Tag Archive: Volatility

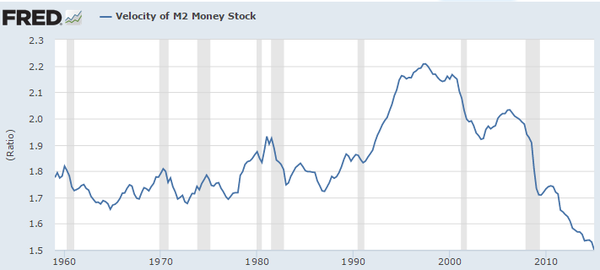

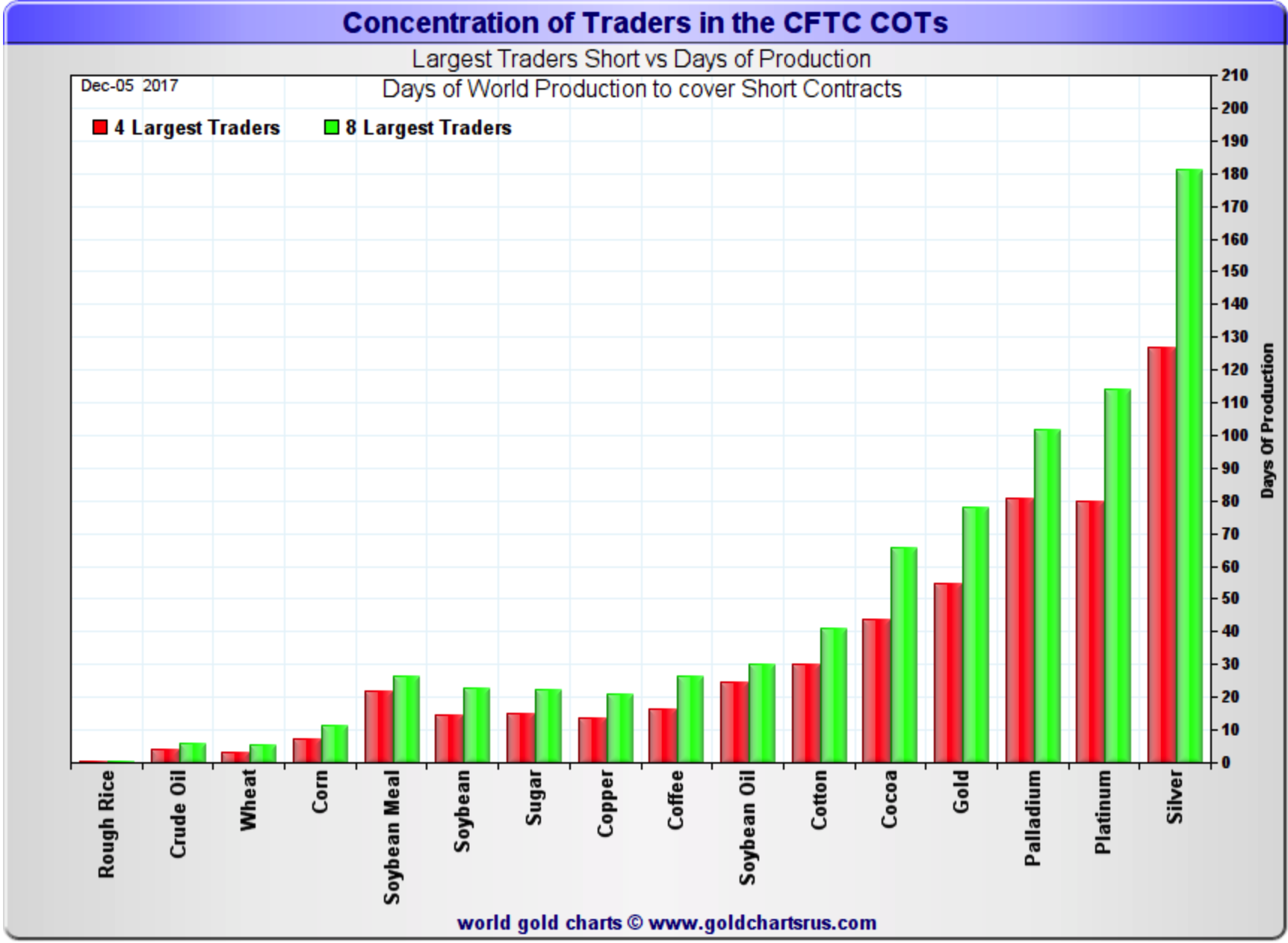

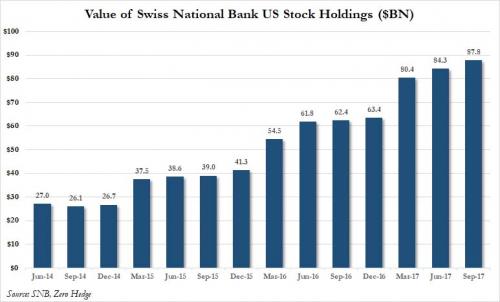

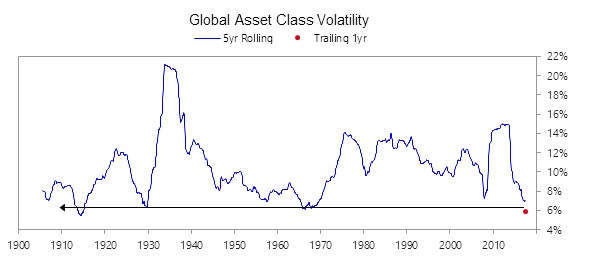

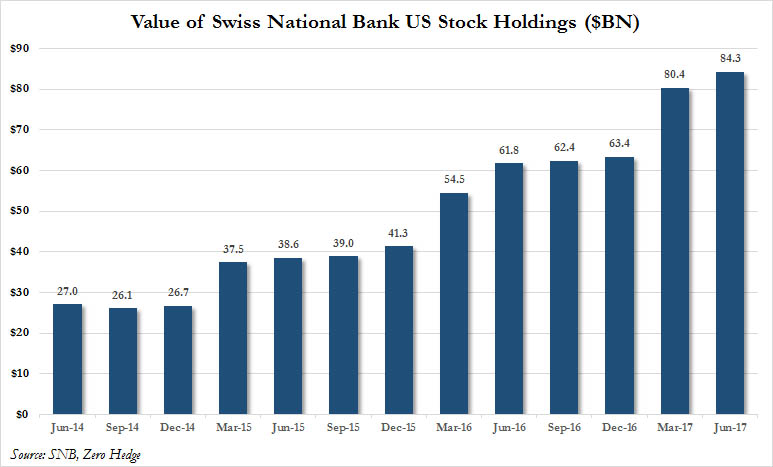

Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the co...

Read More »

Read More »

