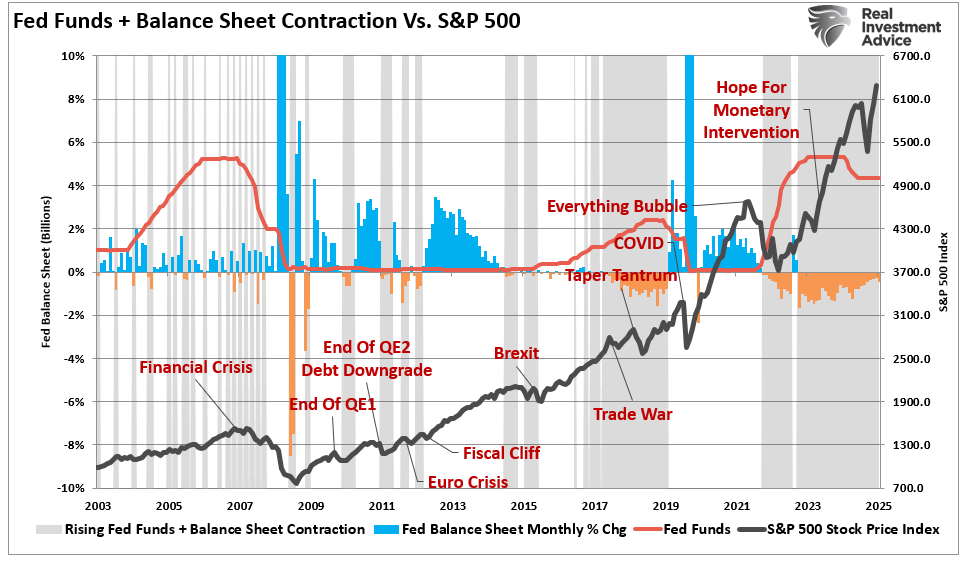

There are two main drivers behind the price action in the foreign exchange market and they will likely persist in the days ahead. First, there continues to be position adjustment ahead of the what promises to be eventful few weeks. Second, the release of the minutes from the August 1 FOMC meeting has increased the perceived odds that QE3 is launched at next month’s meeting. Both of these drivers generally weighed on the dollar and extended the month-long downside correction.

Ahead of Bernanke’s Jackson Hole speech, these forces may continue to dominate. However, we think that underlying fundamentals remain dollar positive and expect them to begin reasserting themselves shortly.

Below, we draw your attention to two potential early warning signs. The first is that although the next speculative futures position swung to the long side in sterling, we note a potential reversal pattern late last week. Often it seems that sterling leads euro moves.

The second is the heaviness of the Australian dollar, which was the G10 leader in June and July. In terms of price action, the Canadian dollar and Mexican peso, which have also been speculators’ favorites, have seen the rally stall out. This fading momentum stands in contrast to the futures positioning, where new late longs have been established. If our fundamental analysis is correct and the risk-on tone yields to its opposite in the coming weeks, these currencies seem vulnerable.

Our

fundamental view is fairly straight forward. We think FOMC minutes are a

bit dated and that the decision on new asset purchases largely rests on the next batch of employment data. We suspect the August non-farm payrolls on Sept 7 will show that net private sector job creation was on par with the July rise of 172k (which is above the early consensus, which is near the Q2 monthly average of 91k).

This implies that Bernanke can’t and won’t tip his hand at Jackson Hole, as he did in 2010. The day before he speaks, the US will release July personal consumption expenditures. An increase of 0.5% would be the largest since February and with one blow offset the full softness in Q2.

We do take seriously that Fed officials are looking at not just liquidity provisions, but what the ECB’s Draghi has called the transmission mechanism. However, this seems more likely to be ready for the last FOMC meeting of the year in December rather than next month.

While we expect a change in the Fed’s forward guidance, we recognize some risk of QE3. However, even under a renewed asset purchase program, we are not convinced that this is a dollar negative event. Leaving aside theory, the dollar tended to advance after the first two rounds of asset purchases were announced. Other countries that have pursed some form of what is called quantitative easing (e.g., UK, Japan, Switzerland) did not experience depreciating currencies either.

