Tag Archive: USD/JPY

Has Abenomics Failed? Let us Go for Exchange Rate Targeting and Maintain Stability

Abenomics has failed It was doomed from the very beginning. You cannot create out of risk-averse Japanese risk-tolerating Americans. Public Japanese opinion puts enormous pressure on BoJ policy and on the government; the risks of rising JGB yields are too high. Japanese hate volatility, the government cannot risk its funding. The emphasis on the word …

Read More »

Read More »

Abenomics: A USD/JPY Trade the Smart Money Banks on

Hedge funds worldwide have been counting on a rise and subsequent fall in USDJPY, and conditions remain intact for that to happen, though not to the extremes that many once expected.

Read More »

Read More »

BoJ: Despite Quantitative and Qualitative Easing No Sign of FX Purchases

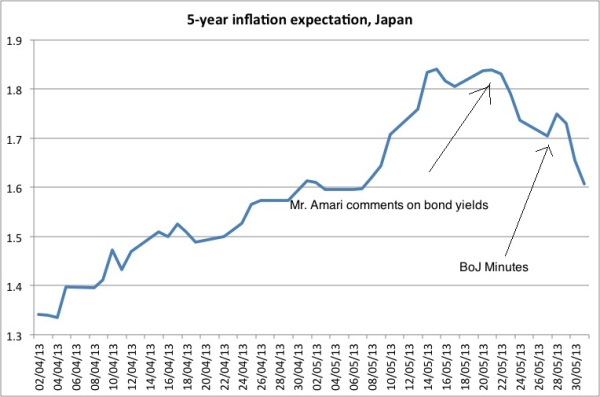

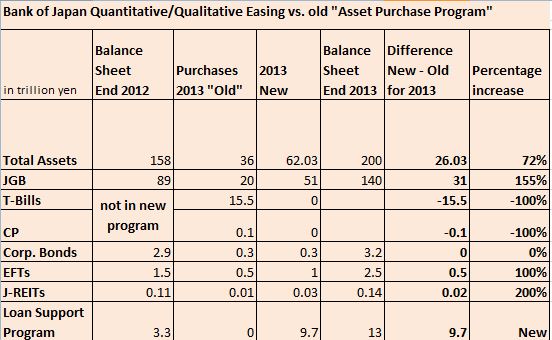

The Bank of Japan has introduced the expected “massive” quantitative and qualitative easing programme. “Quantitative” means increase of quantities of JGBs bought, “qualitative” the purchase of more ETFs, REIT and the loan support program.

Read More »

Read More »

Why the Yen Is Now Fairly Valued, USD back as Preferred Funding Currency

Producer prices and “real mean reversion” for currencies show that the yen is currently fairly valued. Many momentum factors could, however, speak for some further weakening, while seasonality favours an appreciation. For us, the US dollar is back as the preferred funding currency. The real mean reversion for currencies Some economists, like Goldman’s O’Neill, in the case …

Read More »

Read More »

When Will Hedge Funds and FX Traders Close their Short Yen Positions?

Hedge Funds have lost their power. This year has shown that their only remaining possibility to gain easy money is a concerted action with some of their friends manipulating currency markets, calling it “currency wars” and creating an unholy alliance with the dovish prime minister Abe. Some of the biggest U.S. hedge-fund investors have made …

Read More »

Read More »

Is a Liquidity Trap Really a Problem? Yen Debasement Part3 by Noah Smith

Thoughts on the Japanese Currency Debasement (part 3) In previous posts we looked on the following aspects of the recent Japanese currency debasement: Overview: What different leading economists – Paul Krugman, Richard Koo, Adam Posen, Kyle Bass – think about the Japanese currency debasement and the way to more private spending and investing instead of …

Read More »

Read More »

Epic Shift in Monetary Policy: Japan goes SNB, Nuclear Option

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy.

Read More »

Read More »

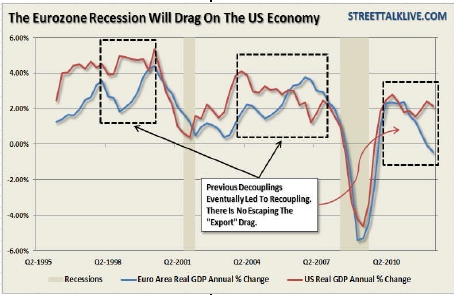

Same Procedure as Every Year: Analysts Shouting “The Great Recession is Over!” But It Is Not!

Or why we do not believe in the American economy. Like every year in Q4, analysts proudly present the end of the great recession: 2009: The big picture: The Great Recession is Over! Long Live the Ordinary Recession …. 2010: Mish Global Trend Analysis: The Great Recession is Over; Bad News: It Doesn’t Feel Like … Continue...

Read More »

Read More »