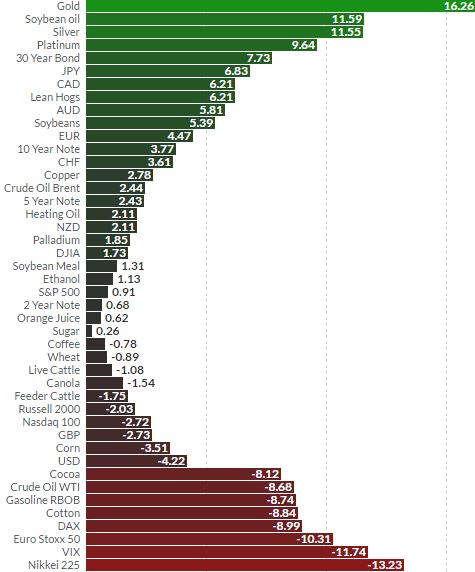

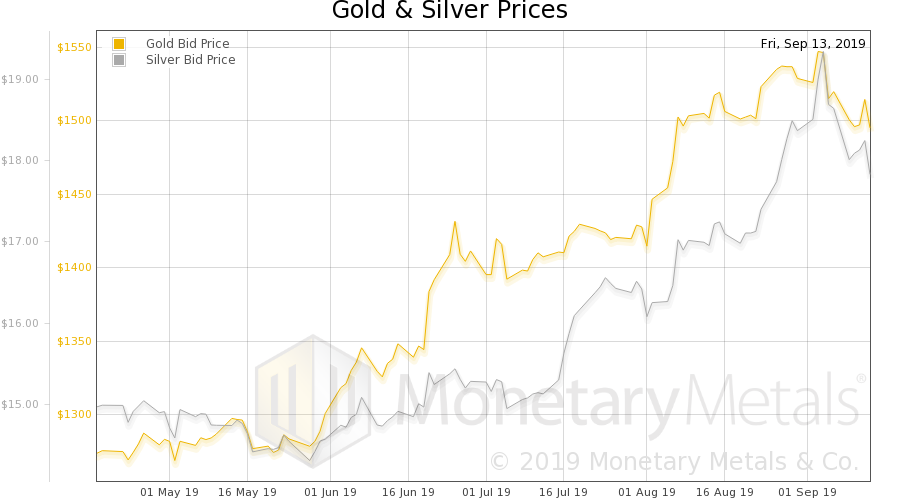

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

– Gold prices gained 16% in Q1 – best quarterly performance since 1986– Gains due to increasing global financial, macroeconomic and monetary risk– Stocks come under pressure – Flat in U.S.; Falls ...

