Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| Markets may still enjoy short-term momentum, but long-term retirement planning must confront a different reality: elevated valuations, lower forward returns, and rising sequence-of-returns risk. Richard Rosso explains why retirees face a near-term tailwind in market returns—but potentially long-term secular stagnation that demands tighter portfolio guardrails. Rich will discuss why historically tested retirement income strategies matter more today than at any point in the last two decades. #RetirementIncome #MarketValuations #SequenceOfReturns #FinancialPlanning #RIAAdvisors |

You Might Also Like

What Does Kevin Warsh Bring To The Fed?

What Does Kevin Warsh Bring To The Fed?

2026-01-21

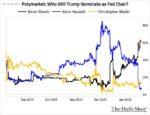

It appears that President Trump wants Kevin Hassett to remain in his role at the White House. With the supposed frontrunner to replace Powell out of the running, the nomination now seems open to Kevin Warsh. As the graph below shows, Polymarket bettors are assigning 60% odds that Kevin Warsh will be nominated.

1-19-26 The Illusion of Economic Acceleration: What’s Really Driving Markets

1-19-26 The Illusion of Economic Acceleration: What’s Really Driving Markets

2026-01-19

The economic acceleration story doesn’t hold up when you look at the data.

In this Short video, Michael Green and I discuss why GDP trends look unchanged, earnings quality is weakening, small-cap profits are negative, and passive flows—not growth—are driving markets.

📺Full episode: -GazpbG0

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

12-1-25 Bear Markets Are a Good Thing

12-1-25 Bear Markets Are a Good Thing

2025-12-01

Bear markets aren’t the enemy—they’re the reset that creates future returns.

Lance Roberts breaks down why market downturns are a normal, necessary, and even healthy part of a full market cycle. We explore how bear markets cleanse excess speculation, reset valuations, restore forward returns, and give disciplined investors long-term opportunities to improve financial outcomes.

We’ll discuss why drawdowns feel worse than they are, why expectations matter more than predictions, how risk management reduces behavioral mistakes, and why volatility is a feature—not a flaw—of investing.

#BearMarkets #MarketCycles #InvestingEducation #RiskManagement #FinancialPlanning

Year-End Rally Begins

Year-End Rally Begins

2025-11-29

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you’d like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

The K Shaped Economy In One Graph

The K Shaped Economy In One Graph

2025-11-28

Tuesday’s weak Consumer Confidence report was a good reminder of why some economists are calling our economy the K shaped economy. The Conference Board Consumer Confidence Index fell 6.8 points to 88.7 in November, below expectations of 93. Moreover, it sits at levels similar to those of early 2020, when the pandemic shuttered the economy. …

8-14-25 The Risks of Over-Valued AI Stocks

8-14-25 The Risks of Over-Valued AI Stocks

2025-08-14

What happens if Nvidia reports slowing earnings or lowered guidance in their next quarterly report? Anything that might change the narrative of the AI cap-ex cycle will have consequences.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

——-

Read the article Lance mentions on our website, sign up for Lance’s newsletter:

https://realinvestmentadvice.com/newsletter/

——-

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

——-

➢ Listen daily on Apple Podcasts:

https://podcasts.apple.com/us/podcast/the-real-investment-show-podcast/id1271435757

——-

Register for our next Candid Coffee, "Savvy Social Security Planning,"

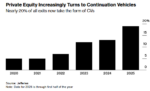

CVs Signal Maturity In Private Equity

CVs Signal Maturity In Private Equity

2025-08-14

Private equity funds often buy assets intending to sell them and realize a profit over a specific period. However, recently it’s become more common that their assets are not ready to be sold when they had initially forecasted. While the fund can hold the assets longer than expected, fundholders may demand liquidity. Instead of selling …

8/11/25 U.S. GDP Shows Cracks – Why Investors Should Pay Attention

8/11/25 U.S. GDP Shows Cracks – Why Investors Should Pay Attention

2025-08-11

July’s employment report confirmed that the slowdown in US economic growth is taking root.

The unemployment rate increased to 4.2 percent, while labor force participation remained at 62.2 percent.

If wage growth continues to moderate and hiring slows, the consumption-driven economy will lose its primary growth engine.

Lance Roberts examines the data and suggests strategies for investors on today’s episode of #TheRealInvestment Show.

#USEconomy #EconomicGrowth #MarketOutlook #GDPTrends #RecessionRisk

Tags: Featured,newsletter

2 pings