Tag Archive: USD/JPY

Weekly Technical Analysis: 23/04/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/USD, WTI oil futures

The USDCHF pair touched the bullish channel’s resistance that appears on the chart, and the price might be forced to show some temporary decline to test the support base formed above 0.9790 before resuming the rise again. In general, we will continue to suggest the bullish trend supported by the EMA50, depending on the organized trading inside the mentioned bullish channel, noting that our next target is located at 0.9900, while holding above...

Read More »

Read More »

Weekly Technical Analysis: 29/01/2018 – USDJPY, EURUSD, GBPUSD, GBPJPY

The USDCHF pair shows some bullish bias to approach retesting the previously broken support that turns into key resistance now at 0.9418, noticing that stochastic loses its bullish momentum clearly to reach the overbought areas, while the EMA50 forms continuous negative pressure against the price.

Read More »

Read More »

Weekly Technical Analysis: 15/01/2018 – USDJPY, EURUSD, GBPUSD, WTI Oil Futures

The USDCHF pair succeeded to break 0.9656 level and hold with a daily close below it, which confirms opening the way to extend the bearish wave towards our yesterday's mentioned next target at 0.9566, noticing that the price approaches retesting the broken level now.

Read More »

Read More »

Weekly Technical Analysis: 18/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, EUR/CHF

The USDCHF pair traded with clear negativity yesterday to break 0.9892 level and settles below it, which stops the recently suggested positive scenario and put the price within the correctional bearish track again, noting that there is a bearish pattern that its signs appear on the chart, which means that breaking its neckline at 0.9840 will extend the pair's losses to surpass 0.9800 and reach 0.9730 as a next station.

Read More »

Read More »

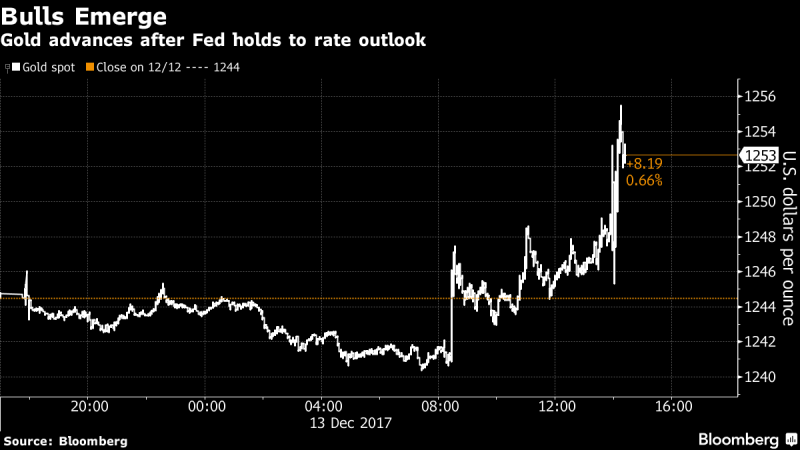

Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price. FOMC follows through on much anticipated rate-hike of 0.25%. Spot gold responds by heading for biggest gain in three weeks, rising by over 1%. Final meeting for Federal Reserve Chair Janet Yellen. Yellen does not expect Trump's tax-cut package to result in significant, strong growth for US economy. No concern for bitcoin which 'plays a very small role in the payment system'.

Read More »

Read More »

Weekly Technical Analysis: 11/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, Gold

The USDCHF pair begins to bounce higher after approaching from 0.9892 level, supported by the EMA50 that meets the mentioned level, while stochastic shows clear bullish trend signals on the four hours time frame. Therefore, these factors encourage us to keep our positive expectations in the upcoming period, waiting for visiting 1.0038 level as a next main station, being aware that breaking 0.9892 will stop the expected rise and turns the price back...

Read More »

Read More »