Read More »

Read More »

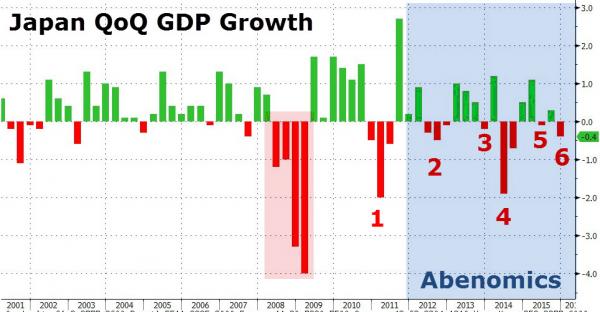

Global Stocks Soar On Stimulus Hopes After Miserable Chinese, Japanese Data; Short Squeeze

Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, ...

Read More »

Read More »

The Chinese Yuan Countdown Is On

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com,

Currency stability is a prerequisite for China's economic transition

Defending the yuan is prohibitively expensive – China cannot beat the market

Progressive devaluation managed by PBoC...

Read More »

Read More »

Square Holes And Currency Pegs

Submitted by Raul Ilargi Meijer via The Automatic Earth blog,

When David Bowie died, everybody, in what they wrote and said, seemed to feel they owned him, and owned his death, even if they hadn’t thought about him, or listened to him, for years....

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

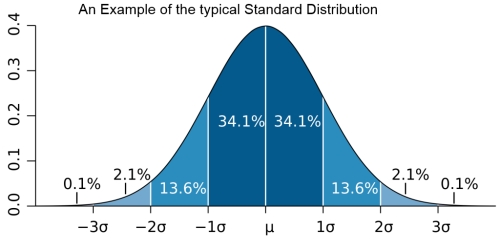

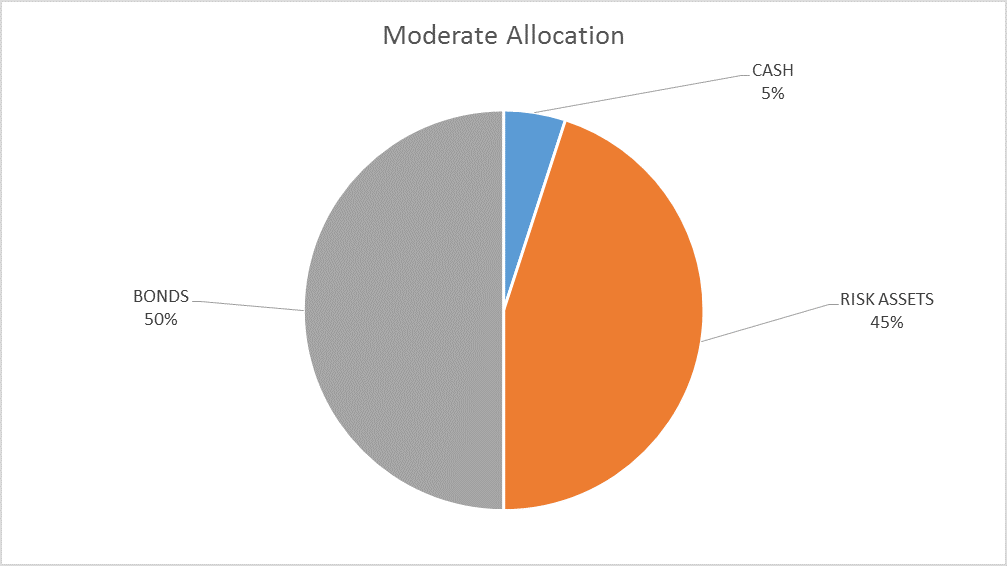

The Fallacies of Portfolio Volatility Measurements

John Henry Smith introduces the base concepts of portfolio volatility: Standard deviation, linearity, normal distribution and the Gaussian bell curve, skewness, value-at-risk and the alpha premium. He explains why they are often misinterpreted.

Read More »

Read More »