Meanwhile, there are some indications that the market may be disappointed yet again with European officials. First, one press report suggested that Draghi’s “modalities” (to ensure a more effective transmission of the central bank’s monetary policy) may not quite be ready in time for the Sept 6 ECB meeting (one day before the US jobs report). The fact that the German Constitutional Court does not make its preliminary ruling on the ESM until the following week does not help very much either.

Second, Spain does not seem prepared to formally request EFSF assistance to depress yields. It is not just the ECB has not worked out the details of its facility. Spain is not ready. Spain’s two year yield has been more than halved over the past month (from 7.14% on July 25 to 3.35% last week). In the same time, the 10-year yield fell about 160 bp. This was largely achieved by Draghi’s comments and Merkel’s apparent support. This has helped ease the sense of urgency on Spain’s Prime Minister Rajoy.

Third, other reports indicate that no decision on Greece can be made until the Troika makes its next report, which now seems likely toward the end of September. This means the sword of Democle’s will continue to hang over it for some time. Ideas that a temporary exit can be engineered, which surfaced in recent days, seem silly (politically naive, technically impractical and economically even more disruptive than the status quo) and a non-starter, except perhaps in the blogosphere.

Euro:

Futures positioning squaring continues to dominate activity. In the week ending August 21, the net short speculative position was cut to 124k contracts, the smallest this month, from 138k at the end of the prior reporting week. This was a function of 11k shorts covering, though at almost 170k, the gross shorts were still substantial. We suspect more shorts covered when the FOMC minutes appeared to increase the risks of QE3 and spurred the euro to its best level since early July.

The short-covering phase does not look over yet. There is scope for additional euro gains ahead of Bernanke’s Jackson Hole speech at the end of the week. The key in the market now is support not resistance. Here the trend line off the July 24 low (~$1.2045), the August 2 low (~$1.2135) and August 16 low (~$1.2255) is important. It comes in near $1.2345 on Monday and rises almost 15 ticks a day. However, retracement objectives in the $1.2420-$1.2460 may be attract new buyers ahead of Bernanke’s speech.

Yen:

The net long speculative position was slashed to 11.2k from 30.7k contracts. This is the smallest long position since late July. The longs capitulated and were culled by nearly a quarter prior to the release of the FOMC minutes which quick saw the yen rally more than a percentage point. About 7.1k new gross shorts entered the market and were likely in weak hands.

The yen’s recovery in the second half of last week was clearly sparked by a retreat in US yields. However, the dollar had run into offers just above JPY79.55, which corresponds to a retracement objective of the dollar’s slide from the late June high near JPY80.60 to the Aug 1 low just below JPY78. In the days ahead, the dollar can recover back into the JPY78.80-JPY79.20 area.

Sterling:

The net speculative sterling position switched to long (7.8k contracts) from short (a little less than 300 contracts). It is the first net long position since early June. The gross longs grew by 13.9k contracts to stand at 46k, which is ironically the same as the gross long euro positions. The difference of course, lies with the shorts. The gross short sterling positions rose 5.8k contracts to 38.2k.

Our

understanding of the underlying fundamentals favor the dollar over sterling. We have advised participants to stay attentive to possible reversal signs in the price action to align one’s self with fundamentals. On August 23, sterling posted such a reversal pattern (e.g.,

shooting star). There was some follow through on August 24, which lends credence to the one-day pattern. The retracement objective of the latest leg up is found in the $1.5740-75 band.

Other technical tools underscore the importance of this area. A trend line drawn off the Aug 2, Aug 10 and Aug 16 (~$1.5490, $1.5580, $1.5635 respectively) lows is found near $1.5740 on Monday and rises 10-15 ticks a day. Sterling broke above its 200-day moving average on a closing basis early last week for the first time since May 21. It comes in now near $1.5720. A convincing break of this area would boost confidence that a high of some import is in place.

