Lance Roberts

My articles My offerMy siteAbout meMy videosMy books

Follow on:TwitterSeeking AlphaFacebookAmazon

| Most investors lose money by chasing whatever narrative is hot, whether it’s $SLV or $MSTR. Real investing is about anticipating where capital will rotate next and building positions gradually, not trying to time exact bottoms or going all in. Start small, size positions wisely, and let rotations work in your favor. In this short video, Lance Roberts & Michael Lebowitz discuss why fundamentals matter more than headlines, and being early matters more than being fast. 📺Full episode: _IPrDUg Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow |

You Might Also Like

1-19-26 The Metric that Matters – The Michael Green Interview

1-19-26 The Metric that Matters – The Michael Green Interview

2026-01-15

What really matters for markets in 2026—and why are most forecasts focused on the wrong metrics?

Lance Roberts visits with Simplify Portfolio Manager & Chief Investment Strategist, Michael Green, CFA, to examine the structural changes inside today’s markets that are reshaping price discovery, volatility, and risk. From the rise of passive investing and ETF dominance to the growing disconnect between fundamentals and flows, the mechanics of how markets trade have changed dramatically.

#MarketOutlook2026 #PassiveInvesting #ETFMarketStructure #FinancialNihilism

#MarketRisk #MichaelGreen

1-14-26 Why “Just Hold Forever” Isn’t a Good Strategy

1-14-26 Why “Just Hold Forever” Isn’t a Good Strategy

2026-01-14

The market isn’t about to crash, but it is pressing against a rare, long-term resistance zone at historically high valuations. That raises the risk of lower future returns and periodic corrections.

In this Short video, Lance Roberts discussed why ignoring valuation and mean reversion can leave long-term investors short of their goals.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

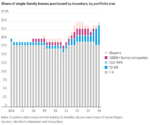

Fannie And Freddie To The Rescue

Fannie And Freddie To The Rescue

2026-01-12

President Trump is using Fannie Mae and Freddie Mac to help make housing more affordable. According to a TruthSocial post, the President claims Fannie and Freddie have a combined $200 billion in cash. Accordingly: I am instructing my Representatives (Fannie and Freddie) to buy $200 billion dollars In mortgage bonds. The hope is that increased …

Market Bubbles: A Rational Guide To An Irrational Market

Market Bubbles: A Rational Guide To An Irrational Market

2025-11-24

We’re hearing it everywhere: AI is in a bubble. The surge in capital, the parabolic stock charts, and the bold claims from CEOs all have a familiar rhythm. Nvidia’s valuation has soared, along with AI-related startups raising billions with little to no revenue. Investment in data centers, chips, and infrastructure is happening at a scale …

11-19-25 Pension or Lump Sum – What’s the Smarter Move?

11-19-25 Pension or Lump Sum – What’s the Smarter Move?

2025-11-19

Choosing between a company pension and a lump-sum payout is one of the biggest financial decisions many pre-retirees will ever face—especially for workers in industries facing layoffs or restructuring, like the major oil companies in Houston right now.

Lance Roberts & Danny Ratliff break down the key factors to consider when comparing a lifetime pension annuity versus taking a lump-sum distribution you can invest or convert into a private annuity. Using a real-world scenario from a viewer—age 64, a $700,000 lump-sum offer, and a sizable 401(k)—we explore the risks, trade-offs, and questions every retiree should ask before making the call.

0:00 – INTRO

0:1 – Why Nvidia Matters

2:53 – Yes, Virginia, Draw Downs Happen

:50 – 2026 Economic Summit Preview

10:3 – It’s Just a 3% Pullback

10-3-25 Forget the Shutdown, Jobs Are Getting Weaker and Weaker

10-3-25 Forget the Shutdown, Jobs Are Getting Weaker and Weaker

2025-10-03

The real story isn’t the government shutdown. ADP just showed another 32,000 job losses, with prior months revised lower.

In this short video, @michaellebowitz and I discuss why the labor market is deteriorating even without the BLS report and what it means for $SPY / $QQQ.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

RSI (Relative Strength Index): Timing The Next Correction

RSI (Relative Strength Index): Timing The Next Correction

2025-09-29

In the world of technical analysis, there is one reliable indicator for measuring market risk. The relative strength index (RSI) measures overextension (in either direction). Developed by J. Welles Wilder in 1978, the RSI is a momentum oscillator. As such, it measures the velocity and magnitude of price changes, plotting those on a scale from 0 …

US Economic Growth Shows Cracks

US Economic Growth Shows Cracks

2025-08-09

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you’d like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Tags: Featured,newsletter

1 pings