Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| Everyone expects strong economic growth, falling inflation, and endless Fed cuts. In this short video, Lance Roberts & Michael Lebowitz discuss why that combo is far from guaranteed—and how a pause (or even hike) could hit valuations fast. 📺Full episode: Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow |

You Might Also Like

Stagnation Is Lulling The Fed To Sleep

Stagnation Is Lulling The Fed To Sleep

2026-01-09

The JOLTs data released on Wednesday paint a picture of labor market stagnation. The graph below shows that the number of job openings has fallen to levels similar to those right before the pandemic. While the number of openings seems somewhat stable, layoffs are slowly increasing, while new hires are near a 15-year low. Similarly, …

Precious Metals Aren’t Predicting Economic Collapse

Precious Metals Aren’t Predicting Economic Collapse

2026-01-05

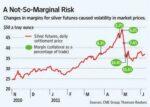

In 2025, the prices of precious metals rose sharply, with silver prices recently surging past $80 per ounce. Of course, when precious metals rise, there is always the same group of commentators (mostly paid newsletter writers and physical metal dealers) to declare that a financial breakdown is underway. Articles like those published on ZeroHedge by …

The Bearish Bond Narrative Fades

The Bearish Bond Narrative Fades

2025-11-14

Not that long ago, bond yields were rising as concerns over deficits, inflation, and a series of bad Treasury auctions were paraded through the media. We bring this to your attention as the Ten-year Treasury auction on Wednesday was on the weaker side, yet the bond market reaction was minimal. Additionally, government deficits are just …

11-13-25 QE Is Coming: Why Fed Liquidity Now Runs the Entire Market

11-13-25 QE Is Coming: Why Fed Liquidity Now Runs the Entire Market

2025-11-13

The scent of QE is back.

With overnight funding markets flashing early stress and NY Fed President John Williams hinting at “gradual asset purchases,” it’s clear: the liquidity cycle is turning again.

But the real question is why markets have become so dependent on the Fed in the first place.

Lance Roberts & Michael Lebowitz break down how the 2008 financial crisis fundamentally rewired market plumbing, sidelined private liquidity providers, and turned the Federal Reserve into the primary—and often the only—source of liquidity in the financial system.

0:00 – INTRO

0:20 – Government Shutdown Concludes – Deluge of Data to Follow

3:04 – Dow 48,000

9:43 – Will the Fed Cut Rates?

13:21 – Why the Rush to Cut Rates?

17:14 – What’s Causing Turmoil at the Fed?

20:42 – What Changed w Bank

9-18-25 Savvy Medicare Planning –

9-18-25 Savvy Medicare Planning –

2025-09-19

Planning for Medicare can feel overwhelming, but understanding your options is the key to protecting your health and finances in retirement. In this Savvy Medicare Planning Webinar, Richard Rosso & Danny Ratliff walk you step-by-step through what Medicare covers, who’s eligible, enrollment periods, penalties, premiums, Medigap, Medicare Advantage, and long-term care planning.

✅ What you’ll learn in this Medicare webinar:

The basics of Medicare Parts A, B, C & D (“the alphabet soup of Medicare”)

How and when to enroll in Medicare to avoid costly penalties

Understanding Medicare Advantage vs. Medigap policies

What Medicare does not cover (including long-term care)

How income adjustments affect your monthly Medicare premiums

Smart strategies for budgeting healthcare costs in

Market Mechanics Override Weakening Economic Data

Market Mechanics Override Weakening Economic Data

2025-09-19

Since the middle of July, UST 10-year yields have fallen from 4.50% to 4.00%. While the yield decline has been profitable for bondholders, it has also aided many other investors. Such a finding may seem counterintuitive, considering that lower yields are the result of a significant weakening in the labor market and a range of …

7-28-25 Big Tech Earnings

7-28-25 Big Tech Earnings

2025-07-28

Big Tech Earnings: Lance Roberts reviews what Apple, Google, and Microsoft Just Revealed, plus Market Reaction & Forecast on #TheRealInvestmentShow.

#BigTechEarnings #TechStocks2025 #EarningsSeason

#StockMarketNews #FAANG

Portfolio Benchmarking: 5-Reasons Underperformance Occurs

Portfolio Benchmarking: 5-Reasons Underperformance Occurs

2025-07-28

When markets decline—especially after long periods of sustained growth—the familiar advice resurfaces: “Be patient. Stay invested. Ride it out.” The rationale? The market always goes up over time. But there’s a critical flaw in this narrative. Your portfolio and a portfolio benchmark are entirely different things. And portfolio benchmarking, or the constant comparison of your …

Tags: Featured,newsletter

1 pings