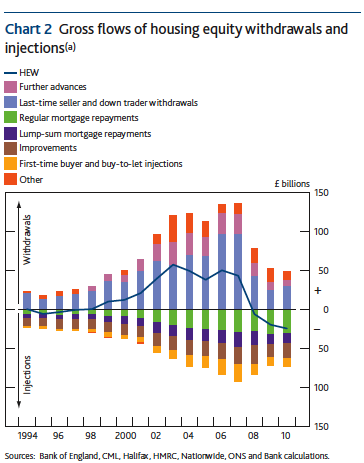

The Balance Sheet Recession: UK Q2 Housing Equity Injection Largest Since Q2 2011

The American-Taiwanese economist Richard Koo, is the chief-economist of the Nomura Research Institute. In his theory of the Balance Sheet Recession he distinguishes between the “Yang” phase of the economy and the “Yin” phase (the so-called “balance sheet recession”). In “Yang” times companies want to increase profit and people consume a big part of their pay …

Read More »

Read More »

Die immer falschen Vorhersagen und Rezepte der OECD-Ökonomen

Ein herrlicher Kommentar von Wolfgang Vontobel über die Unfähigkeit der OECD-Ökonomen, korrekte Vorhersagen und wirtschaftliche Rezepte zu erarbeiten und Selbstkritik zu üben.

Details in Cash.ch

Read More »

Read More »

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »

Ist der Franken überbewertet? Kaufkraftparitäten

Nach dem starken Anstieg des Frankens in den letzten Jahren, sagten Ökonomen wie O’Neilly von Goldman Sachs oder die der Schweizerischen Nationalbank (SNB), dass die Schweizer Währung überbewertet wäre. Einige benutzen den “Big Mac Index”, den OECD-Kaufkraftsparitätsindex oder Kaufkraftparitäten auf der Basis von Konsumentenpreisen als Beweis. Wir zeigen, dass aber nur die Kaufkraftparität aufgrund von …

Read More »

Read More »

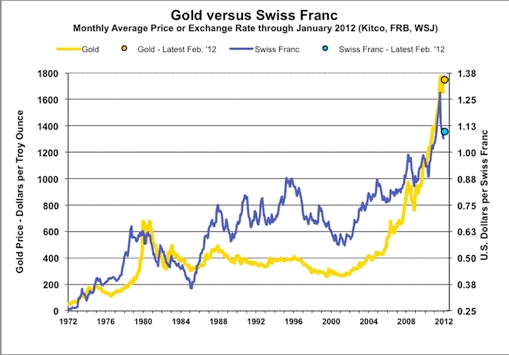

Gold, CHF, Brent Arbitrage Trading after Negative CS, UBS Interest Rates

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such news was worth 250 bps, on December 3 only 28 bips. One remembers August 26, 2011, when UBS only spoke of negative interests and consequently EUR/CHF rose from 1.1420 to 1.1688. At the time FX traders …

Read More »

Read More »

Die Wiederwahl Obamas bedeutet nichts Gutes für die Schweiz

Obama mag zwar das kleinere Übel für die USA und den Weltfrieden sein, er ist aber das weit grössere Übel für die Schweiz. SNBCHF.COM

Read More »

Read More »

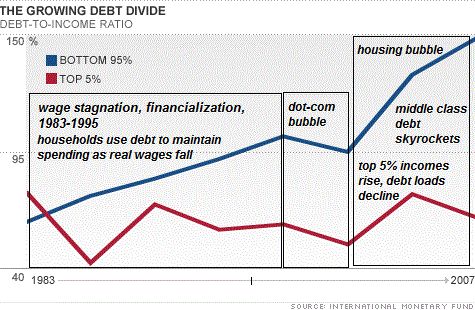

How Economists Got Income Inequality Wrong

In our manifesto we criticized that central banks created inequality. They pushed asset prices upwards from which only the rich informed investor could take profit. The middle class was left with an over-indebted home.

With the upcoming end of this Joseph cycle even the rich are not able to increase their income.

Read More »

Read More »