The Dow Jones Stoxx 600 rose 6.9%, led by a 12.5% rally in Germany’s DAX. The MSCI Asia-Pacific Index rose also 12.5%, which is all the more impressive given that the Nikkei and the Shanghai Composite both fell (-1.2% and -6.3% respectively).

Bond markets also did well, even though the benchmark 10-year US and UK yields did rise by a few basis points. The anticipation of new supportive measures that were ultimately outlined in early September helped spark a sharp rally in Spanish and Italian debt markets. Spanish 10-year yields fell 98 bp over the quarter, while Italy’s 10-year yield fell 110 bp. Two-year yields fell 196 and 191 bp respectively. Gold too rallied; appreciating 14.2% on the quarter. The low and stable volatility was also an important feature of the global capital markets.

There simply are too many brinkmanship games being played in the major financial centers to expect this to persist. If Q3 was about positioning for the risk-on advance, then Q4 may be about protecting those gains.

In Q3, many fund managers that were underweight Europe, and speculative shorts, were forced to cover. This theme is clearly evident in the futures market with the gross short euro contracts were slashed from 250k in early June to about 100k as of Sept 25. However, as Q3 wound down, the tone in the market had already begun changing.

Over the last two weeks (

here and

here), we have been observing a deterioration in the tone of the major foreign currencies against the dollar. This has continued over the past week and looks set to continue, as we discuss below.

The fourth quarter begins with a bang. In the days ahead, four G10 central banks meet (RBA, BOE, RBA and BOJ) Japan releases its quarterly Tankan survey (early Monday), the US holds its first presidential debate and reports it employment figures at the end of the week. The backdrop and context that these events include the deterioration of the global economic outlook. US economic data mostly has surprised to the downside. The euro zone is contracting. This in turn is weighing on industrial output in Japan, China, South Korea and Taiwan, for example. Japan’s economy may also be contracting. The UK may be one of the few countries that growth likely improved in recent months. After three quarters of contraction, it may have grown again, albeit slightly.

The political backdrop may arguably be even worse. The odds-on most likely scenario in the US is that Obama is re-elected and the Republicans hold the House of Representatives. While most observers appear to believe the fiscal cliff will be avoided, the uncertainty related to the tax outlook, the debt ceiling already appears to be having a cooling effect on employment and business investment. In addition, many businesses and investors are skeptical of the risk-reward of QE+. Given this skepticism, the program that was meant to improve risk taking may result in its opposite, further driving the animal spirits into comatose state.

In Europe, the Spanish and French 2013 budgets were greeted with a yawn. Optimistic assumptions about growth, for example, allow officials to square the circle, and project meeting EU targets. Overshoots are more the rule than the exception. There is no closure yet on Greece and there may not be until November. Spain’s three-prong debt crisis (sovereign, regions, and banks) is also morphing into a constitutional crisis. Prime Minister Rajoy meets with the regional heads on Tuesday in an attempt ease the dispute with Catalonia.

A major surprise of last week was the selection by Japan’s Liberal Democrat Party (LDP) of former Prime Minister Shinzo Abe as its leader, putting him position to becoming prime minister again after the elections. No date has yet been set, but pressure is mounting on the government as the LDP is blocking issuing any more bonds to finance the current spending.

During his first term, Abe is credited with improving relations with China, after it deteriorated under his predecessor Koizumi. However, he has taken on a more nationalistic mantle, but it is not clear whether he is leading the party or the party is leading him.

In either case, it is unlikely to help resolve the present tensions over disputed territory. Politics, as is said, makes strange bedfellows. China is warned Japan that it will defend the Taiwanese fishing boats that harass Japanese ships near the disputed territory, which it also claims.

Euro: The attempt to rally in the second half of last week failed and the euro finished the week near the recent multi-week lows. The technical tone is poor, with momentum indicators pointing down. In the coming days, the 5-day moving average will most likely cross below the 20-day moving average, confirmed the downtrend. A break now of the $1.2775-$1.2800 area signals another 1-2% decline. It requires a move above the $1.3000-50 area to signal a new leg higher, which we had previously thought possible.

Yen: The dollar recorded a big outside up day on Friday. The yen’s weakness was also notable because it seemed to be more a risk-off day. Nevertheless, it is unlikely to mark the start of a significant decline in the yen. Initial resistance is seen in the JPY78.20 area and a break could see the dollar retest the JPY79.00 area. Many technical tools get chopped up in the relatively narrow trading ranges that continue to prevail. The low volatility, near the lowest since the crisis began, is one of the conditions that draw players to carry trade trades, but the fear of adverse impulses emanating from the US or Europe, is an important deterrent.