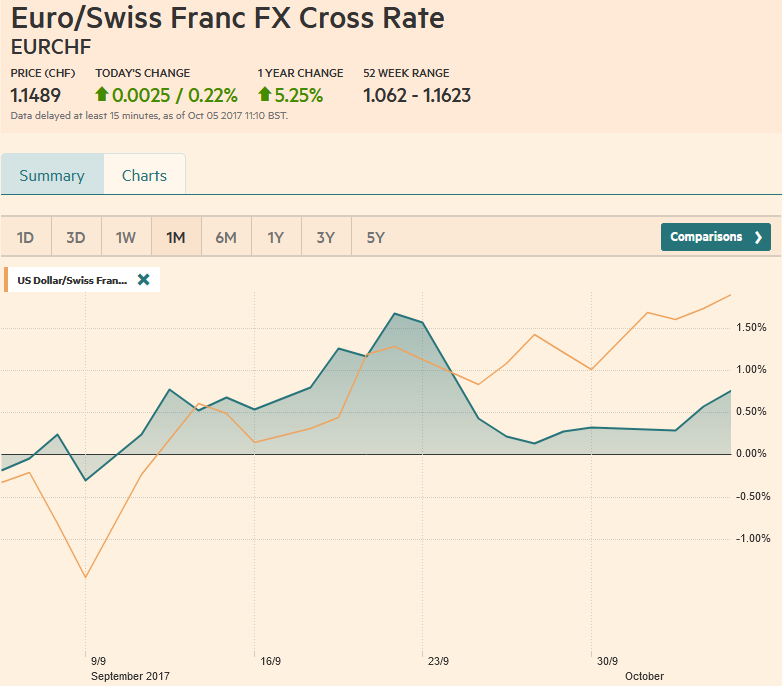

FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

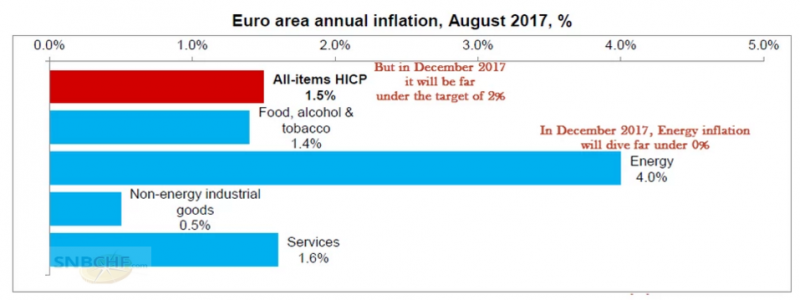

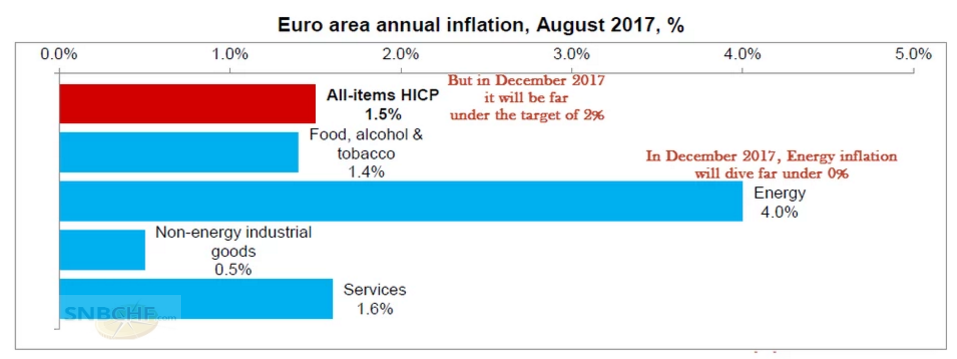

The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach.

Read More »

Read More »

FX Weekly Review, August 28 – September 02: The end of big euro rise?

For us, the sudden euro rise from 1.08 to 1.14 is an illusion, the euro will fall sooner or later again. Macron will not help the French economy and low core inflation will prevent that the ECB ends her bond buying program.

Read More »

Read More »

