11-7-25 Top 3 Financial Guardrails You Should Know

11-7-25 Top 3 Financial Guardrails You Should Know

2025-11-07

RIA Advisors’ Financial Guardrails are timeless principles for building lasting wealth and protecting your financial future. Richard Rosso, CFP®, shares insights from decades of experience helping investors avoid common pitfalls and build financial wellness that lasts generations. From annuities and debt control to emotional investing and realistic return expectations, these guardrails are designed to keep you on track — no matter what markets do.

#FinancialPlanning #WealthManagement #InvestingTips #RetirementPlanning #MoneyMindset

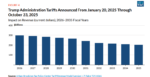

Tariffs Are On The Docket: Will SCOTUS Upset The Market?

Tariffs Are On The Docket: Will SCOTUS Upset The Market?

2025-11-05

The Supreme Court (SCOTUS) will begin hearing arguments challenging President Trump’s use of tariffs. Given the market volatility that tariffs have generated over the last six months, the SCOTUS case could prove to be yet another market-moving event. The tariff challengers argue that the administration overstepped its bounds under the 1977 International Emergency Economic Powers …

Continue reading »

9-9-25 Gold, Jobs & the Fed: Axel Merk’s Market Outlook

9-9-25 Gold, Jobs & the Fed: Axel Merk’s Market Outlook

2025-09-12

From the Fed’s next move to the outlook for gold and gold miners, Axel Merk, CEO of Merk Investments, shares with Lance Roberts his take on today’s biggest market risks: The largest jobs revision ever, the Fed’s lagging response, why active management beats passive distortions, and how investors should think about risk, contrarian views, and the role of gold in their portfolios.

0:18 – Introduction of Alex Merk, CEO Merk Investments

2:01 – Annual revisions to BLS Employment Report – Largest negative revision to jobs in history.

4:20 – William Poole’s explanation of BLS numbers & methodology and why markets pay attention.

6:13 – Herbert Hoover’s belief in National Data for creating BLS numbers.

8:19 – The market trades off the data, whether you agree with it or not.

9:35 – How the

Main Street Optimism Ticks Higher Despite Hiring Challenges

Main Street Optimism Ticks Higher Despite Hiring Challenges

2025-09-10

Main Street optimism edged higher in August, as the NFIB Small Business Optimism Index rose to 100.8. That reading sits above the long-term average of 98 but missed the consensus estimate of 101. Stronger sales expectations led the improvement, with a net 12% of owners anticipating higher real sales volumes. This represents a six-point jump …

Continue reading »

2 pings