Sterling: The technical tone deteriorated further in the past week. Bears seem to be gathering an upper hand as selling rallies seems more successful than buying dips. Momentum indicators are pointing lower and, like the euro, the 5-day moving average will likely cross below the 20-day average in the days ahead. A break of $1.6115 would signal a move toward support in the $1.6000-$1.6050 initially, but would suggest potential toward $1.5900.

Swiss franc: For all practical purposes, the franc is pegged to the euro. Consider that the Hong Kong dollar, which is pegged to the US dollar, has moved 0.13% over the past 6 months. The Swiss franc has moved 0.25% against the euro. The technical condition is therefore similar to the euro and it has similarly deteriorated in recent days. A dollar move through the CHF0.9420 area would spur a new leg up for the greenback.

Canadian dollar: The Canadian dollar’s technical tone was the first we saw deteriorating two weeks ago. The technical condition continues to deteriorate. The attempt to recover failed in the second half of last week. If the US dollar overcomes resistance near CAD0.9860, there is scope for a move toward into the CAD0.9950-CAD1.000 area in the near-term, and would suggest a more important bottom may have been carved out on a medium term basis. We note that the greenback’s 5-day moving average crossed above the 20-day moving average.

Australian dollar: The Australian dollar’s technical tone has also deteriorated. The attempt on the upside was rebuffed before the weekend and additional losses are likely. The 5- and 20-day moving averages will likely cross next week. Trend line support near $1.03 is likely to be tested on a break of $1.0360, but the more important target is the lows from the start of September near $1.0175.

|

Net |

Prior Week |

Gross Long |

Change |

Gross Short |

Change |

| Euro |

-50.2

|

-73.5

|

53.3

|

4.5

|

103.6

|

-18.7

|

| Yen |

21.1

|

15.4

|

47.3

|

5.8

|

26.2

|

0.2

|

| Sterling |

27.1

|

14.4

|

60.8

|

8.2

|

33.7

|

-4.5

|

| Swiss Franc |

-0.9

|

-4.5

|

13.6

|

0

|

14.5

|

-3.7

|

| Canadian Dollar |

105.0

|

112.0

|

123.6

|

-3.0

|

18.3

|

3.5

|

| Australian Dollar |

89.6

|

69.2

|

119.1

|

2.1

|

29.6

|

-18.2

|

| Mexican Peso |

141.0

|

118.0

|

147.2

|

6.9

|

6.0

|

-16.2

|

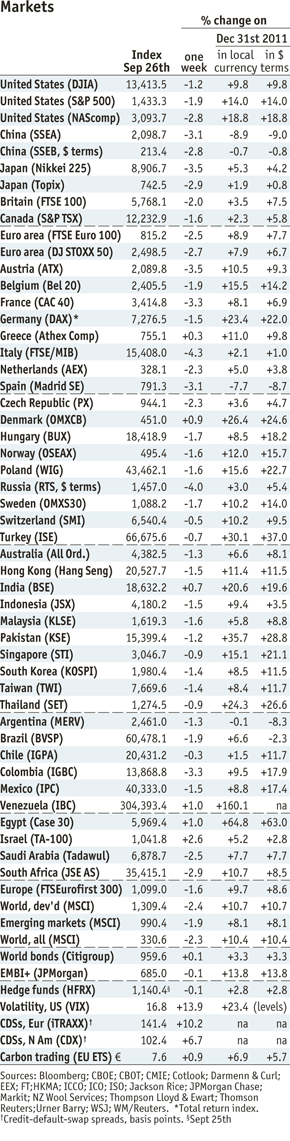

In the last week the Denmark’s OMX could retake the first position for developed economies in this year’s return in US$ terms. It was one of the few indices that rose last week. The DAX, the Dow Jones, the S&P 500 and especially the NASDAQ lost some ground.

Chinese stocks continue their downward trend and Japanese, Canadian and British stocks saws losses.

In the euro area French, Spanish and Italian stocks saw losses, but this week the Greek Athex was the positive exception. Northern and Eastern Europe markets saw losses again.

The Swiss SMI has achieved 10.2% return in CHF and 9.5% in USD terms, lower values in US$ because € and CHF recovered till last Wednesday.

After initial QE3-related gains, stocks markets related to commodity currencies lost terrain last week, especially Russia. Doubt about the effectiveness of QE3 let the stocks of emerging markets fall again and restart a certain capital outflows. Only the continuous winners Venezuela and Egypt (Year to date +64% in US$ terms) moved against this trend.