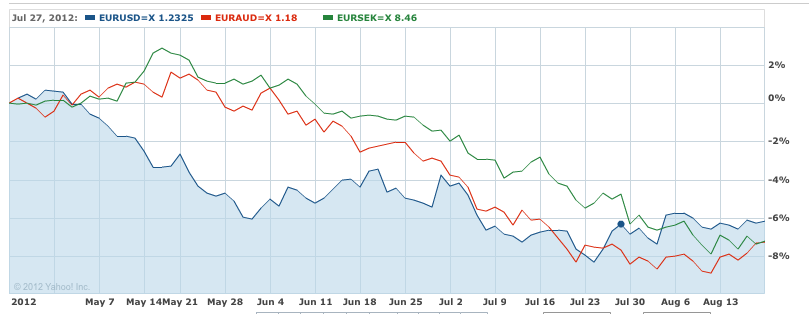

The weak euro in recent weeks

In recent weeks and months markets witnessed a strong fall of the euro exchange rate, e.g. against the dollar (down to 1.2062 on July 20th) , the Aussie (to 1.1610 on August 18) and the Swedish Krona (down to 8.18).

This exaggerated downtrend of the euro had many reasons: the ECB rate cut to 0.75%, the euro crisis events in Spain, Italy and Greece, the negative trend channel followed by technical FX traders. The main important reason to us were the poor euro zone Markit Purchasing Manager Indices (“PMIs”).

Purchasing Manager Indices and their GDP prediction capabilities

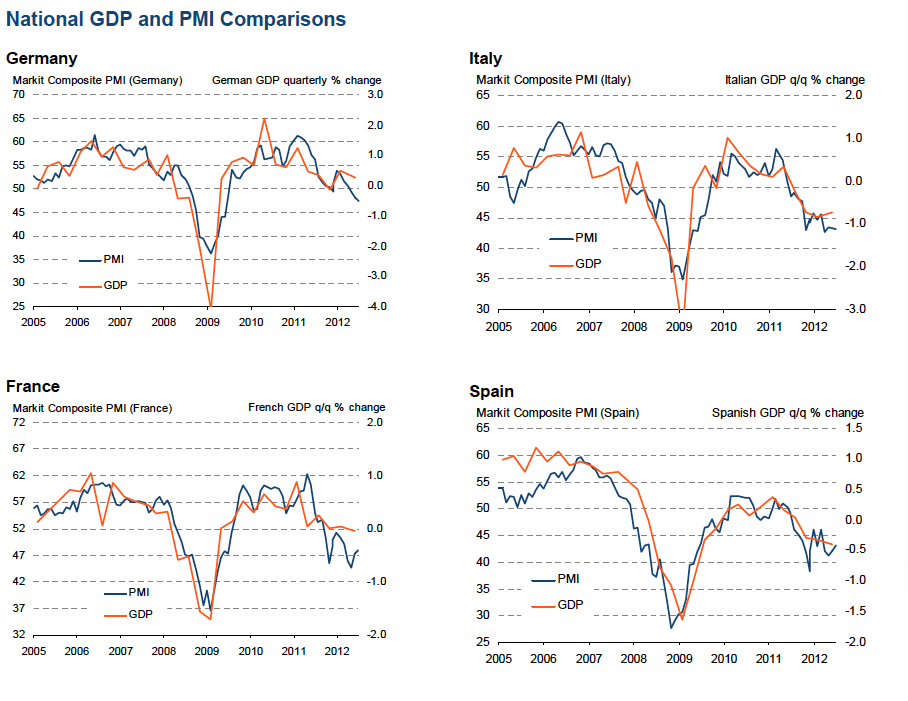

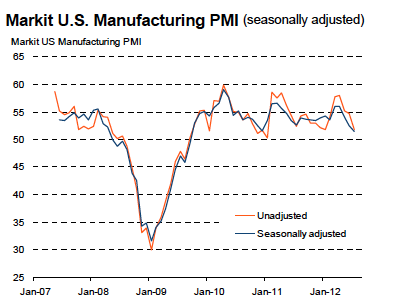

Purchasing Manager Indices (“PMIs”) are delivered by the economic survey provider Markit. The German Manufacturing PMI and the ones of other eurozone members contracted during the second quarter (Q2) of 2012. The “Markit Composite PMI” contains data from the manufacturing and the services sector. Markit has a quite good track record in predicting Gross Domestic Product (GDP).

