Tag Archive: U.K. Average Earnings

The Average Earnings Index measures change in the price businesses and the government pay for labor, including bonuses. The Average Earnings figure gives us a good indication of personal income growth during the given month.

FX Daily, June 16: Correction Scenario Tested

Overview: Shortly after the US stock market opened sharply lower, the Federal Reserve announced that it's Main Street facility was up and running. US stocks never looked back. After the S&P 500 recouped its full decline, the Fed announced it would begin buying corporate bonds. Up until now, it had been buying representative ETFs. Stocks rallied further on the news before pulling back into the close. The rally in risk assets carried into Asia.

Read More »

Read More »

FX Daily, July 12: Currencies Stabilize, but Yen Strengthens

The US dollar and sterling have stabilized after being sold off yesterday. The yen, which had begun recovering from a four-month low, is the strongest of the major currencies today, gaining around 0.5% against the dollar (@~JPY113.40).

Read More »

Read More »

FX Daily, May 17: Drama In Washington Adds To Dollar Woes

The US dollar has drifted lower against most of the major currencies as the culmination of news from Washington, escalating already rising concerns about the economic agenda that was to bolster growth with dramatic tax reform, infrastructure initiative, and re-orienting trade.

Read More »

Read More »

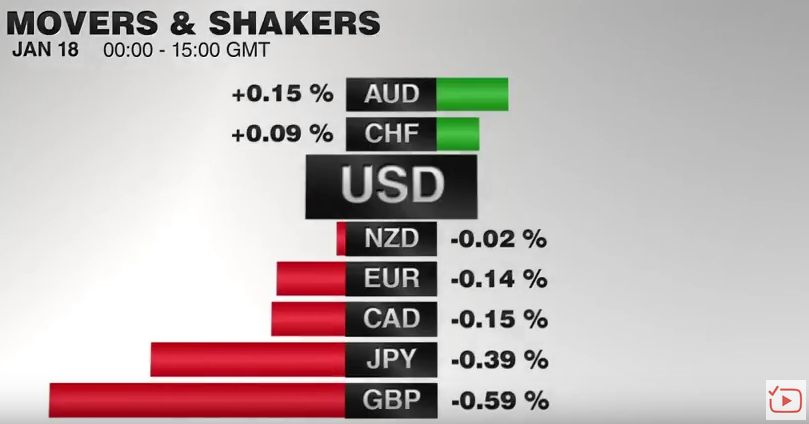

FX Daily, January 18: Markets Stabilize, Awaiting Fresh Cues

The US dollar has stabilized after yesterday's bruising. From a fundamental perspective, little has changed. After hard exit signals from the UK government sent sterling down from $1.2430 on January 5 and 6, to below $1.20 at the start of the week, the pound rallied back to almost $1.2430 yesterday amid "sell the rumor buy the fact" activity.

Read More »

Read More »

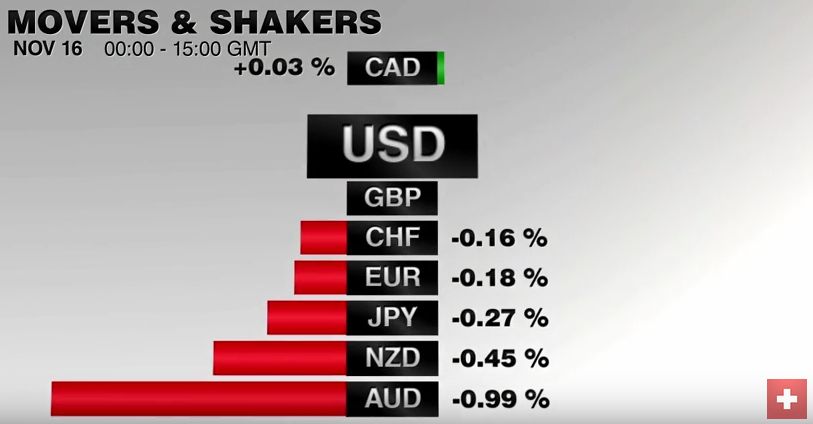

FX Daily, November 16: The Greenback Remains Resilient

The US dollar remains bid. It is at its year high against the euro and five-month highs against the Japanese yen. Sterling, which has performed better recently, remains in the trough around 30-year lows. It surge since the election reflects three considerations. The first is December Fed hike. Prior to the election, the market was assessing around a two-thirds chance. Now both the CME and Bloomberg's WIRP estimate the odds above 90%....

