Tag Archive: Volatility

Weekly Market Pulse: Is The Bear Market Over?

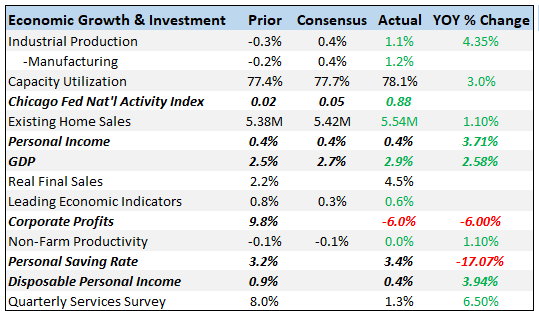

Stocks had a rip snorter of a rally last week and a lot of people are pondering the question in the title over this long weekend. The S&P 500 was down 20.9% from intraday high (4818.62, January 4th) to intraday low (3810.32, May 20th). From that intraday low the market has risen 9.1% in just six trading days.

Read More »

Read More »

Weekly Market Pulse: Fear Makes A Comeback

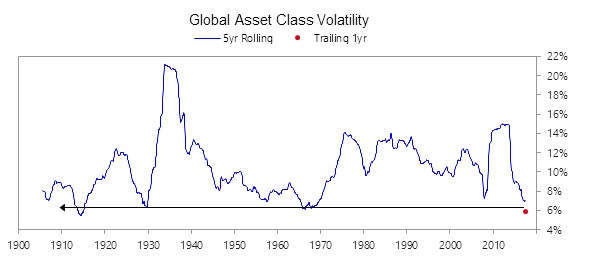

Fear tends to manifest itself much more quickly than greed, so volatile markets tend to be on the downside. In up markets, volatility tends to gradually decline.

Read More »

Read More »

Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

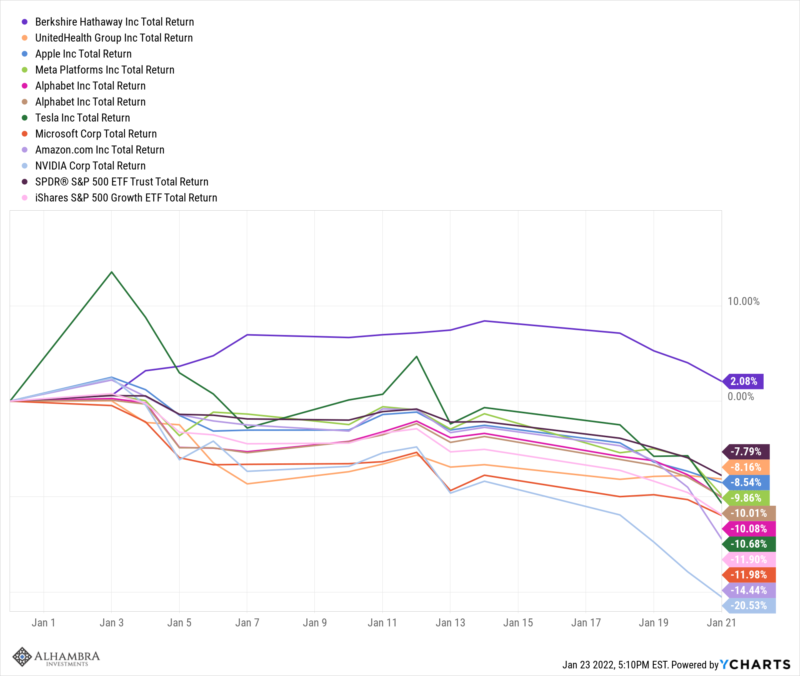

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a matter of days.

Read More »

Read More »

