SNB Q3 Profits: 10 billion francs

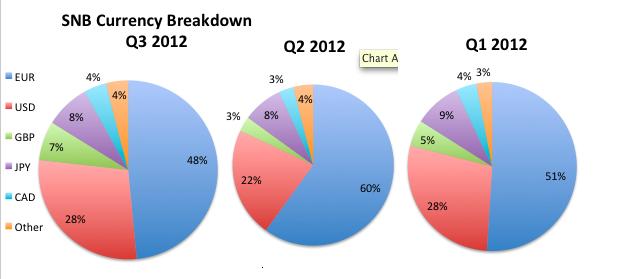

The Swiss National Bank (SNB) radically reduced its euro share, in the third quarter from 60% to 48%, and bought US dollars and sterling instead. In the second quarter, however, it increased the euro share from 51% to 60% and concentrated on buying euros. Given that the EUR/USD was valued around 1.24 in Q2 and 1.30 in September, this fluctuation of the euro share and the increase of EUR/USD from 1.24 to 1.30 contributed heavily to a big gain in foreign currency reserves of 5.2 bln. CHF (see details).

Thanks to the ECB Outright Monetary Transactions (OMT) and the Fed’s Q3, gold holdings appreciated by 10% between Q2 and Q3 and helped with 4.94 bln. francs gain to achieve very good results in Q3 (here on SNB website).

Our calculation gives 1.4 billion in pure Forex gains, i.e. price changes in the FX rates, without looking at the composition of the SNB portfolio. Changes to the composition of the Forex portfolio helped to achieve another 2 billion CHF income. Higher equity prices (from 10% to 12% of the SNB portfolio) helped more to achieve over 5 billion francs in FX positions.

Changes in the Foreign Currency Portfolio

The Swiss National Bank radically reduced the euro share in the third quarter from 60% to 48% and bought US dollars and sterling instead. In the second quarter, however, it increased the euro share from 51% to 60%. Given that the EUR/USD traded at 1.24 in Q2 and 1.30 in September by 5%, this heavily contributed to a gain in foreign currency reserves. We estimate 2 billion CHF in gains, the details are here.

Pure Price Change in Foreign Currency

The EUR/CHF appreciated from 1.2009 (end June) to 1.2084 (end September), a change of 0.6%. Euro positions represented 60% of the SNB reserves in Q2, the equivalent of 262 bln. CHF. Therefore, the euro price increase helped to achieve another 1.6 bln. in profit.

The USD fell from 0.9488 at the end of June to 0.9400 at the end of September. 22% of reserves means 95.9 bln. CHF. By price change they were reduced to 95.0 bln. CHF; hence, a loss of 0.9 bln. francs.

The price for 100 yen fell from 84.12 to 82.63 CHF. Based on 8% reserves or 34.9 bln. francs in Q2, the value of the yen positions reduced to 34.55 bln., a loss of 0.35 bln. CHF.

The Loonie rose by 2% and sterling by 3% in the third quarter: Based on 6% reserves for these currencies, this gives a gain of 0.7 bln. francs.

Other currencies had a slightly positive performance of 1%: this gives a gain of 0.15 bln. francs.

- Australian dollar rose from 0.9713 to 0.9767 CHF.

- The Swedish Krona fell from 7.30 to 6.98 in September.

- The Singapore dollar rose 0.7499 to 0.7674 in September.

- The euro-pegged DKK appreciated with the euro.

Hence the total Q3 result in pure currency price changes against CHF was 1.4 billion francs.

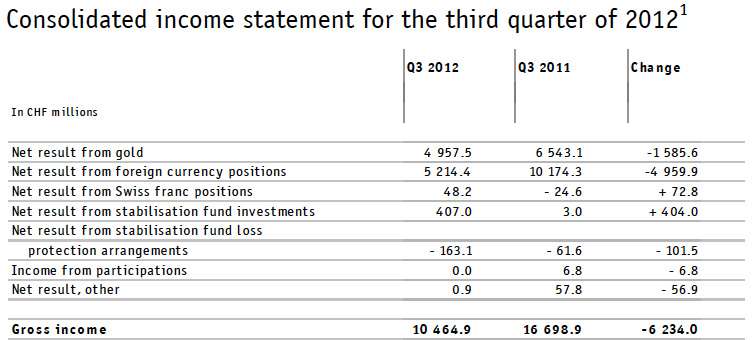

The following table gives an overview:

Share in % and in bln. CHF Price Change since Q2 against CHF Result in Bln. CHF

EUR 60% = 261bln 0.6% 1.60

USD 22% = 96.9 bln -0.9% -0.70

JPY 8% = 34.9 bln -1.8% -0.35

CAD, GBP 6% = 26.8 bln 2.5% 0.70

Other currencies 4% = 17.6 bln. 1% 0.15

Total pure FX price changes 100% = 436 bln. 0.3% 1.40

Change in Gold Holdings

The October 12, 2012 IMF data is as follows:

Thanks to the ECB Outright Monetary Transactions (OMT) and the Fed’s Q3, Gold holdings appreciated by 10% between Q2 and Q3. The price increased from 1597 US$ in Q2 to 1768 US$ (by 10.7%) in Q3 with a 0.8% weaker USD/CHF (from 0.9488 to 0.9400). This gave the strong result in gold holdings of 4.9 billion francs. However, gold has already lost much of its value with the latest price at 1711 US$.

Seigniorage Effect

Tags: Gold,IMF,income,profit,Reserves,results,Seigniorage,SNB Gold Holdings,Swiss National Bank