Read More »

Read More »

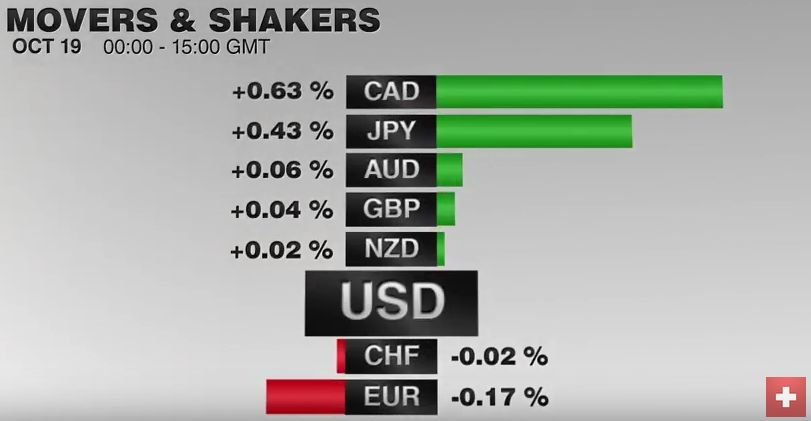

FX Daily, October 19: FX After China GDP

The Swiss Franc has strengthened against the pound as global uncertainty persists in the form of the UK’s Brexit vote and the US Presidential Election. Looking ahead it seems the CHF may soften a little as we learn of the new President, I found it very interesting that yesterday Paddy Power paid out on any bets for Hilary Clinton to become President in the United States.

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

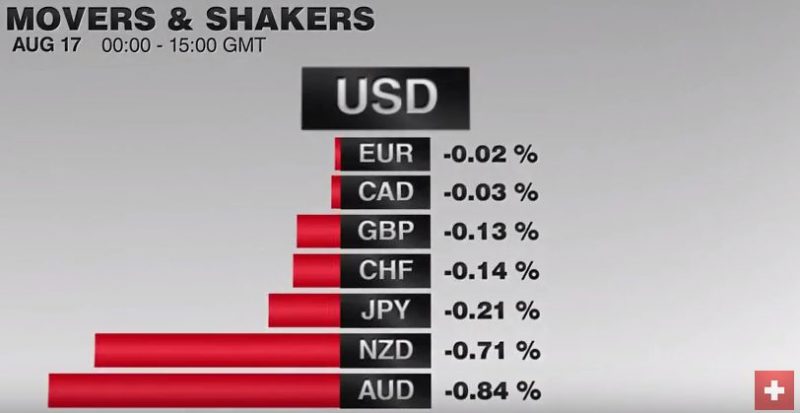

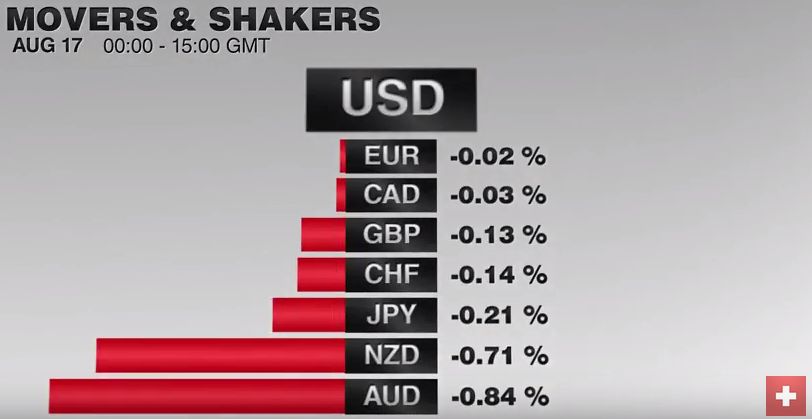

FX Daily, August 17: Dollar Snaps Back

The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley's comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent.

Read More »

Read More »

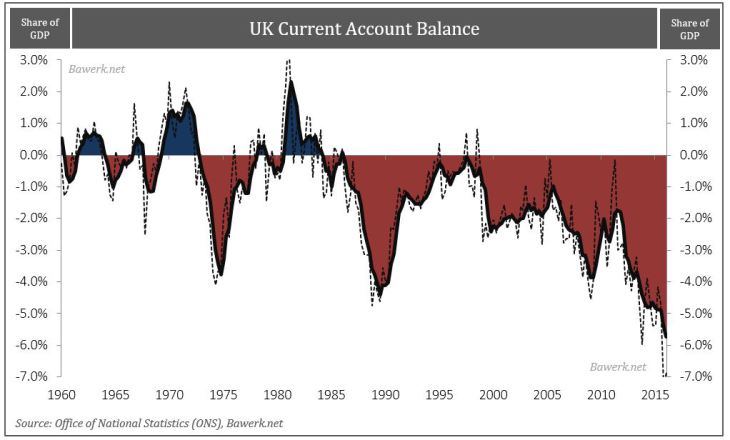

Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience.

Read More »

Read More »

FX Daily, June 15: Key Data and FOMC

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »