Tag Archive: Warren Buffett

Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business.

Read More »

Read More »

Weekly Market Pulse: TANSTAAFL

TANSTAAFL is an acronym for “There ain’t no such thing as a free lunch”. It has been around a long time – Rudyard Kipling used it in an essay in 1891 – but it was popularized by Robert Heinlein’s 1966 book, “The Moon is a Harsh Mistress”.

Read More »

Read More »

As the Fed Pumps, the Stock Market Is Increasingly the Only Game in Town

While the economic storm caused by COVID-19 has seemed to wane (temporarily?), the stock market can’t seem to go but one direction—up. Graham and Dodd’s meaty 700-page Security Analysis has soared to number 7695 on the Amazon best-seller list. According to Warren Buffett, the book is A road map for investing that I have now been following for 57 years.

Read More »

Read More »

Yes, Gold “Just Sits There” and That’s Quite a Feat

The Wall Street Journal’s Jason Zweig famously referred to gold as a “Pet Rock” in 2015. He was blasted by people who understand that gold is no passing fad, and it serves some very important roles in an investment portfolio. The valuable roles played by gold have been well covered here. It’s a hedge against both inflation and deflation, it represents true diversification for portfolios stuffed with conventional securities, and it is a way of...

Read More »

Read More »

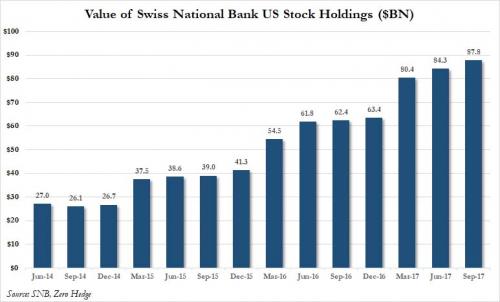

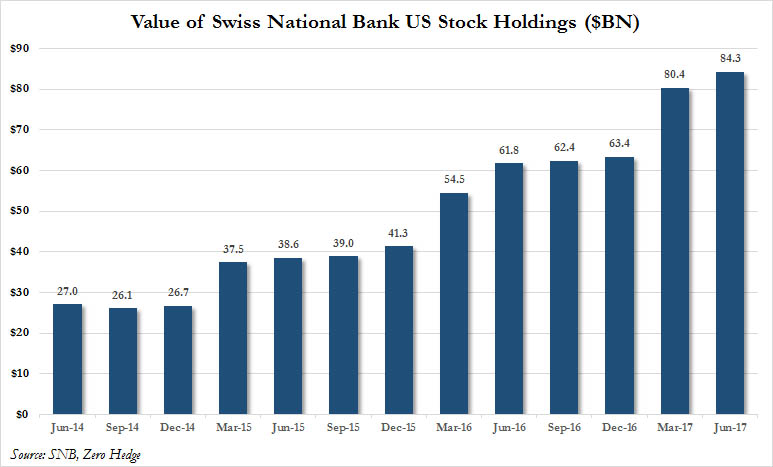

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

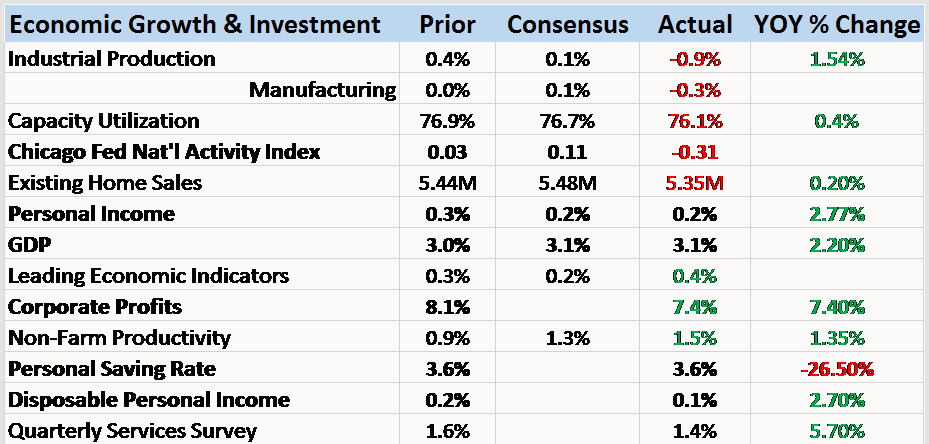

Bi-Weekly Economic Review: Maximum Optimism?

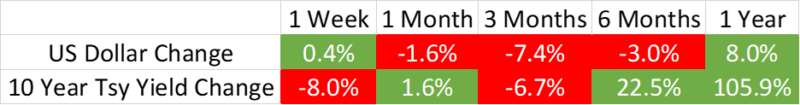

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady stream of all time highs, bond...

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks.

Read More »

Read More »

Incrementum Advisory Board Meeting, Q3 2017

The quarterly Incrementum Advisory Board meeting was held last week (the full transcript is available for download below). Our regulars Dr. Frank Shostak and Jim Rickards were unable to attend this time, but we were joined by special guest Luke Gromen of research house “Forest for the Trees” (FFTT; readers will find free samples of the FFTT newsletter at the site and in case you want to find the link again later, we have recently added it to our...

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank's interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the "the BoJ comes in big, the...

