Extracts from the history of the Swiss franc (March 2009).

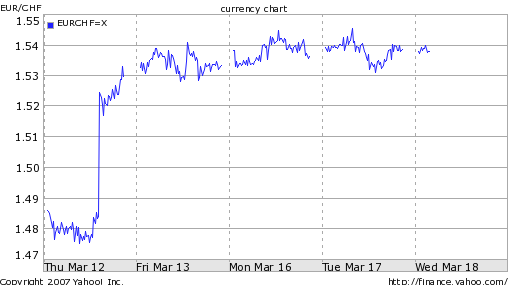

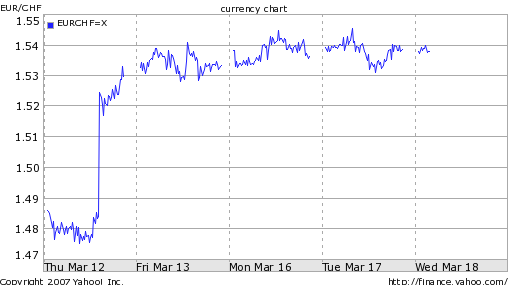

Last week, the Forex Blog concluded a post on the Swiss Franc by suggesting that the Swiss National Bank (SNB) could artificially depress the value of its currency, which had “not just posted strong gains against the eurosince late August but has gained 8% on a trade weighted basis.” The very next day, the SNB followed its widely anticipated rate cut by announcing that it would indeed intervene in forex markets, “implementing” a decision to buy foreign currencies. The Swiss Franc immediately fell into a tailspin, falling 7 units against the Euro, and more than 3 against the Dollar. According to one trader, “the way this was communicated was intended at maximizing its shock value.” By the end of the week, the Franc had posted a record decline, as investors remained alert to the possibility of further invention.

This is the first ‘solo’ intervention since 1992 by the SNB, which has “followed a noninterventionist policy when it came to its currency, occasionally hinting at interventions but never following it up. It remained on the sidelines in September 2001 when the euro traded even lower than its present rate, at 1.44 Swiss francs.” It is also the first intervention by any Central Bank since 2003, when Japan intervened unsuccessfully to try to halt the rise of the Yen. Evidently, the SNB felt justified in its decision not only because of a deteriorating economy, but more importantly because of monetary conditions. Inflation is now projected to dissappear by 2010, and may even “slow to the point where prices broadly fall.” Traders also speculated that the move was designed to relieve downward pressure on Eastern European economies, whose economic woes are being compounded by the fact that much of their debt is denominated in Swiss Francs. It is doubtful that Switzerland will receive much sympathy from other countries, nearly all of whom have thus far refrained from forex intervention in spite of widespread economic contraction and the risk of deflation. In the words of one analyst, “It is troubling that a country with a current surplus larger than 10% of GDP feels compelled to depreciate its currency.” The greater concern is that this could ignite some kind of “currency war,” where Central Banks around the world compete with each other to see who can most debase their respective currency. Traders are already speculating that the Bank of Japan could be next: “The BoJ should pay close attention to the SNB’s actions, given that both central banks have expressed a desire to see their currencies weaken.”

Are you the author?

Previous post

See more for

Next post

Tags: Bank of Japan,franc,Gold,intervention,Japanese yen,Swiss National Bank,Switzerland