When we looked into the details of Markit’s comparison, we realized the following:

German Composite PMI in contraction (e.g. 47.5) during April, May, June but at the end German GDP expanded by 0.5% in Q2.

but:

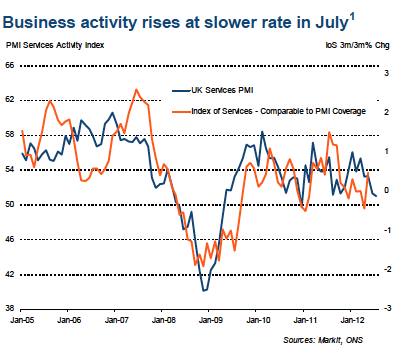

UK Composite PMI in expansion during Q2 but at the end UK GDP contracted by 0.7%.

The graphs show the big miss of around 0.8% GDP for Markit PMIs against GDP, for Germany and in the opposite direction for the UK.

US Manufacturing PMI July 2012 ( http://www.MarkitEconomics.com/MarkitFiles/Pages/ViewPressRelease.aspx?ID=9897>source Markit - Click to enlarge

UK Services PMI Markit July 2012 (source Markit) - Click to enlarge

Are Markit PMIs really a leading indicator ?

In our finance school we learned:

Purchasing Manager Indices are leading indicators, GDP is a lagging one.

Looking at the graph above we really cannot see the empirical evidence that PMIs are leading indicators. In Q2 2008 even the opposite occurred: the German GDP contracted but the composite PMI was unable to detect the upcoming recession, the PMIs pointed to continuing expansion.

As little side note here another explanation of Steve Keen why nobody saw the recession coming.

Markit’s chief economist Chris Williamson explained

[tweet

Hence Markit PMI values for the months of April, May and June reflect Q3 GDP values (as the FT says here), the lead of PMIs against GDP is longer than 3 months ? Like in spring 2008, when PMIs showed expansion, but the recession was upcoming ?

But why did Markit compare Q2 PMIs with Q2 GDP and not with Q3 GDP ?

PMIs do not reflect government spending and inventories

French GDP was buoyed by government and inventories as Mr Williamson explained.

In Q2/2012 German GDP rose thanks to the strong current account surplus, and thanks to state and private consumption, whereas investments slowed.

Markit Composite PMIs do not contain construction

By pure definition the Markit Composite PMI takes into consideration only the output in manufacturing and services, but not construction. Eurostat shows that German construction production rose by 1.6% in Q2, but the UK production fell by 10 percent.

PMIs do not reflect trade balances or current accounts

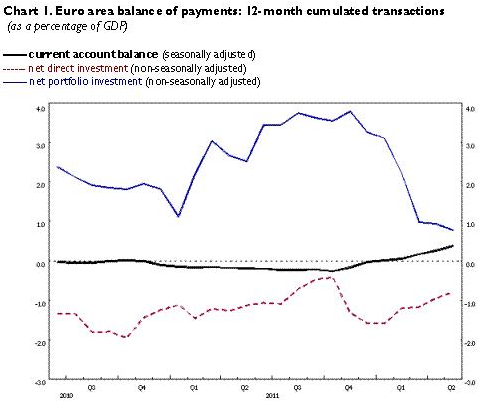

Eurozone Balance of Payments Jul 2012( source ECB) - Click to enlarge

The German and Italian trade balances and current accounts improved , whereas the UK and US ones deteriorated. When the current account data came out on July 19, we predicted the inversion of the EUR/USD trend.

Provided that global demand did not become much weaker, we expected the German and Swiss trade surpluses to rise further at the cost of American and British producers.

The eurozone balance of payment attached makes a positive current account, but strong portfolio investment outflows from the euro zone.

PMIs are subject to sentiments

For us the reasons for the lower German PMIs can be found in the bust of the QE2 induced Chinese real estate bubble and in the austerity and therefore less demand for German cars and equipment in the periphery, but not in a significant reduction of German consumer demand. We summarized:

Markit Purchasing Manager Indices possess a high degree of sentiment and have to be taken into perspective against sentiments of previous years.

