Currency Positioning and Outlook, week from August 20

Submitted by Mark Chandler, from marctomarkets.com

The market is like expectant parents who don’t know the gender of the fetus. They know something big is around the corner, but they don’t have enough information to make some important decisions. They can contemplate the future, but there no sure of any scenario.

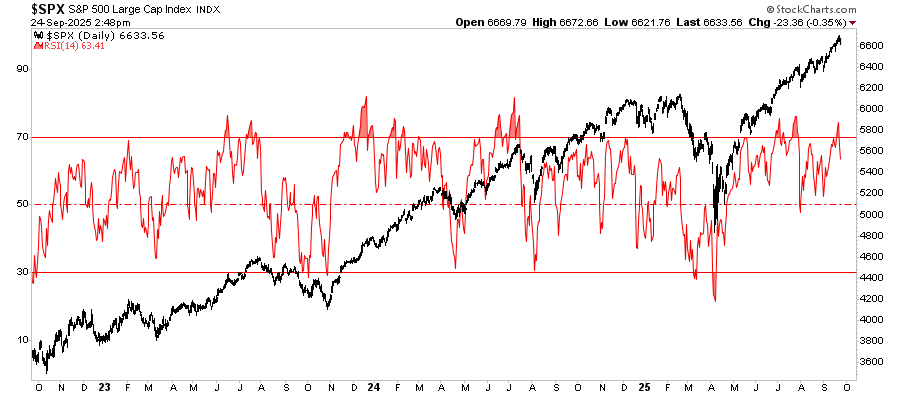

Perhaps former US Defense Secretary Rumsfeld was not always wrong. There are some known unknowns. The event risk is palpable and outcomes are important. Yet, the implied volatility of all the currencies looked at here are near multi-year lows, except the Mexican peso, which is low, but still a 1 percentage page above the year’s low. The volatility of the S&P 500 (VIX) is also at lows for the year. Typically, large moves take place in low vol environments. The market’s spring is coiling and may coil further. With volatility so low, participants may be find that buying options are a cost efficient way to express views.

In the mean time, the Commitment of Traders report shows speculators in the futures market continue to shift funds into the Canadian, Australian and Mexican peso. There seems to be less of a clear pattern in the other currency futures. However, there are a few points to share. Although they have been pared, the speculative community still have a substantial short euro position. In addition to the high yielding dollar-bloc and peso, speculators have continued accumulating yen positions. They have lost much interest in trading the Swiss franc and the bulls and bears are near equilibrium in sterling.

Euro:

The net short speculative position edged higher in the reporting week ending August 14 to stand at 138k contracts. The 6k increase reflects a 2.5k increase in gross shorts and a 3.6 trimming of gross longs. The late shorts were in weak hands, given the stalled downside momentum and we suspect that part of the rally in the few sessions after the reporting report ended was a function of short-covering.

Last week, the euro traded within the previous week’s range. The base near $1.2240 is important. On the upside, the $1.2340 area has given way and there is scope to test the $1.2440 area. The choppiness of the price action seems to be chewing up short-term players. They may want to consider a vacation. Medium term participants may want to scale into a short position as the risks still favor a further euro decline.

Yen:

The net long speculative yen position rose by 3.2k contracts to 30.7k. This was not so much a function of new longs, which rose by about 100 contracts. Rather the gross shorts were cut to by 3.1k to 25.3k. In the three sessions since the reporting period ended, the yen declined by about 0.7% and broke below its 200-day moving average for the first in a month.

The dollar closed above its Bollinger Band (2 standard deviations on either side of its 20-day moving average) for the first time since March 14. Although the moves are not normally distributed this (or some derivative, like a sense the dollar has moved too far too fast) may discourage strong follow through dollar buying. That said, technically, the weekly close was strong and important resistance is not seen until JPY80.00-10. Perhaps of interest, the March 14 was a day before the 8 yen dollar rally ended that had begun in late-January from JPY76.

Sterling:

The net speculative short sterling position was slashed to just below 300 contracts from 8.3 in the prior reporting report. This is the smallest net short position since early June when the net position swung from long to short. The gross shorts were shaved by 1.7k contracts. The gross longs rose 6.3k to 32.1k. Unlike the euro and yen, the late positioning in sterling may have prescient. Sterling did make a new high for the month a couple of days into the new reporting period.

Sterling’s resilience has been impressive. It remains firm within its $1.5400-$1.5800 trading range, with the European crisis and its own poor data. Even if the 0.7% decline in Q2 GDP exaggerates the contraction, the economy may be contracting as we speak for a fourth consecutive quarter. It is possible the Olympics provided some palliative support, but a stagnant economy is preferable to one that is contracting only in the same sense that suffocation may be preferable to defenestration. Sterling may outperform the euro if, as we expect, the European crisis intensifies again next month, but it is likely to depreciate against the dollar (and yen).

Swiss franc:

The Swiss National Bank’s cap on the franc has succeeded in driving speculators away. The absolute value of gross longs and shorts is the smallest among the currency futures. The 18.9k net (short) position is also the smallest. It grew by 1k contracts.