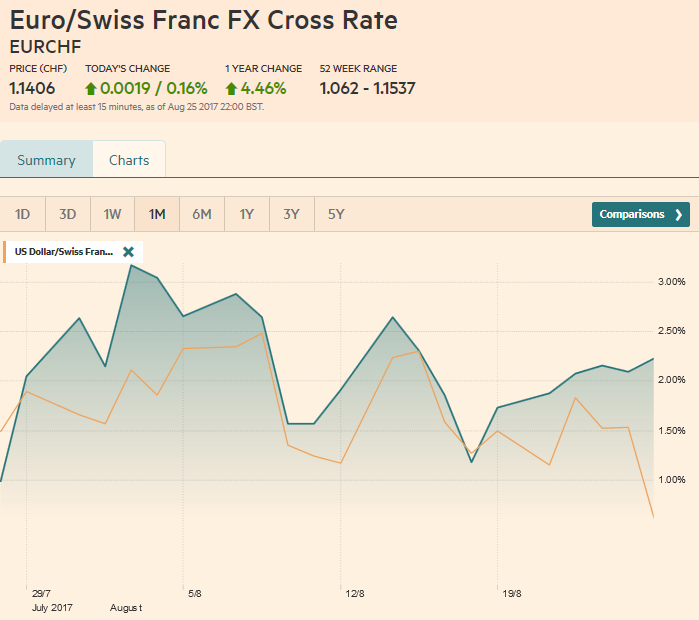

FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

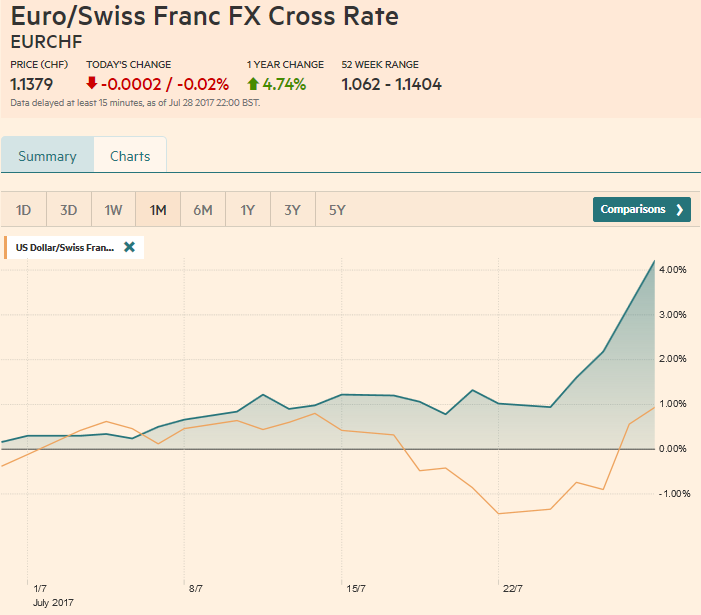

The broad technical condition of the dollar deteriorated materially before the weekend. The dollar had some gains versus the franc during the last month, but it lost all during the last days.The EURCHF continues with a 2.5% win for the last month.

Read More »

Read More »

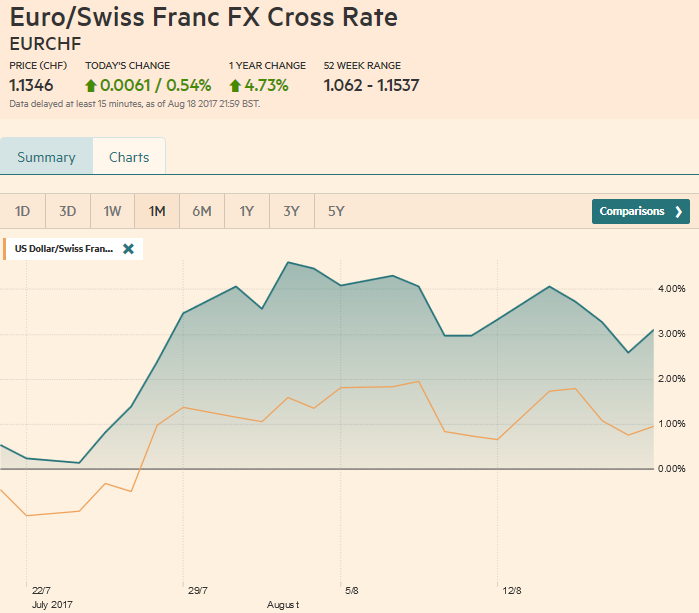

FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

The euro has lost some momentum, Draghi does not want to talk about an early end of his bond buying programming. Confirmed by economic data, 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swiss appreciated during the week.

Read More »

Read More »