Swiss franc:

Speculative interest in the Swiss franc continues to diminish. Gross longs were trimmed by 220 contracts to stand at 5.9k. Gross shorts reduced 3.4k contracts to 21.6k. This produced a net short speculative position of 15.7k contracts, the smallest in nearly two months.

Although the Swiss franc acts as if it is pegged against the euro, sometimes the dollar-franc charts is clearer than the euro-dollar chart. The up trend line we identified in the euro is a dollar down trend line against the Swiss franc. It is found near CHF0.9720 on Monday and falls about 10 ticks a day. The CHF0.9640-70 may provide an initial cap on dollar upticks.

Canadian dollar:

The net long speculative position jumped to 50.9k from 28.6k contracts to stand at its largest since mid-May. This reflected almost exclusively new longs coming into the market. They rose by 22.1k to 76k contracts. The gross shorts were shaved by 160 contracts to 25.1k. The new longs are vulnerable. The combination of softer Canadian data and the heightened speculation another round of QE in the US means that contrary to official rhetoric, a rate hike before the end of the year is highly unlikely.

The US dollar may have recorded a one-day reversal pattern (

hammer?) on August 21. There was some follow through buying subsequently, helping to lift the greenback off of nearly 4 month lows against the Canadian dollar. It is not immediately clear whether this is the end of the US dollar’s decline or simply a short-term bounce. The CAD0.9970-CAD1.0000 area may offer the first test. If this area holds, the greenback could go down and make a marginal new low. If there area is convincingly penetrated, position squaring pressure could see the US dollar rise toward CAD1.0100-CAD1.0150.

Australian dollar:

The net speculative long position jumped 20.2k contracts to 86.9k, a new record high. This was largely a function of the establishment of another 17.6k contracts to 107.1k, which itself is a record. Some 2.6k shorts were covered, leaving a gross short position of 40.6k contracts.

The late longs are in weak hands. The 5-day moving average fell below the 20-day average on August 20, for the first time since early June. The RSI and MACDs also have rolled over. The Australian dollar, which had been the strongest major currency in June and July, peaked on August 9 and is flirting with support near $1.0370. If it gives way, it could signal a pullback to near $1.02 initially and then $1.01, if not deeper. Disappointing Chinese data and falling iron ore and steel prices may weigh on sentiment and market positioning, if the IMM data is representative, appears stretched.