This was the explanation why German PMIs currently look weaker than last year, and the ones of the UK better.

Moreover managers take into account the stock price of their company, when they make economic decisions. Stock prices again are driven strongly by sentiment, especially the by the sentiment of the American public. For more details see our first take on Seeking Alpha.

[tweet

My response was the following:

For me hard data are only realized sales, as contained in the GDP. I suppose that Markit data is based on forecasts for the future, e.g. on purchasing orders, which you consider as hard data. Purchasing orders to suppliers are based on orders to the companies that Markit examines. The numbers of orders the company receives might be also based on sentiments driven down by the euro crisis.

A cheap euro as compared to an expensive dollar or pound can make German manufacturing products more attractive to an American buyer than American or British products. Some orders will be cancelled for American or British companies and some new orders will be given to German companies. Orders are subject to change, therefore they are for me no hard data as opposed to realized sales. Moreover, the German consumers continue spending as the GDP showed. Only this GDP news may result in a better sentiment among German business leaders who will give more orders to other companies.

The logical consequence is that Markit PMI rises for Germany and falls for the UK falls, sooner or later. The strong fall of the UK manufacturing PMI to 45.4 in July is a first evidence. With the strong fall of the euro, markets have destroyed Markit’s PMI ability to be a leading indicator. For me, Germany’s Q3 GDP growth will be stronger than UK GDP growth despite Markit’s leading indicators claim that it will be the opposite.

Which fundamental indicators are important for forex traders ?

PMIs are hence only one of several leading indicators, but should never be used as main indicator and should be compared with others. The main fundamental indicators for forex trading are for us:

- Nominal and real interest rate differentials (e.g. currently between Sweden, Australia and the euro zone, which supports the currencies of the higher leading ones) for risk-taking investors

- The demand for save-havens for risk-averse investors

- The Markit PMIs including the construction PMIs

- The exchange rate itself (e.g. has the euro fallen too strongly recently ?)

- Trade and current account balances reflect recent strong changes of exchange rates

- Sentiments: especially in the euro zone crisis, brought into perspective with money outflows seen in the portfolio investments above.

Our investment recommendation re-visited

At the time of writing our Seeking Alpha take on August 15th, the euro zone GDP for the second quarter came out. We claimed that German and euro zone PMIs would rise, but UK PMIs would fall and German GDP growth would be stronger than the UK GDP growth in Q3.

We suggested to go long the euro and the Swiss franc against the US dollar and the pound, but to be short German stocks and the Aussie. Only at that moment, traders started to reflect the positive euro zone trade and current account balance and the euro started to rise and stocks followed.

By August 23, the french manufacturing PMI improved from 43.4 to 46.1. The German manufacturing PMI rose from 43 to 45.1 thanks to the cheap euro and was almost equal to the UK one. The unnatural difference between Manufacturing and Services PMIs has narrowed in Germany, but the German composite PMI has further deteriorated from 47.7 to 47.0. The Eurozone composite PMI recovered slightly from 46.5 to 46.6. The reason for this weaker German data is that the Chinese bust of last years’ booms could be a lot bigger than official data suggests.

As we expected, the Swiss trade balance improved thanks to the cheap Swiss franc.

Since August 15 the EUR/USD has recovered from level 1.2290 to 1.2550, a win of 260 pips for the traders who followed our recommendation. We suggest to take partially profit now. For the remaining part a target of 1.27 and a stop-loss of 1.2514 (MA100) should be established.

Stocks have not depreciated yet, because the weaker US and British manufacturing PMIs and GDPs are still to come and the Chinese PMI is even stronger in contraction. We continue to be short German stocks and the Australian dollar, but we are still long CHF.

Are you the author? Previous post See more for Next post

Tags: balance of payments,current account,ECB,Euro crisis,Krona,PMI,Purchasing Manager,Seeking Alpha,U.K. Gross Domestic Product,U.K. Manufacturing PMI,U.S. Markit Manufacturing PMI,U.S. Nonfarm Payrolls