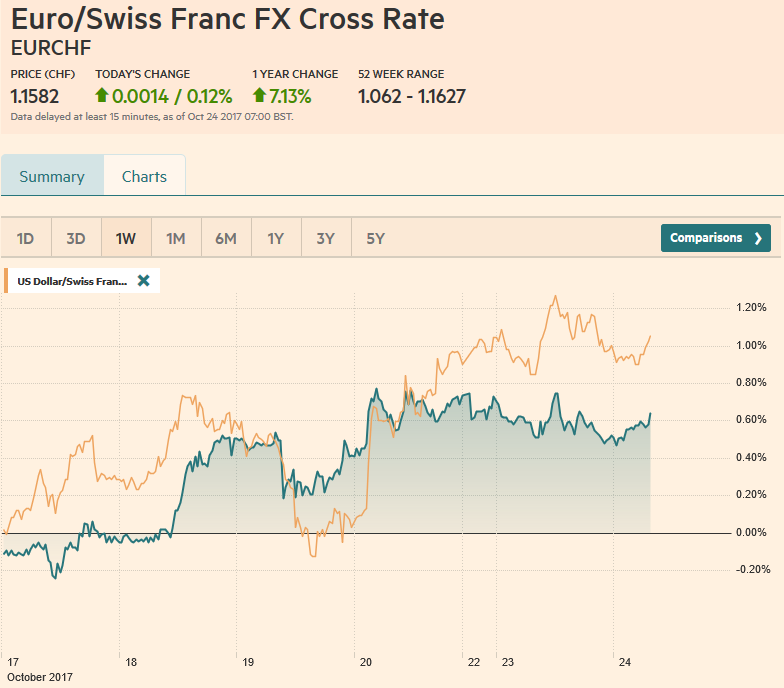

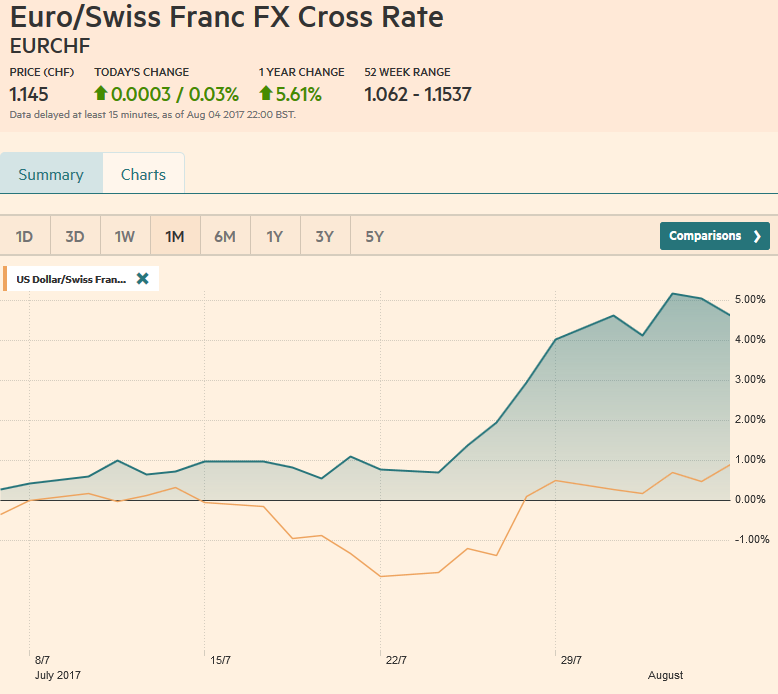

FX Weekly Review, July 31 – August 05: Second Week of Strong CHF Losses

The Swiss Franc entered the second week of stronger losses. While the euro gained 4% last week, the dollar appreciated against the Swiss Franc 2% during this week.

Read More »

Read More »

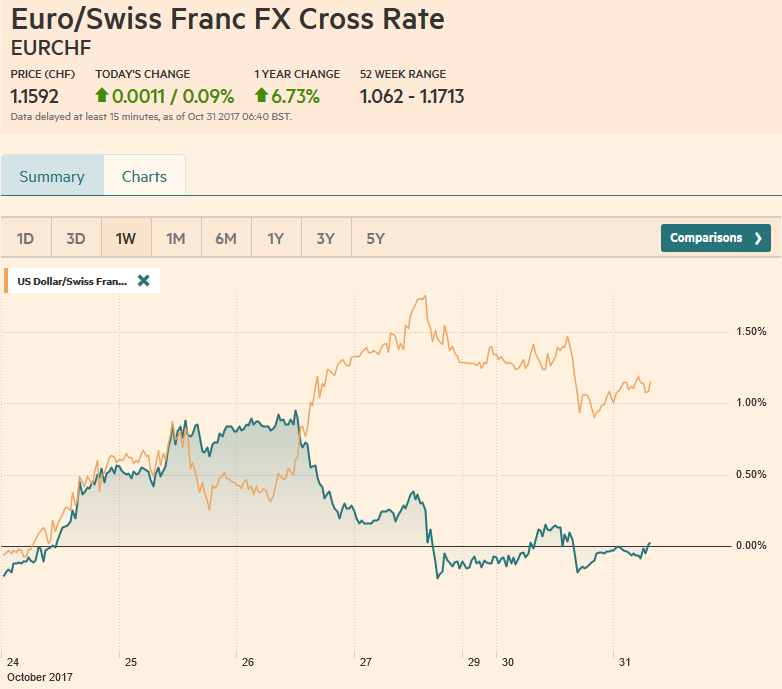

FX Weekly Review, July 24 – July 29: Swiss Franc getting crushed

The Swiss franc was the only major foreign currency that fell against the dollar last week. The 2.6% decline was the largest in two years.

Read More »

Read More »