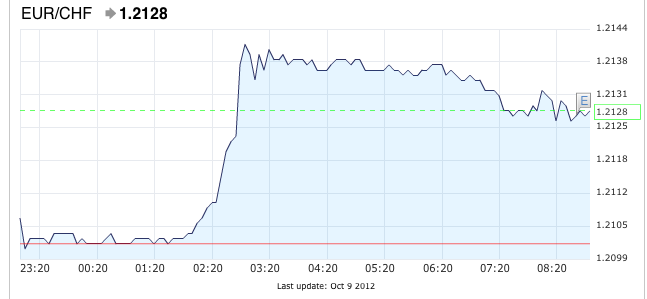

Strange movement in the EUR/CHF in the Asian session today

The Asian session was a risk-on session, it recovered some of yesterday’s losses. After yesterday’s rather good HSBC services PMI, Shanghai Composite was up today by 1.97%. Therefore safe-havens like the yen and the Swissie were under pressure.

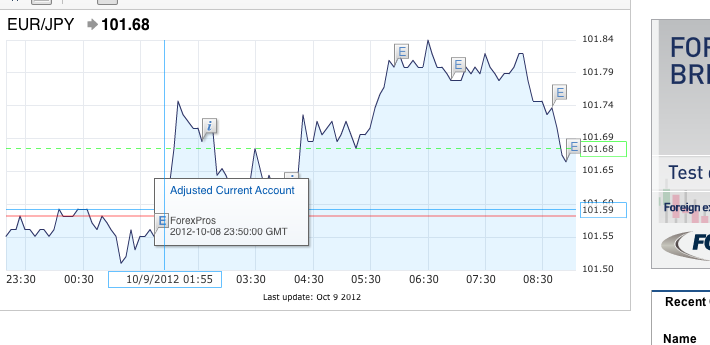

At first, some Forex traders interpreted the stronger Japanese current account as bullish. After some time they realized that both exports and imports were contracting. This is bullish for the yen, namely a slowing in the global economy and repatriation of the Japanese current account surplus into yen.

The remaining bullish sentiment of the risk-on session needed another safe-haven to be punished and this was the Swiss franc. Consequently the CHF/JPY fell strongly from 2:20 CET, 02:20 GMT on. This strong movement was potentially intensified by first rumors about negative Swiss interest rates at State Street and BNY and low Asian volumes.

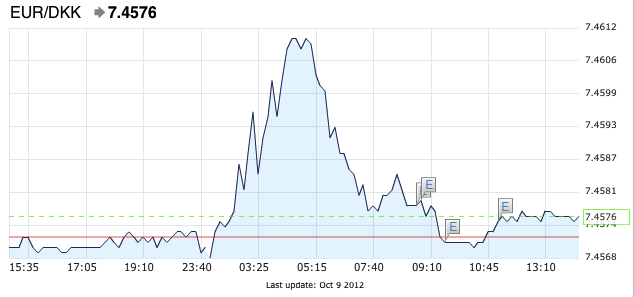

The Danish Krona, strangely, moved a lot later than Swiss franc, it was more or less in sync with the Bloomberg news about the negative interest at 6 am CET (4 am GMT).

Are you the author? Previous post See more for Next post

Tags: current account,negative interest,Switzerland