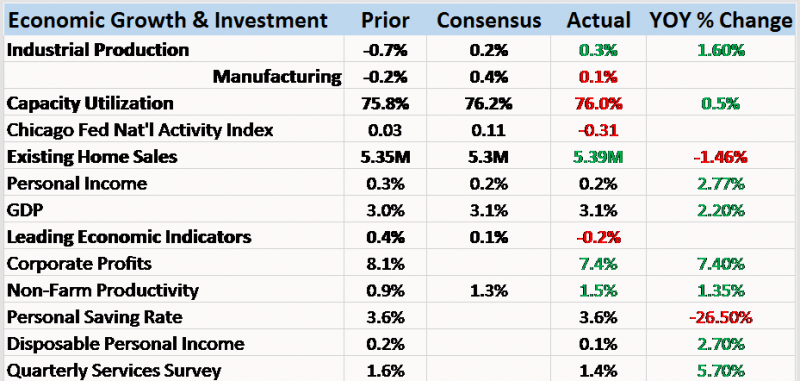

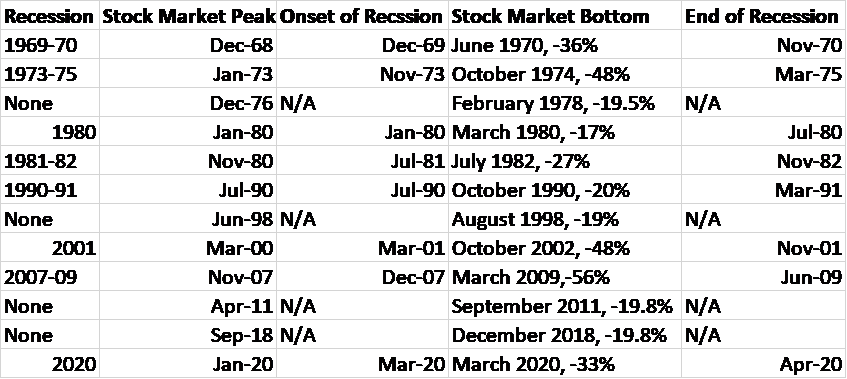

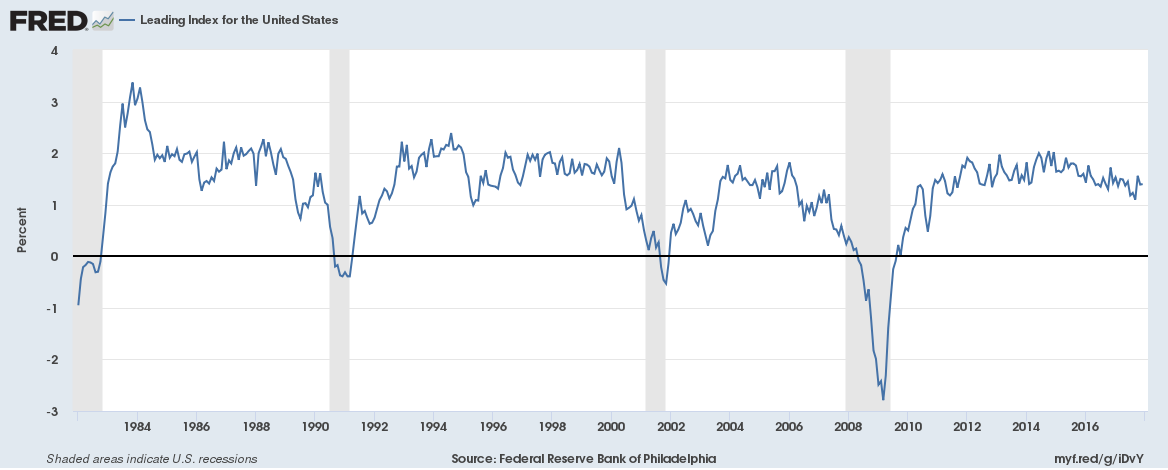

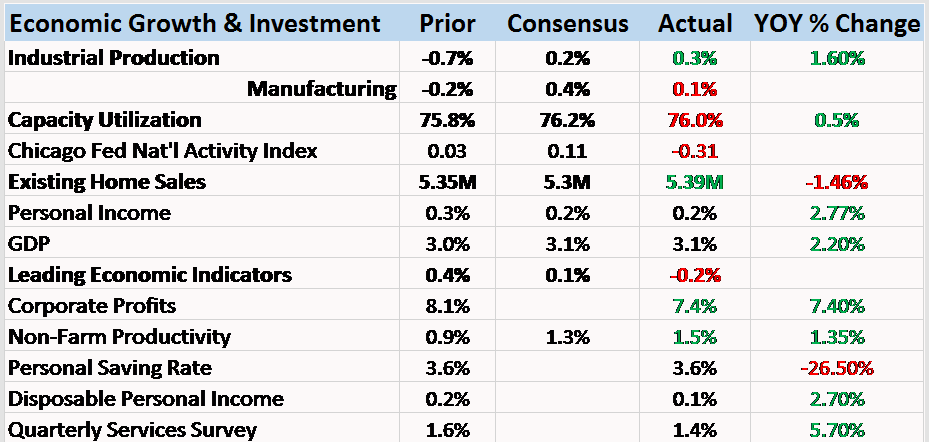

Bi-Weekly Economic Review: One Down, Three To Go

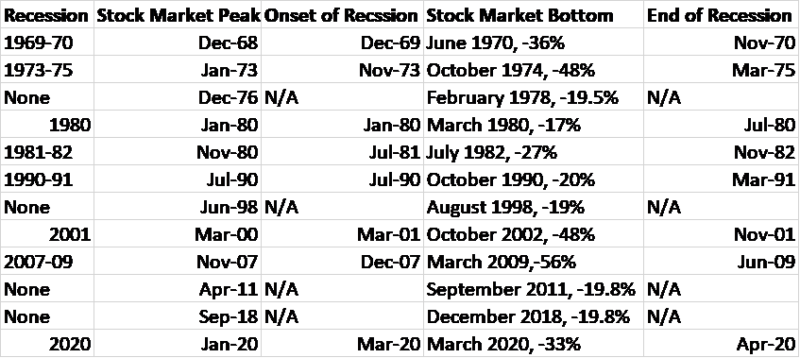

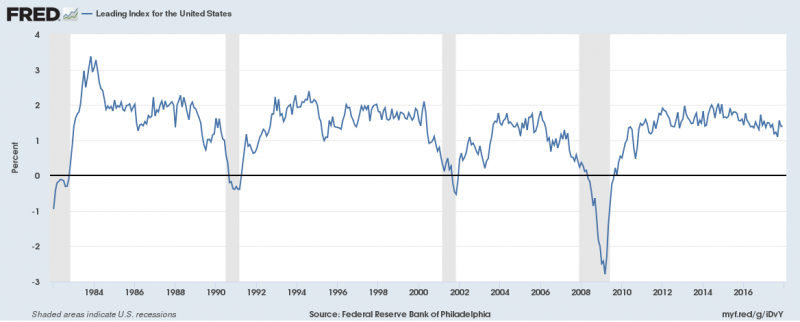

We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of recession, it is rare and unpredictable.

Read More »

Read More »

Great Graphic: FX Vol Elevated, but Still Modest

With the substantial swings in the volatility of equities that have captured the imagination of journalists and punished investors who bought financial derivatives that profited from the low vol environment, we thought it would be helped to look at the implied volatility of the leading currencies against the US dollar. The Great Graphic looks at the three-month implied volatility for the euro (white line), the yen (yellow line), and sterling (green...

Read More »

Read More »

Global Asset Allocation Update:

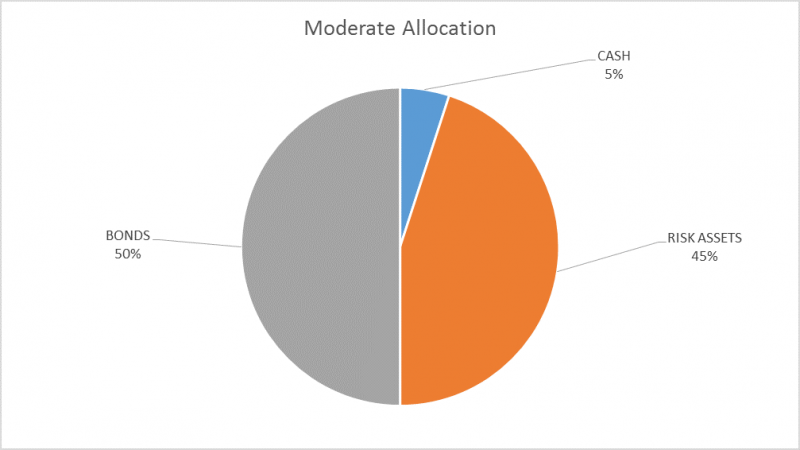

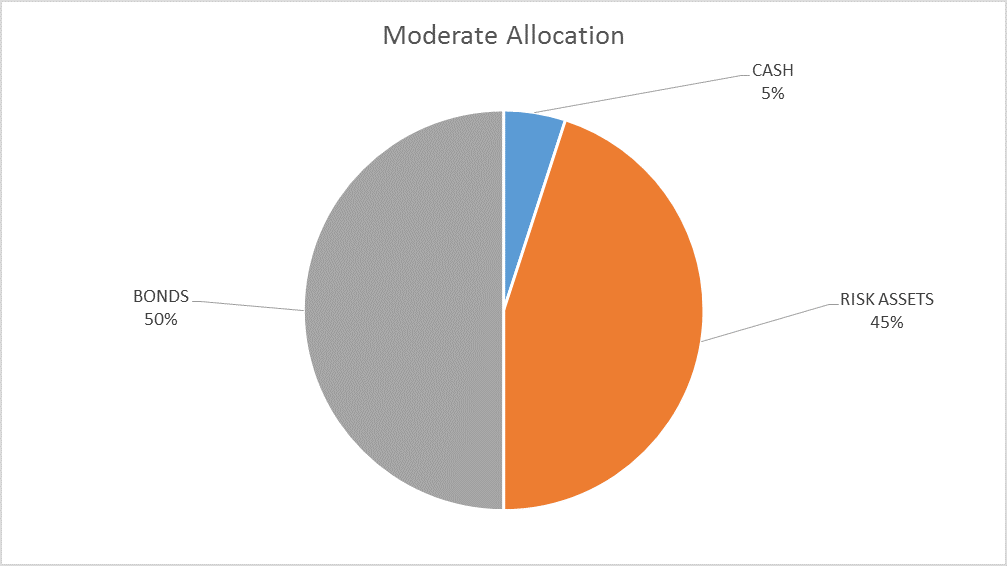

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in correction territory, down 10% from the...

Read More »

Read More »

If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange.

Read More »

Read More »

Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

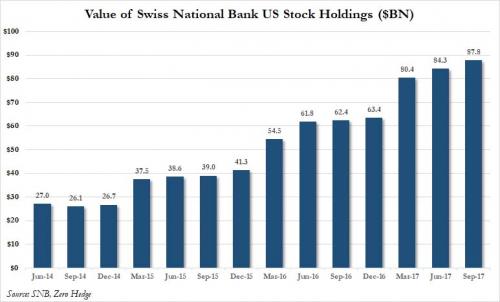

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.

Read More »

Read More »