Read More »

Read More »

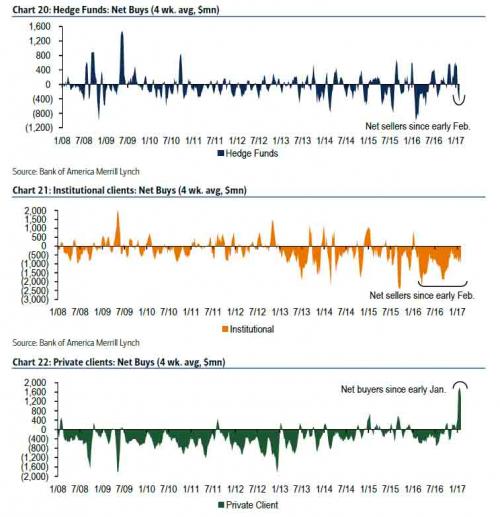

CS and UBS Tell Wealthy Retail Clients To Buy Stocks…”Here, Can You Please Hold This Bag”

Warren Buffett has frequently advised aspiring investors to take a contrarian view on markets and "be fearful when others are greedy and be greedy when others are fearful." In fact, being dismissive of the wall street 'herd mentality' has resulted in some of Buffett's most successful trades over the years including his decision to load up on bank stocks during the 'great recession'.

Read More »

Read More »

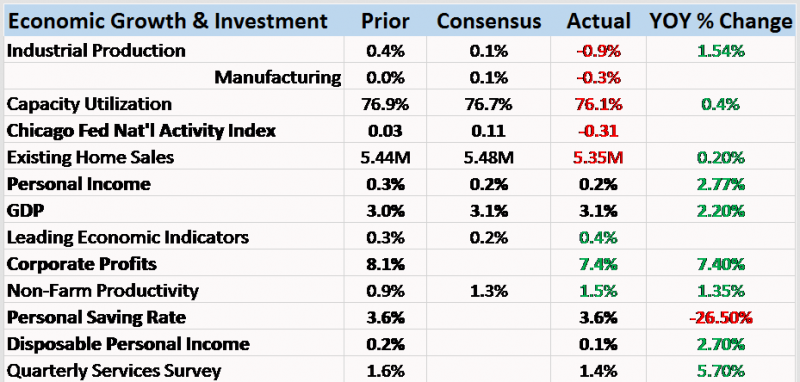

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

While Davos Elites Address Populism, Just “Eight Men Own Same Wealth As Half The World”

As political and business elite gather at the Swiss ski resort of Davos, a new report is shining light on the shocking reality of the wealth gap between the very rich and poor that is “pull our societies apart.” A report by Oxfam released ahead the World Economic Forum in Davos shows the gap between the ultra-wealthy and the poorest half of the global population is starker than previously thought, with just eight men owning as much wealth as 3.6...

Read More »

Read More »

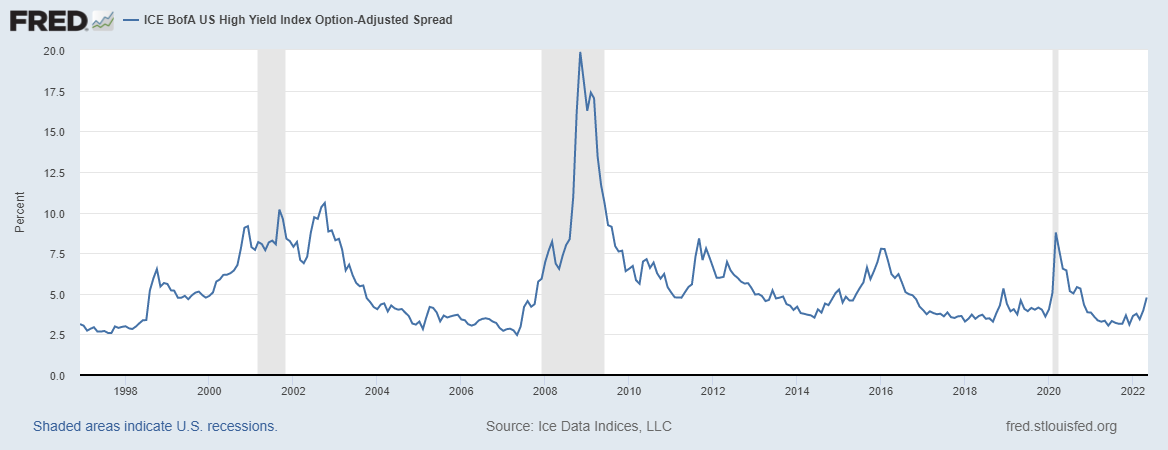

Get Ready for a New Crisis – in Corporate Debt

OUZILLY, France – We’re going back to basics here at the Diary. We’re getting everyone on the same page… learning together… connecting the dots… trying to figure out what is going on. We made a breakthrough when we identified the source of so many of today’s bizarre and grotesque trends. It’s the money – the new post-1971 dollar. This new dollar is green. You can buy things with it.

Read More »

Read More »

Tim Price: Why I’m Voting To Leave The European Union

On 23 June 2016, this British citizen will be voting to leave the European Union.

To me it’s clear: the EU has not only become too big for its own good, it’s too big to do hardly anything good.

Read More »

Read More »

Apple Jumps After Berkshire Reveals 9.8 Million Share Stake

After three consecutive weeks of seemingly relentless bad news for Apple, moments ago the stock jumped by $2 dollars, rising from $90.5 to over $92.50. Some hope for the Swiss National Bank or will Berkshire shares sink together with Apple and the SNB?

Read More »

Read More »