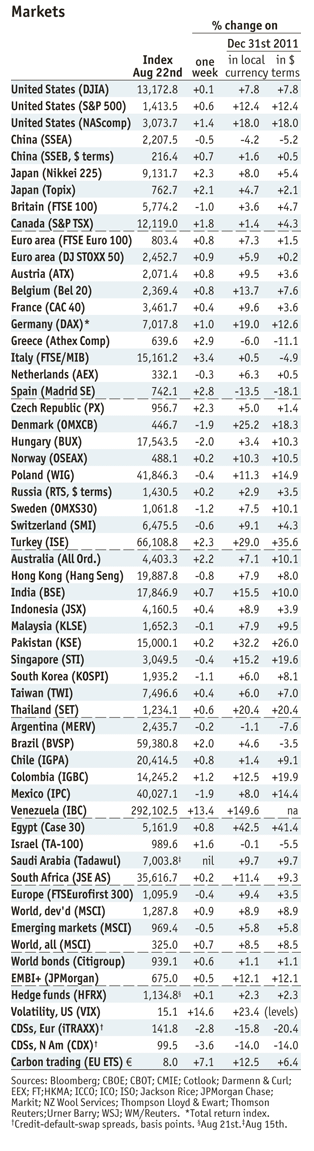

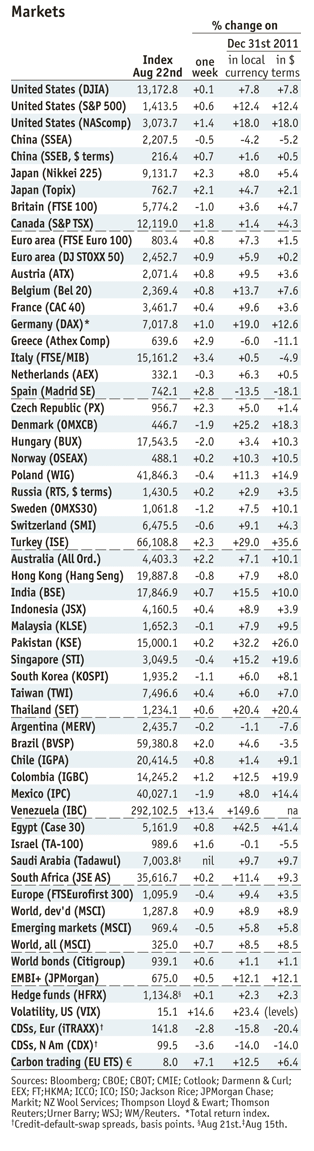

The Economist markets by August 22 ( ) - Click to enlarge

Mexican Peso:

Speculators continued to build a long peso position. The net position rose 14.5k contracts to 98k. The gross longs rose 11.3k to 107.1k contracts. The gross shorts were trimmed by about quarter to 9.2k contracts.

The recent longs in the Mexican peso may be getting frustrated. The dollar has been largely stuck in a range between MXN13.05 and MXN13.25. The lack of spot appreciation is mitigated by the fact there is a relatively juicy carry that pays one to be patient. There is about a 400 bp annualized pick-up, or about 8 bp a week. It does not seem sufficient of compensation if the dollar moves back toward the upper end of its two-month range near MXN13.50. Market positioning is lopsided and given the key events looming, the peso seems vulnerable to a new risk-off phase.

Global Stock Markets (by George Dorgan)

The German DAX managed to overtake the NASDAQ in this year’s performance in local currency terms. The DAX even passed the S&P500 in US$ terms. Chinese, Japanese and Canadian stocks managed to extend their small gains in $ terms for this year, whereas British stocks lost some of this year’s profit. In the euro area Greek, Italian and Spanish stocks managed to trim some of their losses, in both local currency and $ terms.

Most countries of Northern and Eastern Europe continue to see strong gains this year, the technology-oriented Swedish OMXS30 follows the lead of the NASDAQ. As opposed to the Euro, the Swedish Krona rose this year against the dollar, the strong rise of the currency is now taking a toll on the OMXS30. Switzerland’s SMI continues to see only small gains this year in $ terms, a strange diversion from the strong performance of the DAX, even if the SMI is a more conservative index and contains a higher share of banking (UBS and Credit Suisse). Remember that German and Swiss exporters showed near record trade balances and Swiss GDP growth outperformed German GDP growth.

After the RBA threatened to cut interest rates, the Australian stock market saw strong gains. In the Emerging Markets Argentine, Brazilian, Chinese and Israeli markets recovered a bit, but these countries still suffer of outflows. For Mexico and Colombia the story is different. With a smaller local and/or a closer distance to the United States their economies and stock markets are expanding well.

More posts from Marc to Markets: , , , , , , , , , , , , , ,

Are you the author?

He has been covering the global capital markets in one fashion or another for more than 30 years, working at economic consulting firms and global investment banks. After 14 years as the global head of currency strategy for Brown Brothers Harriman, Chandler joined Bannockburn Global Forex, as a managing partner and chief markets strategist as of October 1, 2018.

Previous post

See more for 4.) Marc to Market

Next post

Tags:

Ben Bernanke,

Canadian Dollar,

Commitments of Traders,

Constitutional Court,

COT,

Credit Suisse,

Currency Positioning,

EFSF,

FOMC,

FX Positioning,

Jackson Hole,

Japanese yen,

Krona,

Marc Chandler,

Net Position,

Non-Farm,

Peso,

QE3,

Speculative Positions,

Switzerland,

Technical Analysis,

U.S. Nonfarm Payrolls,

UBS