Canadian dollar:

The speculative community continued to accumulate a long Canadian dollar position. It had unwound a substantial long position in May and June and has been rebuilding it since. The net long position rose by 50% to 28.6k contracts. The gross longs tacked on another 10.7k to bring it to 53.9k contracts. Top picking increased by 1.7k contracts to 25.3k.

The Canadian dollar’s bull move was extended in recent days. It has gained 5.8% against the US dollar since early June. The move has gone further than we expected, though we recognize that a break of CAD0.9900 could spur another cent loss for the greenback. We are more inclined to see the trend move to be closer to a conclusion that the start. The next big move is likely to be to the Canadian dollar’s downside and perhaps recognition that the Bank of Canada is unlikely to raise interest rates this year may be the spark.

Australian dollar:

The net long speculation position rose to 66.7k contracts from 52.9 k. The net figure, while large, does not do justice to the Aussie bulls. The gross long position rose by 15.2k contracts to 109.9k, a new record. The bears have also accumulated a substantial position. With the 1500 contracts added, the gross short position stands at 43.2k.

The kind of reversal in trend we expect in the Canadian dollar may have begun in the Australian dollar. It recorded an outside down day on Friday (traded on either side of Thursday’s range and closed below it’s low), further weakening a technical picture that seemed to be carving out a top. If our analysis is right, (leaving speculative forces), gains in the Australian dollar reflect foreign savings being drawn to Australia’s interest rates, then the sell-off in Australian bonds, the worst performing of the major bond markets (10 yr yield rose 22 bp last week) dovetails nicely with the pullback in the Aussie.

Support near $1.04 held, but the trend line off the June 1 low was successfully (on a close basis) violated on the daily and weekly bar charts. A break of that support area now and the crossing over the 5-day moving average below the 20-day (in a trending market), which is likely early next week, could being forcing late longs out and bringing the next target near $1.03 into view.

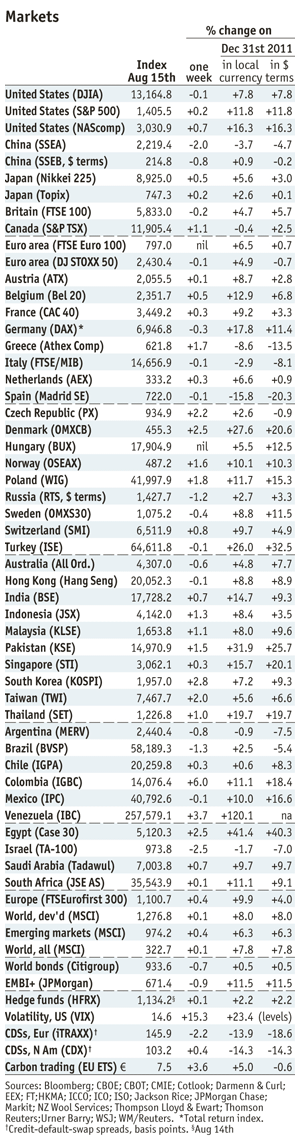

Markets by Aug15, 2012 weekly updated (source The Economist) - Click to enlarge

Mexican peso:

The speculation community continues to be enamored with the peso. The net long position increased by another 14.2k contracts to 83.5k. The longs added 13.9k to stand at 95.8k. About 220 shorts capitulated, leaving 12.3k still resisting.

Like the Canadian and Australian dollars, speculators have been drawn to the peso. Unlike them, the peso is not seen even as a minor way to diversify reserves. The price action suggests the speculators are not deterred and good bids are seen on pullbacks. A cap for the dollar is seen in the MXN13.25-27 area.

While we think that, like the Canadian and Australian dollars, the peso’s advance is getting long in the tooth, technically it seems as it it can hang in there better. Perhaps the higher yields offer a sense of a greater cushion during sideways or choppy markets, giving the momentum traders greater staying power. It still offers an attractive place to park savings over the next few weeks. The peso bulls have their sights set on the MXN12.90-MXN13.00 area.

Stock Markets (by George Dorgan)

As for developed markets the NASDAQ and the S&P 500 continues to perform best, as money floes back from Emerging Markets into the US. Despite the falling euro and very weak German PMIs, the German DAX performs very well in $ terms, the DAX firms function as safe-haven in the euro crisis.

For Sweden, Norway and Poland both the currency and the stock markets perform well. Switzerland’s SMI, the Netherland’s AEX and Austria’s ATX underperform against the DAX (partially due to the high percentage of banking stocks in these indices).

The Southern European markets underperform in both local currency and $ terms. The Nikkei 225 remains undervalued in $ terms.

Australia’s All Ordinary rises despite the strong currency. The formerly strong BRICS and other Emerging Markets, especially Argentina, Brazil, Israel and China, remain in the downturn.

,,

Related Posts from Marc’s site

- UK Goes Shopping (sort of) and Euro Observations

- FX: Hurry Up and Wait

- Great Graphic: Nominal Effective Exchange Rates

- Market Update and Thoughts on the Canadian Dollar

- Market Update and Three Items that Should be on Your Radar Screen

Tags: Bank of Canada,Canadian Dollar,Commitments of Traders,COT,Currency Positioning,FX Positioning,Japanese yen,Marc Chandler,Peso,PMI,Speculative Positions,Swiss National Bank,Switzerland,Technical Analysis