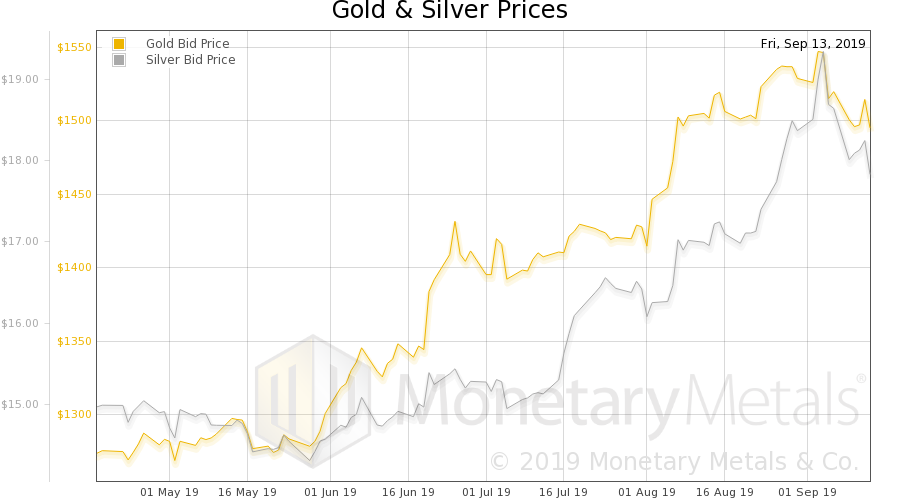

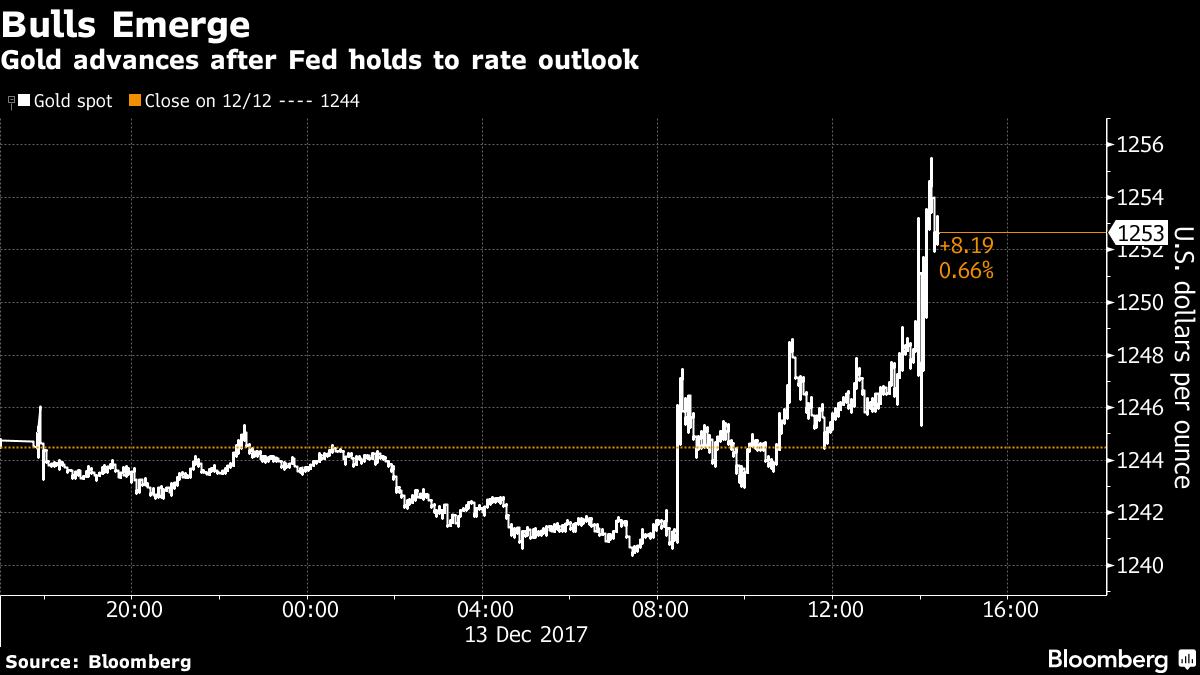

Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price. FOMC follows through on much anticipated rate-hike of 0.25%. Spot gold responds by heading for biggest gain in three weeks, rising by over 1%. Final meeting for Federal Reserve Chair Janet Yellen. Yellen does not expect Trump's tax-cut package to result in significant, strong growth for US economy. No concern for bitcoin which 'plays a very small role in the payment system'.

Read More »

Read More »

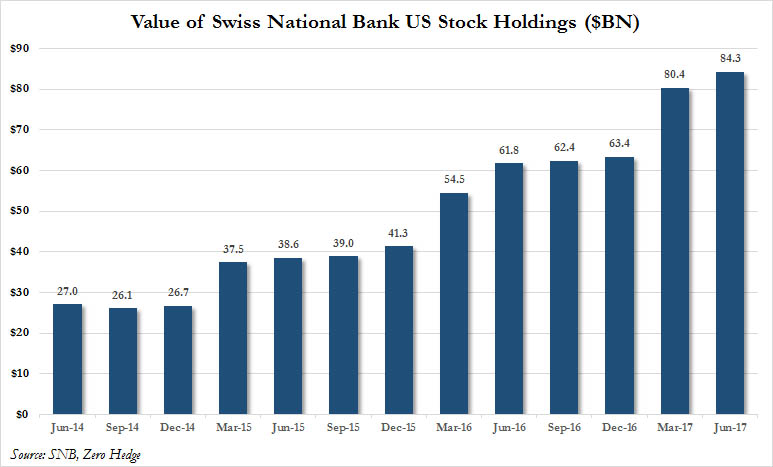

The Swiss National Bank Now Owns A Record $88 Billion In US Stocks

In the third quarter of 2017, one in which the global economy was supposedly undergoing an unprecedented "coordinated growth spurt", and in which central banks were preparing to unveil their QE tapering intentions, in the case of the ECB, or raising rates outright, at the Fed, what was really taking place was another central bank buying spree meant to boost confidence that things are now back to normal, using "money" freshly printed out of thin...

Read More »

Read More »

Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky.

Read More »

Read More »

Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Authored by Kevin Muir via The Macro Tourist blog, Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Read More »

Read More »

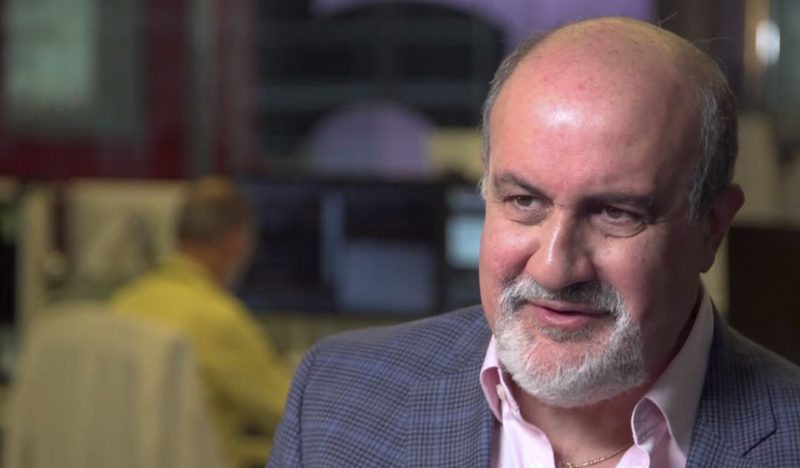

Taleb Explains How He Made Millions On Black Monday As Others Crashed

Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday.

Read More »

Read More »

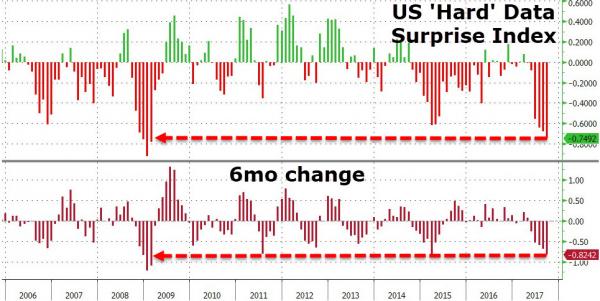

Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown - the 4th-longest streak since 1928... So everything is awesome...BUT...US 'hard' economic data has not been this weak (and seen the biggest drop) since Feb 2009...Q3 Was a Roller-Coaster...Q3 was the 8th straight quarterly gain in a row for The Dow - the longest streak since Q3 1997.

Read More »

Read More »

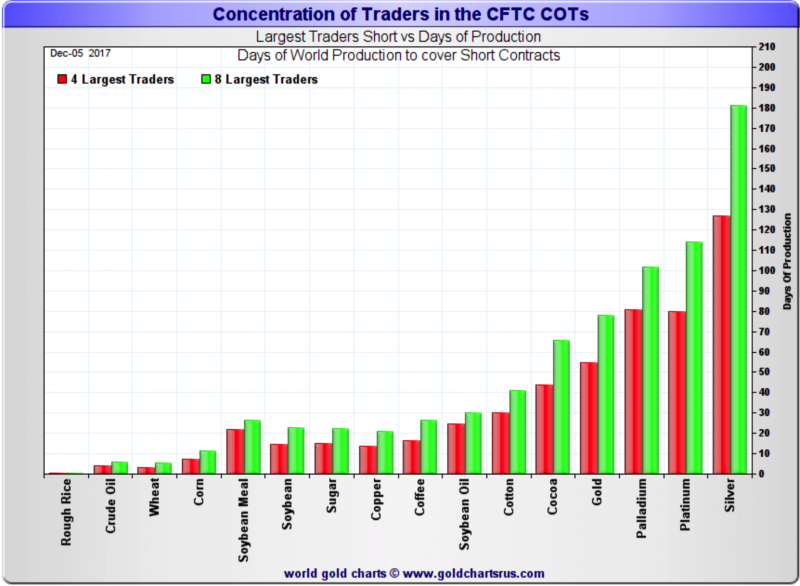

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Latest developments show risks in crypto currencies. Confusion as bitcoin may split tomorrow. SEC stepped into express concern over ICOs. ICOs have so far raised $1.2 billion in 2017. ICOs preying on lack of understanding from investors. Physical gold not vulnerable to technological risk. Beauty and safety in simplicity of gold and silver.

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks.

Read More »

Read More »